In a world where businesses are racing toward automation, data intelligence, and cloud-native ecosystems, Coforge Ltd has steadily emerged as one of India’s most agile and differentiated IT services providers. Known for its domain expertise, client-centric approach, and consistency in execution, the company has built a strong niche across financial services, travel, insurance, and public sector verticals. As digital transformation spending continues to accelerate globally, Coforge stands well-positioned to ride the next wave of enterprise modernization.

But does Coforge offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | COFORGE |

| Industry/Sector | Information Technology (Software) |

| CMP | 1760.00 |

| Market Cap (₹ Cr.) | 58,889 |

| P/E | 51.11 (Vs Industry P/E of 25.44) |

| 52 W High/Low | 2005.36 / 1194.01 |

| EPS (TTM) | 35.45 |

| Dividend Yield | 0.22% |

About Coforge Ltd.

Founded in 1992 and headquartered in Noida, Coforge Ltd (formerly NIIT Technologies) is a mid-tier IT services and digital transformation company serving clients across 20+ countries. The company offers end-to-end technology solutions in cloud, digital integration, automation, data analytics, and product engineering. Backed by Baring Private Equity Asia, Coforge has transitioned from a traditional IT service provider to a high-value, domain-driven enterprise partner with a focus on long-term annuity-based contracts.

Key business segments

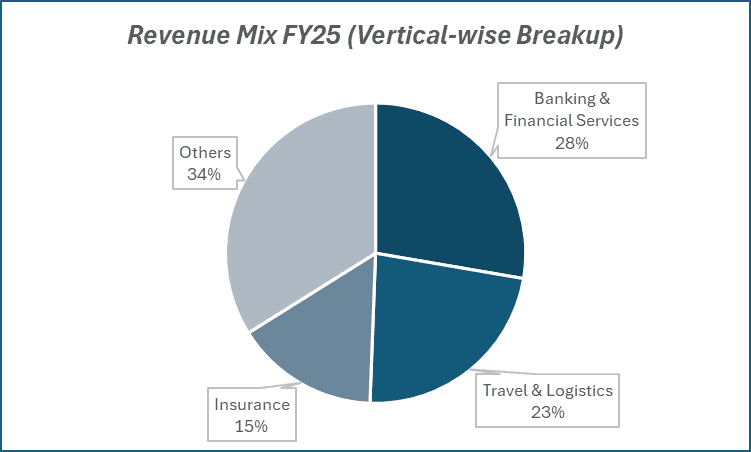

Coforge Ltd. operates primarily in the following key business segments:

- BFSI (Banking, Financial Services & Insurance): Core vertical contributing the largest revenue share, driven by digital transformation, data integration, and platform modernization services.

- Travel, Transportation & Hospitality (TTH): Deep domain expertise with clients in airlines, logistics, and travel tech platforms.

- Public Sector & Government: Focused on large transformation deals in the UK and US, particularly in citizen services and automation.

- Others: Expanding presence in manufacturing, healthcare, and retail with AI-led and cloud-first solutions.

Primary growth factors for Coforge Ltd.

Coforge Ltd. key growth drivers:

- Strong Order Book: Record Total Contract Value (TCV) pipeline driven by large multi-year deals and renewals across BFSI and public sector.

- Digital & Cloud Momentum: Increasing demand for data-driven and cloud-native transformation projects across enterprise clients.

- Domain Depth: Industry-specialized solutions in travel, insurance, and banking help Coforge differentiate from peers.

- Strategic Acquisitions: Bolt-on acquisitions in data engineering, low-code platforms, and insurance tech to enhance capabilities.

- Operational Leverage: Improving offshore mix, cost optimization, and utilization rates driving margin recovery.

Detailed competition analysis for Coforge Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Coforge Ltd. | 14402.40 | 2279.50 | 15.83% | 1273.40 | 8.84% | 51.11 |

| Persistent Systems | 13218.70 | 2416.93 | 18.28% | 1665.16 | 12.60% | 55.17 |

| OFSS Ltd. | 7072.50 | 3071.90 | 43.43% | 2373.20 | 33.56% | 31.37 |

| Mphasis Ltd. | 14540.01 | 2731.30 | 18.78% | 1739.33 | 11.96% | 30.85 |

| LTTS Ltd. | 11480.90 | 1923.40 | 16.75% | 1275.00 | 11.11% | 34.68 |

Key insights on Coforge Ltd.

- Over 95% of revenues come from repeat business, showcasing strong client stickiness.

- Top 20 clients account for nearly two-thirds of revenue, indicating deep relationships and long-term engagements.

- Consistent double-digit revenue growth trajectory driven by digital and cloud integration.

- AI and automation integration is becoming central to delivery efficiency and client outcomes.

- Healthy deal pipeline with rising share of large deals in North America and Europe.

