As India races ahead with its infrastructure transformation agenda, road and highway development stands at the forefront of this journey. One of the rising names in this space is HG Infra Engineering Ltd., a homegrown EPC (engineering, procurement, and construction) player that has swiftly scaled up its presence in the roads and highways sector with a solid execution track record and an expanding order book. With a prudent approach to bidding, a lean balance sheet, and forays into newer segments like railways and metros, HG Infra presents a high-conviction opportunity in India’s infrastructure upcycle.

But does HG Infra offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | HGINFRA |

| Industry/Sector | Infrastructure (Engineering) |

| Market Cap (₹ Cr.) | 7,146 |

| P/E | 14.03 (Vs Industry P/E of 27.01) |

| 52 W High/Low | 1,879.90 / 928.55 |

| EPS (TTM) | 77.56 |

| Dividend Yield | 0.18% |

About HG Infra

Founded in 2003 and headquartered in Jaipur, HG Infra Engineering Ltd. is an EPC company primarily focused on the road and highway sector, executing projects for the National Highways Authority of India (NHAI), Ministry of Road Transport and Highways (MoRTH), and state governments.

The company has grown from a regional player into a national-level contractor, known for timely project delivery, efficient execution, and robust financial discipline. It undertakes both EPC and HAM (Hybrid Annuity Model) projects and has also begun expanding into railways, metros, and water infrastructure.

Key business segments

HG Infra operates primarily in the following key business segments:

- Roads & Highways (EPC + HAM): Core segment contributing the majority of revenue through NHAI and state government contracts.

- Railway & Metro Projects: A growing segment with recent wins in metro rail civil packages.

- Private Sector & Subcontracting: Undertakes civil works for private sector clients and other infrastructure developers.

Primary growth factors for HG Infra

HG Infra key growth drivers:

- Massive Infrastructure Push: Government capex under Bharatmala, Gati Shakti, and state road programs.

- Asset Light HAM Model: Balances execution with lower capital intensity and stable cash flows.

- Segment Diversification: Entry into rail and metro infrastructure opens new growth levers.

- Strong Order Book Visibility: Over ₹10,000 crore order book provides multi-year revenue visibility.

- Operational Efficiency: Strong execution capabilities with high EBITDA margins and healthy RoCE.

Detailed competition analysis for HG Infra

Key financial metrics – FY25

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE(%) | ROCE(%) | P/E (TTM) |

| HGINFRA | 5056.18 | 20.93% | 9.97% | 24.61% | 24.57% | 14.03 |

| PNC Infratech | 6768.68 | 30.52% | 12.05% | 19.21% | 16.07% | 9.60 |

| Dilip Buildcon | 11316.72 | 19.00% | 7.42% | 4.88% | 13.51% | 11.17 |

| NCC Ltd. | 22199.36 | 8.64% | 3.87% | 11.56% | 22.43% | 18.21 |

Key insights on HG Infra

- 10-year median revenue growth of 23.2% reflects strong execution and leadership in road infrastructure.

- Consistent EBITDA margins between 18–20% highlight cost efficiency and disciplined project management.

- Robust bottom-line performance with 10-year PAT CAGR of 49% underscores strong value creation.

- Low leverage and efficient working capital management reflect conservative financial discipline.

- Recent entry into metro rail projects signals diversification and ambition to scale beyond roads.

- EPC model ensures asset-light scalability and high capital efficiency across project lifecycles.

Recent financial performance of HG Infra for Q4 FY25

| Metric | Mar-24 | Dec-24 | Mar-25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 1708.26 | 1264.84 | 1360.89 | 7.59% | -20.33% |

| EBITDA (₹ Cr.) | 332.56 | 286.90 | 239.45 | -16.54% | -28.00% |

| EBITDA Margin (%) | 19.47% | 22.68% | 17.59% | -509 bps | -188 bps |

| PAT (₹ Cr.) | 189.90 | 114.18 | 146.95 | 28.70% | -22.62% |

| PAT Margin (%) | 11.12% | 9.03% | 10.80% | 177 bps | -32 bps |

| Adjusted EPS (₹) | 29.16 | 17.67 | 22.55 | 27.62% | -22.67% |

HG Infra financial update (Q4 FY25)

Financial performance

- Steady execution in Q4; EBITDA margins temporarily impacted due to one-offs.

