Diversification is often cited by experts as one of the most efficient ways to balance risk and returns for a portfolio. Sectoral diversification can potentially help reduce concentration in one sector and help tap market trends.

One such unique yet fast-growing industry in India is aviation. In 2024, India crossed the milestone of flying 5 lakh passengers in a single day. The rising disposable income, government investments in the sector and infrastructural development are expected to provide a boost to this sector in the upcoming years.

Two of the most popular players in this sector are Air India and IndiGo. Based on the passenger count, IndiGo leads with a 64% market share, followed by Air India with a 26.7% market share in March 2025.

Investors can capitalise on this market share by comparing Air India vs IndiGo in terms of financials, share price and operational efficiency. Explore this blog to compare these companies in detail.

IndiGo

It is the 7th largest company in the world based on the daily departures. IndiGo’s low-cost flying experience has gained it a leading status in the aviation industry. As of FY 2025, its network has expanded to 40 international and 91 domestic destinations. The company is projecting to add 600 new aircraft to its collection by 2030.

In terms of financial performance, its revenue from operations has increased by 2.65 times from FY 2022 to FY 2024. In Q3 FY 2025, the company also recorded 13.6 y-o-y growth in its revenue from operations.

Air India

The company can be termed as one of the pioneers of the Indian aviation industry. Established by J.R.D Tata, Air India is the second largest airline in India based on the passenger market share, even after 93 years of its legacy. In 1953, the company was nationalised.

However, the Tata Group took back its 100% stake in the entity in 2022. Recently, in 2024, a merger of Air India and Vistara was announced, which increased the efficiency of these airlines to 5600 flights per week.

Dive Deeper! Air India and Vistara Complete Merger: A New Era in Aviation

Financials: Air India vs IndiGo

In terms of different financial metrics, IndiGo is outperforming Air India based on the financial results of FY 2024. The company is gaining an edge over almost all other peers due to its low cost and strong network presence. However, Air India’s pacing recovery from the volatility, owing to recent privatisation and merger, may make it profitable.

Air India Ltd.

| Particulars | FY 2024 | FY 2023 | Change (%) |

| Revenue from operations (in ₹ crores) | 51,364.8 | 41,261.1 | 24.4 |

| Net profit (in ₹ crores) | (6,697.1) | (13,966.7) | 52.0 |

| Operating profit margins | 1.9% | (3.4)% | 155.8 |

| Return on equity | (42%) | (86%) | 51.1 |

| Earnings per share (in ₹) | (1.89) | (4.23) | 55.3 |

IndiGo: InterGlobe Aviation Ltd.

| Particulars | FY 2024 | FY 2023 | Change (%) |

| Revenue from operations (in ₹ crores) | 68,904.3 | 54,446.4 | 26.5 |

| Net profit (in ₹ crores) | 8,172.4 | (305.7) | 27.7 times |

| Operating profit margins | 25.6% | 14.5% | 76.5 |

| Return on equity | 0.0% | 0.0% | – |

| Earnings per share (in ₹) | 211.61 | (7.93) | 27.6 times |

- Revenue from Operations: In FY24, Indigo earned a significantly higher revenue from operations than Air India. This is majorly due to higher operational capability of Indigo airlines.

- Market Control: Indigo controls 64.4% market share of Indian commercial aviation as of December 2024. That shows its market leadership. In the same period Tata Group (Air India and Air India Express) held a market share of 26.4%.

- Weekly Flights: According to DGCA, in 2025, Indigo is expected to operate 14,158 flights a week for summer travel season, whereas Air India is expected to operate 4,310 weekly flights in the same time period. This shows the dominance of Indigo in the Indian aviation sector, and can further boost its revenue.

- Fleet Size: As of January 2025, Air India (not including Air India Express) has a fleet size of 205 aircrafts. At the same time Indigo has 437 aircraft, that is more than double the fleet size of Air India.

- Profitability: As of FY24, Air India incurred a loss of ₹6,697 crores, which is a 52% less than the ₹13,966 crores loss incurred in FY23. Indigo, on the other hand, made a profit of ₹8172 crores, after making a loss of ₹305 crores in FY23. This shows that Indigo has a better financial position than Air India.

Share price comparison: Air India vs IndiGo

Comparing the share prices of these entities may not present the most appropriate picture because Air India is an unlisted company.

Tata Group(Air India Ltd.)

The original owners, Tata Sons, acquired a 100% stake in Air India through its subsidiary Talace Pvt Ltd. However, this entity is not listed on the stock exchange. Therefore, its share price or performance is unavailable.

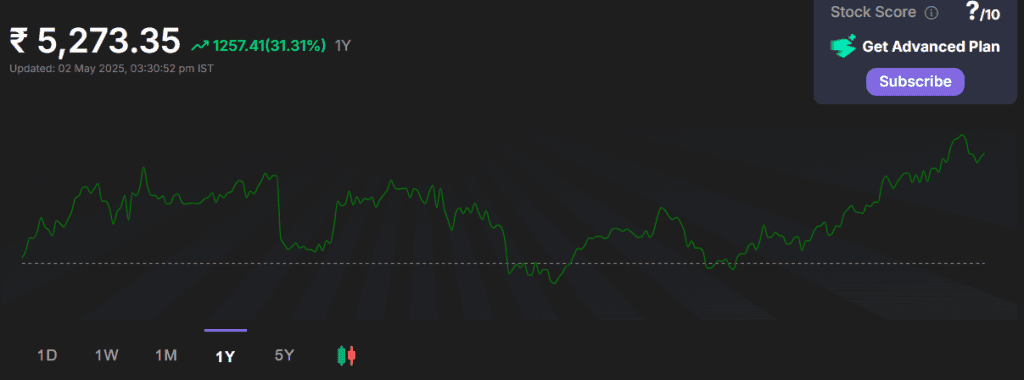

InterGlobe Aviation Ltd. (IndiGo)

The stock is trading at a P/E ratio of 24.91 times as of May 3, 2025. The share price has surged by 31% despite overall stress in the Indian markets. It also recorded a new 52-week high of ₹5,556.

Must read: InterGlobe Aviation Share News & Stock Analysis

Comparative SWOT analysis: Air India vs IndiGo

| Particulars | IndiGo Ltd. | Air India Ltd. |

| Strength | Leading in the industry with a market share of 64% due to its low-cost features. | Industry’s pioneer brand, strong parent company (Tata Group) and improving financials. |

| Weakness | The company reported negative cash flows in FY 2024. | One of the biggest operating hurdles for the company is its outdated fleet of aircraft. |

| Opportunity | Its fleet is expected to add 600+ aircrafts by 2030, which may indicate better operational efficiency in the upcoming days. | The recent merger with Vistara is expected to increase the airline’s operating efficiency. |

| Threat | Rising fuel costs may affect the overall profits for the company | Tough competition and geo-political uncertainty may hinder the company’s growth. |

Air India vs IndiGo: Which is a better aviation stock?

India is expected to become the world’s 3rd largest air passenger market by 2030. The leading entities, IndiGo and Air Indi,a are currently leading this industry. Their passenger share covers nearly 90% of the total market.

Comparing Air India vs Indigo, the main difference is evident in its financials. Air India is still a loss-making entity due to volatility regarding its privatisation and mergers. In contrast, IndiGo has booked significant profits in FY 2024. Understanding the share price movement and operational efficiency can help investors decide the best option for their portfolio.

Explore more: Top Airline Stocks to Invest in India