In a country where air travel demand is rising faster than runways can be built, IndiGo has established itself as the undisputed leader in the skies. From being a budget carrier focused on punctuality and efficiency to becoming one of the largest airlines in Asia by passenger volume, IndiGo’s evolution mirrors the rapid growth of India’s aviation sector. With a sharp focus on cost leadership, disciplined expansion, and an ambitious international push, IndiGo remains a key player in India’s long-term consumption and mobility story.

But does Interglobe Aviation offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | INDIGO |

| Industry/Sector | Aviation (Airlines) |

| CMP | 5890.00 |

| Market Cap (₹ Cr.) | 2,29,441 |

| P/E | 34.21 (Vs Industry P/E of 33.67) |

| 52 W High/Low | 6232.50 / 3780.00 |

| EPS (TTM) | 173.46 |

| Dividend Yield | 0.17% |

About Interglobe Aviation Ltd.

Founded in 2006 and operated by InterGlobe Aviation Ltd, IndiGo is India’s largest airline, commanding over 60% domestic market share. The company operates on a low-cost carrier (LCC) model focused on providing affordable fares, on-time performance, and a lean cost structure.

Its fleet exceeds 350 aircraft, primarily Airbus A320/A321neos and ATRs, with a record order book of over 1,000 aircraft, among the world’s largest. Headquartered in Gurugram, IndiGo’s operations extend across 85+ domestic and 30+ international destinations, and it continues to deepen its global presence with an expanding network in the Middle East, Southeast Asia, and Europe.

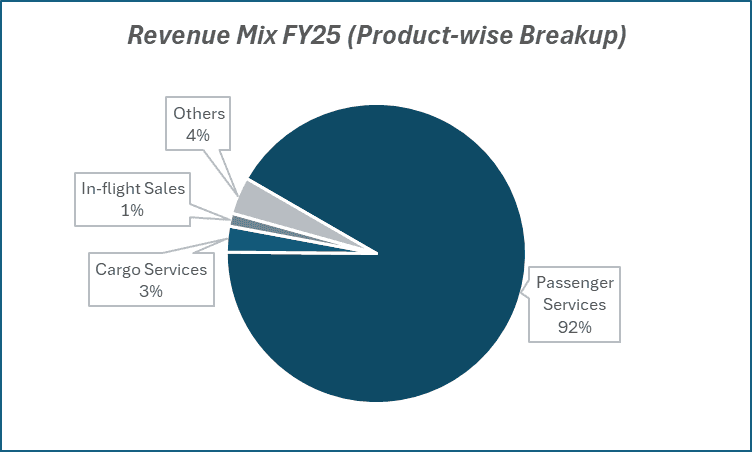

Key business segments

Interglobe Aviation Ltd. operates primarily in the following key business segments:

- Passenger Services (Core Business): Domestic and international scheduled flights contribute the bulk of revenues, supported by high load factors and disciplined pricing.

- Cargo & Logistics: Under the CarGo by IndiGo brand, the airline operates dedicated freighters and belly cargo across its passenger network.

- Ancillary Revenues: Income from add-ons such as seat selection, in-flight meals, excess baggage, loyalty programs (6E Rewards), and charter services, a key profitability driver.

- International Expansion: Rapidly scaling medium-haul international routes through fleet additions and partnerships with global airlines.

Primary growth factors for Interglobe Aviation Ltd.

Interglobe Aviation Ltd. key growth drivers:

- Rising Air Travel Penetration: Less than 10% of India’s population flies annually, leaving massive headroom for growth as incomes rise and travel preferences evolve.

- Fleet Expansion: One of the youngest and most fuel-efficient fleets globally, ensuring lower maintenance and fuel costs.

- International Growth Opportunity: Expanding beyond South Asia to Europe and Africa; launching direct long-haul operations using A321 XLRs by FY27.

- Ancillary Revenue Focus: Non-fare income contributes ~20% of revenue, supporting margin resilience.

- Strong Cost Leadership: Efficient operations, scale advantage, and robust supplier contracts ensure consistent cost competitiveness.

Detailed competition analysis for Interglobe Aviation Ltd.

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Interglobe Aviation | 81728.50 | 18125.60 | 22.18% | 6705.90 | 8.21% | 34.21 |

| SpiceJet Ltd. | 4737.66 | -576.95 | -12.18% | -330.26 | -6.97% | -14.37 |

| FlySBS Aviation | 193.90 | 39.92 | 20.59% | 28.41 | 14.65% | 35.43 |

| TAAL Enterprises | 182.94 | 59.82 | 32.70% | 51.73 | 28.28% | 19.11 |

| Taneja Aerospace | 40.00 | 26.37 | 65.93% | 18.15 | 45.38% | 50.46 |

Key insights on Interglobe Aviation Ltd.

- IndiGo continues to deliver industry-leading profitability, supported by scale, disciplined capacity management, and fuel efficiency.

- The airline’s cash reserves exceed ₹35,000 crore, providing a strong liquidity buffer and funding flexibility for fleet expansion.

- Load factors consistently above 85% and rising yields reflect strong demand despite fare normalization.

