After years of volatility driven by regulatory challenges, pricing pressures, and delayed launches, Lupin Ltd has made a strong comeback. With improving margins, a revitalized U.S. generics pipeline, and rising traction in complex and specialty therapies, Lupin is re-emerging as a key player in India’s pharmaceutical growth story. The company’s renewed strategic focus on efficiency, niche product launches, and leadership in respiratory and cardiovascular therapies positions it well for sustained earnings recovery and re-rating potential.

But does Lupin Ltd. offer a compelling case for long-term investors at its current valuation? Let’s delve deeper.

Stock overview

| Ticker | LUPIN |

| Industry/Sector | Healthcare |

| CMP | 1971.00 |

| Market Cap (₹ Cr.) | 89,936 |

| P/E | 24.00 (Vs Industry P/E of 34.72) |

| 52 W High/Low | 2402.90 / 1795.20 |

| EPS (TTM) | 81.49 |

| Dividend Yield | 0.61% |

About Lupin Ltd.

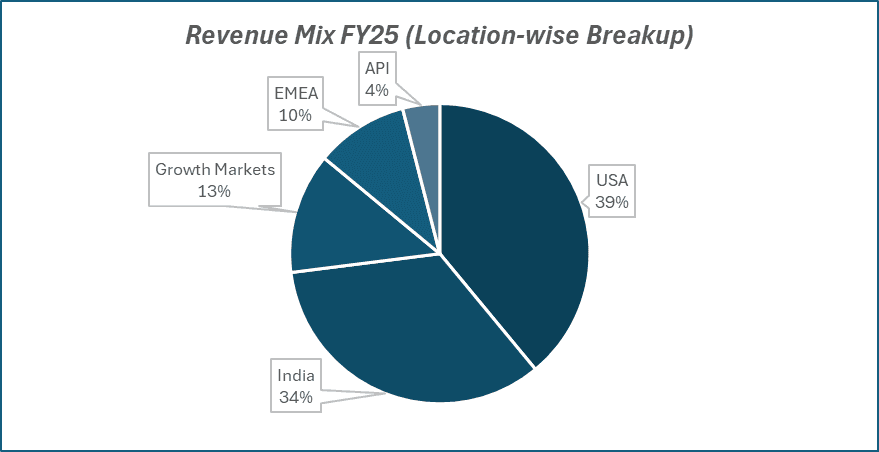

Founded in 1968 by Dr. Desh Bandhu Gupta, Lupin Limited is one of India’s leading global pharmaceutical companies. Headquartered in Mumbai, the company operates across over 100 countries, with manufacturing facilities in India, the U.S., and Japan. Lupin’s product portfolio spans formulations, APIs (Active Pharmaceutical Ingredients), biosimilars, and specialty products, serving both developed and emerging markets.

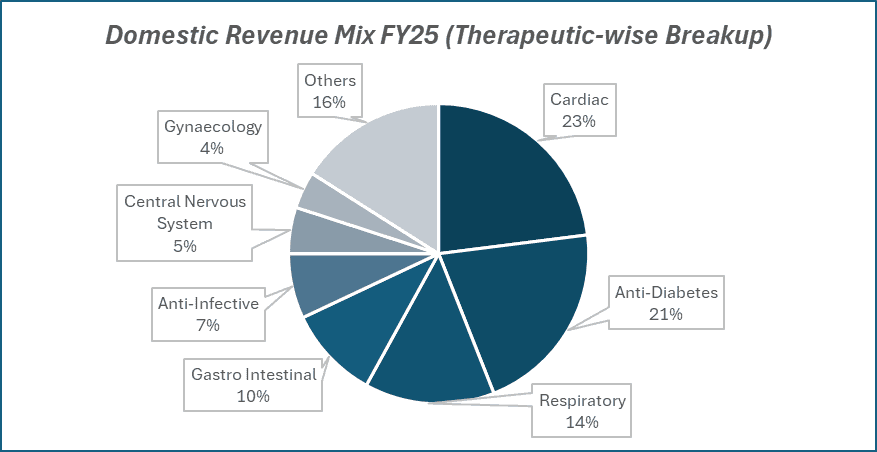

Over the decades, Lupin has built strong positions in cardiovascular, respiratory, anti-infective, and diabetes segments domestically, while expanding into complex generics and inhalation products in the U.S. and Europe.

