India’s public sector banks have been at the center of a remarkable turnaround story in recent years, thanks to improved asset quality, stronger capital positions, and rising credit growth. Among them, Canara Bank stands out as one of the largest and fastest-growing PSU banks, leveraging its strong retail and corporate franchise while embracing digital transformation. With India’s banking sector witnessing accelerating credit demand and improving profitability trends, Canara Bank is positioned as a key beneficiary of this structural upcycle.

But does Canara Bank offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | CANBK |

| Industry/Sector | Financial Services (Banking) |

| CMP | 118.08 |

| Market Cap (₹ Cr.) | 1,07,260 |

| P/E | 6.43 (Vs Industry P/E of 13.36) |

| 52 W High/Low | 124.55 / 78.60 |

| EPS (TTM) | 18.37 |

| Dividend Yield | 3.39% |

About Canara Bank

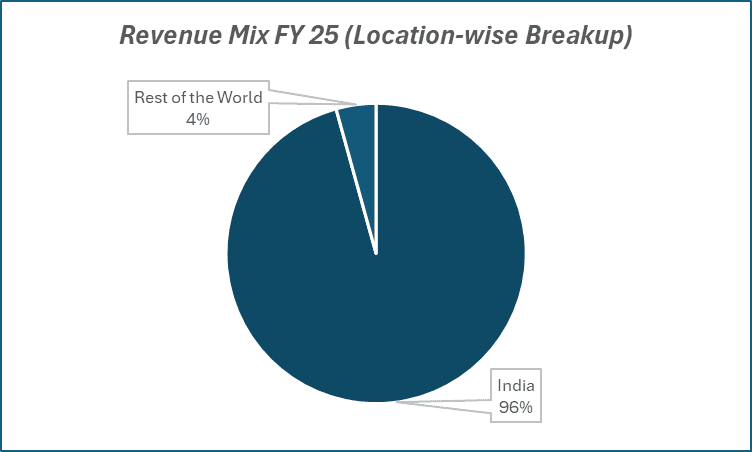

Founded in 1906 and headquartered in Bengaluru, Canara Bank is one of India’s oldest and largest public sector banks. Following its merger with Syndicate Bank in 2020, the bank has significantly expanded its scale and branch network. Today, it operates with over 9,500 branches and 12,000+ ATMs across India, offering a comprehensive range of retail, corporate, and digital banking services.

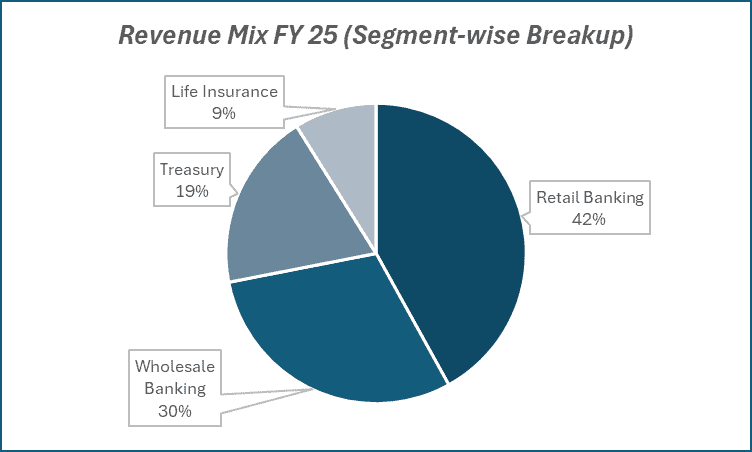

Key business segments

Canara Bank operates primarily in the following key business segments:

- Retail Banking: Housing loans, vehicle loans, gold loans, personal loans, and priority sector lending form a large part of the retail book.

- Corporate Banking: Provides working capital, term loans, trade finance, and project lending to large corporates and SMEs.

- Treasury & Investment Operations: Handles investment in government securities, forex operations, and risk management.

- Digital & Payment Solutions: Expanding presence through Canara ai1 app, internet banking, and UPI integration.

Primary growth factors for Canara Bank

Canara Bank key growth drivers:

- Credit Growth Momentum: Double-digit growth in retail and MSME loans, supported by strong demand in housing and personal finance.

- Asset Quality Improvement: Declining GNPA and NNPA ratios as resolution of stressed assets continues.

- Digital Push: Technology-led offerings to enhance customer acquisition and reduce costs.

- Synergy Gains Post-Merger: Efficiency improvements from consolidation with Syndicate Bank.

- Government & Infra Spending: Strong credit demand from infrastructure, housing, and MSMEs driven by government policies.

