In recent years, Bharat Heavy Electricals Ltd (BHEL) has made a remarkable comeback from a long period of muted growth. Riding on India’s mega infrastructure boom, rising power demand, and a renewed pipeline of thermal and renewable projects, the company has reclaimed relevance in India’s capital goods ecosystem.

But does Bharat Heavy Electricals Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BHEL |

| Industry/Sector | Capital Goods (Industrial Equipments) |

| CMP | 288.25 |

| Market Cap (₹ Cr.) | 1,00,336 |

| P/E | 178.50 (Vs Industry P/E of 51.55) |

| 52 W High/Low | 290.90 / 176.00 |

| EPS (TTM) | 1.60 |

| Dividend Yield | 0.18% |

About Bharat Heavy Electricals Ltd.

Founded in 1964, BHEL is India’s largest engineering and manufacturing enterprise in the energy and industrial systems space. With deep capabilities in power plant equipment, industrial systems, transportation, defence, and renewables, BHEL plays a crucial role in India’s infrastructure development.

The company operates one of the widest manufacturing footprints in the country, offering end-to-end solutions from design and engineering to commissioning and after-sales support.

Key business segments

Bharat Heavy Electricals Ltd. operates primarily in the following key business segments:

- Power Sector: Thermal, nuclear, hydro & gas power equipment including boilers, turbines, generators, EPC solutions, and high-margin R&M/spares.

- Industry Sector: Motors, drives, compressors, railways electrification, propulsion & defence systems, steel plant equipment, and solar/renewable EPC.

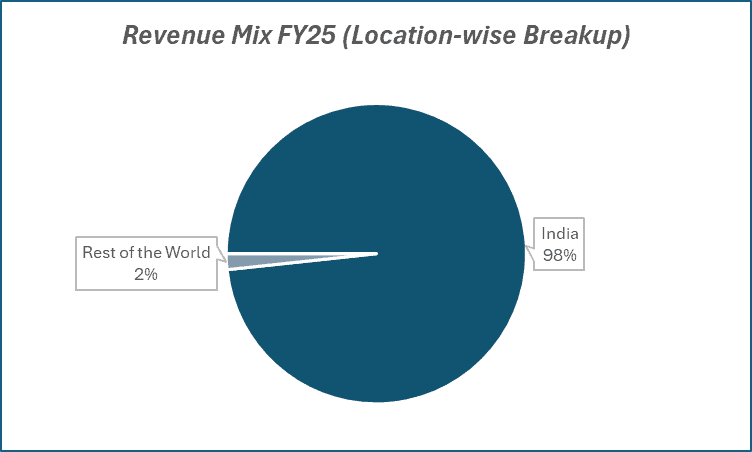

- International Business: Export of power equipment, EPC projects, and industrial systems across Asia, Africa, and the Middle East.

Primary growth factors for Bharat Heavy Electricals Ltd.

Bharat Heavy Electricals Ltd. key growth drivers:

- India’s Rising Power Demand: Structural rise in peak power demand (thermal and renewable) supports long-term order visibility.

- Revival of Thermal Projects: Multiple NTPC, state utility, and private thermal projects re-entering the pipeline after nearly a decade of slowdown.

- Infrastructure Capex Cycle: Heavy investments in railways, metro, defence, and industrial electrification fueling non-power growth.

- Renewable Energy Expansion: Solar EPC, inverters, and grid equipment to scale as renewable penetration rises.

- Defence & Transportation: Increased allocation to defence production and Make-in-India propulsion systems strengthens diversification.

Detailed competition analysis for Bharat Heavy Electricals Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBIT (₹ Cr.) | EBIT Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| BHEL Ltd. | 29269.17 | 1179.71 | 4.03% | 502.33 | 1.72% | 178.50 |

| Thermax Ltd. | 10216.77 | 885.79 | 8.67% | 590.23 | 5.78% | 60.87 |

| Jyoti CNC Automation | 1943.26 | 515.00 | 26.50% | 346.13 | 17.81% | 63.84 |

| Triveni Turbine Ltd. | 1918.90 | 417.90 | 21.78% | 343.00 | 17.87% | 49.84 |

| Kirloskar Oil Engines | 6918.77 | 1276.42 | 18.45% | 487.82 | 7.05% | 32.73 |

Key insights on Bharat Heavy Electricals Ltd.

- Record Order Book Visibility: BHEL is benefiting from revival in ordering activity across power and industrial segments, improving multi-year revenue visibility.

- Execution Cycle Improving: Shift from legacy projects to new orders is enhancing margin profile and EPC execution clarity.

- Aftermarket Revenue Strength: Spares, refurbishment, and O&M services continue to offer high-margin annuity income.

- Diversification in Progress: Railways, defence, and renewables provide long-term de-risking from thermal cyclicality.

- Balance Sheet Repair: Working capital improvements and lower receivables from state utilities improving cash flows.