Key business segments

Lupin Ltd. operates primarily in the following key business segments:

- U.S. Formulations: Focused on generics, complex generics, and inhalation therapies. Recent launches in women’s health and respiratory drugs have driven strong recovery.

- India Formulations: Leadership in chronic therapies such as cardiovascular, anti-diabetic, and respiratory segments; consistent outperformance versus the IPM (Indian Pharmaceutical Market).

- EMEA, LATAM, and APAC Markets: Growing presence in key emerging regions through partnerships and branded generics.

- Active Pharmaceutical Ingredients (APIs): Backward integration supporting margin stability and supply chain resilience.

- Biosimilars and Specialty Products: Focused on niche, high-margin segments to drive the next phase of growth.

Primary growth factors for Lupin Ltd.

Lupin Ltd. key growth drivers:

- U.S. Market Revival: Launch of high-value complex generics (like Spiriva and Albuterol) supporting margin expansion and topline growth.

- Domestic Leadership: Consistent market share gains in chronic therapies through strong brand recall and physician engagement.

- Cost Optimization: Focused restructuring of manufacturing footprint and logistics has enhanced operating leverage.

- Pipeline Strength: Over 150 ANDAs filed and 70+ approved products in the U.S., with several first-to-market opportunities in the next two years.

- Emerging Market Growth: Strategic partnerships and branded generics expansion driving double-digit growth in Latin America and APAC.

- R&D Focus: Increased investments in complex injectables, biosimilars, and inhalation platforms to sustain long-term innovation.

Detailed competition analysis for Lupin Ltd.

Key financial metrics – TTM;

| Company | Revenue (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Lupin Ltd. | 24750.69 | 6745.64 | 27.25% | 4347.53 | 17.57% | 24.00 |

| Mankind Pharma Ltd. | 13576.88 | 3281.09 | 24.17% | 1767.06 | 13.02% | 49.83 |

| Zydus Lifesciences | 24493.90 | 7146.20 | 29.18% | 4973.40 | 20.30% | 20.00 |

| Aurobindo Pharma | 32514.48 | 6651.03 | 20.46% | 3447.75 | 10.60% | 19.54 |

| Dr. Reddy’s Lab Ltd. | 34310.00 | 8454.40 | 24.64% | 5721.40 | 16.68% | 17.53 |

Key insights on Lupin Ltd.

- Lupin’s EBITDA margin recovery (now above 20%) marks a turning point after years of pricing pressure in the U.S.

- The company’s U.S. respiratory portfolio is expected to be a key earnings lever, with steady traction in Albuterol and Spiriva.

- India continues to be a consistent growth engine, outperforming peers in chronic therapies.

- Debt reduction and working capital control have strengthened the balance sheet, improving return ratios.

- Digital engagement and supply chain optimization initiatives are improving operational efficiency and patient reach.

Recent financial performance of Lupin Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue(₹ Cr.) | 5672.73 | 6268.34 | 7047.51 | 12.43% | 24.23% |

| EBITDA (₹ Cr.) | 1340.36 | 1727.24 | 2341.33 | 35.55% | 74.68% |

| EBITDA Margin (%) | 23.63% | 27.55% | 33.22% | 567 bps | 959 bps |

| PAT (₹ Cr.) | 859.48 | 1221.46 | 1484.83 | 21.56% | 72.76% |

| PAT Margin (%) | 15.15% | 19.49% | 21.07% | 158 bps | 592 bps |

| Adjusted EPS (₹) | 18.69 | 26.69 | 32.35 | 21.21% | 73.09% |

Lupin Ltd. financial update (Q2 FY26)

Financial performance

- Revenue grew 24.2% YoY to ₹7,048 crore, led by strong growth across the U.S., India, and Europe.

- EBITDA margin expanded by 959 bps YoY to 33.2%, despite higher R&D spends (7.9% of sales).

