Ashok Leyland Ltd. (ASHOKLEY), the second-largest commercial vehicle (CV) manufacturer in India, is successfully navigating a complex and evolving automotive market. While the overall domestic CV industry has faced headwinds, Ashok Leyland has demonstrated remarkable resilience and strategic strength. The company is actively capturing market share from competitors in both its stronghold of Medium and Heavy Commercial Vehicles (MHCV) and the high-growth Light Commercial Vehicle (LCV) segment.

The core of the investment thesis for Ashok Leyland is no longer just about volume growth; it’s about a structural improvement in profitability. Management is executing a clear strategy focused on margin expansion, driven by lower material costs, a richer product mix (more premium vehicles), and a significant surge in high-margin export volumes.

But does Ashok Leyland Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | ASHOKLEY |

| Industry/Sector | Automobile (Commercial Vehicles) |

| CMP | 148.25 |

| Market Cap (₹ Cr.) | 87,051 |

| P/E | 26.59 (Vs Industry P/E of 25.93) |

| 52 W High/Low | 152.94 / 95.93 |

| EPS (TTM) | 6.03 |

| Dividend Yield | 2.11% |

About Ashok Leyland Ltd.

Founded in 1948, Ashok Leyland is the flagship of the Hinduja Group and a leader in the Indian commercial vehicle industry. It is the 2nd largest manufacturer of medium and heavy commercial vehicles (MHCVs) in India and the 4th largest manufacturer of buses in the world.

Headquartered in Chennai, the company has a massive manufacturing footprint across India and also has international operations, including a significant presence in the UK through its electric vehicle (EV) arm, Switch Mobility. Beyond trucks and buses, the company also has a strong presence in defence vehicles, power solutions (engines), and spare parts, making it a well-diversified industrial powerhouse.

Key business segments

Ashok Leyland Ltd. operates primarily in the following key business segments:

- Medium & Heavy Commercial Vehicles (M&HCV): Core segment with strong market share in trucks and buses; demand linked to industrial capex, infrastructure growth, and logistics.

- Light Commercial Vehicles (LCV): Product range includes Dost, Bada Dost, and Partner, a fast-growing segment driven by e-commerce, rural logistics, and last-mile delivery.

- Switch Mobility (EV Buses & LCVs): A fully electric mobility arm offering e-buses and e-LCVs for domestic and global markets.

- Defense Vehicles: Supply of logistics and armored vehicles to the Indian armed forces.

- Aftermarket & Spare Parts: A high-margin annuity business driven by Pan-India service network and fleet support solutions.

Primary growth factors for Ashok Leyland Ltd.

Ashok Leyland Ltd. key growth drivers:

- Infrastructure & Capex Boom: Road construction, mining, ports, urban transit, and real estate activity are driving M&HCV demand.

- Shift to Organized Logistics: GST-led consolidation, express logistics, and fleet upgrades support new truck purchases.

- EV & Alternative Energy Push: Strong opportunity pipeline in electric buses and hydrogen-powered trucks under Switch Mobility.

- Rising Replacement Demand: Older CV fleets are being replaced due to stricter emission norms and fuel-efficiency needs.

- LCV Market Momentum: E-commerce, MSME activity, rural mobility, and last-mile logistics are boosting LCV volumes.

Detailed competition analysis for Ashok Leyland Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBIT (₹ Cr.) | EBIT Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Ashok Leyland | 50976.16 | 9941.55 | 19.50% | 3511.11 | 6.89% | 24.59 |

| Force Motors | 8624.15 | 1255.74 | 14.56% | 1074.80 | 12.46% | 21.59 |

| SML Mahindra | 2504.18 | 255.70 | 10.21% | 141.49 | 5.65% | 29.23 |

| Atul Auto | 758.92 | 60.29 | 7.94% | 23.34 | 3.08% | 55.44 |

| Olectra Greentech | 1968.13 | 272.47 | 13.84% | 142.54 | 7.24% | 80.93 |

Key insights on Ashok Leyland Ltd.

- Ashok Leyland has one of the strongest M&HCV franchises, backed by durable brand equity and fleet operator trust.

- The company’s modular platform AVTR has improved product customization, margins, and customer stickiness.

- Switch Mobility offers long-term optionality in e-buses, e-LCVs, and hydrogen fuel-cell vehicles, potentially creating a new growth curve.

- The aftermarket business provides high-margin recurring revenue and stabilizes profitability across cycles.

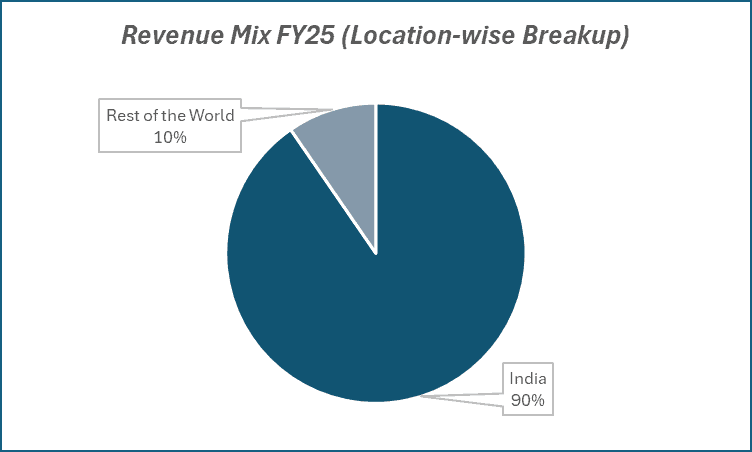

- Export opportunities remain strong across the Middle East, Africa, and SAARC regions as demand recovers post-pandemic.