Recent financial performance of Coforge Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 3025.60 | 3688.60 | 3985.70 | 8.05% | 31.73% |

| EBITDA (₹ Cr.) | 422.60 | 577.00 | 732.50 | 26.95% | 73.33% |

| EBITDA Margin (%) | 13.97% | 15.64% | 18.38% | 274 bps | 441 bps |

| PAT (₹ Cr.) | 246.80 | 286.20 | 425.40 | 48.64% | 72.37% |

| PAT Margin (%) | 8.16% | 7.76% | 10.67% | 291 bps | 251 bps |

| Adjusted EPS (₹) | 6.06 | 9.49 | 11.23 | 18.34% | 85.31% |

Coforge Ltd. financial update (Q2 FY26)

Financial performance

- Revenue: ₹3,986 crore (+31.7% YoY / +8.1% QoQ), driven by strong growth across verticals and expanding offshoring share.

- PAT: ₹425 crore (10.7% margin), up 72% YoY, supported by margin recovery and higher operating efficiency.

- EBITDA Margin: 18.4% (+441 bps YoY), aided by disciplined cost management and improved utilization.

- Order Intake: $514 million, including five large deals; executable order book over the next 12 months stood at $1.63 billion (+26.7% YoY).

- Attrition: Among the lowest in the industry at 11.4%, reflecting strong employee engagement and retention.

Business highlights

- Broad-based growth led by BFS (+17.4% YoY), Travel & Hospitality (+60.8% YoY), and Engineering (+39.9% YoY).

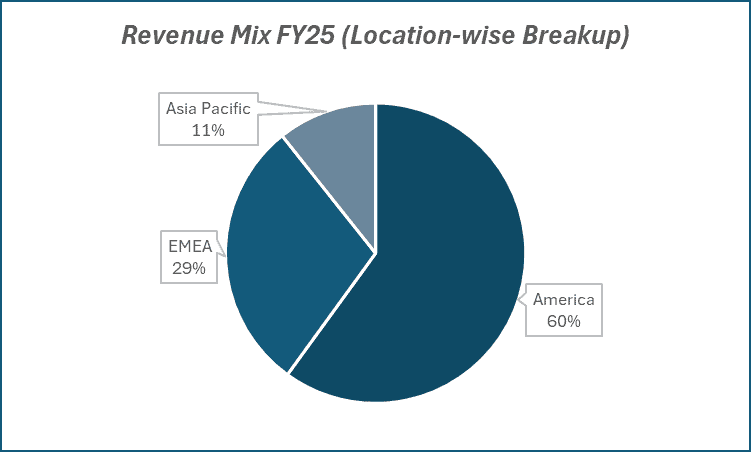

- Added 9 new clients across geographies, Americas (4), EMEA (2), and Rest of World (3).

- Headcount increased by 709 during the quarter, reaching 34,896 employees globally.

- Expanded offshoring revenues to 52.3% of total, enhancing delivery efficiency and margins.

- Strengthened large-account relationships with 34 clients above $10 million in annual revenue.

- Opened the third Coforge Public Library in Hyderabad, reinforcing its community-focused culture.

Outlook

- Sustained double-digit growth visibility supported by a robust $1.6 billion order book.

- Margin improvement expected to continue, backed by cost optimization and higher offshore mix.

- Diversified vertical exposure and strong client mining to drive long-term growth momentum.

- Strategic investments in AI-led engineering, data integration, and cloud services to enhance competitiveness.

- Healthy cash flows and a strong balance sheet position Coforge well for future expansion.

Recent Updates on Coforge Ltd.

- Announced a strategic partnership with a leading cloud provider to build a GenAI Center of Excellence.

- Expanded insurance platform capabilities through a new product suite for global clients.

- Opened new delivery centers in tier-II Indian cities to improve talent availability and cost efficiency.

- Collaborating with a major airline group to modernize its operations and passenger management systems.

Company valuation insights – Coforge Ltd.

Coforge is currently trading at a TTM P/E of 51.1x, significantly above the industry average of 25.4x, reflecting investor confidence in its consistent execution and strong growth visibility. The stock has delivered a 14.2% return over the past year, outperforming the Nifty 50’s 6.0% gain.

The investment case for Coforge is supported by its broad-based business momentum, diversified vertical exposure, and sustained margin improvement. The company continues to demonstrate operational excellence through expanding offshoring share, robust order inflows, and increasing client mining depth across large accounts. With a strong culture driving low attrition, healthy cash generation, and deep domain expertise in BFS, insurance, and travel verticals, Coforge is well-positioned to sustain its growth trajectory. Strategic investments in AI-led engineering, cloud, and data integration solutions further enhance its competitiveness in the digital transformation space.

We value Coforge at 40x FY27E EPS of ₹54, arriving at a 12-month target price of ₹2,160, implying a 22% upside from current levels. For the short term, we assign a 3-month target of ₹1,870, indicating a 6% upside. Key upside triggers include sustained deal wins, margin expansion through higher offshoring, and continued growth in digital and data-led services.

Major risk factors affecting Coforge Ltd.

- Macroeconomic Slowdown: Prolonged weakness in the US or Europe could delay client IT spending.

- Currency Fluctuations: Volatility in INR/USD may impact profitability.

- Attrition & Wage Pressure: Rising talent costs could affect margins.

