As India rapidly scales up its logistics and infrastructure backbone, one name stands at the intersection of freight movement, economic efficiency, and long-term growth – Container Corporation of India (CONCOR).

With the government’s thrust on multimodal logistics, dedicated freight corridors, and ‘Make in India’, CONCOR is emerging as a key beneficiary.

But is this PSU logistics giant just a slow mover, or is it quietly laying the tracks for explosive growth? Let’s find out.

Stock overview

| Ticker | CONCOR |

| Industry/Sector | Logistics Solution Provider |

| Market Cap (₹ Cr.) | 41,603 |

| Free Float (% of Market Cap) | 45.11% |

| 52 W High/Low | 1,180.00 / 601.25 |

| P/E | 31.76 (Vs Industry P/E of 36.80) |

| EPS (TTM) | 21.45 |

About Container Corporation of India

Container Corporation of India Ltd. (CONCOR), a Navratna PSU, was incorporated in 1988 under the Ministry of Railways. It is the market leader in India’s containerised rail freight transport, operating a vast network of Inland Container Depots (ICDs) and Container Freight Stations (CFSs).

With over 60 terminals, a fleet of more than 350 rakes, and a dominant 60%+ market share in rail container transport, CONCOR is not just a logistics provider; it’s a strategic asset that underpins India’s trade infrastructure. The company plays a critical role in facilitating EXIM (export-import) cargo as well as domestic container movement across the country.

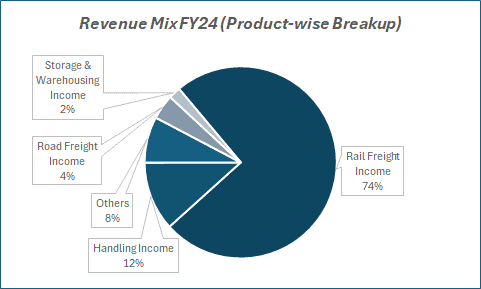

Key business segments

Container Corporation of India operates primarily in the following key business segments:

- EXIM Rail Operations: Container transport for international trade via ports to hinterland ICDs.

- Domestic Rail Operations: Transportation of goods across India for domestic industries.

- Handling & Warehousing Services: Value-added services like storage, loading, unloading, and customs clearance at ICDs and CFSs.

- Logistics Solutions & MMLPs: Developing Multimodal Logistics Parks for integrated road–rail–port connectivity.

Primary growth factors for Container Corporation of India

Container Corporation of India key growth drivers:

- Dedicated freight corridors (DFC): The Western DFC is operational, reducing transit times and improving efficiency for CONCOR’s freight routes.

- India’s manufacturing & export push: As India boosts exports and industrial activity, containerised cargo is expected to grow, directly benefiting CONCOR.

- Shift to Rail from road: Rising fuel costs and environmental concerns are driving a modal shift from road to rail freight.

- Asset-Light transition: CONCOR is increasingly moving toward a more asset-light model, leasing rakes and outsourcing terminal ops to boost returns on capital.

- Privatisation & strategic stake sale buzz: Though paused, any future movement on divestment could unlock significant value and operational efficiency.

Detailed competition analysis for Container Corporation of India

Key financial metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE % | ROCE % | P/E (TTM) |

| CONCOR | 8653.41 | 22.63% | 14.24% | 10.95% | 15.05% | 31.76 |

| BLUEDART | 5267.83 | 16.19% | 5.71% | 23.67% | 30.85% | 53.99 |

| GESHIP | 5255.17 | 56.50% | 49.74% | 23.06% | 20.18% | 4.34 |

| TCI | 4024.20 | 10.20% | 6.92% | 19.24% | 20.49% | 20.17 |

Key insights on Container Corporation of India

- Revenue CAGR of 10% over the last 3 years, reflecting steady top-line growth despite external trade disruptions.

- Profit CAGR of 32% over the same period, underscoring strong earnings momentum and operational leverage.

- Stable EBITDA margins above 22%, indicating consistent operating efficiency and cost control.

- The company is almost debt-free, enhancing financial flexibility and reducing risk from interest rate fluctuations.

- Healthy dividend payout ratio of 54.9%, balancing shareholder returns with reinvestment in infrastructure.

- CONCOR commands over 60% market share in containerized rail freight, making it a near-monopoly in a capital-intensive, high-barrier segment.

- Operates 60+ terminals with exclusive access to railways and pan-India warehousing – enabling unmatched logistics reach and scalability.

Recent financial performance of Container Corporation of India for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2210.57 | 2287.75 | 2208.31 | -3.47% | -0.10% |

| EBITDA (₹ Cr.) | 517.46 | 582.02 | 464.99 | -20.11% | -10.14% |

| EBITDA Margin (%) | 23.41% | 25.44% | 21.06% | -438 bps | -235 bps |

| PAT (₹. Cr.) | 325.81 | 371.25 | 340.52 | -8.28% | 4.51% |

| PAT Margin (%) | 14.74% | 16.23% | 15.42% | -81 bps | 68 bps |

| Adjusted EPS (₹) | 5.43 | 6.00 | 6.02 | 0.33% | 10.87% |

Container Corporation of India financial update (Q3 FY25)

Financial performance

- Total originating volumes in Q3 FY25 grew 1.3% YoY to 6,43,456 TEUs; EXIM volumes were 5,25,812 TEUs, and domestic volumes were 1,17,644 TEUs.

