In an industry often defined by volatility, regulatory surprises, and pricing pressure, Torrent Pharmaceuticals stands out as a rare blend of consistency and disciplined execution. Known for its differentiated India portfolio, strong presence in chronic therapies, and operational excellence in key international markets, Torrent Pharma has steadily carved out a reputation as a quality-led, brand-driven pharmaceutical compounder.

But does Torrent Pharma Ltd. offer a compelling case for long-term investors at its current valuation? Let’s delve deeper.

Stock overview

| Ticker | TORNTPHARM |

| Industry/Sector | Healthcare |

| CMP | 3847.00 |

| Market Cap (₹ Cr.) | 1,30,301 |

| P/E | 60.50 (Vs Industry P/E of 33.78) |

| 52 W High/Low | 3882.20 / 2886.45 |

| EPS (TTM) | 63.23 |

| Dividend Yield | 0.16% |

About Torrent Pharma Ltd.

Founded in 1959 and headquartered in Ahmedabad, Torrent Pharmaceuticals Ltd. is one of India’s leading pharma companies with a strong focus on branded generics, chronic therapies, and specialty pharmaceuticals.

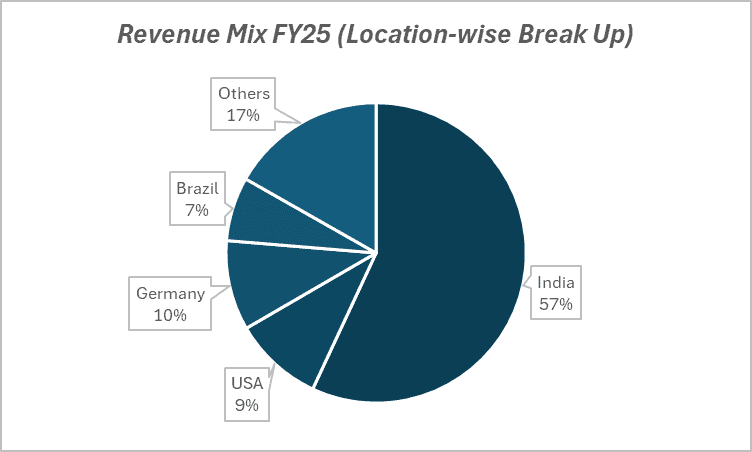

Torrent operates in 40+ countries, with a robust presence in India, Brazil, Germany, and the U.S. Its capabilities span formulations, APIs, oncology products, biosimilars, and high-complexity manufacturing including oral solids, injectables, and dermatology products.

The company is known for executing with operational discipline, stable margins, and a sharp focus on branded chronic therapies.

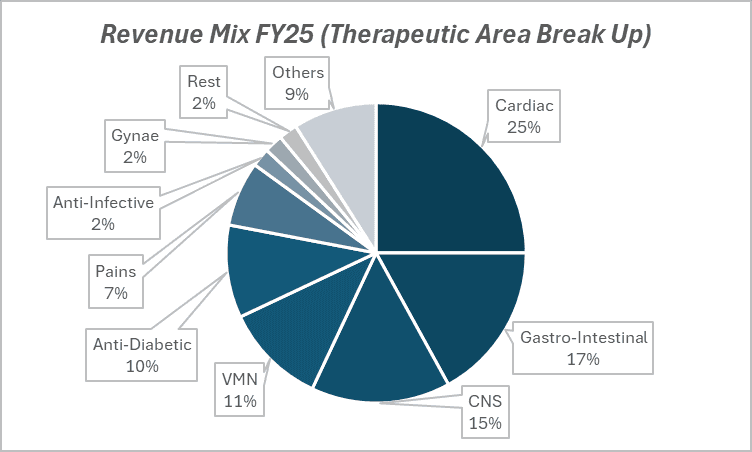

Key business segments

Torrent Pharma Ltd. operates primarily in the following key business segments:

- India Formulations (45–50% of revenue): Leadership in chronic therapies such as cardiovascular, central nervous system (CNS), gastro, and diabetes; strong doctor-patient franchise and brand equity.