- FY25 performance remained strong with sustained profitability.

- Net debt rose to ₹9.3bn due to land purchases and early solar module procurement; the balance sheet remains healthy.

- Monetisation of near-completion HAM assets expected to support liquidity in FY26.

Business highlights

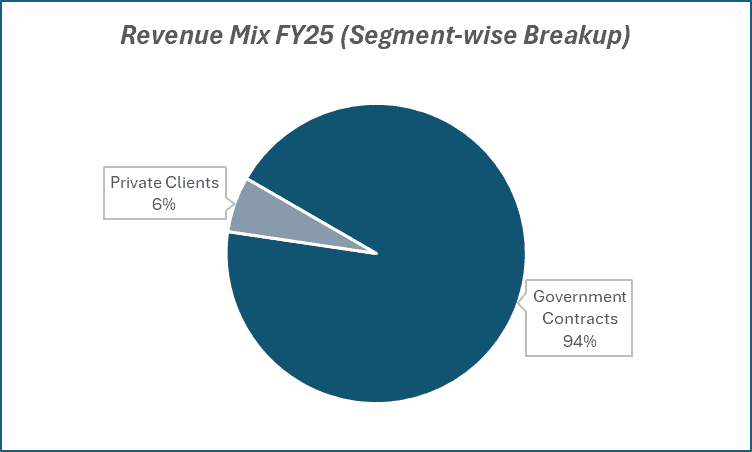

- Order book at ₹15,280 crore as of Mar-25, diversified across HAM roads (₹5,560 crore), EPC roads (₹4,830 crore), Railways (₹3,100 crore), Solar (₹820 crore), and BESS (₹970 crore).

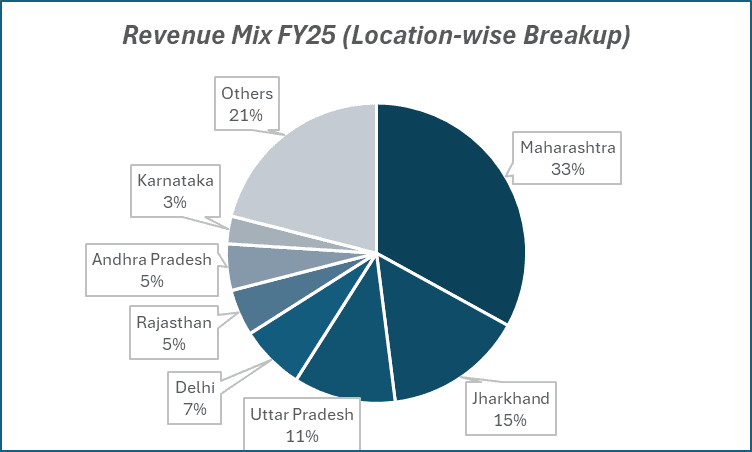

- Geographic mix: Maharashtra (33%), Jharkhand (15%), Gujarat & UP (11% each), with 49% from the West.

- Success in solar, BESS, and rail projects supports business model diversification and reduces dependency on roads.

Outlook

- Targeting expansion into water infrastructure and power transmission through PPP and annuity-based models.

- Plans to participate in river interlinking and green energy corridor projects in MP, Rajasthan, and UP.

- Confident of reducing leverage in FY26 with better cash flow, HAM asset monetisation, and continued scale-up.

Company valuation insights – HG Infra

HG Infra is currently trading at a TTM P/E of 14.03, significantly below the industry average of 27.01, indicating scope for a valuation re-rating as execution and earnings visibility improve. The stock has underperformed over the past year, with a -30.13% return vs. NIFTY 50’s +7.93%.

