In today’s fast-moving economy, logistics is no longer just about transporting goods – it’s about enabling trade, fueling e-commerce, and driving business growth. At the heart of this transformation is Blue Dart Express Ltd (Bluedart), India’s premier logistics and express delivery company. With its deep-rooted presence, customer-first approach, and alignment with the global DHL network, Bluedart has built a reputation as the go-to name in time-sensitive logistics.

But does Blue Dart Express offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BLUEDART |

| Industry/Sector | Logistics (Courier Services) |

| CMP | 5705.50 |

| Market Cap (₹ Cr.) | 13,540 |

| P/E | 54.45 (Vs Industry P/E of 46.02) |

| 52 W High/Low | 9,488.70 / 5,365.00 |

| EPS (TTM) | 104.44 |

About Blue Dart Express Ltd

Founded in 1983 and headquartered in Mumbai, Bluedart is a leader in express air and integrated transportation services. It operates across more than 55,000 locations in India, with access to over 220 countries worldwide through its parent company, DHL Express. The company runs a fleet of dedicated freighter aircraft and offers door-to-door express deliveries for parcels, documents, and freight, making it the backbone of critical supply chains across sectors like e-commerce, pharmaceuticals, banking, and manufacturing.

Key business segments

Blue Dart Express Ltd. operates primarily in the following key business segments:

- Express Air Services – Bluedart operates a dedicated air cargo network, making it one of the few logistics players in India with its own freighter fleet.

- Ground Express Services – Offers surface transportation across India for time-bound shipments.

- E-commerce Logistics – Provides last-mile delivery, reverse logistics, and cash-on-delivery solutions tailored to India’s booming e-commerce sector.

- Industry-Specific Solutions – Customized logistics for pharma, banking (secure document handling), automotive, and retail sectors.

Primary growth factors for Blue Dart Express

Blue Dart Express key growth drivers:

- E-commerce Boom – Rising online shopping volumes are driving demand for reliable last-mile delivery.

- Pharma & Healthcare Logistics – Temperature-controlled and time-sensitive delivery solutions position Bluedart well in this space.

- Premium Positioning – Strong brand recall and service reliability allow Bluedart to command premium pricing over peers.

- Digital & Tech Investments – AI-driven tracking, automation, and warehouse technology enhance efficiency and customer experience.

- DHL Integration – Access to DHL’s global network gives Bluedart a unique advantage in international express deliveries.

Detailed competition analysis for Blue Dart Express

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Blue Dart Express | 5819.39 | 866.03 | 14.88% | 247.83 | 4.26% | 54.45 |

| VRL Logistics Ltd. | 3178.08 | 637.67 | 20.06% | 219.54 | 6.91% | 21.31 |

| Delhivery Services | 9053.60 | 427.58 | 4.72% | 198.12 | 2.19% | 177.05 |

| Concor India Ltd. | 8937.52 | 1920.26 | 21.49% | 1258.59 | 14.08% | 31.81 |

| TCI Ltd. | 4586.00 | 478.30 | 10.43% | 343.50 | 7.49% | 21.21 |

Key insights on Blue Dart Express

- Bluedart has consistently maintained industry-leading margins, thanks to its premium service positioning.

- Its air cargo network gives it a moat against competitors who rely solely on ground logistics.

- However, cost pressures from aviation fuel and infrastructure expansion remain important variables for profitability.

- Strong cash generation and brand-led pricing power make it relatively resilient even in weak demand cycles.

Recent financial performance of Blue Dart Express for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1342.71 | 1417.32 | 1441.92 | 1.74% | 7.39% |

| EBITDA (₹ Cr.) | 202.17 | 213.14 | 195.61 | -8.22% | -3.24% |

| EBITDA Margin (%) | 15.06% | 15.04% | 13.57% | -147 bps | -149 bps |

| PAT (₹ Cr.) | 53.42 | 55.15 | 48.83 | -11.46% | -8.59% |

| PAT Margin (%) | 3.98% | 3.89% | 3.39% | -50 bps | -59 bps |

| Adjusted EPS (₹) | 22.51 | 23.24 | 20.58 | -11.45% | -8.57% |

Blue Dart Express financial update (Q1 FY26)

Financial performance

- Revenue: ₹1,442 cr, up 7.4% YoY, led by growth in both B2B and B2C segments, especially surface.

