Did you know India is topping the chart in the global IPO (Initial Public Offering) market this year? Yes, companies have already accumulated over ₹40,000 crores, and they expect to collect much more in the coming months.

The growth of the IPO market is a reason good enough for us to understand and dive deep into the IPO process. In this article, we will explore one of the primary components of an IPO – the abridged prospectus.

What is a prospectus?

The prospectus is an official document filed with the Securities and Exchange Board of India (SEBI) by the company issuing the IPO. It is a mandatory requirement for all companies going public to draft and issue a prospectus.

The prospectus contains all the details about the company – its background, financials, vision, mission, plans, etc., that help investors make their investment decisions. While it is a statutory requirement for SEBI, the prospectus of an IPO acts as an advertisement about the company to the public.

You may also like: What is Capital Market – an engaging guide for beginners

What is an abridged prospectus?

The SEBI requires companies to file different kinds of prospectus for various purposes.

Section 2(1) of the Companies Act deals with abridged prospectus.

An abridged prospectus acts as a summary containing all essential details of the IPO. As per SEBI’s requirement, an abridged prospectus must hold all significant details without omitting any material information required for investors to make decisions.

The purpose of an abridged prospectus

Now that we know the meaning, let us understand when an abridged prospectus is issued. The SEBI mandates issuing an abridged prospectus with the application form during the issue of shares and debentures to the public.

The primary role of a prospectus is to inform the regulator and investors about the different aspects of companies going public. The final prospectus of companies is generally lengthy, and the chances of investors missing significant information are high. This can lead to investors making incorrect information.

An abridged prospectus eliminates this issue by summarising all material information into a simple document, making it easily understandable for investors. The abridged prospectus is a starting point for research before making investment decisions.

The SEBI focuses immensely on investor’s protection from fraud. Abridged prospectus helps SEBI in doing so by ensuring the disclosure of significant details.

Also read: Understanding the difference between equity and debt IPO for the right investment

What does an abridged prospectus cover?

As per the requirement of SEBI, some details to be included in the abridged prospectus are as follows:

- The basic details of the issuing company like the name, registered address, telephone, website, etc

- Names of the company’s promoters

- Confirmation of the eligibility to issue an IPO under required regulations of statutory bodies

- The timetable of the IPO, containing bid opening and closing date, share allotment date, refund date, etc

- A mention of general risks involved in investing in the share market

- Price details of shares in IPO

- An overview of the issuing company’s business, its strategies and model

- The names, designations, and experiences of the Board of Directors of the issuing company

- The purpose or objective of the IPO and the fund utilisation plan

- Details of convertible securities, if any

- Current shareholding pattern (Before IPO)

- Audited financial statements containing significant details like net profit/loss, earnings per share, net asset value, etc., for five years

- Internal risks that the issuing company is exposed to

- Summary of litigations, outstanding claims or regulatory actions

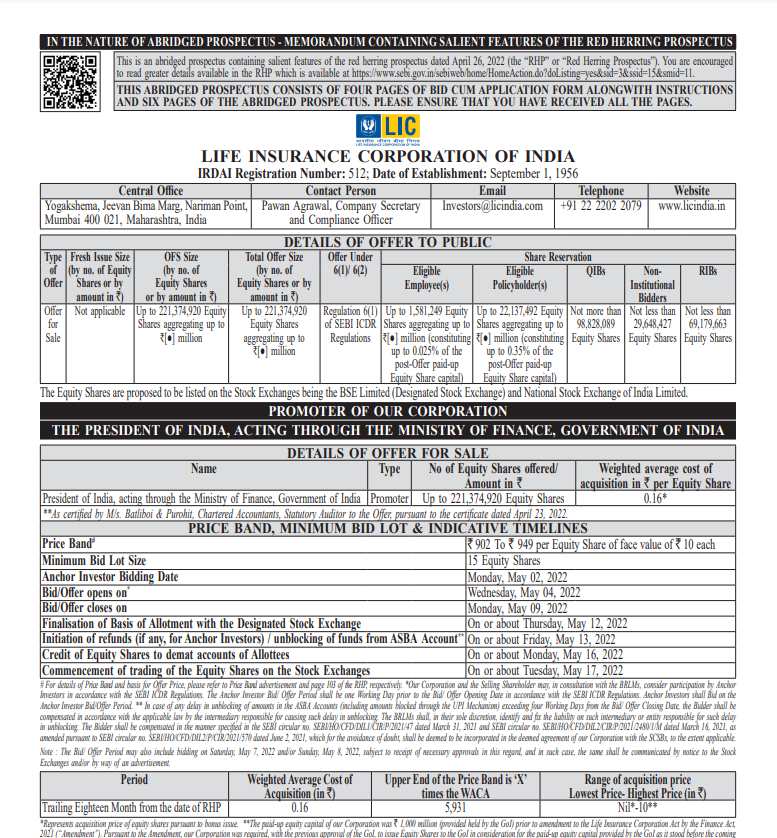

Below is an example of an abridged prospectus issued by Life Insurance Corporation (LIC) in 2022.

Regulation 58(1) of SEBI deals with the format of publishing an abridged prospectus:

- The abridged prospectus should not utilise more than five sheets printed on both sides.

- It must be printed in the form of an A4 booklet.

- Font: Times Roman, Font size: Not less than 11, Line spacing: 1.0

- Information that requires a tabular format must not be written in texts

As per SEBI’s latest update on the abridged prospectus, the document should contain a QR code on the last page that leads to the main prospectus, containing all the information in detail.

Exemptions to issue abridged prospectus

The application for an IPO to issue shares or debentures is not considered valid by SEBI if it is not backed by the abridged prospectus. Hence, the document is crucial and is required at all times. However, below are some exceptions where issuing companies do not have to file an abridged prospectus:

- If the company is not issuing shares or debentures to the public, it does not have to file an abridged prospectus.

- When the issuing company directs the invitation of subscription to a specific underwriter, an abridged prospectus is not necessary.

Also read: Debt instruments in India: Understanding your investment options

Differences between a red herring prospectus and an abridged prospectus

The red herring prospectus is also called the offer document. It is a lengthy prospectus that contains in-depth information about the company that is issuing shares through an IPO. The document must be filed with SEBI before the IPO. Only upon SEBI’s verification and approval of the red herring prospectus, the issuing company can begin offering its shares to the public.

The primary distinction between a red herring prospectus (RHP) and an abridged prospectus is the length of the document and, the details in them. The RHP can be as long as 500 pages as it contains all minute details of the company. However, the abridged prospectus is a simplified version of RHP, containing noteworthy information in 5 to 6 pages.

Bottomline

An abridged prospectus is one of the initial documents required for a company to get SEBI’s approval for an IPO. It contains all the relevant information required for investors before they subscribe to the company’s shares. The prospectus is published on the issuing company’s website, along with the website of the banker assisting in the IPO process. The document is also available on SEBI’s portal, making it easily accessible to the public.