In a tech world dominated by giants, mid-tier IT companies often go unnoticed. But beneath the surface, some of these players are scripting extraordinary growth stories by targeting niche areas, delivering high-quality services, and building deep client relationships.

Sonata Software is one such under-the-radar performer – a quiet achiever in India’s IT sector that is positioning itself as a specialist in digital transformation with global relevance.

But does Sonata Software offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | SONATSOFTW |

| Industry/Sector | Information Technology (Software) |

| Market Cap (₹ Cr.) | 11,068 |

| Free Float (% of Market Cap) | 69.25% |

| 52 W High/Low | 763.70 / 286.40 |

| P/E | 25.80 (Vs Industry P/E of 27.96) |

| EPS (TTM) | 15.14 |

About Sonata Software

Sonata Software Ltd., headquartered in Bengaluru, is a mid-sized IT services company with a strong focus on digital transformation, platform-based services, and modernisation initiatives. With over three decades of experience, the company has evolved from a domestic software distributor to a global IT services provider.

It has built a strong presence in high-growth verticals like Retail, Travel, Distribution, and ISVs (Independent Software Vendors). Sonata’s acquisition-led strategy and its proprietary Platformation™ framework distinguish it from peers in the mid-cap IT space.

Key business segments

Sonata Software operates primarily in the following key business segments:

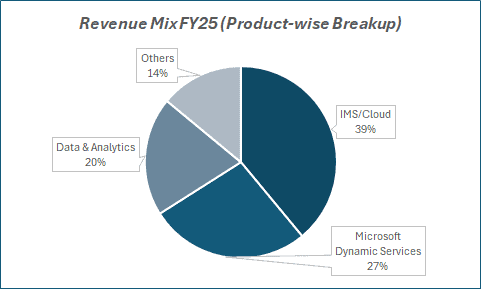

- Digital IT Services – End-to-end digital transformation offerings including cloud, data analytics, AI, customer experience, and application development for global clients.

- Microsoft Dynamics Business (ISV Ecosystem) – Sonata is among the top global partners for Microsoft Dynamics, providing implementation and support services to ISVs and enterprises.

- Domestic Products & Services – Distribution and implementation of IT infrastructure, enterprise software, and solutions in India (contributing a smaller portion post demerger).

Primary growth factors for Sonata Software

Sonata Software key growth drivers:

- Platformation™ Strategy – A proprietary framework focused on platform-based digital transformation is gaining traction across verticals.

- Microsoft Partnership – Deep strategic alignment with Microsoft, especially in Dynamics, Azure, and cloud services, opens high-margin global opportunities.

- Acquisitions – Recent inorganic growth (Quant Systems, Encore Software, etc.) enhances capabilities in BFSI, healthcare, and analytics.

- Mid-Tier Advantage – Nimbleness, domain depth, and cost-effectiveness allow it to win digital transformation mandates over larger players.

- Global Digital Spend – Clients across the US and Europe continue to spend on modernisation and cloud transformation, sustaining demand.

Detailed competition analysis for Sonata Software

Key financial metrics – Trailing Twelve Months (TTM);

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT(₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Sonata Software | 10157.25 | 689.25 | 6.79% | 424.67 | 4.18% | 25.80 |

| Newgen Software | 1486.88 | 376.21 | 25.30% | 315.24 | 21.20% | 56.05 |

| Intellect Design Arena | 2500.00 | 530.55 | 21.22% | 337.69 | 13.51% | 46.09 |

| Cyient Ltd. | 7360.40 | 1143.30 | 15.53% | 653.20 | 8.87% | 23.42 |

| Birlasoft Ltd. | 5420.90 | 736.88 | 13.59% | 574.74 | 10.60% | 20.36 |

Key insights on Sonata Software

- Median sales growth of 17.9% over the last 10 years reflects consistent top-line performance in a competitive IT services landscape.

- EBITDA margins in the 6–8% range highlight disciplined cost management and operational efficiency.

- Strong return profile with a 3-year average ROE of 31.3%, underpinned by robust capital allocation and profitability.

- Strategic focus on high-growth verticals like travel-tech and retail-tech, supported by a rising share of recurring revenues, a solid order book, and deep client relationships.

- Maintains a healthy dividend payout ratio of 59.9%, indicating shareholder-friendly policies.

Recent financial performance of Sonata Software for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2191.61 | 2842.79 | 2617.20 | -7.94% | 19.42% |

| EBITDA (₹ Cr.) | 144.12 | 163.57 | 172.66 | 5.56% | 19.80% |

| EBITDA Margin (%) | 6.58% | 5.75% | 6.60% | 85 bps | 2 bps |

| PAT (₹ Cr.) | 110.36 | 105.01 | 107.53 | 2.40% | -2.56% |

| PAT Margin (%) | 5.04% | 3.69% | 4.11% | 42 bps | -93 bps |

| Adjusted EPS (₹) | 3.98 | 3.78 | 3.87 | 2.38% | -2.76% |

Sonata Software financial update (Q4 FY25)

Financial performance

- Reported an 8% QoQ revenue decline due to ongoing weakness in the Quant segment, client ramp-downs in the TMT vertical, and seasonal softness.

- International revenues de-grew by 6.6% QoQ in reported terms and 7.2% in constant currency; domestic business declined 1.9% QoQ but rose 26.6% YoY.