- PAT: ₹49 cr, down 8.6% YoY, impacted by margin contraction.

- EBITDA margin: 13.6% (vs 15.1% YoY), decline due to product/customer mix changes, heavier shipments, and higher rental/communication costs.

- Shipments volume: 9.41 crore; tonnage: 3,40,068 tonnes.

- Segment performance: Surface tonnage up 13% YoY; Air tonnage up 2.2% YoY.

- Revenue mix: B2B 71% (vs 74% YoY), B2C 29% (vs 26% YoY); strong 20% YoY growth in B2C tonnage.

Business highlights

- Expanded fleet to 8 freighters (6 Boeing 757, 2 Boeing 737) with ~85% utilization.

- Continued shift toward owned fleet, reducing reliance on costlier leases.

- New integrated operating facility launched at Bijwasan (Delhi) to enhance efficiency.

- Guwahati was added as a direct flying location to strengthen Northeast India presence.

- Surface logistics remained the key growth driver; the air segment continues to carry higher fixed costs.

Outlook

- Focus on expanding B2B surface segment where market share is relatively low.

- Emphasis on service differentiation and quality over volume push.

- Margins expected to improve in H2 FY26, driven by peak load period and operating leverage.

- Network expansion and operational efficiencies to support long-term sustainable growth.

Recent Updates on Blue Dart Express

- Network Expansion – Bluedart has been adding new pin codes to strengthen its ground network in Tier-II and Tier-III cities.

- Sustainability Initiatives – Announced investments in green logistics, including electric vehicles for last-mile deliveries.

- Technology Upgrades – Rolling out AI-based route optimization and real-time tracking features for clients.

Company valuation insights – Blue Dart Express

Blue Dart is currently trading at a TTM P/E of 54.5x, at a premium to the industry average of 46.0x, despite delivering a -29.4% return over the past year compared to the Nifty 50’s -1.6%.

The stock’s underperformance has largely been due to margin pressures from higher costs and muted profitability. However, the company retains strong competitive advantages with its dominant position in express logistics, pan-India reach, and leadership in time-definite deliveries.

Rising e-commerce penetration, strong B2C tonnage growth (20% YoY in Q1 FY26), and increasing demand for integrated logistics solutions are expected to act as key growth drivers. Investments in expanding surface logistics, owned fleet strategy, and new operating hubs (like Bijwasan, Delhi) position Blue Dart well to capture scale benefits and improve operating leverage over the medium term.

Looking ahead, profitability is expected to rebound with margin recovery from H2 FY26, aided by peak season demand, network expansion, and higher operating efficiencies.

Applying a 36x multiple to FY27E EPS of ₹190, we derive a 12-month target price of ₹6,840, implying a 20% upside from current levels. A near-term target of ₹6,200 suggests a 9% upside over the next three months, underpinned by steady B2C growth momentum, surface-led expansion, and margin recovery trends.

Major risk factors affecting Blue Dart Express

- Fuel Cost Volatility – Jet fuel prices directly impact margins.

- Rising Competition – Aggressive expansions by Delhivery, Ecom Express, and other logistics startups.

- Economic Slowdowns – Trade and e-commerce volumes can drop in weak demand environments.

- High Valuation Multiples – Leaves limited room for error if growth disappoints.