Recent financial performance of Bharat Heavy Electricals for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 6584.10 | 5486.91 | 7511.80 | 36.90% | 14.09% |

| EBITDA (₹ Cr.) | 275.00 | -537.14 | 580.93 | 208.15% | 111.25% |

| EBITDA Margin (%) | 4.18% | -9.79% | 7.73% | 1752 bps | 355 bps |

| PAT (₹ Cr.) | 89.53 | -469.17 | 360.53 | 176.84% | 302.69% |

| PAT Margin (%) | 1.36% | -8.55% | 4.80% | 1335 bps | 344 bps |

| EPS (₹) | 0.30 | -1.31 | 1.08 | 182.44% | 260.00% |

Bharat Heavy Electricals Ltd. financial update (Q2 FY26)

Financial performance

- Revenue grew 14% YoY to ₹7,512 crore, driven by broad-based execution across power (+13% YoY) and industrial (+18% YoY) segments.

- EBITDA more than doubled to ₹581 crore, with margins expanding 355 bps YoY to 7.7%, aided by lower employee costs, tighter overhead control, and a more profitable execution mix.

- PAT surged 3.3x YoY to ₹361 crore, supported by stronger operating performance and higher other income; PAT margins rose 344 bps YoY to 4.8%.

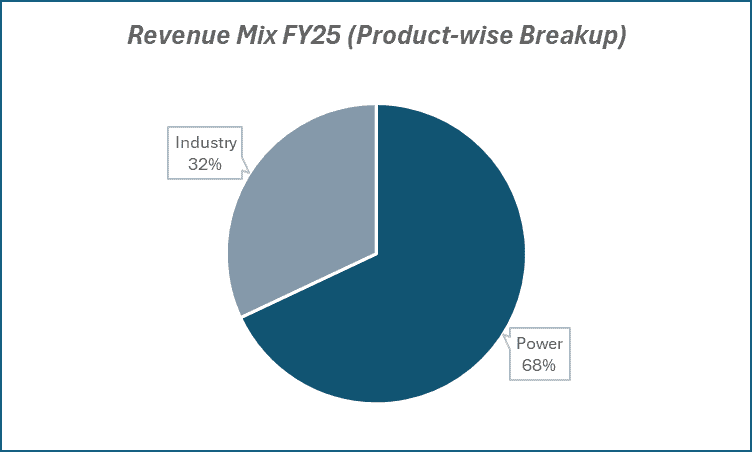

- Power contributed 76% of revenue, while Industry accounted for 24%, both showing sequential pickup in execution.

Business highlights

- Order inflows jumped to ₹21,920 crore in Q2 (83% from Power), taking the total order book to ₹2.19 lakh crore, with a strong 80:20 Power & Industry mix.

- Secured 1.63 GW of thermal capacity addition this quarter, reaffirming BHEL’s leadership in the domestic baseload thermal equipment market.

- Strong bid pipeline ahead: CEA targets 97 GW of thermal additions by FY35, with an additional 37 GW of ageing plants requiring replacement.

- This implies ₹9–10 trillion bid opportunities over the next decade, providing exceptional long-term revenue visibility.

- Execution momentum improving: Industry +18% YoY and Power +13% YoY, supported by a healthy 8x order book-to-bill ratio.

- Margins show early signs of structural improvement, led by profitable order execution and cost discipline.

Outlook

- Execution is expected to accelerate through H2 FY26 and FY27, driven by the ramp-up of newly awarded thermal projects and scale-up in industrial systems.

- Management expects strong order visibility to continue, with ₹66,800 crore inflows in FY26E and ₹49,200 crore in FY27E.

- EBITDA margin expansion from 4.4% in FY25 to 9.9% in FY27E is expected, driven by operating leverage and better order quality.

- Revenue and PAT are projected to grow at a 26% and 166% CAGR (FY25–27E) respectively, with RoCE improving to 12% by FY27E.

- BHEL remains a key beneficiary of India’s renewed thermal capex cycle, providing strong multi-year visibility on growth, margins, and returns.

Recent Updates on Bharat Heavy Electricals Ltd.

- Won multiple NTPC and state utility EPC contracts for boilers and turbine-generator packages.

- Secured new orders in defence, including naval gun systems and propulsion equipment.

- Expanded solar EPC portfolio with new tenders from government agencies.

- Entered partnerships for indigenous manufacturing of advanced power and industrial components under Make-in-India.

- Increasing traction in railways electrification and propulsion systems with bigger orders from Indian Railways.

Company valuation insights – Bharat Heavy Electricals Ltd.

BHEL trades at a rich TTM P/E of 178.5x, significantly above the industry average of 51.6x, supported by strong earnings revival expectations and a robust order cycle. The stock has delivered a healthy 29.4% 1-year return, outperforming the Nifty 50’s 10.6%, driven by improving execution visibility and the sharp recovery in the thermal capex pipeline.

