In a rapidly evolving global IT services landscape, shaped by AI disruption, cloud adoption, and enterprise cost optimization, Tech Mahindra stands at an inflection point. Once known primarily for its leadership in telecom services, the company is now reshaping itself into a broader digital transformation partner. The key question for investors is whether Tech Mahindra’s strategic reset can translate into sustainable growth and margin recovery in the years ahead.

But does Tech Mahindra Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | TECHM |

| Industry/Sector | Information Technology |

| CMP | 1580.00 |

| Market Cap (₹ Cr.) | 1,54,434 |

| P/E | 34.64 (Vs Industry P/E of 26.73) |

| 52 W High/Low | 1793.50 / 1209.40 |

| EPS (TTM) | 45.54 |

| Dividend Yield | 2.85% |

About Tech Mahindra Ltd.

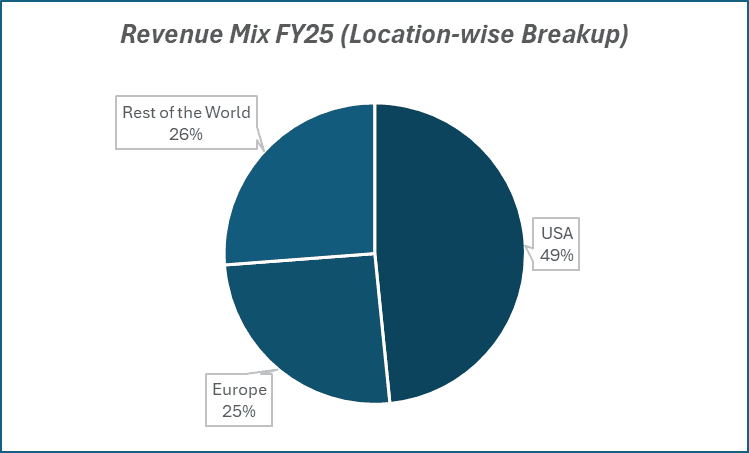

Tech Mahindra is a global IT services and consulting company and part of the Mahindra Group. It provides end-to-end digital transformation solutions across cloud, enterprise applications, data, AI, network services, and business process services. With a strong global delivery footprint and deep client relationships, Tech Mahindra serves enterprises across telecom, BFSI, manufacturing, healthcare, retail, and hi-tech verticals.

Historically, the company built a strong franchise in the communications (telecom) segment. Over time, it has expanded into enterprise IT, digital engineering, and platform-led services, aiming to reduce cyclicality and diversify revenue streams.

Key business segments

Tech Mahindra Ltd. operates primarily in the following key business segments:

- Communications (Telecom): Provides network services, 5G rollout support, OSS/BSS modernization, and digital platforms for global telecom operators.

- Enterprise Business: Covers BFSI, manufacturing, healthcare, retail, and hi-tech clients with offerings in cloud transformation, ERP modernization, data analytics, and AI-led solutions.

- Engineering Services & Digital Solutions: Focuses on digital engineering, product development, embedded systems, IoT, and platform engineering for global enterprises.

- Business Process Services (BPS): Delivers customer experience management, finance & accounting, and industry-specific BPM solutions.

Primary growth factors for Tech Mahindra Ltd.

Tech Mahindra Ltd. key growth drivers:

- Digital transformation-led growth: Focused on rising enterprise demand for cloud migration, AI adoption, data modernization, and automation.

- Telecom tailwinds: Long-term growth supported by investments in 5G, network virtualization, and cloud-native telecom platforms.

- Large deal prioritisation: Emphasis on high-value, large transformation contracts and deal-led growth.

- Platform & client mining strategy: Expanding platform-based offerings and deepening wallet share with existing strategic clients.

- Margin restoration focus: Cost optimisation through portfolio rationalisation and operational efficiency to improve medium-term margin resilience.