- Brazil & Emerging Markets: A top-5 player in Brazil with high-growth branded generics; strong specialty product traction.

- Germany Market: Operates through Heumann Pharma with steady contribution in the tender-driven generics market.

- U.S. Generics: A moderate-sized business focused on select oral solids and niche generics; portfolio rationalization improving profitability.

- API & Contract Manufacturing: Backward integration ensures supply stability, supported by a well-invested API manufacturing ecosystem.

Primary growth factors for Torrent Pharma Ltd.

Torrent Pharma Ltd. key growth drivers:

- Strong Chronic Portfolio: Torrent’s chronic-heavy mix insulates it from India’s acute volatility, supporting consistent growth.

- Branded Generics Leadership: Increasing market share across cardiology, diabetes, CNS, and gastro, high-margin, sticky therapy areas.

- Brazil Momentum: Double-digit growth in Brazil aided by volume expansion, new launches, and strong brand positioning.

- Margin Improvement Focus: Cost discipline, manufacturing optimization, and better product mix to support EBITDA margin expansion.

- Pipeline Strength: 100+ ongoing R&D projects across India and international markets, including specialty and niche molecules.

- Acquisitions & Portfolio Expansion: Torrent’s track record of value-accretive acquisitions (Elder, Unichem, Curatio) supports long-term compounding.

Detailed competition analysis for Torrent Pharma Ltd.

Key financial metrics – TTM;

| Company | Revenue (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Torrent Pharma Ltd. | 12248.00 | 3993.00 | 32.60% | 2140.00 | 17.47% | 60.50 |

| Divi’s Lab Ltd. | 10029.00 | 3246.00 | 32.37% | 2485.00 | 24.78% | 70.39 |

| Sun Pharma Ltd. | 54964.01 | 15603.07 | 28.39% | 10517.89 | 19.14% | 39.72 |

| Cipla Ltd. | 28349.57 | 7199.40 | 25.40% | 5453.86 | 19.24% | 22.68 |

| Dr Reddy’s Lab Ltd. | 34310.00 | 8454.40 | 24.64% | 5721.40 | 16.68% | 17.96 |

Key insights on Torrent Pharma Ltd.

- Torrent enjoys one of the highest EBITDA margins (25–28%) in the Indian pharmaceutical industry due to its chronic-heavy branded generics model.

- Its Brazil and India businesses continue to outperform peers on the back of strong prescription penetration and focused marketing.

- U.S. business stabilization reduces earnings volatility and improves predictability.

- Curatio acquisition strengthens dermatology, a high-growth, high-margin therapy.

- Strong free cash flow generation enables continued capex, R&D investment, and shareholder payouts.

- Torrent’s renewed capex cycle in Dahej, Indrad, and Pithampur enhances long-term capacity.

Recent financial performance of Torrent Pharma Ltd. for Q2 FY26

| Metric | Q2 FY25 | Q1 FY26 | Q2 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue(₹ Cr.) | 2889.00 | 3178.00 | 3302.00 | 3.90% | 14.30% |

| EBITDA (₹ Cr.) | 939.00 | 1032.00 | 1083.00 | 4.94% | 15.34% |

| EBITDA Margin (%) | 32.50% | 32.47% | 32.80% | 33 bps | 30 bps |

| PAT (₹ Cr.) | 453.00 | 548.00 | 591.00 | 7.85% | 30.46% |

| PAT Margin (%) | 15.68% | 17.24% | 17.90% | 66 bps | 222 bps |

| Adjusted EPS (₹) | 13.38 | 16.19 | 17.46 | 7.84% | 30.49% |

Torrent Pharma Ltd. financial update (Q2 FY26)

Financial performance

- Revenue rose 14.3% YoY to ₹3,302 crore, led by strong branded market growth.

- India grew 12% YoY; Brazil up 20.9%; US up 25.7% on new launches.

