In the rapidly evolving world of specialty chemicals, few Indian companies have managed to carve a niche as deep and defensible as Cummins India Ltd (CUMMINSIND). With a legacy of over six decades in engine technology, Cummins India has successfully transitioned from being a premier diesel engine manufacturer to a high-value, integrated power solutions provider for a modernizing economy. Its strategic evolution, strong and long-standing client partnerships, and a clear focus on high-margin segments and new technologies have positioned it as a key and structural beneficiary of India’s sustained infrastructure and industrial growth story.

But does Cummins India offer a compelling case for long-term investors at its current valuation? Let’s delve deeper.

Stock overview

| Ticker | CUMMINSIND |

| Industry/Sector | Automobile & Auto Parts |

| CMP | 4287.00 |

| Market Cap (₹ Cr.) | 1,18,769 |

| P/E | 55.89 (Vs Industry P/E of 36.97) |

| 52 W High/Low | 4402.90 / 2580.00 |

| EPS (TTM) | 77.24 |

| Dividend Yield | 1.19% |

About Cummins India Ltd.

Founded in 1962 and headquartered in Pune, Cummins India Ltd is a key part of the global Cummins Inc. (USA), which holds a 51% majority stake. This lineage provides unparalleled access to global R&D, manufacturing best practices, and a robust export pipeline. The company is India’s leading designer and manufacturer of diesel and natural gas engines, as well as a provider of fully integrated power solutions. It caters to a wide and critical array of industries including transportation (trucks, buses), power generation (data centers, hospitals, real estate), construction (excavators, cranes), mining, and industrial manufacturing. Its extensive reach is supported by 21 manufacturing facilities and over 200 service locations across India.

CUMMINSIND’s strategic emphasis on R&D, bolstered by its global parent, and its proactive expansion into new-age power solutions (like battery storage and hydrogen-based technologies) has allowed it to deliver consistent growth and strong performance, navigating complex emission norm changes ahead of competitors.

Key business segments

Cummins India Ltd. operates primarily in the following key business segments:

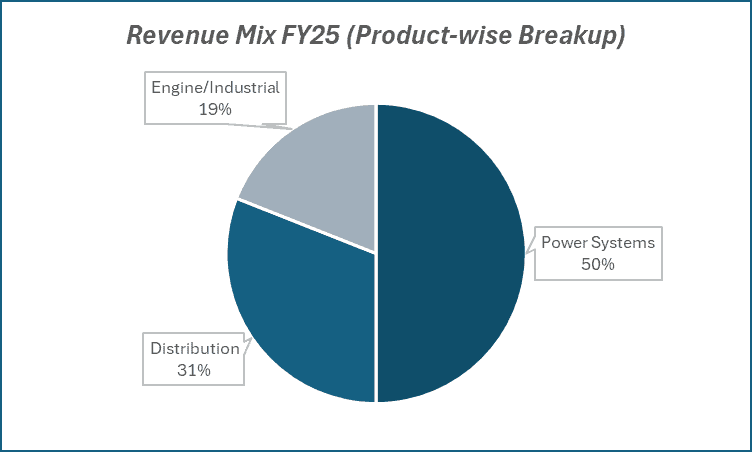

- Engine: Develops diesel and natural gas engines for mining, railways, construction, agriculture, and industrial use. Contributes 18-20% of domestic revenue, forming the backbone of India’s industrial activity.

- Power Systems: Largest segment (50% of domestic revenue), offering complete power generation solutions, gensets, alternators, and switchgear.

- Distribution: Accounts for 30-32% of revenue through parts, service, and maintenance contracts. A stable, high-margin business ensuring recurring income and strong customer relationships.

Primary growth factors for Cummins India Ltd.

Cummins India Ltd. key growth drivers:

- Sustained Infrastructure Push: Ongoing public and private capex across data centers, infra, and manufacturing drives strong demand for engines and power systems.

- Global Supply Chain Diversification: The “China+1” shift boosts exports as Cummins India emerges as a trusted, high-quality manufacturing base.

- R&D-Led Technology Transition: Backed by Cummins Inc.’s global R&D, the firm leads in emission compliance, hybrid systems, and next-gen clean technologies.

- Strong Aftermarket & Distribution: A deep service network and long-term contracts ensure recurring, high-margin revenue and customer stickiness.

- New Product Lines: Expansion into data center power and green tech platforms positions the company for long-term, sustainable growth.

Detailed competition analysis for Cummins India Ltd.

Key financial metrics – TTM;

| Company | Revenue (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Cummins India | 10981.95 | 2230.24 | 20.31% | 1876.52 | 17.09% | 55.89 |

| Kirloskar Oil | 6470.71 | 1187.92 | 18.36% | 453.51 | 7.01% | 32.18 |

| Kirloskar Brothers | 4432.20 | 575.50 | 12.98% | 375.20 | 8.47% | 35.15 |

| Elgi Equipments | 3576.05 | 523.03 | 14.88% | 354.54 | 9.91% | 42.09 |

| KSB Ltd. | 2605.00 | 345.10 | 13.25% | 242.20 | 9.30% | 52.37 |

Key insights on Cummins India Ltd.