- Consolidated EBITDA margin improved by 80 bps QoQ to 6.6%, led by operational efficiency and normalisation of one-time costs; international margins stood at 16.5%, up 1.9% QoQ.

Business highlights

- Secured two large deals: a $73 million 5-year deal with a leading US TMT client and another with a BFSI client for platform modernisation and application development.

- 45% of the active deal pipeline consists of large deals, with 33% involving Fortune 500 clients; FY25 closed with 11 large deals and 13 new client logos, mostly in BFSI and healthcare.

- Workforce stood at 6,810; attrition at 14%, utilisation at 87%, with 95% of employees now AI-trained.

Outlook

- Q1FY26 expected to be soft but an improvement over Q4; recovery expected from Q2FY26 onwards, driven by large deal ramp-ups in TMT and BFSI.

- Management targets a $250 million revenue run-rate over the next 3–5 years, with BFSI, healthcare, and tech projected to contribute 35% of revenues.

- Near-term headwinds expected from elongated deal cycles in retail and manufacturing; margins to stay stable with minimal immediate impact from new deal ramp-ups.

Company valuation insights – Sonata Software

Sonata Software is currently trading at a TTM P/E of 25.80, slightly below the industry average of 27.96. Over the last year, the stock has declined by 24.46%, underperforming the Nifty 50’s +8.21% return.

While near-term headwinds persist – driven by large deal ramp-ups and continued investment in AI and hyperscaler-related projects – the long-term growth outlook remains intact. Key drivers include strong traction in AI, Microsoft Fabric, and Quant, along with a healthy large-deal pipeline (book-to-bill at 1.25x) and deeper client mining, especially with Fortune 500 clients.

Sonata’s focus on scaling four core verticals, advancing modernisation and engineering services, and deepening capabilities in data and analytics supports its long-term positioning. At 19x FY27E EPS of ₹25.1, the 12-month target price is ₹480, offering a 22% upside. A shorter-term 3-month target of ₹430 implies a 9% upside from current levels.

Major risk factors affecting Sonata Software

- Client Concentration: Dependence on key clients in the ISV and retail space can pose revenue risk.

- Global Slowdown: Prolonged macro weakness in the US/Europe could delay digital spending.

- Integration Risks: An Aggressive M&A strategy needs efficient integration to protect margins and culture.

- Currency Volatility: Being export-driven, forex fluctuations impact earnings.

- Competitive Pressure: Large IT firms moving aggressively into mid-sized digital deals can compress pricing power.

Technical analysis of Sonata Software share

Sonata Software has recently broken out of a descending channel with a sharp 12% up move, confirming the beginning of a bullish trend reversal. The stock is now trading above its 50-day, 100-day, and 200-day EMAs, signalling the establishment of a strong uptrend.

MACD stands positive at 8.39 and is poised to cross above the signal line, which would confirm renewed bullish momentum. The RSI at 54.75 indicates decent buying interest, while the Relative RSI over the 21-day period stands at 0.18, reflecting the stock’s recent outperformance.

While the ADX at 18.84 suggests that the trend strength is still developing, the overall setup remains favourable. A breakout above ₹460 could open room for further upside towards ₹480, while ₹345 serves as a crucial support level to watch.

- RSI: 54.75 (Decent Buying Interest)

- ADX: 18.84 (Building Trend)

- MACD: 8.39 (Positive)

- Resistance: ₹460

- Support: ₹345

Sonata Software stock recommendation

Current Stance: Buy with a target price of ₹430 over a 3-month horizon and ₹480 over a 12-month horizon. Sonata Software remains a promising play on digital transformation and enterprise modernisation, despite short-term pressures. Its focus on large deals, AI capabilities, and deep client relationships sets the stage for long-term growth.

Why buy now?

Deal momentum: Despite near-term softness, Sonata continues to win large deals (book-to-bill at 1.25x), with a third of the pipeline involving Fortune 500 clients.

Strategic focus: Emphasis on four core verticals - BFSI, healthcare, retail-tech, and travel-tech - backed by strengths in data, Microsoft technologies, and modernisation services.

AI-led transformation: Investments in AI and hyperscaler partnerships are expected to unlock scalable growth over the next few years.

Portfolio fit

Sonata provides exposure to India’s mid-cap digital transformation theme, with strong long-term tailwinds from AI, cloud, and large enterprise tech upgrades. Its improving operational efficiencies and deep domain capabilities make it suitable for portfolios looking to ride structural IT services growth beyond the near-term volatility.

If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSonata Software: Budget 2025-26 opportunities

- Digital Infra Push – Higher tech spending fuels demand for IT and digital transformation services.

- PLI & Make in India – Supports Sonata’s ERP and modernisation solutions for manufacturing clients.

- AI & Tech Focus – Aligns with Sonata’s strengths in AI, data, and cybersecurity.

- Skill Development – Enhances tech talent pool, aiding Sonata’s scaling efforts.

- MSME & BFSI Digitisation – Drives growth in Sonata’s core verticals through increased tech adoption.

Final thoughts

Imagine a global retailer looking to shift its entire operations to the cloud while ensuring a seamless omnichannel customer experience. Or a legacy travel company trying to build a real-time pricing and analytics engine. Sonata Software doesn’t just write code for these businesses – it writes the digital script that helps them survive and scale.

For investors, Sonata offers a slice of India’s IT prowess – but with a sharper focus, differentiated strategy, and niche bets that could deliver outsized returns over time. It’s not the loudest name in tech, but it might just be one of the most quietly effective.