- Germany declined due to third-party supply disruptions.

- EBITDA grew 15.3% YoY with a margin of 32.8%.

- PAT increased 30.5% YoY to ₹591 crore; margins improved to 17.9%.

Business highlights

- Chronic therapies drove domestic outperformance across cardiac, gastro, and derma.

- Branded markets contributed 73% of revenue with India and Brazil leading growth.

- US business recovered on the back of new products and stronger volumes.

- Field force expanded to 6,800 MRs, aiding improved coverage and productivity.

- R&D pipeline strengthened; semaglutide filed with ANVISA; JB Chemicals acquisition progressing toward closure.

Outlook

- The company expects to continue outpacing IPM growth.

- US momentum to improve further through FY26–FY27.

- Brazil to sustain double-digit growth supported by launches and pipeline.

- German recovery expected from FY27 as supply issues ease.

- Margins to remain stable, supported by branded strength and synergy benefits ahead.

Recent Updates on Torrent Pharma Ltd.

- Capacity Expansion: Torrent announced manufacturing expansion in Dahej and Indrad to support domestic and export markets.

- Pipeline Visibility: Progress in derma, CNS, and cardiology molecules with multiple launches lined up across markets.

- Strategic Alliances: Partnerships in emerging markets to strengthen branded generic distribution.

- Leadership Reinforcement: Increased R&D investment and senior talent addition across quality and regulatory functions.

- New Product Launches in India: Focus on diabetes, hypertension, neurology, and dermatology, all high-growth segments.

Company valuation insights – Torrent Pharma Ltd.

Torrent Pharma currently trades at an EV/EBITDA of 30x, with a strong 1-year return of 24%, outperforming the Nifty 50’s 10%.

The investment case for Torrent Pharma is anchored in its consistent outperformance in branded markets, strong leadership in chronic therapies, and robust momentum across India and Brazil. The company continues to benefit from a high-quality branded portfolio, rising contributions from new product launches, and steady expansion in chronic and sub-chronic therapies. Its US business is recovering on the back of new launches and improved contract volumes, while Brazil remains a key growth engine supported by a rich pipeline, including the high-potential semaglutide opportunity. Torrent’s strategic focus on scaling its field force, accelerating R&D filings, and integrating JB Chemicals enhances long-term visibility. Backed by strong margins, improving profitability, and a healthy balance sheet, Torrent Pharma remains well-positioned for sustained earnings growth across core markets.

We value Torrent Pharma at 23x FY27E EV/EBITDA, arriving at a 12-month target price of ₹4,700, implying 22% upside from current levels. For the near term, we assign a 3-month target price of ₹4,100, reflecting 6% upside potential.

Key upside triggers include sustained double-digit growth in India, new product momentum in Brazil, recovery in the US portfolio, margin stability, and synergy benefits from the JB Chemicals integration.

Major risk factors affecting Torrent Pharma Ltd.

- Regulatory Risk: Any adverse FDA observations can impact U.S. exports.

- Brazil FX Volatility: Currency fluctuations can impact margins and reported growth.

- Competitive Pressure in India: Chronic therapies remain competitive with aggressive marketing spends from peers.

- U.S. Pricing Pressure: Even though Torrent has a limited U.S. presence, erosion risk remains.

- Integration Challenges: Large acquisitions or expansions may temporarily pressure margins.