The investment case is underpinned by exceptional medium-term revenue visibility, backed by ₹1.97 trillion of order inflows in FY24–Q2FY26 and a ₹2.19 lakh crore order book, along with a strong pipeline of 30 GW thermal bids. As India targets 97 GW of new thermal capacity by FY35 and replacement demand from ageing plants accelerates, BHEL remains uniquely positioned to capture a disproportionate share of these opportunities. Execution momentum is improving, margins are expanding, and profitability is set for a meaningful turnaround, with EBITDA margins rising from 4.4% in FY25 to 9.9% by FY27E and PAT expected to grow 166% CAGR (FY25–27E). Rising scale, better order quality, and cost discipline are set to structurally lift returns, with ROCE projected to reach 12% by FY27E, marking a significant improvement from historical levels.

We value BHEL at 40x FY27E EPS of ₹9, implying a 12-month target price of ₹360, offering 25% upside potential from current levels. The 3-month target price is ₹305, implying 6% upside in the near term.

Key upside triggers include faster-than-expected thermal order conversions, continued execution ramp-up, margin expansion from profitable orders, and a sustained improvement in industrial systems and export momentum.

Major risk factors affecting Bharat Heavy Electricals Ltd.

- Execution Delays: Any slowdown in commissioning or project clearance may compress margins.

- Thermal Dependence: Large reliance on thermal orders exposes the company to policy and ESG risks.

- Working Capital Stress: High receivables from state utilities may impact cash flows.

- Competitive Pressure: Aggressive bidding from domestic & global EPC players may limit margin expansion.

- Slowdown in Government Capex: BHEL’s growth remains highly dependent on public sector ordering.

Technical analysis of Bharat Heavy Electrical Ltd. share

BHEL continues to display strong bullish momentum after delivering impressive Q2 results, breaking out of a rounding bottom pattern, a classic signal of a potential sustained uptrend. The breakout confirms a structural trend reversal, with the stock now firmly positioned for further upside.

BHEL remains comfortably above its 50-day, 100-day, and 200-day EMAs, underscoring the strength and durability of its medium- to long-term bullish setup. Holding above these moving averages will be crucial for maintaining positive sentiment and trend continuation.

Momentum indicators reinforce this bullish narrative. The MACD at 13.33 stays firmly positive, with the MACD line well above the signal line, reflecting accelerating buying strength. The RSI at 75.86 signals robust bullish momentum, while the relative RSI readings of 0.23 (21-day) and 0.30 (55-day) highlight clear and consistent outperformance versus the broader market. Additionally, the ADX at 37.28 confirms a strong and strengthening trend, indicating that directional momentum continues to build.

A decisive breakout above ₹305 could open the gates toward ₹360 (12-month target). On the downside, ₹270 acts as a critical support zone; sustaining above this level will be key to preserving the stock’s bullish structure.

- RSI: 75.86 (Strong Buying Interest)

- ADX: 37.28 (Strong Trend)

- MACD: 13.33 (Positive)

- Resistance: ₹305

- Support: ₹270

Bharat Heavy Electrical Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹305 (6% upside) and a 12-month target of ₹360 (25% upside) based on 40x FY27E EPS of ₹9.

Why buy now?

Thermal capex revival: Massive 97 GW new capacity +37 GW replacements create a multi-year order supercycle.

Exceptional visibility: ₹2.19 lakh crore order book with strong thermal bid pipeline ensures sustained inflows.

Execution accelerating: Power and Industry segments showing clear YoY pickup, improving revenue momentum.

Sharp margin expansion: EBITDA margins set to rise from 4.4% to 9.9% by FY27E on profitable order execution.

Earnings turnaround: PAT expected to grow 166% CAGR (FY25–27E), driven by leverage and cost discipline.

Improving returns: ROCE to climb to 12% by FY27E, signalling structural profitability recovery.

Portfolio fit

BHEL suits investors looking for a stable large-cap industry with strong visibility from India’s power capex cycle. Its deep order book, improving execution, and margin recovery position it as a structural growth play with long-duration earnings potential and solid infrastructure exposure.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBharat Heavy Electrical Ltd.: Budget 2025-26 opportunities

- Thermal Capacity Push: Higher budgetary support for baseload thermal additions to accelerate large project awards.

- Plant Modernisation: Increased allocation for replacing ageing coal plants (~37 GW) boosts retrofit and EPC opportunities.

- Transmission Capex: Expanded funding for green energy corridors and interstate transmission systems drives HV equipment demand.

- Make in India Thrust: Incentives for domestic manufacturing strengthen BHEL’s position in boilers, turbines, and power equipment.

- Export Support: Enhanced export financing and credit guarantees improve competitiveness for overseas power projects.

Final thoughts

BHEL’s revival story is a classic case of a legacy engineering giant adapting to a modern infrastructure cycle. As India pushes aggressively into power generation, renewable energy, railways modernization, and defence indigenisation, BHEL stands at the centre of multiple policy priorities.

The company’s ability to convert a record order pipeline into profitable execution will determine whether it can sustain momentum and reclaim its long-lost capital goods leadership. For long-term investors looking to participate in India’s infrastructure renaissance, BHEL emerges as a high-conviction cyclical-to-structural opportunity provided they ride out the inherent volatility of EPC businesses.