Detailed competition analysis for Canara Bank

Key financial metrics – TTM;

| Company | NII(₹ Cr.) | PAT(₹ Cr.) | PAT Margin (%) | Gross NPA (%) | Net NPA (%) | P/B (TTM) |

| Canara Bank | 38812.41 | 18194.98 | 11.58% | 2.69% | 0.63% | 1.08 |

| State Bank of India | 190915.01 | 80963.00 | 11.94% | 1.82% | 0.52% | 1.53 |

| Bank of Baroda | 49679.09 | 19230.74 | 12.37% | 2.26% | 0.60% | 0.84 |

| Punjab National Bank | 43441.78 | 15555.68 | 10.68% | 3.95% | 0.38% | 0.95 |

| Union Bank of India | 37404.85 | 18456.79 | 14.09% | 3.60% | 1.08% | 0.95 |

Key insights on Canara Bank

- Canara Bank’s CASA ratio continues to support a healthy deposit profile, lowering cost of funds.

- Credit costs are moderating, with provision coverage ratio improving steadily.

- Profitability is being driven by expanding Net Interest Margins (NIMs) and strong fee income traction.

- Focus on retail and MSME lending enhances diversification and reduces dependence on cyclical corporate credit.

- Digital adoption is accelerating, with a rising share of transactions handled through digital channels.

Recent financial performance of Canara Bank for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| NII (₹ Cr.) | 9638.84 | 9939.60 | 9530.82 | -4.11% | -1.12% |

| PAT (₹ Cr.) | 3977.22 | 5097.45 | 4836.21 | -5.12% | 21.60% |

| PAT Margin (%) | 10.76% | 12.66% | 11.67% | -99 bps | 91 bps |

| Gross NPA (%) | 4.14% | 2.94% | 2.69% | -25 bps | -145 bps |

| Net NPA (%) | 1.24% | 0.70% | 0.63% | -7 bps | -61 bps |

| Adjusted EPS (₹) | 4.48 | 5.59 | 3.52 | -37.03% | -21.43% |

Canara Bank financial update (Q1 FY26)

Financial performance

- Global business grew 11% YoY, reaching an all-time high of ₹25.63 lakh crore.

- Deposits rose 10% YoY to ₹14.67 lakh crore, while global advances grew 12.4% YoY to ₹10.96 lakh crore.

- Operating profit increased 12.3% YoY to ₹8,554 crore, the highest in the bank’s history.

- Net profit rose 21.6% YoY to ₹4,836 crore, with ROA at 1.14%, above the guided 1.05%.

- Fee income grew 16.4% YoY to ₹2,223 crore.

- Asset quality improved: GNPA at 2.69% (-145 bps YoY), NNPA at 0.63% (-61 bps YoY), and slippage ratio down to 0.80% (-52 bps YoY).

- NIM declined 17 bps due to rate transmission, but management expects recovery from Q3 FY26 as deposit repricing benefits kick in.

Business highlights

- RAM credit grew 15% YoY, now 58% of the book, led by retail (+34% YoY to ₹2.35 lakh cr), housing (+14% to ₹1.09 lakh cr), and vehicle loans (+22% to ₹0.21 lakh cr).

- PSLC Income: Continues to be a steady source as Canara maintains excess PSL.

- Subsidiaries: IPO plans for 2 subsidiaries; stake sale in Canara HSBC OBC underway; focus remains on growing Can Fin Homes.

- Tech investments: ₹1,000 crore annually; initiatives in digital lending, cybersecurity, and a new credit card platform.

Outlook

- Advances expected to grow 10–11% and deposits 9–10% in FY26, already tracking above guidance in Q1.

- NIM expected to stay above 2.5% in Q2 and improve in H2, though prior FY26 guidance of 2.75–2.80% may be difficult to sustain if more rate cuts occur.

- CASA ratio currently below 30% but targeted to reach 32% by year-end.

- ROA guidance of 1.05% for FY26 looks achievable, with upside potential given Q1 performance.

- Focus on retail-led growth, steady asset quality, and efficiency improvements.

Recent Updates on Canara Bank

- Canara Bank announced plans to expand its digital-only banking ecosystem, targeting millennials and urban customers.

- The bank has launched new green finance initiatives, including funding for renewable energy and electric mobility projects.

- Strengthened its focus on cybersecurity and AI-driven fraud detection systems to enhance risk management.

- Continued investments in branch expansion in semi-urban and rural India, aligning with financial inclusion goals.