- Parentage Advantage: A 51% subsidiary of Cummins Inc. (USA), offering global tech access, advanced R&D, world-class manufacturing, and export opportunities.

- Institutional Confidence: Strong 28% institutional holding reflects high conviction in management, strategy, and long-term leadership.

- Aftermarket Strength: Stable, high-margin distribution and service revenue cushions earnings from cyclical engine sales.

- Robust Balance Sheet: Virtually debt-free, enabling self-funded expansion, tech upgrades, and resilience during downturns.

- Operational Discipline: Focused on profitability through efficiency and cost control, ensuring growth translates into sustained shareholder value.

Recent financial performance of Cummins India Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue(₹ Cr.) | 2315.56 | 2470.38 | 2906.82 | 17.67% | 25.53% |

| EBITDA (₹ Cr.) | 473.30 | 525.23 | 623.50 | 18.71% | 31.73% |

| EBITDA Margin (%) | 20.44% | 21.26% | 21.45% | 19 bps | 101 bps |

| PAT (₹ Cr.) | 395.27 | 439.13 | 538.62 | 22.66% | 36.27% |

| PAT Margin (%) | 17.07% | 17.78% | 18.53% | 75 bps | 146 bps |

| EPS (₹) | 16.69 | 19.10 | 21.79 | 14.08% | 30.56% |

Cummins India Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: Consolidated revenue for Q1 FY26 (Jun 2025) was exceptionally strong at ₹2,907 crore, marking a 25.5% year-over-year (YoY) and a 17.7% quarter-over-quarter (QoQ) growth, indicating robust and accelerating demand.

- Profitability: The company achieved a record quarterly Profit After Tax (PAT) of ₹539 crore (up 36.3% YoY and 22.7% QoQ). EBITDA also hit a high of ₹624 crore, growing 31.7% YoY.

- EBITDA margins: Showed healthy expansion, increasing by 101 basis points YoY to 21.45%. This was driven by strong “volume leverage” (higher production volumes spreading fixed costs) and steady demand from key high-margin markets.

Business highlights

- Segmental Momentum: The powerful 25.5% YoY sales growth reflects strong, synchronized execution across the business. This growth is anchored by robust domestic demand from data centers and infrastructure, coupled with a strong recovery in the high-margin exports business.

- Capacity & Commercialisation: The company is actively ramping up its capabilities and capacity to meet the evolving, stringent emission norms (CPCB-IV+) and rising demand in new high-tech segments.

Outlook

- Management remains “cautiously optimistic” about maintaining this growth momentum. This positive outlook is anchored by the government’s continued, multi-year push for infrastructure and a stable domestic economic environment, which continues to fuel capital expenditure.

Recent Updates on Cummins India Ltd.

- Hybrid Tech Grant: Received a $2.1 mn grant to develop hybrid haul truck tech, reinforcing its decarbonization push and mining market leadership.

- “Power to Build” Platform: Launched an online forum for vocational bodybuilders to integrate Cummins engines, boosting ecosystem engagement and brand loyalty.

- Natural Gas Expansion: Extended L9N and X15N engine lines to meet rising demand for cleaner, cost-efficient fuel solutions.

- Data Center Focus: Expanding integrated power and BESS offerings to tap into the fast-growing, uptime-critical data center market.

Company valuation insights – Cummins India Ltd.

Cummins India currently trades at a TTM P/E of 55.9x, above the industry average of 36.9x, with a 1-year return of 18.2% versus the Nifty 50’s 4.4%.

The investment case for Cummins India rests on its leadership in high-horsepower gensets, broad-based revival in the Powergen segment, and strong operating leverage from higher CPCB-IV+ adoption and export recovery. Supported by global parent Cummins Inc., the company continues to benefit from its deep technological edge, expanding presence in data-center and infrastructure power systems, and margin expansion across its distribution and aftermarket businesses. With a clean balance sheet, strong cash flows, and 16% revenue/PAT CAGR projected over FY25–27E, Cummins remains well-positioned to capture India’s sustained infrastructure and industrial capex cycle.

We value Cummins India at 52x FY27E EPS of ₹100, arriving at a 12-month target price of ₹5,200 (22% upside). For the near term, we assign a 3-month target of ₹4,550 (6% upside). Upside triggers include faster adoption of CPCB-IV+ engines, continued data-center demand, and export recovery in high-horsepower segments.

Major risk factors affecting Cummins India Ltd.

- Execution Delays: Slow project ramp-up or CPCB-IV+ rollout may defer revenues.

- Export Weakness: Global slowdown or geopolitical risks could hit export demand.

- Cost Inflation: Rising input or component costs may pressure margins.