Recent financial performance of Ashok Leyland for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 11147.58 | 11708.54 | 12576.86 | 7.42% | 12.82% |

| EBITDA (₹ Cr.) | 2039.77 | 2173.14 | 2441.20 | 12.34% | 19.68% |

| EBITDA Margin (%) | 18.30% | 18.56% | 19.41% | 85 bps | 111 bps |

| PAT (₹ Cr.) | 755.21 | 652.98 | 811.66 | 24.30% | 7.47% |

| PAT Margin (%) | 6.77% | 5.58% | 6.45% | 87 bps | -32 bps |

| EPS (₹) | 1.20 | 1.04 | 1.29 | 24.04% | 7.50% |

Ashok Leyland Ltd. financial update (Q2 FY26)

Financial performance

- Revenue rose 12.8% YoY to ₹12,577 crore, supported by 7.7% YoY volume growth, a richer product mix, and steady pricing.

- Domestic MHCV and LCV volumes grew, while exports surged 45% YoY on strong traction in GCC, SAARC, and Africa.

- EBITDA increased 19.7% YoY to ₹2,441 crore with a 19.4% margin, aided by better realisations and commodity cost control.

- PAT grew 7.5% YoY to ₹812 crore, with margins benefiting from strong operating leverage and higher other income.

Business highlights

- Market share in MHCVs sustained near 31%, while LCV share improved to ~15%, reaffirming product strength.

- Hinduja Leyland Finance (HLF) AUM grew 26% YoY; upcoming NXTDigital merger sets up a value-unlocking IPO.

- Capacity ramp-up continues with the AP plant scaling and the new Lucknow bus plant set to lift annual body-building capacity to 20,000+ units.

- Dealer network expansion added 53 new touchpoints in Q2, moving toward the FY26 target of 2,000+ outlets.

- Switch Mobility delivered strong traction with ~600 e-buses and ~600 ELCVs sold in H1; OHM operates 1,100 buses with a roadmap to cross 2,500 buses in 12 months.

- Exports strengthened with UAE nearing full utilisation; Saudi Arabia remains a key growth market.

Outlook

- Demand is expected to improve post-monsoon, supported by freight stability, logistics activity, and infrastructure spending.

- US-style (non-cyclical) businesses, exports, defence, and power solutions—are set to drive incremental mix and margin resilience.

- Management guides for a 6% volume CAGR over FY25–28, with Switch Mobility targeting cash-flow positivity by FY27.

- Margins are expected to remain steady, aided by cost discipline, better mix, and operating leverage.

Recent Updates on Ashok Leyland Ltd.

- Large EV Bus Orders: Switch Mobility secured multiple state transport corporation orders for electric buses across India.

- Hydrogen Truck Development: Ashok Leyland announced pilots of hydrogen internal combustion engine (H2-ICE) trucks for Indian highways.

- Capacity Expansion: Investments to increase LCV production capacity driven by demand for Bada Dost.

- Partnerships & MoUs: Collaborations with state governments and private players for EV ecosystem development.

- Defense Orders: New supply orders secured for logistics and defense mobility vehicles.

Company valuation insights – Ashok Leyland Ltd.

Ashok Leyland trades at a TTM P/E of 26.6x, broadly in line with the industry average of 25.9x, and has delivered a strong 1-year return of 34.6% versus the Nifty 50’s 10.5%.

The investment case remains supported by steady market share gains in MHCVs, improving traction in LCVs, and a diversified portfolio across defence, power solutions, exports, and electric mobility. Capacity expansion at the Andhra Pradesh and upcoming Lucknow plants, along with rapid dealer network growth, strengthens scale and operating leverage. Export momentum in GCC and Africa, a growing order book in Switch Mobility, and the path to profitability in its EV business enhance long-term visibility. Margin resilience is improving on the back of better mix, pricing discipline, and rising contributions from non-cyclical segments. Value unlocking from the Hinduja Leyland Finance listing and a stronger balance sheet further bolster the outlook.

We value Ashok Leyland at 24x FY27E EPS of ₹7.5, arriving at a 12-month target price of ₹180 (22% upside). The 3-month target is ₹157 (6% upside).

Key upside drivers include faster MHCV recovery, stronger e-bus deployments, better utilisation at new plants, export-led volumes, and progress on HLF monetisation.

Major risk factors affecting Ashok Leyland Ltd.

- Macroeconomic Slowdown: CV demand is cyclical; weak GDP or capex cuts can reduce volumes.