Company valuation insights – Canara Bank

Canara Bank is currently trading at a TTM P/B of 1.08x, modestly above its historical average, and has delivered a 6.2% return over the past year, outperforming the Nifty 50’s -4.5%.

This performance reflects steady growth in the RAM (Retail, Agriculture, MSME) segment, improving asset quality, and robust profitability metrics with ROA above guidance. The bank’s focus on expanding its retail book, strengthening digital platforms, and leveraging its strong liability franchise positions it well for sustainable growth. Additionally, consistent fee income growth and declining slippages provide further earnings visibility.

Applying a 1.0× multiple to FY27E BVPS, we derive a 12-month target price of ₹145 (≈ 22% upside) and a 3-month target of ₹128 (≈ 8% upside), offering an attractive risk-reward profile supported by improving margins, healthy credit growth, and a stable capital position.

Major risk factors affecting Canara Bank

- PSU Overhang: Valuations may remain capped due to PSU ownership and policy-driven mandates.

- Asset Quality Sensitivity: Any slowdown in recovery or fresh slippages in the corporate book could pressure profitability.

- Competitive Pressure: Aggressive private banks and NBFCs may limit market share gains.

- Macroeconomic Risks: Inflationary pressures, interest rate volatility, or slowdown in credit demand could impact growth.

Technical analysis of Canara Bank share

Canara Bank was trading in a sideways channel but has recently broken out above the upper trendline, signaling the potential for a strong up move. The stock is comfortably positioned above its 50-day, 100-day, and 200-day EMAs, confirming the strength of its long-term uptrend.

Momentum indicators remain supportive. The MACD is positive at 3.12, with the MACD line above the signal line, validating bullish momentum. The RSI at 60.03 reflects strong buying interest, while relative RSI scores of 0.12 (21-day) and 0.07 (55-day) indicate steady outperformance versus the broader market. An ADX reading of 33.69 highlights a very strong trend, adding conviction to the breakout.

A decisive move above ₹128 resistance could pave the way for a rally toward ₹145, aligning with the 12-month fundamental target. On the downside, ₹112 serves as a key support, and holding above this level will be critical to sustaining the bullish structure.

- RSI: 60.03 (Strong Buying Interest)

- ADX: 33.69 (Very Strong Trend)

- MACD: 3.12 (Positive)

- Resistance: ₹128

- Support: ₹112

Canara Bank stock recommendation

Current Stance: Buy, with a 3-month target of ₹128 (~8% upside) and a 12-month target of ₹145 (~22% upside) based on 1.0× our FY27E BVPS.

Why buy now?

RAM-led Growth: Retail, agriculture, and MSME credit grew 15% YoY, now 58% of the book, led by strong retail (+34%) and housing (+14%).

Improving Profitability: Q1 FY26 ROA stood at 1.14%, above guidance; operating profit grew 12% YoY and net profit 22% YoY.

Asset Quality Gains: GNPA declined to 2.69% and NNPA to 0.63%, with slippages and restructuring under control.

Fee Income Momentum: Fee-based income rose 16% YoY, aided by PSLC sales and cross-sell, providing earnings visibility.

Digital & Tech Push: Annual tech investment of ₹1,000 cr in digital lending, credit cards, and cybersecurity to drive scalability and efficiency.

Portfolio fit

Canara Bank offers investors a large-cap PSU banking play with improving asset quality, strong RAM-driven growth, and steady profitability. Backed by a robust liability franchise, rising fee income, and digital initiatives, it provides exposure to India’s credit cycle recovery with an attractive risk-reward profile.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCanara Bank: Budget 2025-26 opportunities

- RAM Credit Growth: Government push on retail, agriculture, and MSME lending supports Canara’s RAM-focused strategy, now 58% of its book.

- Infrastructure Spend: Higher allocation to housing, roads, and urban projects to drive loan demand across retail housing and corporate segments.

- Digital Banking Incentives: Budgetary support for UPI, fintech adoption, and digital infrastructure aligns with Canara’s ₹1,000 cr annual tech investments.

- PSU Bank Support: Continued capital allocation and reform measures strengthen public sector banks’ balance sheets and growth capacity.

- Fee Income Levers: Policy thrust on capital markets, insurance, and financial inclusion can enhance cross-sell and fee-based income streams.

Final thoughts

Canara Bank represents the revival of PSU banking, offering investors exposure to India’s accelerating credit growth, improving asset quality, and digital banking transformation at attractive valuations. As profitability metrics continue to strengthen and efficiency gains from its merger play out, the bank stands well-placed to deliver sustainable value creation. For long-term investors seeking a mix of growth and stability in the financial sector, Canara Bank could be a promising addition.