India’s pharmaceutical landscape is steadily moving up the value chain, from generics to complex biologics and specialty therapies. At the center of this transition stands Biocon Ltd, a company that has evolved from a fermentation-led API player into a global biosimilars and innovation-driven biopharma platform. As the industry navigates pricing pressure and regulatory scrutiny, Biocon’s long-term thesis rests on scale, complexity, and execution.

But does Biocon Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BIOCON |

| Industry/Sector | Pharma & Drugs |

| CMP | 395.00 |

| Market Cap (₹ Cr.) | 52,897 |

| P/E | 69.83 (Vs Industry P/E of 33.31) |

| 52 W High/Low | 424.95 / 291.00 |

| EPS (TTM) | 5.70 |

| Dividend Yield | 0.11% |

About Biocon Ltd.

Founded in 1978, Biocon Ltd is India’s leading biopharmaceutical company with a strong presence across biosimilars, generic formulations, APIs, and novel biologics. Over the years, Biocon has deliberately pivoted toward high-entry-barrier segments such as biologics and complex injectables, significantly differentiating itself from traditional generics-focused peers.

The group operates through a diversified structure that includes Biocon Biologics, Syngene (CRDMO), and research-led innovation assets, offering both stability and long-term optionality.

Key business segments

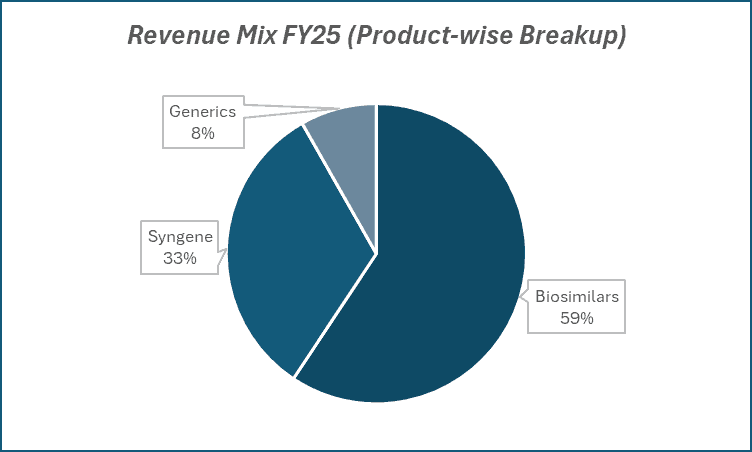

Biocon Ltd. operates primarily in the following key business segments:

- Biosimilars (Biocon Biologics): Core growth engine focused on insulin, oncology, and immunology, with a strong commercial footprint across the US, Europe, and emerging markets.

- Generics & APIs: Mature but cash-generative segment in chronic therapies, providing stable earnings and manufacturing leverage.

- Novel biologics R&D: Early-stage innovation pipeline in metabolic and autoimmune diseases, offering long-term optionality despite near-term investments.

- CRDMO (Syngene): Differentiated contract research and manufacturing business that adds earnings stability and lowers group cyclicality.

Primary growth factors for Biocon Ltd.

Biocon Ltd. key growth drivers:

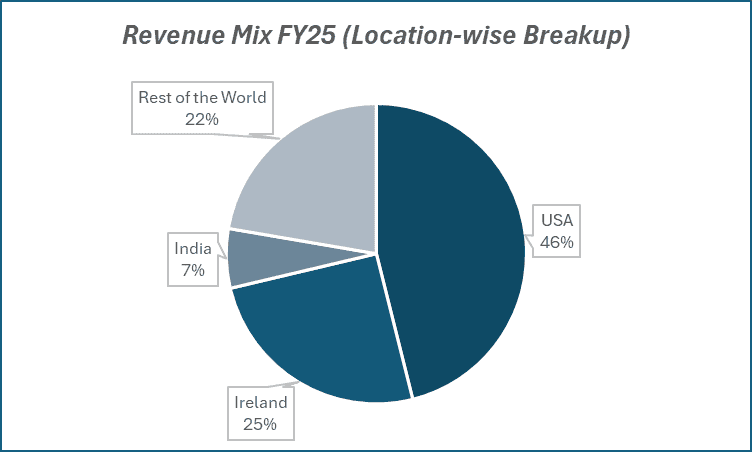

- Biosimilars-led growth: Expansion in global biosimilars adoption, driven by high biologics costs, underpins Biocon’s medium-term growth.