Detailed competition analysis for Tech Mahindra Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Tech Mahindra Ltd. | 54015.70 | 7752.30 | 14.35% | 4458.10 | 8.25% | 34.64 |

| TCS Ltd. | 257688.00 | 68867.00 | 26.72% | 49687.00 | 19.28% | 23.33 |

| Infosys Ltd. | 169458.00 | 40467.00 | 23.88% | 28159.00 | 16.62% | 23.49 |

| HCL Technologies Ltd. | 122427.00 | 25922.00 | 21.17% | 16983.00 | 13.87% | 26.40 |

| Wipro Ltd. | 89654.90 | 17769.30 | 19.82% | 13503.90 | 15.06% | 20.06 |

Key insights on Tech Mahindra Ltd.

- Structural reset underway: Management is prioritizing profitability, deal quality, and execution discipline over volume-driven growth.

- Portfolio clean-up: Conscious exit from low-margin engagements while scaling digital, cloud, and AI-led services.

- Telecom edge intact: Strong telecom heritage positions the company well for ongoing 5G, network modernization, and digital CX investments.

- Client mix stability: Client concentration remains manageable, with deeper wallet share in top enterprise clients improving revenue visibility.

- Key turnaround variables: Success hinges on execution strength, recovery in discretionary IT spending, and sustained margin improvement.

Recent financial performance of Tech Mahindra Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 13313.20 | 13351.20 | 13994.90 | 4.82% | 5.12% |

| EBITDA (₹ Cr.) | 1750.20 | 1935.20 | 2168.00 | 12.03% | 23.87% |

| EBITDA Margin (%) | 13.15% | 14.49% | 15.49% | 100 bps | 234 bps |

| PAT (₹ Cr.) | 1256.90 | 1128.30 | 1204.50 | 6.75% | -4.17% |

| PAT Margin (%) | 9.44% | 8.45% | 8.61% | 16 bps | -83 bps |

| Adjusted EPS (₹) | 14.14 | 12.89 | 13.49 | 4.65% | -4.60% |

Tech Mahindra Ltd. financial update (Q2 FY26)

Financial performance

- Moderate revenue growth: Revenue at USD 1.59 bn, up 1.6% QoQ in CC, marking the strongest sequential growth in the last 10 quarters.

- Margin recovery underway: EBIT margin expanded 108 bps QoQ to 12.1%, driven by Project Fortius-led cost efficiencies.

- Strong earnings momentum: PAT at USD 135 mn, up 28.2% YoY (excluding exceptional items), reflecting operating leverage.

- Robust cash generation: FCF/PAT at 120.8%, underscoring strong working capital discipline and cash conversion.

Business highlights

- Improving deal momentum: TCV at USD 816 mn, up 57% on LTM basis, with management targeting a USD 1 bn quarterly run-rate.

- Large client strength: Clients with USD 20 mn+ annual revenue now contribute over USD 1 bn per quarter, growing faster than portfolio average.

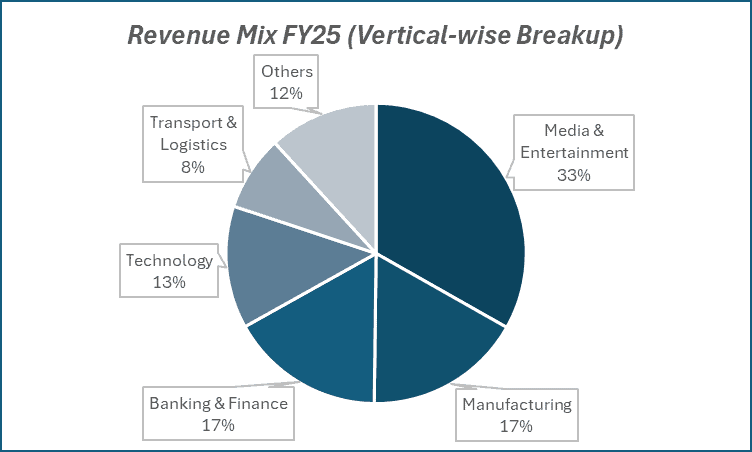

- Vertical traction: Strong YoY growth in Retail, Transport & Logistics (+7.2%), BFSI (+6.2%), and Manufacturing (+5.2%); Communications stabilising.

