Stock overview

| Ticker | HDFC AMC |

| Sector | Financial Services |

| Market Cap | ₹ 1,19,575 Cr |

| CMP (Current Market Price) | ₹ 5,590 |

| 52-Week High/Low | ₹ 5,626/3,525 |

About HDFC AMC India Ltd.

HDFC AMC is one of India’s largest and most trusted mutual fund houses. Known for its strong brand, disciplined investment philosophy, and wide distribution reach, the company manages assets across equity, debt, and hybrid schemes. With a legacy of consistent performance and investor-centric focus, HDFC AMC plays a pivotal role in shaping retail investment behavior in India’s fast-growing asset management industry.

Primary growth factors for HDFC AMC India Ltd

- Financialization of Savings: Shift from physical to financial assets boosts demand for mutual funds.

- Retail SIP Inflows: Monthly SIP contributions hitting all-time highs (₹15,500 crore+).

- Regulatory Tailwinds: SEBI push for transparency and investor education supports organized players.

- Brand Trust: HDFC’s legacy in financial services adds credibility in attracting and retaining investors.

- Product Innovation: Target maturity funds, smart-beta ETFs, and global exposure funds gaining traction.

Q1 FY26 financial performance

| Metric | Q1 FY 26 | YoY Growth | QoQ Growth |

| Total Income | ₹ 1200 cr | 25% | 17% |

| Total Expenses | ₹ 214 cr | 10% | 13% |

| PAT | ₹ 748 cr | 24% | 17% |

- Strong YoY and QoQ growth driven by retail SIP flows and higher equity market participation.

- 70% of the company’s total monthly average AUM for June 2025 is contributed by individual investors compared to 61% for the industry.

- Market share of 13.1% of the individual monthly average AUM for June 2025, making the company one of the most preferred choices of individual investors.

Detailed competition analysis for HDFC AMC India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| HDFC AMC | ₹ 1,19,575 cr | ₹ 1200 cr | 46x | 43% |

| Nippon Life India | ₹ 53,460 cr | ₹ 566 cr | 42x | 41% |

| Aditya AMC | ₹ 24,900 cr | ₹ 428 cr | 27 x | 35% |

| UTI AMC | ₹ 18,300 cr | ₹ 376 cr | 25 x | 21% |

HDFC AMC continues to command a premium with respect to its peers on account of strong business fundamentals and solid YoY growth both in terms of revenue and profitability. The brand has started to focus a lot more on operational efficiency as well making it an individual investor’s first choice. An overstretched valuation can however pose a risk in the short term and business results will need to justify that on a QoQ basis.

Company valuation insights: HDFC AMC India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of HDFC AMC shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹6000 per share

- Upside Potential: –6%

- WACC: 10.9%

- Terminal Growth Rate: 3.5%

Major risk factors affecting HDFC AMC India

- Regulatory Caps on Fees: SEBI reforms on TER (Total Expense Ratio) could compress margins.

- Market Dependency: AUM and income are sensitive to market cycles.

- Rising Competition: New-age fintech players offering low-cost investment platforms.

- Parent Integration: Merger of HDFC Ltd. with HDFC Bank may lead to structural changes.

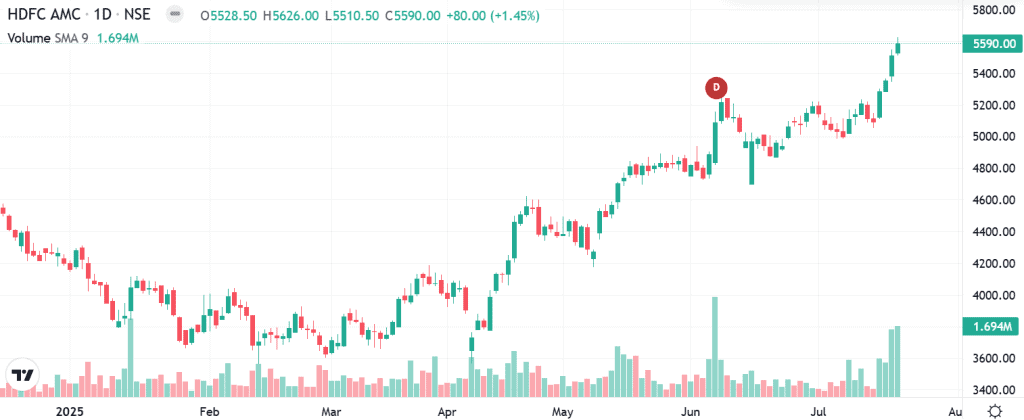

Technical analysis of HDFC AMC India

- Resistance: ₹5850

- Support: ₹ 5200

- Momentum: Positive

- RSI (Relative Strength Index): 62 (Overbought)

- 50-Day Moving Average: ₹5200

- 200-Day Moving Average: ₹5150

HDFC AMC India stock recommendation by Ketan Mittal

Recommendation: Buy on dips

Target Price: ₹6000 (12-month horizon);

Rationale

Recommend a Buy on Dips / Accumulate approach for HDFC AMC. HDFC AMC offers a rare combination of brand strength, scalable operations, high operating margins, and increasing retail traction. Its dominance in the SIP ecosystem and new fund launches make it a quality long-term compounder.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

HDFC AMC offers a rare combination of brand strength, scalable operations, high operating margins, and increasing retail traction. Its dominance in the SIP ecosystem and new fund launches make it a quality long-term compounder.