- Client Concentration: Dependence on top clients, particularly in BFSI and TTH, remains a key risk.

- Execution Risk: Large deal ramp-ups or integration of acquired entities may face operational challenges.

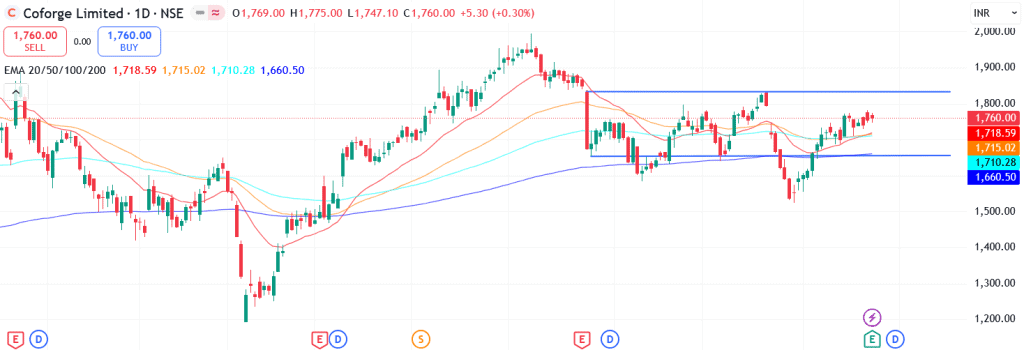

Technical analysis of Coforge Ltd. share

Coforge is currently trading in a sideways channel but is approaching the upper trendline, and following its strong Q2 results, a breakout above this level could trigger a fresh phase of strong upward momentum.

The stock is trading above its 50-day, 100-day, and 200-day EMAs, reaffirming a robust bullish structure. Sustaining above these averages would further strengthen the medium- to long-term positive outlook.

Momentum indicators reinforce this setup. The MACD at 16.51 remains positive, with the line positioned above the signal line, signaling strong momentum build-up. The RSI at 58.26 indicates healthy buying interest, while the relative RSI scores of 0.03 (21-day) and 0.01 (55-day) suggest consistent outperformance versus the broader market. The ADX at 13.14 points to a range-bound phase, but a breakout above the resistance zone could mark the start of a more defined upward trend.

A decisive move above ₹1,870 could open the path toward ₹2,160 (12-month fundamental target). On the downside, ₹1,650 serves as a crucial support; holding above this level is essential to maintain the bullish structure.

- RSI: 58.26 (Strong Buying Interest)

- ADX: 13.14 (Range Bound)

- MACD: 16.51 (Positive)

- Resistance: ₹1,870

- Support: ₹1,650

Coforge Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,870 (~6% upside) and a 12-month target of ₹2,160 (~22% upside).

Why buy now?

Strong Execution: Consistent double-digit growth driven by broad-based momentum across BFS, Insurance, and Travel verticals.

Robust Order Book: $1.6 billion executable order book with five large deal wins in Q2FY26 provides high revenue visibility.

Margin Expansion: EBIT margin has improved, aided by higher offshore mix and operational efficiencies.

Low Attrition & Talent Depth: Among the lowest attrition in the industry at ~11%, enabling stable delivery and client continuity.

Digital Transformation Focus: Strategic investments in AI-led engineering, cloud, and data integration strengthen long-term competitiveness.

Healthy Balance Sheet: Strong cash flows support reinvestment and inorganic growth opportunities.

Portfolio fit

Coforge combines sustained growth visibility, operational resilience, and digital transformation leadership within the IT services space. Its expanding client base, improving margins, and deep domain expertise make it a core holding for investors seeking exposure to India’s high-quality mid-cap IT theme with global scalability.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCoforge Ltd.: Budget 2025-26 opportunities

- Digital Transformation Push: Government focus on AI, data analytics, and digital infrastructure to accelerate enterprise tech adoption across sectors, boosting demand for Coforge’s digital and cloud services.

- Global Capability Expansion: Incentives for IT exports and digital trade partnerships to enhance Coforge’s global delivery footprint and competitiveness in key markets like the U.S. and Europe.

- Tech Skill Development: Increased allocation for upskilling and tech education to strengthen India’s IT talent pool, supporting Coforge’s hiring and innovation pipeline.

- AI & Automation Incentives: Policy support for AI, robotics, and automation to drive enterprise modernization, directly benefiting Coforge’s Intelligent Automation and data integration businesses.

- Sustainability & ESG Focus: Green data center and energy-efficiency initiatives to complement Coforge’s ESG roadmap and enhance its appeal among global clients.

Final thoughts

Coforge is more than a traditional IT services firm, it’s an agile digital partner driving transformation at scale. With a sharp focus on domain-led technology, automation-first delivery, and AI-integrated innovation, the company is unlocking new layers of efficiency and value for its clients. As global enterprises evolve toward cloud-native and AI-powered ecosystems, Coforge’s deep client relationships, operational resilience, and differentiated offerings position it as a standout mid-cap tech leader ready to accelerate into its next growth phase.