India’s financial services landscape is transforming rapidly, credit penetration is rising, insurance adoption is accelerating, and wealth-creation products are becoming mainstream. Amidst this structural tailwind, Aditya Birla Capital (ABCL) stands out as a diversified, retail-focused financial conglomerate with strong execution across lending, insurance, AMC, and digital finance.

But does Aditya Birla Capital Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ABCAPITAL |

| Industry/Sector | Financial Services (NBFC) |

| CMP | 345.90 |

| Market Cap (₹ Cr.) | 90,400 |

| P/E | 25.90 (Vs Industry P/E of 20.99) |

| 52 W High/Low | 346.80 / 149.01 |

| EPS (TTM) | 12.79 |

| Dividend Yield | 0.00% |

About Aditya Birla Capital Ltd.

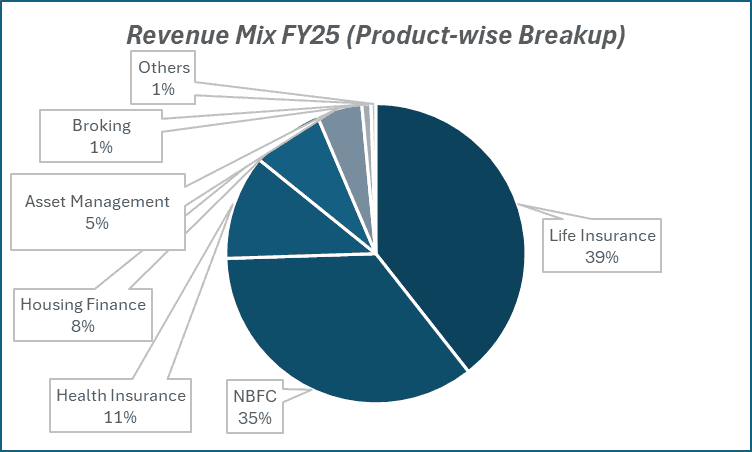

Aditya Birla Capital is the financial services arm of the Aditya Birla Group, housing businesses across lending, insurance, asset management and digital financial services. Its NBFC and housing finance franchises continue to scale strongly, driven by retail-led growth and disciplined risk management.

The company also benefits from fast-growing life and health insurance businesses and a large, diversified asset and wealth management platform. With over 38 million customers and a tech-enabled distribution network expanding deeper into Tier-2/3 markets, ABCL is sharpening its focus on risk-calibrated growth and ecosystem-led cross-sell. This positions the franchise well for consistent, multi-engine compounding.

Key business segments

Aditya Birla Capital Ltd. operates primarily in the following key business segments:

- Lending (NBFC + Housing Finance): A fast-scaling retail, MSME and housing finance franchise with disciplined underwriting and a granular, well-diversified loan book.

- Insurance (Life & Health): Strong life and health insurance platforms delivering high growth, improving margins and rising customer engagement through wellness-led offerings.

- Asset & Wealth Management: A mature, scalable AMC and wealth business with broad product coverage and strong operating leverage across equity, debt, passive and alternates.

- Digital Financial Services: A rapidly expanding digital ecosystem integrating lending, insurance, investments and payments with seamless onboarding and omni-channel distribution.

Primary growth factors for Aditya Birla Capital Ltd.

Aditya Birla Capital Ltd. key growth drivers:

- Deep retailisation: Across lending, insurance, and mutual funds, leading to better risk-adjusted returns.

- Underpenetrated insurance: Opportunity, with health insurance growing at double digits.

- Rising wealth participation: Through SIPs and market-linked savings supporting AMC scalability.

- MSME credit demand: Driving secured, granular NBFC growth.

- Digital transformation: Reducing acquisition cost and boosting cross-sell.

- Ecosystem synergies: Enabling multi-product adoption and enhanced customer lifetime value.

Detailed competition analysis for Aditya Birla Capital Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Aditya Birla Capital | 41693.04 | 15151.78 | 36.34% | 2901.94 | 6.96% | 25.90 |

| Bajaj Finance Ltd. | 76194.74 | 52179.07 | 68.48% | 18550.93 | 24.35% | 33.31 |

| Jio Financial Services | 2525.44 | 1796.69 | 71.14% | 1276.78 | 50.56% | 116.67 |

| Shriram Finance Ltd. | 45601.30 | 33103.56 | 72.59% | 9836.51 | 21.57% | 15.79 |

| Muthoot Finance Ltd. | 24544.40 | 18643.49 | 75.96% | 7221.38 | 29.42% | 20.08 |

Key insights on Aditya Birla Capital Ltd.