- Competition: Intense rivalry with Tata Motors and new entrants in EV mobility.

- Commodity Inflation: Higher steel and aluminum prices can pressure margins.

- Execution Risk in EV Arm: Switch Mobility’s scale-up requires strong capital and global competitiveness.

- Export Volatility: Political and currency fluctuations in Africa and the Middle East can impact export revenue.

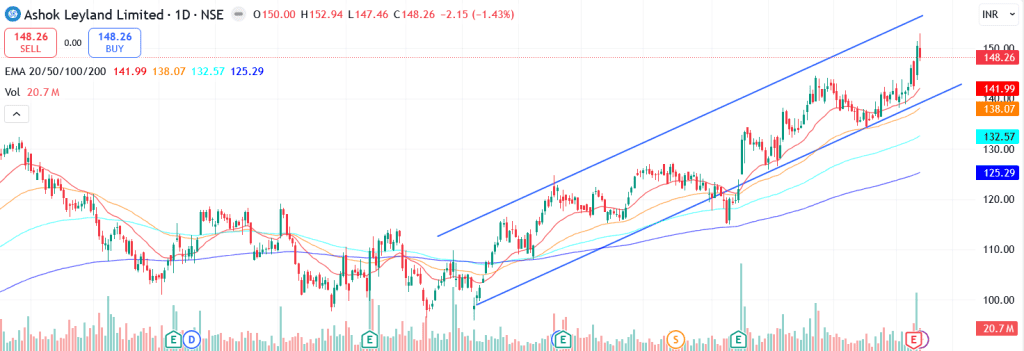

Technical analysis of Ashok Leyland Ltd. share

Ashok Leyland continues to trade firmly within an upward channel, indicating sustained strength in its ongoing uptrend. A breakout above the upper trendline could trigger accelerated momentum and extend the rally further. The stock remains comfortably above its 50-day, 100-day, and 200-day EMAs, reinforcing the durability of its bullish structure. Holding above these moving averages will be key to maintaining the medium- to long-term positive bias.

Momentum indicators also support the uptrend. The MACD at 2.49 stays positive, with the MACD line positioned well above the signal line, an indication of strengthening bullish momentum. The RSI at 63.83 reflects healthy buying interest, while the relative RSI readings of 0.06 (21-day) and 0.09 (55-day) highlight steady outperformance versus the broader market. The ADX at 30.89 signals strong trend strength, confirming that directional momentum continues to build.

A decisive move above ₹160 may open the path toward ₹180 (12-month target). On the downside, ₹135 serves as a crucial support level, and sustaining above it will be essential to preserve the stock’s bullish setup.

- RSI: 63.83 (Strong Buying Interest)

- ADX: 30.89 (Strong Trend)

- MACD: 2.49 (Positive)

- Resistance: ₹160

- Support: ₹135

Ashok Leyland Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹157 (6% upside) and a 12-month target of ₹180 (22% upside) based on 24x FY27E EPS of ₹7.5.

Why buy now?

CV Upcycle Tailwinds: Strong demand from infra, construction, mining, and logistics driving M&HCV volume growth.

Margin Expansion Ahead: Better mix (AVTR), cost efficiencies, and operating leverage to lift EBITDA margins over FY26–27.

LCV Momentum: Bada Dost platform gaining market share, supported by e-commerce and MSME-led last-mile demand.

EV & Hydrogen Optionality: Switch Mobility scaling e-buses and e-LCVs; hydrogen truck development adds long-term upside.

Healthier Balance Sheet: Improving profitability and disciplined capex ensure comfortable leverage and growth capacity.

Portfolio fit

Ashok Leyland offers a strong cyclical and structural play on India’s commercial vehicle upcycle, backed by rising infra spending and freight demand. Its expanding LCV franchise, premium M&HCV portfolio, and EV optionality through Switch Mobility add both stability and long-term growth. For investors seeking a balanced mix of core industrial exposure and emerging clean-mobility catalysts, Ashok Leyland fits well as a mid-cap compounder.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebAshok Leyland Ltd.: Budget 2025-26 opportunities

- Infra Capex Boost: Higher spending on roads and urban projects to lift M&HCV demand.

- Logistics Expansion: Gati Shakti and freight corridor investments to support fleet replacement.

- EV Incentives: Support for electric buses and hydrogen mobility to benefit Switch Mobility.

- MSME Credit Push: Improved MSME lending to drive LCV and ICV volume growth.

- Scrappage Policy: Increased funding for scrappage centers to accelerate old fleet replacement.

Final thoughts

Ashok Leyland’s evolution is more than a CV story, it’s a transformation into a full-spectrum mobility company. From fuel-efficient modular trucks to next-gen electric and hydrogen solutions, the company is strengthening its leadership across every segment of commercial mobility.

The storyline for investors is clear: Back a market leader entering a strong cycle, expanding margins, and investing heavily in future technologies.

For investors seeking exposure to India’s logistics boom, green mobility transition, and industrial capex upcycle, Ashok Leyland stands out as a compelling and high-conviction stock idea.