- Regulated market catalysts: Increasing approvals, launches, and scale-up in the US and Europe support revenue acceleration.

- Structural cost advantage: Large-scale manufacturing, backward integration, and cost-efficient biologics production enhance competitiveness.

- Defensive therapy mix: Focus on chronic segments like diabetes, oncology, and immunology adds earnings resilience across cycles.

Detailed competition analysis for Biocon Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Biocon Ltd. | 16475.80 | 3414.30 | 20.72% | 762.50 | 4.63% | 69.83 |

| Sunpharma Ltd. | 54964.01 | 15603.07 | 28.39% | 10517.89 | 19.14% | 39.76 |

| Divi’s Lab Ltd. | 10029.00 | 3246.00 | 32.37% | 2485.00 | 24.78% | 69.39 |

| Torrent Pharma Ltd. | 12248.00 | 3993.00 | 32.60% | 2140.00 | 17.47% | 60.64 |

| Cipla Ltd. | 28349.57 | 7199.40 | 25.40% | 5453.86 | 19.24% | 22.24 |

Key insights on Biocon Ltd.

- Shift to execution: Biocon is moving from an investment-heavy phase to commercialization and monetization, led by biosimilars.

- Margin normalization watch: Profitability recovery depends on scale-up, operating leverage, and easing regulatory overhangs.

- Diversified earnings base: Biosimilars drive growth, generics provide cash flows, and CRDMO adds stability, reducing volatility.

- Execution-led returns: Future returns will increasingly hinge on disciplined execution and prudent capital allocation.

Recent financial performance of Biocon Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 3590.40 | 3941.90 | 4295.50 | 8.97% | 19.64% |

| EBITDA (₹ Cr.) | 685.40 | 748.90 | 835.40 | 11.55% | 21.89% |

| EBITDA Margin (%) | 19.09% | 19.00% | 19.45% | 45 bps | 36 bps |

| PAT (₹ Cr.) | 27.10 | 89.20 | 132.80 | 48.88% | 390.04% |

| PAT Margin (%) | 0.75% | 2.26% | 3.09% | 83 bps | 234 bps |

| Adjusted EPS (₹) | -0.13 | 0.23 | 0.63 | 173.91% | 584.62% |

Biocon Ltd. financial update (Q2 FY26)

Financial performance

- Strong topline momentum: Q2 operating revenue rose 20% YoY to ₹4,296 crore, led by sharp acceleration in biosimilars and a recovery in generics.

- Margin expansion underway: Core EBITDA grew 22% YoY to ₹835 crore with margins at 19%, reflecting operating leverage, improved mix, and easing cost pressures.

- Earnings turnaround: PBT (ex-exceptionals) surged 153% YoY to ₹183 crore; reported net profit stood at ₹133 crore, marking a clear profitability inflection.

- R&D discipline maintained: Group R&D spend at ~7% of revenues, sustaining pipeline strength while supporting margin expansion.

Business highlights

- Biosimilars driving growth: Biosimilar revenues jumped 25% YoY to ₹2,721 crore; Yesintek (bUstekinumab) achieved ~70% U.S. commercial formulary coverage, with the oncology franchise maintaining 25%+ market share.

- New launches & approvals: bDenosumab secured U.S. FDA approval with Amgen commercialization tie-up; multiple launches (bUstekinumab, bAspart, bBevacizumab, bAflibercept) scaled across geographies.