- The lending franchise is shifting aggressively toward retail + MSME, improving portfolio stability and profitability.

- The health insurance business has become a robust growth engine, supported by differentiated wellness solutions.

- Life insurance is improving mix quality with higher non-par and protection contributions.

- AMC business remains a strong annuity generator with sustainable margins.

- Digital initiatives are driving higher customer activation and direct-to-customer business.

- Operating leverage is expanding as scale builds across segments.

Recent financial performance of Aditya Birla Capital Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 10322.01 | 9502.69 | 10594.96 | 11.49% | 2.64% |

| EBITDA (₹ Cr.) | 3717.57 | 3850.37 | 4001.38 | 3.92% | 7.63% |

| EBITDA Margin (%) | 36.02% | 40.52% | 37.77% | -275 bps | 175 bps |

| PAT (₹ Cr.) | 936.22 | 743.39 | 805.20 | 8.31% | -13.99% |

| PAT Margin (%) | 9.07% | 7.82% | 7.60% | -22 bps | -147 bps |

| Adjusted EPS (₹) | 3.84 | 3.20 | 3.27 | 2.19% | -14.84% |

Aditya Birla Capital Ltd. financial update (Q2 FY26)

Financial performance

- Consolidated sales grew 3% YoY to ₹10595 crore, up 11% QoQ.

- NBFC PAT rose 14% YoY to ₹714 crore, with RoA improving to 2.20%.

- HFC RoA improved 23 bps QoQ to 1.82%, supported by strong operating leverage.

- AMC AUM grew 11% YoY; alternatives surged with the ₹25,800 crore ESIC mandate.

- Life insurance delivered 19% FYP growth and expanded VNB margin by 420 bps to 11.6%.

Asset quality

- NBFC gross stage 2 & 3 assets declined 121 bps YoY to 3.03%.

- Stage 3 fell sharply from 2.3% to 1.7% QoQ, with PCR improving to 44.2%.

- HFC stage 3 improved to 0.61%, with net stage 3 at 0.26%.

- Credit cost guidance maintained at 1.2–1.3% for FY26.

- No stress pockets identified; loan book selectively cleansed via strategic sales.

Business highlights

- NBFC disbursements hit a record ₹21,990 crore (+39% QoQ), led by retail and SME.

- HFC AUM surged 65% YoY, aided by strong disbursements and network expansion.

- Equity AUM crossed ₹2 trillion, and alternatives AUM grew 8x YoY.

- Life insurance grew 19% FYP, while health insurance GWP rose 31% YoY.

- Digital platforms scaled rapidly with 7.6 million ABCD customers and deeper MSME penetration via Udyog Plus.

Outlook

- H2 expected to be stronger, driven by retail momentum and HFC operating leverage.

- NBFC yields to improve with higher retail/unsecured mix; HFC NII to normalize to 4.75–4.80%.

- Medium-term targets: NBFC RoA 2.4–2.5%, HFC RoA 2–2.2%, life VNB margin 18%+.

- GST impact near term, but structurally positive for insurance penetration.

- Capital buffers remain strong, supporting sustained 20%+ AUM growth without dilution.

Recent Updates on Aditya Birla Capital Ltd.

- Launch of new digital platforms integrating lending, insurance, and investments.

- Expansion of health insurance product suite with chronic-care and wellness-focused plans.

- Mutual fund business launching innovative passive and thematic offerings.

- Strengthening focus on Tier-2/3 geographies for MSME and affordable housing.

- Partnerships with fintechs and digital aggregators to enhance customer reach.

- Enhanced governance, risk controls, and cyber-security frameworks across the group.

Company valuation insights – Aditya Birla Capital Ltd.

Aditya Birla Capital (ABCL) trades at a TTM P/E of 25.9x, above the industry average of 20.99x, supported by strong operating momentum. The stock has delivered an exceptional 81.6% 1-year return, far ahead of the Nifty 50’s 6.9%.

The investment case is backed by rapid improvement across its lending businesses. The NBFC continues to post solid growth with RoA at 2.2% and a clear path to 2.4–2.5%, driven by a better mix, strong unsecured/SME traction, and disciplined credit costs.