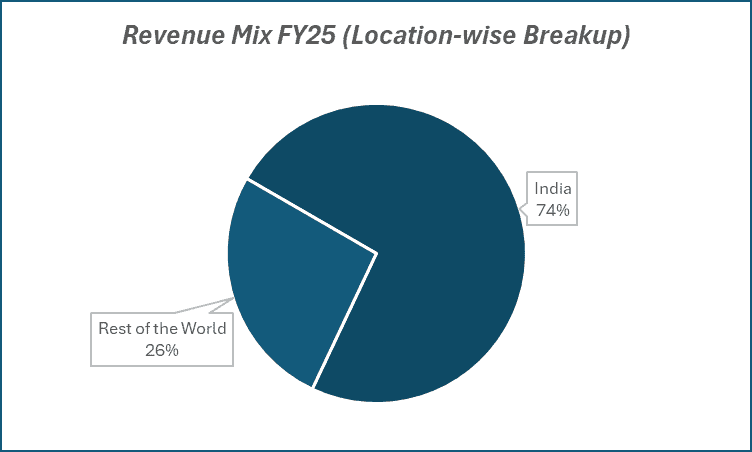

- International routes are contributing a growing share of revenues (over 25%), aiding diversification from domestic cyclicality.

- IndiGo’s cost per available seat kilometer (CASK) remains among the lowest globally, underlining its efficient model.

Recent financial performance of Interglobe Aviation Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 19570.70 | 22151.90 | 20496.30 | -7.47% | 4.73% |

| EBITDA (₹ Cr.) | 5159.20 | 6089.40 | 5226.50 | -14.17% | 1.30% |

| EBITDA Margin (%) | 26.36% | 27.49% | 25.50% | -199 bps | -86 bps |

| PAT (₹ Cr.) | 2728.80 | 3067.50 | 2176.30 | -29.05% | -20.25% |

| PAT Margin (%) | 13.94% | 13.85% | 10.62% | -323 bps | -332 bps |

| Adjusted EPS (₹) | 70.69 | 79.39 | 56.31 | -29.07% | -20.34% |

Interglobe Aviation Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹20,496 crore (+5% YoY), supported by strong capacity expansion and resilient demand.

- PAT: ₹2,176 crore (11% margin), reflecting disciplined cost control despite yield softness.

- Yields: Down 5% YoY to ₹4.98, impacted by competitive pricing; PRASK declined 7% to ₹4.21.

- Load Factor: 85% (↓200 bps YoY), healthy despite higher capacity.

- Fuel CASK: Fell 21.9% YoY on lower fuel prices and renegotiated contracts, while CASK ex-fuel ex-forex rose 1.8% YoY, expected to remain steady through FY26.

Business highlights

- Reiterated full-year double-digit capacity growth; Q2 to see mid-to-high single-digit expansion.

- Inducted 8 aircraft via GIFT City leasing unit; 16 damp-leased aircraft returned.

- Signed MoU with Bengaluru Airport for dedicated MRO facility to enhance efficiency.

- Expanded international network with new widebody orders, Amsterdam/Manchester launches, and upcoming London/Copenhagen routes.

- Strengthened partnerships with KLM, Delta, Virgin Atlantic, and Jetstar for broader global connectivity.

Outlook

- Margins expected to remain firm, supported by disciplined cost management.

- Capacity expansion and global network to drive near-term growth.

- Domestic leadership and increasing international presence to sustain momentum.

- Strategic initiatives like IndiGo Ventures and loyalty expansion to add long-term value.

- Strong cash flows and operational resilience underpin continued profitability.

Recent Updates on Interglobe Aviation Ltd.

- IndiGo placed a historic order for 500 Airbus A320neo family aircraft, reinforcing its long-term growth vision.

- The airline announced the launch of flights to Nairobi, Jakarta, and Tbilisi, strengthening its international footprint.

- IndiGo signed codeshare agreements with leading carriers such as British Airways and Turkish Airlines to expand global connectivity.

- Expansion of cargo operations through additional A321 freighters to tap e-commerce logistics growth.

- Plans underway to introduce business-class seating on select international routes, a strategic shift from its pure LCC model.

Company valuation insights – Interglobe Aviation Ltd.

IndiGo is currently trading at a TTM P/E of 34.2x, slightly above the industry average of 33.7x, with a 1-year return of 29.3% versus the Nifty 50’s 4.3%.

The investment case for IndiGo rests on its strong market leadership, robust balance sheet, and strategic push toward international expansion and premiumisation. The company continues to strengthen its dominance with a 64% domestic market share and 45% international share, supported by steady demand recovery and efficient cost management.

Key growth drivers include expanding long-haul operations through widebody inductions, introduction of ‘IndiGo Stretch’ business class, reciprocal partnerships with major global carriers like KLM, Delta, and Virgin Atlantic, and a disciplined cost structure with CASK-ex fuel expected to remain stable. The macro opportunity from rising air travel penetration, improving traffic mix, and favorable supply-demand dynamics provides long-term growth visibility.