- AI-led differentiation: Launch of TechM Orion agentic AI platform; strong traction in GenAI consulting and workflow automation.

- Execution discipline: Margin gains driven by fixed-price productivity, SG&A optimisation, and tighter project governance.

Outlook

- H2 improvement expected: Management guides for stronger performance in H2 FY26, aided by execution initiatives and deal ramp-ups.

- Sustained margin expansion: Continued focus on gross margin-led improvement, with 15% EBIT margin as a medium-term goal.

- AI as a growth lever: GenAI platforms and productivity benefits expected to enhance win rates, deal quality, and margins.

- Balanced growth trajectory: Near-term recalibration in Communications offset by steady demand in BFSI, Manufacturing, and Retail.

- Long-term value creation: Investments in AI platforms, delivery modernisation, GCC offerings, and ecosystem synergies to support durable growth.

Recent Updates on Tech Mahindra Ltd.

- Cost rationalisation drive: Multiple initiatives launched to streamline costs, simplify operations, and improve overall efficiency.

- Leadership & structure reset: Ongoing leadership restructuring aimed at sharper accountability and faster execution.

- Hyperscaler partnerships: Deepening alliances with global hyperscalers and technology platforms to scale cloud and AI offerings.

- ESG & sustainability focus: Growing emphasis on sustainability-led and ESG-driven digital solutions for enterprises.

- Engineering-led use cases: Expanding digital engineering capabilities, especially across manufacturing and automotive clients.

Company valuation insights – Tech Mahindra Ltd.

Tech Mahindra trades at a TTM P/E of 34.6x, above the industry average of 26.7x, despite a –11% 1-year return versus the Nifty 50’s +6%. The underperformance reflects a prolonged reset phase, but improving execution, margin recovery under Project Fortius, and a shift toward profitability-led growth are strengthening the investment case.

The turnaround is anchored in margin visibility, with sustained EBIT expansion and a clear 15% medium-term margin target; better deal quality, as large clients grow faster and TCV momentum improves; and AI-led differentiation, led by TechM Orion and deeper hyperscaler partnerships, supporting non-linear growth and productivity gains. Strong cash generation provides downside protection as growth stabilises into H2 FY26.

Applying a 25x multiple to FY27E EPS of ₹75, we derive a 12-month target of ₹1,875 (19% upside). A 3-month target of ₹1,660 implies 5% upside, as margins improve and turnaround execution gains traction.

Major risk factors affecting Tech Mahindra Ltd.

- IT spending slowdown: Prolonged weakness in global discretionary IT and digital transformation budgets could delay growth recovery.

- Telecom demand risk: Continued softness or delayed capex by telecom clients remains a structural overhang.

- Execution & margin risk: Slippage in margin improvement initiatives could impact profitability.

- Talent retention challenges: Competitive IT services market may pressure attrition and delivery stability.

- Currency & pricing pressure: Forex volatility and aggressive pricing by global peers add near-term uncertainty.