Asset quality has strengthened meaningfully, with stage-2 and stage-3 levels improving across the book. The housing finance business is scaling rapidly (AUM +65% YoY) with operating leverage kicking in and profitability trending toward 2%+ RoA.

Non-lending verticals, life insurance, health insurance, and AMC, are also gaining share and improving margins, supporting overall earnings visibility.

Applying 22x FY27E EPS of ₹19.5, we derive a 12-month target price of ₹430 (24% upside) and a 3-month target of ₹370 (7% upside). With rising return ratios, improving margins, and strong AUM growth across segments, ABCL stands out as a high-quality, diversified financial player with attractive risk–reward.

Major risk factors affecting Aditya Birla Capital Ltd.

- Credit cycle weakness impacting MSME and unsecured retail segments.

- Regulatory changes in insurance products, capital norms, or lending frameworks.

- Increased competition in health insurance and mutual funds.

- Market volatility affecting AUM and AMC revenues.

- Execution risks in digital transformation and cross-sell integration.

- Dependence on macro conditions for lending and investment flows.

Technical analysis of Aditya Birla Capital share

Aditya Birla Capital is trading in a strong upward trajectory, having delivered 80%+ returns over the last year, signalling sustained buying momentum and robust potential for further upside. The stock remains positioned well above its 50-day, 100-day, and 200-day EMAs, reaffirming the strength of its long-term bullish structure and confirming continued trend reliability.

Momentum indicators further validate the positive setup. MACD is firmly positive at 7.92, with the MACD line holding above the signal line, highlighting ongoing upward strength. RSI at 68.86 indicates strong buying interest, yet remains below overbought extremes, allowing room for continued momentum. Relative RSI readings of 0.12 (21-day) and 0.19 (55-day) emphasize persistent outperformance versus benchmark indices. Additionally, an ADX of 30.93 denotes a strong underlying trend, adding conviction to the current breakout formation.

A decisive breakout above ₹370 could accelerate the next leg of the uptrend toward ₹430, aligning with the 12-month fundamental target. On the downside, ₹330 serves as a key support zone; sustaining above this level will be essential to maintain the bullish bias and prevent any deeper pullback.

- RSI: 68.86 (Strong Buying Interest)

- ADX: 30.93 (Strong Trend)

- MACD: 7.92 (Positive Momentum)

- Resistance: ₹370

- Support: ₹330

Aditya Birla Capital Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹370 (~7% upside) and a 12-month target of ₹430 (~24% upside), based on 22x FY27E EPS of ₹19.5.

Why buy now?

Strong lending momentum: NBFC +22% YoY and HFC +65% YoY AUM growth with improving profitability.

Margin expansion visibility: NBFC RoA at 2.2% trending toward 2.4–2.5% with a better product mix.

Strengthening asset quality: Stage-2/3 pools declining with disciplined credit costs.

Multiple growth engines: Insurance and AMC improving margins and scaling steadily.

Adequate capital & scalability: Healthy buffers and parent support enable sustained 20%+ AUM growth.

Portfolio fit

Aditya Birla Capital offers a balanced exposure to lending, insurance and AMC with rising return ratios and improving asset quality. Strong retail momentum, diversified growth drivers and expanding profitability position it as a compelling medium-term compounder within the diversified financials space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebAditya Birla Capital Ltd.: Budget 2025-26 opportunities

- Retail Credit Push: Budget support for consumption, MSME and housing directly boosts AB Capital’s retail and SME lending engines.

- Housing Demand Upswing: Affordable housing incentives strengthen AUM momentum for the Housing Finance business.

- Insurance Penetration: Health and life insurance focus accelerates growth for ABSLI and ABHI.

- Capital Market Expansion: Market-deepening measures support higher flows into AMC, passive and alternates.

- Digital Enablement: DPI investments enhance ABCL’s digital platforms (ABCD, Udyog Plus) for faster, low-cost customer acquisition.

Final thoughts

Can Aditya Birla Capital leverage its unique multi-engine model, spanning lending, insurance, wealth, and digital finance, to become one of India’s leading integrated financial institutions?

As India formalises and financial penetration deepens, ABCL is positioned at the sweet spot of structural demand. The next few years will reveal whether the company can deliver sustained, high-quality compounding driven by retailisation, technology, and synergistic scale.