- Total throughput volume rose 11.6% YoY; EXIM throughput grew 8% and domestic throughput surged 24.7% YoY.

- Rail freight margin improved 15 bps YoY to 25.76%, indicating stable cost efficiency.

- EXIM market share stood at 55.28%, domestic market share at 58%, and overall share at 56% during 9M FY25.

- Capex of ₹444 crore incurred during 9M FY25, reflecting ongoing infrastructure investment.

Outlook

- FY25 capex guidance increased by 40% to ₹855 crore, up from the earlier estimate of ₹610 crore

- The company aims to reach 80 terminals, 500+ rakes, and ~70,000 containers by FY28.

- Double-digit volume growth is expected in Q4 FY25, driven by improving demand and operational scale.

Company valuation insights – Container Corporation of India

CONCOR trades at a TTM P/E of 31.76, below the industry average of 36.80, with a -33.86% 1Y return versus Nifty 50’s +8.48%.

In 9M FY25, CONCOR expanded its logistics backbone through double-stack train deployment, deeper DFC integration, and terminal infrastructure upgrades. Increased capex guidance highlights management’s focus on long-term multimodal dominance and operational efficiency.

With DFC fully operational and rising double-stack train volumes, we expect a blended volume CAGR of 12% over FY24–27, supported by steady EBITDA margins of 22–23%.

Valuation looks attractive at 16x FY26E EV/EBITDA, implying a 12-month target price of ₹820 (20% upside). A near-term 3-month target price of ₹750 suggests 10% upside from current levels.

Major risk factors affecting Container Corporation of India

- Tariff & Regulatory Risks: Being a PSU, tariff revisions and policy interventions could impact margins.

- Privatisation Delays: Uncertainty around divestment may keep valuations range-bound in the near term.

- Port Competition: Increasing reliance on coastal shipping and private port operators may lead to margin pressure in some EXIM routes.

- Capex & Execution Risks: Delays in MMLP construction or technology upgradation could hinder growth.

Technical analysis of Container Corporation of India share

CONCOR recently broke out of a long-term descending channel with a sharp 5% move over two sessions, indicating a potential trend reversal. Since the breakout, the stock has entered a consolidation phase. A positive catalyst could trigger a fresh bullish leg.

The stock hovers near its 50-day EMA but remains below the 100- and 200-day EMAs, suggesting near-term caution. MACD is slightly negative at -0.29, with the MACD line still below the signal line. An upward crossover could validate a bullish setup. RSI stands at 46.85, showing neutral momentum, while Relative RSI remains mildly negative over both 21-day (-0.06) and 55-day (-0.11) periods, indicating minor underperformance.

ADX at 16.66 reflects a range-bound trend. A breakout above the resistance level of ₹730 could open upside potential toward ₹820. On the downside, ₹640 remains a critical support.

- RSI: 46.85 (Neutral)

- ADX: 16.66 (Range Bound)

- MACD: -0.29 (Slightly Negative)

- Resistance: ₹730

- Support: ₹640

Container Corporation of India stock recommendation

Current Stance: Buy with a target price of ₹820 over a 12-month horizon and ₹750 over a 3-month horizon. CONCOR’s dominant market position, strong infrastructure backbone, and strategic use of Dedicated Freight Corridors (DFCs) make it a high-conviction play on India’s logistics and infrastructure growth story.

Why buy now?

Logistics leadership: Over 60% market share in rail container freight with near-monopoly status and high entry barriers.

Infrastructure expansion: Significant capex pipeline aimed at terminal expansion, rake acquisition, and multimodal integration to boost volume growth and efficiency.

DFC tailwinds: Ramp-up of DFC usage and double-stacking initiatives are expected to drive blended volume CAGR of 12% over FY24–27 with stable margins of 22–23%.

Portfolio fit

CONCOR offers defensive exposure to India's long-term infrastructure and logistics development. With steady cash flows, government backing, and secular growth drivers like EXIM trade, e-commerce, and industrial movement, it is well-suited for portfolios aiming for stability, policy-aligned growth, and transport sector diversification.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebContainer Corporation of India: Budget 2025-26 opportunities

- Gati Shakti Boost: Infra push under Gati Shakti to aid CONCOR’s terminal and logistics network expansion.

- Railway Capex: Higher outlay to fast-track DFC usage and double-stack freight efficiency.

- Logistics Focus: Incentives for warehousing and logistics parks align with CONCOR’s growth strategy.

- EXIM Tailwinds: Export-led policies under Make in India to drive container volume growth.

- Privatization Push: Private investment in rail infra opens up collaboration and efficiency gains.

Final thoughts

CONCOR combines the strength of a PSU with the agility of a logistics innovator, well-placed to benefit from the Make in India, DFC, and multimodal connectivity megatrends. While near-term movement may depend on privatization clarity, the long-term fundamentals remain robust.

With strong assets, rising freight volumes, and a strategic role in India’s trade corridors, CONCOR is a steady compounder to watch in the logistics space.