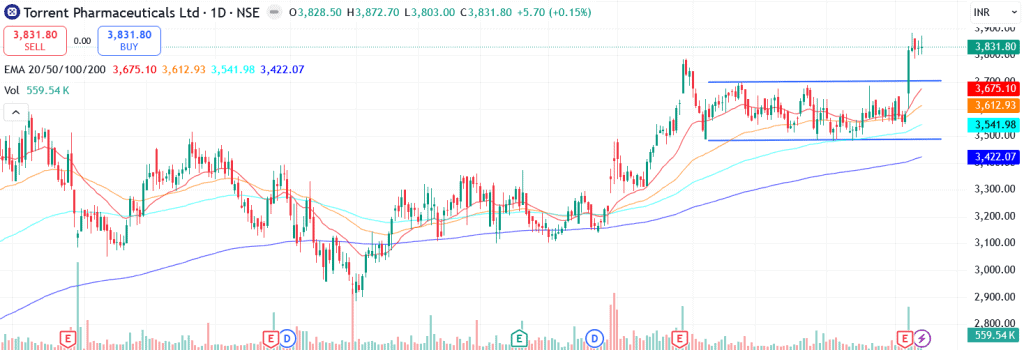

Technical analysis of Torrent Pharma Ltd. share

Torrent Pharma has recently broken out of a prolonged sideways channel, delivering a sharp 6% upside move following its Q2 FY26 results. This breakout above the upper trendline signals renewed strength and the beginning of a potential sustained uptrend after months of consolidation. The move is supported by strong volumes, indicating increasing investor participation and a shift in momentum in favor of the bulls.

The stock is currently trading above its 50-day, 100-day, and 200-day EMAs, reinforcing a strong medium- to long-term bullish bias. Maintaining this position above all key moving averages will be crucial for the stock to extend its ongoing upward trajectory.

Momentum indicators further validate the bullish setup. The MACD at 63.26 is trading comfortably above its signal line, highlighting building buying momentum. The RSI at 70.96 indicates strong demand, while relative RSI readings of 0.06 (21-day) and 0.01 (55-day) confirm continued outperformance versus the broader market. The ADX at 29.14 suggests a strengthening directional trend that could accelerate if the stock sustains above near-term resistance.

A decisive breakout above ₹4,100 could pave the way toward the ₹4,700 12-month fundamental target, in line with the improving technical and fundamental outlook. On the downside, ₹3,700 remains the key support zone; holding above this level will be essential to retain the bullish structure.

- RSI: 70.96 (Strong Buying Interest)

- ADX: 29.14 (Strong Trend)

- MACD: 63.26 (Positive)

- Resistance: ₹4,100

- Support: ₹3,700

Torrent Pharma Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹4,100 (6% upside) and a 12-month target of ₹4,700 (22% upside) based on 23x FY27E EV/EBITDA.

Why buy now?

Strong branded leadership with consistent outperformance in chronic therapies.

India business is growing ahead of IPM with expanding field force and rising productivity.

Brazil and the US showing strong momentum driven by new launches and deeper market penetration.

JB Chemicals acquisition and semaglutide pipeline add meaningful medium-term catalysts.

Healthy margins, strong cash generation, and disciplined R&D investments support long-term earnings visibility.

Portfolio fit

Torrent Pharma fits well as a long-term healthcare compounder, offering steady exposure to chronic therapies, strong branded growth, and rising momentum in key international markets. Its resilient margins, consistent earnings visibility, and defensive stability make it a reliable addition to portfolios focused on quality, compounding, and sustainable growth within the pharma space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebTorrent Pharma Ltd.: Budget 2025-26 opportunities

- Healthcare Push: Higher government spending on public health to support chronic therapy demand.

- R&D Support: Tax incentives and innovation schemes to accelerate filings and strengthen the pipeline.

- Make-in-India: Manufacturing and PLI benefits to enhance cost efficiency and supply-chain resilience.

- Export Boost: Export-friendly policies to aid growth in Brazil, the US, and other key markets.

- Affordable Care: Greater insurance and access initiatives to expand branded generics adoption.

Final thoughts

Torrent Pharma’s story is one of slow, steady, and high-quality compounding, quite different from the scale-driven hyper-growth models of other pharma majors. Its strength lies in being a disciplined player: focused on chronic therapies, maintaining strong margins, and growing through thoughtful acquisitions rather than risky leaps.

For investors seeking a defensive, steady compounding business with high earnings visibility and a strong domestic moat, Torrent Pharmaceuticals stands out as one of India’s most compelling healthcare plays.