- Gross margins improved to 71.3%, reflecting a richer product mix and cost efficiencies.

- U.S. sales surged 22.3% YoY to USD 282 million, marking the highest revenue since FY17.

- India business grew 7.8% YoY, driven by prescription growth of 8.6% and expanding therapy coverage.

Business highlights

- Successful launch of Tolvaptan with sole first-to-file exclusivity strengthened U.S. performance.

- Growth in Europe (+28%) and other developed markets (+17%) offset emerging market softness.

- Focus areas include complex injectables, respiratory, biosimilars, and 505(b)(2) products for long-term growth.

- R&D investments (7.9% of sales) focused on 60+ U.S. filings and 70% allocation to specialty products.

- Received FDA approvals for generic Victoza and Glucagon; Liraglutide launch slated for October.

Outlook

- Reaffirmed FY26 EBITDA margin guidance at 24–25% with cost efficiency levers intact.

- Expects high single-digit to potential double-digit growth in FY27, driven by U.S. and specialty launches.

- Biosimilars and injectables to emerge as key growth engines from FY27 onward.

- ETR expected at ~19%, with improving profitability despite elevated R&D investments.

- Management remains confident of sustaining growth momentum with disciplined execution and compliance.

Recent Updates on Lupin Ltd.

- U.S. Portfolio Expansion: Recent FDA approval for new inhalation and complex oral solid products; ramp-up in Spiriva generics.

- Strategic Alliances: Partnered with global pharma players for biosimilar development and API exports.

- Capacity Optimization: Divested non-core facilities and consolidated production to improve utilization.

- Digital & ESG Focus: Initiatives in green chemistry, renewable energy, and digital manufacturing are enhancing sustainability credentials.

- New Launches in India: Introduced innovative therapy combinations in cardiac and diabetic segments, expanding its chronic care dominance.

Company valuation insights – Lupin Ltd.

Lupin currently trades at a TTM P/E of 24x, lower than the industry average of 34.7x, with a 1-year return of -5.6% versus the Nifty 50’s 5.6%.

The investment case for Lupin is anchored in its improving product mix, strong execution in complex generics, and rising U.S. profitability. The company’s strategic shift toward high-value respiratory, injectables, and biosimilar products, coupled with robust growth in India’s chronic therapy segments, enhances visibility of sustainable earnings growth.

With over 80 new product launches planned in the next five years, Lupin is also deepening its global footprint across the U.S., Europe, and Australia. Supported by a debt-free balance sheet, strong free cash flows, and disciplined R&D investment (~8% of sales), Lupin remains well-positioned to capitalize on long-term growth in complex formulations and specialty segments.

We value Lupin at 24x FY27E EPS of ₹98, deriving a 12-month target price of ₹2,352 (20% upside) and a 3-month target price of ₹2,070 (5% upside). Key upside triggers include successful biosimilar and complex drug launches, margin expansion from high-value U.S. exclusivities, and continued traction in chronic therapies within India.

Major risk factors affecting Lupin Ltd.

- Regulatory Risk: Any adverse U.S. FDA observations could impact exports and profitability.

- Pricing Pressure: Generic price erosion in the U.S. remains a structural industry challenge.

- Currency Volatility: Fluctuations in INR-USD exchange rate can impact reported earnings.

- Execution Risk: Timely launch of complex generics and product scaling remains critical.

- Raw Material Dependence: API input cost inflation could pressure margins.