- Currency Risk: Rupee appreciation can dent export profitability.

Technical analysis of Cummins India Ltd. share

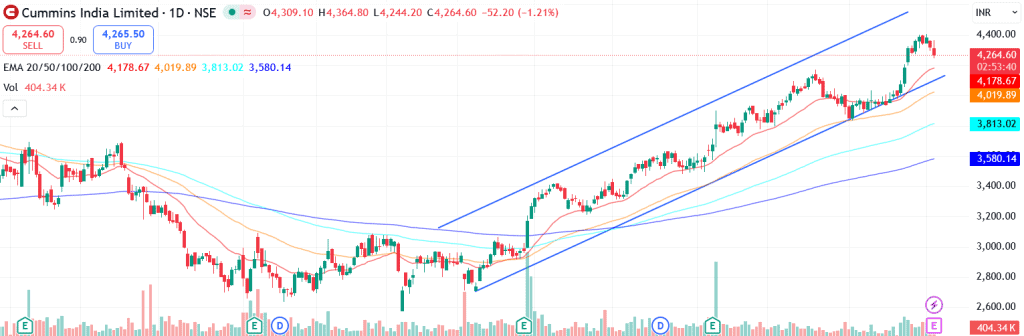

Cummins India continues to trade in a steady uptrend, reflecting strong momentum and sustained investor confidence in its long-term outlook. The stock has been forming higher highs and higher lows, confirming a well-defined bullish structure.

Currently positioned above its 50-day, 100-day, and 200-day EMAs, the stock maintains a strong medium- to long-term trend bias. Holding above these averages will be key to extending the ongoing uptrend.

Momentum indicators remain supportive. The MACD at 104.15 stays positive, signaling strengthening buying pressure. The RSI at 66.64 suggests solid demand, while relative RSI readings of 0.07 (21-day) and 0.09 (55-day) highlight continued outperformance versus the broader market. The ADX at 41.65 further confirms strong directional momentum.

A breakout above ₹4,550 could pave the way toward the ₹5,200 12-month fundamental target. On the downside, ₹3,900 remains a critical support zone; sustaining above it will preserve the bullish setup.

- RSI: 66.64 (Strong Buying Interest)

- ADX: 41.65 (Strong Trend)

- MACD: 104.15 (Positive)

- Resistance: ₹4,550

- Support: ₹3,900

Cummins India Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹4,550 (6% upside) and a 12-month target of ₹5,200 (22% upside) based on 52x FY27E EPS of ₹100.

Why buy now?

Powergen Revival: Strong demand across data centers, real estate, infrastructure, and manufacturing is driving a sustained upcycle in the Power Systems segment, which now contributes nearly half of domestic revenue.

Emission Norm Tailwinds: The transition to CPCB-IV+ norms provides a long-term growth and margin catalyst, supported by Cummins’ early readiness and strong technological edge.

Export Recovery: Gradual improvement in global demand and Cummins’ positioning as a trusted supplier in high-horsepower engines offer additional revenue visibility.

High-Margin Aftermarket: The distribution and service network contributes 30% of revenue, providing stable, recurring, and high-margin cash flows.

Financial Strength: A virtually debt-free balance sheet, strong RoE/RoCE (26–35%), and consistent free cash generation enable self-funded expansion and R&D investment.

Portfolio fit

Cummins India represents a structural play on India’s industrial and infrastructure growth, combining leadership in power solutions with clean-tech readiness and global scalability. For investors seeking steady compounding exposure within capital goods, Cummins offers a blend of earnings visibility, margin resilience, and technological leadership, making it a core long-term holding in the engineering and infra-led growth theme.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCummins India Ltd.: Budget 2025-26 opportunities

- Infrastructure Capex Boost: Continued government focus on infrastructure, manufacturing, and housing under the 2025–26 Budget will drive sustained demand for gensets, engines, and power systems.

- Make-in-India Push: Increased localization incentives and import substitution policies strengthen Cummins India’s domestic manufacturing base and export competitiveness.

- Green Energy Transition: Budgetary focus on clean energy and emission compliance supports adoption of CPCB-IV+ engines, hybrid power systems, and natural gas technologies.

- Data Center Expansion: Incentives for digital infrastructure and data centers create strong tailwinds for Cummins’ high-horsepower and backup power solutions.

- R&D & Skill Development: Enhanced funding for R&D and vocational training aligns with Cummins’ innovation-driven approach and need for a skilled technical workforce.

Final thoughts

Cummins India embodies India’s transformation into a global manufacturing and engineering powerhouse, combining technological excellence, reliability, and sustainability. With leadership in high-horsepower power systems, strong parent-backed R&D, and deep integration across infrastructure, data centers, and clean energy, the company stands at the core of India’s industrial growth cycle.

For long-term investors, Cummins India offers a compelling opportunity to participate in the country’s infrastructure and energy transition story, one driven by innovation, resilience, and enduring industrial strength for the decade ahead.