Stock overview

| Ticker | MRF |

| Sector | Auto Ancillary (Tyres) |

| Market Cap | ₹ 63,200 Cr |

| CMP (Current Market Price) | ₹ 1,48,800 |

| 52-Week High/Low | ₹ 1,53,000/1,00,500 |

About MRF India Ltd.

MRF (Madras Rubber Factory) is India’s largest tyre manufacturer and among the top tyre brands globally. With a diversified portfolio spanning passenger cars, two-wheelers, trucks, buses, and off-the-road tyres, MRF has established itself as a brand synonymous with durability and premium quality.

Primary growth factors for MRF India Ltd

- OEM Demand Revival: Auto sector rebound especially in commercial vehicles and two-wheelers is aiding volume growth.

- Premiumization: Rising share of high-margin radial and performance tyres.

- Export Opportunities: Targeting Southeast Asia, Africa, and Latin America as growth markets.

- Brand Strength: Strong brand recall and premium positioning allow better pricing power.

- Capex for Capacity Expansion: Investments in Gujarat and Tamil Nadu plants to increase output.

Q4 FY25 financial performance

| Metric | Q4 FY 25 | YoY Growth | QoQ Growth |

| Total Revenue | ₹ 7,074 cr | 11% | 1% |

| Operating Expenses | ₹ 6,428 cr | 11% | -2% |

| PAT | ₹ 512 cr | 30% | 60% |

| EPS | ₹ 1,207 | 26% | 62% |

- MRF’s strong Q4 performance was driven by easing raw material costs, improved product mix, and volume recovery across OEM and replacement segments.

- MRF also declared the highest ever dividend of ₹ 229 per share in the quarter.

Detailed competition analysis for MRF India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| MRF | ₹ 1,48,800 cr | ₹ 7074 cr | 34x | 14% |

| Balkrishna Industries | ₹ 2,685 cr | ₹ 2760 cr | 36x | 17% |

| Apollo Tyres | ₹ 455 cr | ₹ 6423 cr | 23 x | 11% |

| CEAT | ₹ 3,377 cr | ₹ 3529 cr | 30 x | 15% |

MRF’s valuations are rich, but justified due to robust financials, low debt, and premium brand positioning. It also continues to be known in the market for it’s premium and durable products which adds to its brand heat.

Company valuation insights: MRF India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of MRF shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹1,60,00 per share

- Upside Potential: 8%

- WACC: 10.3%

- Terminal Growth Rate: 2,1%

Major risk factors affecting MRF India

- Raw Material Inflation: Rubber and crude-derived inputs remain volatile.

- Subdued Replacement Demand: Affected by economic cycles and rural income.

- Capex Overhang: Aggressive expansions may hit short-term ROCE.

- Competition: Gaining share in high-end segments from global players remains tough.

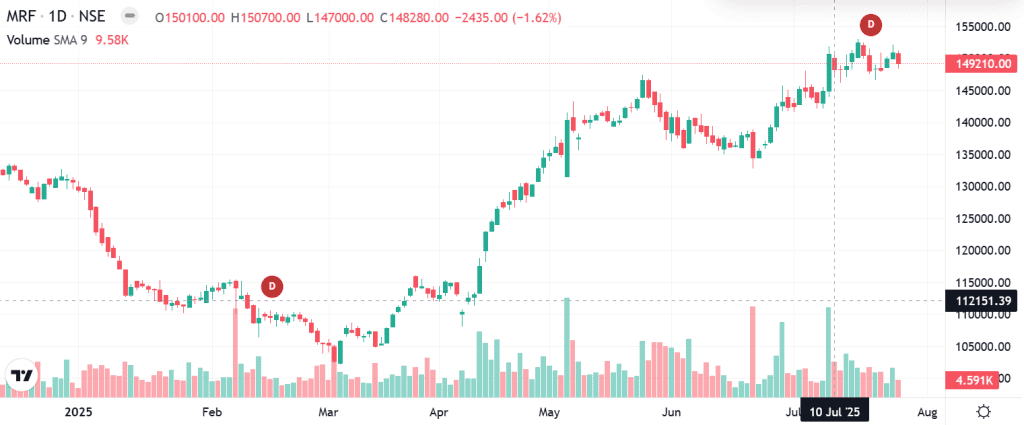

Technical analysis of MRF India

- Resistance: ₹1,53,000

- Support: ₹ 1,44,000

- Momentum: Positive

- RSI (Relative Strength Index): 66 (Overbought)

- 50-Day Moving Average: ₹1,43,780

- 200-Day Moving Average: ₹1,42,000

MRF India stock recommendation by Ketan Mittal

Recommendation: Buy on dips

Target Price: ₹1,60,000 (12-month horizon);

Rationale

Strong brand equity and a dominant share in replacement markets.

Clean balance sheet with limited debt.

Good play on India’s auto recovery with consistent profitability.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

MRF may not be a multi-bagger from here, but it remains a solid blue-chip bet in the tyre industry. Investors looking for a stable, growth-oriented stock with limited downside and strong fundamentals may find MRF an attractive long-term hold.