Despite the correction, HG Infra remains fundamentally strong with a healthy and diversified order book, consistent execution, and strong order inflows across roads, rail, and solar EPC segments. The company’s asset-light model and focus on high-ROCE projects provide further comfort on capital efficiency.

Applying a conservative 12x multiple on FY27E EPS of ₹110, we derive a 12-month target price of ₹1,320, implying a 20% upside from current levels. On a 3-month horizon, a target of ₹1,200 suggests a 9% upside, supported by steady execution, order inflow momentum, and potential HAM asset monetisation.

Major risk factors affecting HG Infra

- Execution Delays: Any disruption in project execution or site availability can impact timelines and cash flows.

- Working Capital Pressure: Delay in payments from government agencies may affect liquidity.

- Policy & Tendering Risks: Heavy dependence on government orders makes it vulnerable to delays in awarding or policy changes.

Technical Analysis of HG Infra share

HG Infra is forming a potential head and shoulders pattern, having completed the first shoulder and head, with the second shoulder formation underway, signalling a possible bullish reversal.

The stock is trading just below its 50-day EMA; a breakout above this level could trigger a fresh up move.

MACD stands negative at -12.02, with the MACD line below the signal line, though declining negative histograms suggest an impending bullish crossover. RSI at 47.09 indicates neutral momentum, while the Relative RSI (21-day) at -0.02 shows mild underperformance relative to peers.

ADX at 14.16 suggests the trend is still developing, but a breakout above ₹1,200, completing the pattern, could lead to upside towards ₹1,320. Key support lies at ₹1,030.

- RSI: 47.09 (Neutral)

- ADX: 14.16 (Developing Trend)

- MACD: -12.02 (Negative)

- Resistance: ₹1,200

- Support: ₹1,030

HG Infra stock recommendation

Current Stance: Buy with a target price of ₹1,200 over a 3-month horizon and ₹1,320 over a 12-month horizon. HG Infra remains a high-conviction mid-cap play on India’s infrastructure development, supported by its robust order book, proven execution, and expanding presence across diversified EPC verticals.

Why buy now?

Diversified Order Book: ₹15,280 crore order backlog across roads, railways, solar, and BESS ensures strong execution pipeline and revenue visibility.

Execution Strength: Consistent project delivery with high EBITDA margins (18–20%) and a 10-year PAT CAGR of 49%.

Expansion Opportunities: Actively diversifying into urban infra, transmission, and water, tapping into key government focus areas.

Financial Discipline: Asset-light EPC model, strong working capital management, and plans for HAM asset monetisation support future scalability.

Portfolio fit

HG Infra is an attractive infrastructure stock for investors looking to capitalise on India’s multi-year capex cycle. Its combination of high growth, disciplined financials, and diversified exposure to roads, rail, and renewable EPC segments makes it suitable for portfolios seeking cyclical growth with margin stability and execution reliability.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHG Infra: Budget 2025-26 opportunities

- Infra Capex Boost – Increased allocation to highways, railways, and renewables to support core EPC growth.

- Urban Infra Push – Metro and urban transit projects to aid diversification beyond roads.

- Green Energy Focus – Solar, BESS, and grid upgrades align with HG Infra’s renewable foray.

- Water & Irrigation Spend – River-linking and irrigation projects open new EPC opportunities.

- PPP & Monetisation – Focus on PPP and asset monetisation supports scalable, asset-light growth.

Final thoughts

HG Infra’s rise from a regional contractor to a national-level EPC player is a classic example of disciplined execution and strategic growth. As India’s infrastructure investments broaden into urban transport, logistics corridors, and smart cities, HG Infra is aligning its capabilities to capture opportunities beyond roads – without compromising on financial prudence. With a proven execution track record, rising order wins, and a playbook for sustainable growth, HG Infra may just be paving its way into becoming a long-term compounder in India’s infra boom.