- Generics recovery visible: Generics revenue rose 24% YoY to ₹774 crore with improving EBITDA, supported by GLP-1 liraglutide launch in Europe and ramp-up of complex products.

- CRDMO resilience: Syngene delivered steady performance (₹911 crore revenue, 23% EBITDA margin), with research services offsetting near-term biologics manufacturing normalization.

Outlook

- Profitability trajectory improving: Management expects sustained margin expansion as biosimilars scale, generics stabilize, and interest costs decline post debt restructuring.

- Balance sheet strengthening: Structured debt exits progressing; full annual interest savings of ~₹300 crore expected from FY27, supporting earnings visibility.

- Volume-led growth ahead: Continued momentum in biosimilars (immunology, oncology, diabetes) and emerging markets expansion underpin medium-term growth.

- Structural differentiation: Integrated R&D-manufacturing-commercial model, expanding GLP-1 capability, and post-patent opportunities position Biocon for resilient, multi-year value creation.

Recent Updates on Biocon Ltd.

- Biologics-first strategy: Continued sharpening of focus on biologics as a standalone global platform, with operational streamlining across geographies.

- Regulatory & market expansion: Ongoing regulatory approvals and portfolio expansion in key regulated markets to strengthen global presence.

- Strategic partnerships: Collaborations remain central to scaling commercialization and accelerating market access.

- Balance sheet priorities: Clear emphasis on deleveraging as cash flows stabilize, supporting lower interest costs.

- Return improvement focus: Management reiterated intent to improve return ratios through disciplined capital allocation and operating leverage.

Company valuation insights – Biocon Ltd.

Biocon is currently trading at a TTM P/E of 69.8x, materially higher than the industry average of 33.3x. Over the last one year, the stock has delivered a 14.2% return, modestly outperforming the NIFTY 50’s 9.7%, reflecting early signs of earnings recovery but with valuation still discounting near-term risks.

While headline valuations appear optically expensive, they understate the ongoing earnings inflection and structural simplification underway. The full consolidation of Biocon Biologics removes the long-standing holding company discount, strengthens cash flow visibility, and creates a unified, scaled biologics platform with global commercial reach. Strong traction in biosimilars, led by Ustekinumab, insulin franchise scale-up, and oncology biosimilars, along with improving profitability in generics and steady CRDMO performance, underpin a multi-year earnings recovery cycle.

The investment case rests on biosimilars-led growth, ramp-up of recent launches in regulated markets, operating leverage as volumes scale, and meaningful interest cost savings from debt restructuring. As biologics move toward free cash flow generation and capital allocation discipline improves, return ratios are expected to steadily normalize over the medium term.

Using a Sum-of-the-Parts (SOTP) valuation, we arrive at a 12-month target price of ₹480, implying ~22% upside from current levels. For the near term, a 3-month target of ₹420 suggests ~6% upside, supported by continued biosimilar momentum, improving margins, and incremental clarity on deleveraging and integration benefits.

Major risk factors affecting Biocon Ltd.

- Regulatory risk: Biologics manufacturing is subject to stringent inspections in regulated markets; adverse observations or delays can disrupt approvals and launches.

- Pricing pressure: Intensifying competition in biosimilars could lead to faster ASP erosion, impacting margins and profitability.

- Market penetration risk: Slower-than-expected uptake of new launches may delay revenue scaling and earnings recovery.

- Approval timelines: Any delays in regulatory clearances across key geographies could affect growth visibility.

- Financial risk: Elevated leverage and ongoing capex commitments require close monitoring until free cash flows stabilize.