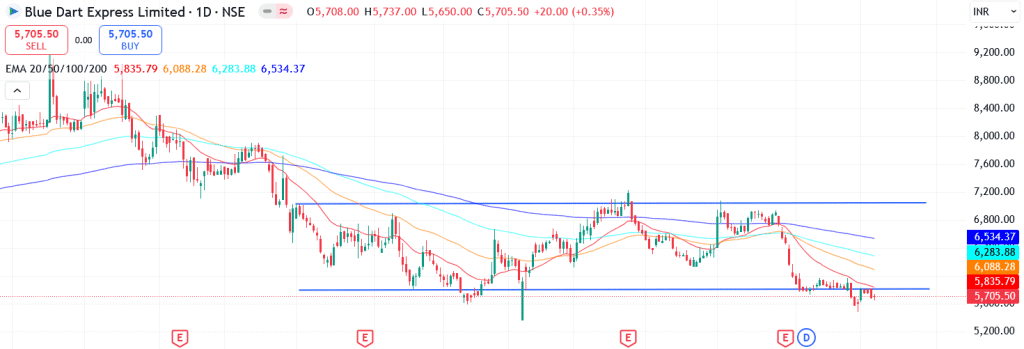

Technical analysis of Blue Dart Express share

Following its consolidation within a sideways channel, Blue Dart Express is currently trading near the lower trendline, which could act as a strong support. A rebound from this level may trigger a trend reversal and potential uptrend momentum.

The stock, however, remains below its 50-day, 100-day, and 200-day EMAs, signaling a weak short-term outlook, though a move above current support could turn sentiment positive.

The MACD stands negative at -142.10, with the line just below the signal line, confirming short-term weakness. A bullish crossover here could signal the start of an up-move. RSI at 38.24 indicates the stock is nearing the oversold region, suggesting a possible entry opportunity, while relative RSI values of -0.02 (21-day) and -0.08 (55-day) reflect slight underperformance versus the broader market. The ADX at 31.89 highlights a strong downward trend, though signs of reversal are emerging.

A breakout above the key resistance at ₹6,200 could unlock upside potential toward ₹6,840, in line with its 12-month fundamental target. On the downside, ₹5,300 remains a critical support; sustaining above this level will be essential for regaining bullish structure.

- RSI: 38.24 (Near Oversold Region)

- ADX: 31.89 (Strong Downward Trend)

- MACD: -142.10 (Negative Momentum)

- Resistance: ₹6,200

- Support: ₹5,300

Blue Dart Express stock recommendation

Current Stance: Buy, with a 3-month target of ₹6,200 (~9% upside) and a 12-month target of ₹6,840 (~20% upside).

Why buy now?

Strong Q1 FY26 shipment growth: 9.41 crore consignments handled, with 20% YoY growth in B2C tonnage.

Surface logistics expansion (13% YoY growth) driving scale benefits and reducing dependence on higher-cost air operations.

Network strengthening through new facilities (Bijwasan, Delhi) and direct flying additions (Guwahati), boosting efficiency and reach.

Transition towards an owned fleet, improving cost structure and long-term balance sheet efficiency.

Margin recovery expected in H2 FY26 as peak load season and operating leverage kick in.

Portfolio fit

Blue Dart Express is India’s leading express logistics provider with unmatched network reach, brand strength, and expertise in time-definite deliveries. Its positioning at the intersection of B2B and B2C logistics, coupled with rising e-commerce penetration, ensures long-term volume growth. With efficiency gains, margin recovery, and structural growth in surface logistics, Blue Dart offers a compelling opportunity to participate in India’s logistics transformation.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBlue Dart Express: Budget 2025-26 opportunities

- E-commerce Boost: Higher support for digital commerce and last-mile delivery to drive B2C parcel growth.

- Infra Push: Investments in roads, highways, and logistics parks to improve efficiency and reduce costs.

- Tax Incentives: GST rationalization or warehousing benefits could aid margins and demand.

- Green Logistics: Policies on EVs and sustainability to support Blue Dart’s eco-initiatives.

- Trade Facilitation: Simplified customs and export policies to lift B2B shipment volumes.

Final thoughts

Imagine a critical shipment of life-saving medicines that needs to reach a remote hospital within hours, or an e-commerce giant promising same-day delivery during a festive sale. In both cases, Bluedart is the silent force that ensures commitments are met. With its unmatched reliability, premium positioning, and integration with DHL’s global network, Bluedart continues to be a key enabler of India’s consumption and trade story. For investors, it offers a play on India’s long-term logistics growth, though one that comes with the price tag of premium valuations.