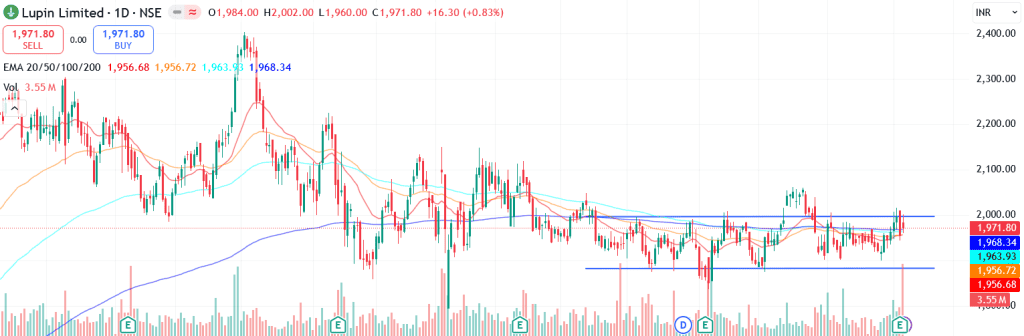

Technical analysis of Lupin Ltd. share

Lupin is currently consolidating within a sideways channel, with the price hovering near the upper trendline, indicating a potential breakout setup. A move above this resistance zone could trigger a strong upward momentum after a period of range-bound trade.

The stock continues to trade above its 50-day, 100-day, and 200-day EMAs, reaffirming a strong medium- to long-term bullish bias. Sustaining above these key averages will be crucial to confirm trend continuation.

Momentum indicators support the emerging positive structure. The MACD at 4.86 remains above its signal line, reflecting building buying pressure. The RSI at 53.33 shows improving demand strength, while relative RSI readings of 0.01 (21-day) and 0.02 (55-day) suggest mild outperformance versus the benchmark. The ADX at 14.35 points to a range-bound phase, though a breakout could strengthen directional momentum.

A decisive move above ₹2,070 could pave the way for an upside toward the ₹2,352 12-month fundamental target, while ₹1,870 acts as a strong support zone. Sustaining above this level will be key to preserving the bullish setup.

- RSI: 53.33 (Decent Buying Interest)

- ADX: 14.35 (Rangebound)

- MACD: 4.86 (Positive)

- Resistance: ₹2,070

- Support: ₹1,870

Lupin Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,070 (5% upside) and a 12-month target of ₹2,352 (20% upside) based on 24x FY27E EPS of ₹98.

Why buy now?

U.S. Growth Momentum: Strong 22% YoY growth driven by Tolvaptan exclusivity and expanding complex generics pipeline.

Margin Expansion: EBITDA margin up 959 bps YoY to 33.2% with gross margins at 71.3%, aided by richer product mix and cost control.

Robust R&D Pipeline: 60+ U.S. filings and 70% of R&D spend directed toward high-value specialty and complex products.

India Growth: Domestic business up 8.6% YoY, supported by chronic therapies and new product launches.

Execution Discipline: Improved compliance and operational focus reinforce confidence in sustained profitability.

Portfolio fit

Lupin offers exposure to India’s pharmaceutical innovation and global specialty drug opportunity, combining steady India growth, U.S. recovery, and margin expansion potential. Its consistent focus on complex generics, biosimilars, and respiratory products provides durable competitive advantage. With healthy free cash flows, prudent capital allocation, and an expanding specialty portfolio, Lupin fits well as a core healthcare compounder in long-term portfolios seeking growth with earnings resilience.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebLupin Ltd.: Budget 2025-26 opportunities

- Healthcare Push: Increased allocation to healthcare and pharma R&D to strengthen Lupin’s domestic growth and innovation pipeline.

- API & Manufacturing Support: Incentives under PLI and Make-in-India to enhance Lupin’s API self-reliance and export competitiveness.

- Generic Exports Boost: Policy focus on pharma exports and regulatory ease to aid Lupin’s U.S. and Europe-driven growth momentum.

- Innovation & Biosimilars: Higher funding for biotech and innovation to accelerate Lupin’s biosimilar and specialty product roadmap.

- Affordable Healthcare: Government focus on chronic disease management and wider drug access to support Lupin’s India formulations growth.

Final thoughts

Lupin’s story is one of renewal and resilience, a company that faced regulatory headwinds, reinvented its strategy, and is now poised for sustainable growth. The focus has shifted from volume-led generics to value-driven complex therapies, ensuring both profitability and longevity. With a stronger pipeline, improved cost structure, and healthier balance sheet, Lupin stands at the crossroads of a structural upcycle in Indian pharma.

For investors seeking exposure to India’s pharmaceutical revival, Lupin offers a balanced blend of growth, innovation, and operational strength, making it a compelling addition to a long-term healthcare-focused portfolio.