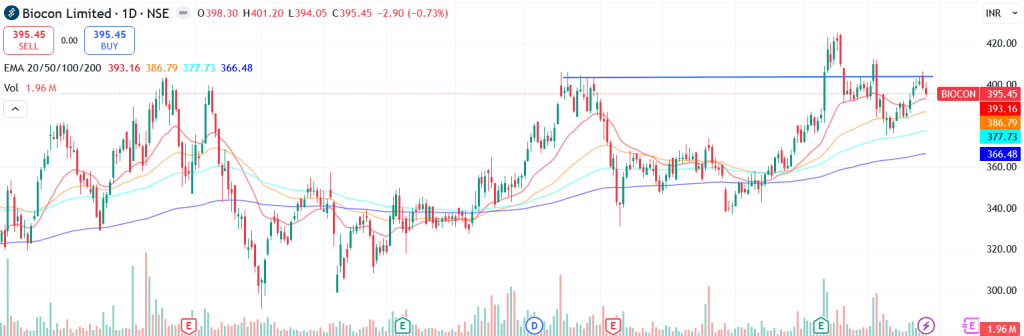

Technical analysis of Biocon Ltd. share

Biocon has formed a cup-and-handle pattern, with price now hovering near the neckline. A sustained breakout from this zone could trigger a strong upside move. The stock continues to trade comfortably above its 50-, 100-, and 200-day EMAs, confirming a positive long-term trend and consistent buying support across timeframes.

Momentum indicators support the bullish bias. MACD at 2.11 remains positive, with the MACD line holding above the signal line, indicating underlying strength. RSI at 55.43 reflects healthy buying momentum while still leaving room for further upside. Relative RSI readings (0.01 / 0.10 over 21- and 55-day periods) suggest continued outperformance versus the broader market. ADX at 17.43 points to a range-bound phase, but a breakout above the neckline could lead to a sharp directional move.

A decisive move above ₹420 could open the path toward ₹480 (12-month target). On the downside, ₹370 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 55.43 (Decent buying momentum)

- ADX: 17.43 (Range-bound, breakout watch)

- MACD: 2.11 (Positive)

- Resistance: ₹420

- Support: ₹370

Biocon Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹420 (~6% upside) and a 12-month target of ₹480 (~22% upside), based on a Sum-of-the-Parts (SOTP) valuation reflecting the core biologics platform, generics, and Syngene stake.

Why buy now?

Earnings inflection underway: Profitability is turning sharply as biosimilars scale up, generics recover, and operating leverage kicks in after multiple quarters of investment-heavy execution.

Structural simplification unlocks value: Full consolidation of Biocon Biologics removes the holding company discount, improves cash flow visibility, and creates a unified global biologics platform.

Margin expansion visibility: Better product mix (Ustekinumab, insulin franchise, oncology biosimilars), operating leverage, and easing interest costs support a sustained EBITDA upcycle.

Balance sheet repair: Debt restructuring and phased exits of structured liabilities drive lower finance costs, improving free cash flow and return ratios over the medium term.

Platform-led growth optionality: Strong biosimilar pipeline, GLP-1 capabilities, and steady CRDMO (Syngene) performance provide diversified growth beyond near-term launches.

Portfolio fit

Biocon offers structural growth exposure within healthcare, combining a global biosimilars platform, improving profitability, and balance sheet strengthening. While near-term valuations appear optically elevated, the ongoing earnings recovery, simplification-led value unlocking, and improving cash generation create an attractive risk–reward for portfolios seeking medium-term compounding driven by biologics-led growth.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBiocon Ltd.: Budget 2025-26 opportunities

- Healthcare access: Higher public healthcare spend boosts demand for affordable biosimilars and insulin.

- Manufacturing incentives: PLI and domestic biopharma focus improve scale and cost competitiveness.

- Export push: Policy support for pharma exports aids global market penetration.

- Regulatory ease: Faster approvals shorten time-to-market for biosimilars.

- R&D support: Biotech and innovation funding aligns with Biocon’s biologics-led growth strategy.

Final thoughts

Biocon Ltd represents a rare Indian pharma platform built around biologics, scale manufacturing, and scientific depth. While near-term volatility persists, the long-term narrative is centered on biosimilars leadership and global healthcare affordability. For investors willing to ride through execution cycles, Biocon offers exposure to India’s shift from generics to complex, innovation-led biopharma.