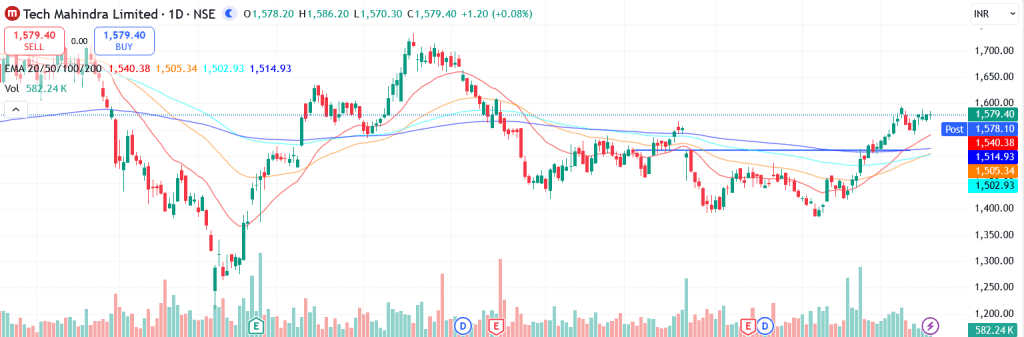

Technical analysis of Tech Mahindra Ltd. share

Tech Mahindra has formed a double bottom pattern and has recently broken out above the neckline, signalling the start of a fresh upward leg.

The stock is trading comfortably above its 50-, 100-, and 200-day EMAs, reinforcing a strong long-term uptrend and sustained buying support.

Momentum indicators confirm the bullish setup. MACD at 31.25 remains firmly positive with the line above the signal line, indicating continued strength.

RSI at 66.26 reflects strong buying momentum while still leaving room for further upside. Relative RSI readings (0.09 / 0.05) highlight ongoing outperformance, and an ADX of 32.31 points to a strong and strengthening trend supporting the breakout.

A decisive move above ₹1,660 could open the path toward ₹1,875 (12-month target). On the downside, ₹1,500 remains the key support; holding above this level keeps the bullish structure intact.

- RSI: 66.26 (Strong Buying Momentum)

- ADX: 32.31 (Strong Trend)

- MACD: 31.25 (Positive)

- Resistance: ₹1,660

- Support: ₹1,500

Tech Mahindra Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,660 (5% upside) and a 12-month target of ₹1,875 (19% upside), based on 25x FY27E EPS of ₹75.

Why buy now?

Turnaround gaining traction: Sequential revenue growth has returned, supported by improving deal execution and management’s confidence in a stronger H2 FY26.

Margin recovery visibility: EBIT margins have expanded consistently, driven by Project Fortius, cost rationalisation, fixed-price productivity gains, and tighter execution, with a clear 15% medium-term target.

Improving deal quality: TCV momentum has strengthened, large clients ($20mn+ accounts) are growing faster than the portfolio average, and management targets a more consistent ~$1bn quarterly deal run-rate.

AI-led differentiation: Launch of TechM Orion, deeper hyperscaler partnerships, and leadership positioning in GenAI consulting enhance win rates, productivity, and non-linear growth potential.

Strong cash generation: Robust FCF conversion (>100% of PAT) provides balance-sheet strength and downside protection during the growth recovery phase.

Portfolio fit

Tech Mahindra offers turnaround-led exposure within large-cap IT, combining improving profitability, strengthening deal quality, and an emerging AI-platform narrative. With margin recovery underway, stabilising growth, and strong cash flows, the stock presents an attractive medium-term risk–reward for portfolios seeking recovery-driven alpha in the IT services space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebTech Mahindra Ltd.: Budget 2025-26 opportunities

- AI & DPI push: Higher AI and digital governance spending boosts demand for Tech Mahindra’s cloud, data, and GenAI-led transformation services.

- Telecom modernisation: Policy support for 5G strengthens Tech Mahindra’s core communications and cloud-native telecom offerings.

- Public sector digitisation: Increased e-governance and cybersecurity opens open large-scale government transformation opportunities.

- GCC expansion: Incentives for GCCs in India position Tech Mahindra as a key partner for cloud, AI, and managed services.

- AI skilling focus: National AI skilling initiatives align with Tech Mahindra’s GenAI-ready talent base, aiding productivity and margins.

Final thoughts

Tech Mahindra’s journey is no longer about chasing scale, it is about rebuilding quality, profitability, and relevance in a rapidly changing digital world. As enterprises recalibrate tech spending toward AI, cloud, and platform-led transformation, Tech Mahindra’s ability to pivot successfully will define its next phase of growth.

For long-term investors, the story lies in tracking execution consistency, margin recovery, and the company’s progress in evolving from a telecom-led IT provider to a diversified digital transformation partner.