We value IndiGo at 28x FY27E EPS of ₹255, arriving at a 12-month target price of ₹7,140 (20% upside from current levels). For the short term, we assign a 3-month target of ₹6,300 (6% upside). Key upside triggers include sustained international expansion, yield recovery with premium offerings, and continued cost efficiency as damp leases reduce.

Major risk factors affecting Interglobe Aviation Ltd.

- Fuel Price Volatility: Jet fuel accounts for 35-40% of total costs; price spikes can materially impact margins.

- Rupee Depreciation: Exposure to dollar-denominated leases and maintenance costs can hurt profitability.

- Competitive Intensity: New entrants and capacity expansion by peers could pressure yields.

- Operational Challenges: Pilot shortages, infrastructure constraints, or supply chain delays could affect fleet utilization.

- Regulatory & Environmental Risks: Stringent emission norms and carbon levies could increase costs over time.

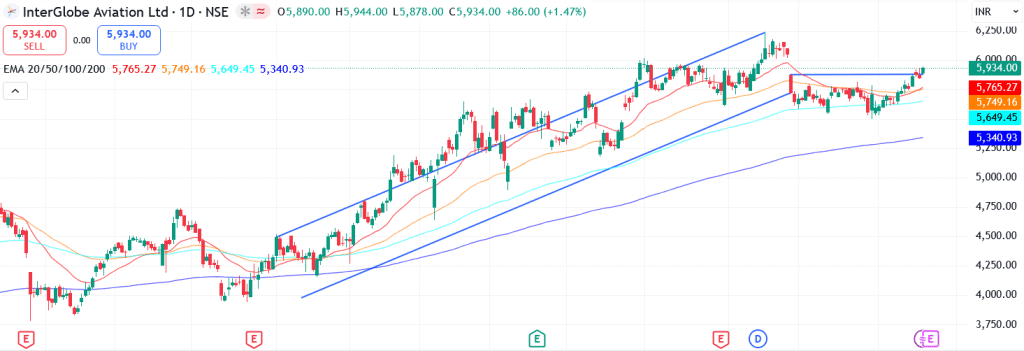

Technical analysis of Interglobe Aviation Ltd. share

IndiGo has recently broken out from a rounded bottom pattern, signaling the start of a potential upward momentum phase. The stock is trading well above its 50-day, 100-day, and 200-day EMAs, confirming a strong bullish trend. Sustaining above these levels would reinforce the medium- to long-term positive outlook.

Momentum indicators support this setup. The MACD at 35.53 remains positive, with the line above the signal line, indicating strong momentum. The RSI at 63.07 reflects healthy buying interest, while relative RSI scores of 0.02 (21-day) and 0.01 (55-day) highlight consistent outperformance versus the broader market. The ADX at 20.46 suggests the trend is gradually strengthening.

A decisive move above ₹6,300 could open the path toward ₹7,140 (12-month fundamental target). On the downside, ₹5,500 serves as a crucial support; holding above this level is key to maintaining the bullish setup.

- RSI: 63.07 (Strong Buying Interest)

- ADX: 20.46 (Trend Gaining Strength)

- MACD: 35.53 (Positive)

- Resistance: ₹6,300

- Support: ₹5,500

Interglobe Aviation Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹6,300 (~6% upside) and a 12-month target of ₹7,140 (~20% upside).

Why buy now?

Market Leadership: Maintains 64% domestic and 45% international share, reinforcing dominance.

Global Expansion: Adding widebody aircraft and new routes like London and Copenhagen; partnerships with Delta, KLM, and Virgin Atlantic enhance connectivity.

Premiumisation: Expanding ‘IndiGo Stretch’ business class and loyalty program to lift yields.

Cost Efficiency: Stable CASK-ex fuel and lower fuel costs sustain 25% margin levels.

Strong Balance Sheet: ₹49,000 crore cash reserve supports growth and resilience.

Portfolio fit

IndiGo offers a rare blend of scale, cost leadership, and structural growth in India’s aviation sector. With its expanding global footprint, disciplined cost management, and strong financial base, it serves as a core portfolio holding for investors seeking exposure to India’s growing air travel and consumption theme.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebInterglobe Aviation Ltd.: Budget 2025-26 opportunities

- Tourism Boost: Higher spending on tourism and regional connectivity to lift air travel demand.

- Airport Expansion: Investments in new airports and MRO facilities to enhance capacity and efficiency.

- Global Trade Support: Export and logistics push to aid international route expansion.

- Green Aviation: SAF incentives and carbon programs to lower costs and strengthen ESG profile.

- Innovation Focus: Skill and startup support to benefit IndiGo’s tech and IndiGo Ventures initiatives.

Final thoughts

IndiGo isn’t just India’s largest airline, it’s the flagbearer of the country’s aviation revolution. With unmatched cost discipline, a world-class fleet, and bold international ambitions, it has proven its ability to sustain growth through market cycles. As India’s skies get busier, IndiGo’s blend of efficiency, scale, and strategy positions it to soar even higher.

In essence: IndiGo isn’t just flying passengers, it’s shaping the future of Indian aviation, one blue tail at a time.