From extracting oil and natural gas to supplying it to customers, there are two types of companies involved. The first one is upstream, those who explore and extract the oil from the sea bed or below the ground. The other one is downstream, who refine the crude oil and markets it.

Upstream companies sell crude oil to downstream companies, and the profitability of both companies depends on the price of crude oil in the international market and the government taxation policy. In FY25 alone, India consumed 239.2 million tonnes of petroleum products.

In this blog, we will compare Hindustan Petroleum Corporation Limited or HPCL and Bharat Petroleum Corporation Limited or BPCL, two public sector downstream oil companies, also known as Oil Marketing Companies (OMC).

Also read: ITC Q4 FY25 result highlights

Company overview

Let us take a look at Bharat Petroleum and Hindustan Petroleum companies individually:

Bharat Petroleum Corporation Limited (BPCL)

BPCL is involved in refining and selling petroleum products through petrol stations located throughout the country. The company owns 3 refineries with 35.3 million metric tons of refining capacity and 0.83 million metric tons capacity annually as of FY25.

As of FY25, the company has the following number of retail outlets:

- 23,642 – Retail outlets

- 6,269 – LPG distributors

- 2,370 – CNG outlets

- 8,000+ – Industrial customers

BPCL also has a presence in the upstream business (oil extracting) in six countries through its subsidiary Bharat Petro Resources Limited.

The company is also a big player in green energy, with 154 MW operational and 176 MW under construction as of FY25. The company has a debt of ₹23,280 crores and it aims to install 10 GW of green energy capacity by 2035.

Hindustan Petroleum Corporation Limited (HPCL)

HPCL, incorporated in 1952, is involved in refining cure oil and marketing it. The company has two refineries of its own and its two refineries as joint ventures. HPCL has 34.5 million metric tons per annum (MMTPA) refining capacity as of FY25.

As of FY25, the company has the following number of retail outlets:

- 23,747 – Retail outlets

- 6,378 – LPG distributors

- 2,038 – CNG facilities

- 5,976 – EV charging facilities

As of FY25, the OMC has 224 MW of renewable energy capability. Out of the total green energy capability, 100.9 MW is through wind energy and around 123 MW from solar energy. The company plans to bring its total capacity to 2.4 GW by FY28.

By FY28, the company also aims to bring its total refining capacity to 45.3 MMTPA. HPCL also has an ambitious goal to go net zero by 2040.

Also read: HPCL Q4 result analysis

Bharat Petroleum vs. Hindustan Petroleum comparison

Here are the financials and financial ratios for Bharat Petroleum and Hindustan Petroleum for FY25.

| Particulars (₹ crores) | BPCL (FY25) | HPCL (FY25) |

| Market Capitalisation (as on 27th May 2025) | 1,38,225 | 87,613 |

| Sales | 4,40,272 | 4,34,106 |

| Operating Profit | 25,401 | 16,432 |

| Net Profit | 13,337 | 6,736 |

| Net Profit Margin % | 3.02% | 1.55% |

| Earnings per share | 30.74 | 31.66 |

| Particulars (on 27th May 2025) | BPCL | HPCL |

| ROE% | 17.3% | 13.7% |

| ROCE% | 16.2% | 10.5% |

| Price to Earnings Ratio | 10.2 | 13 |

| Price to Book Value | 1.69 | 1.71 |

| Debt to Equity | 0.75 | 1.38 |

| Interest Coverage Ratio | 6.17 | 3.67 |

| Gross Refining Margin (GMR) | $6.82 / barrel | $5.74 / barrel |

| No of Filling Stations | 23,642 | 23,747 |

- Sales: In FY25, BPCL sales were 1.42% higher than HPCL. This is because BPCL sold 52.4 MMT of refined petroleum products, whereas HPCL sold 49.8 MMT of refined petroleum products. Despite the fact that HPCL has higher filling stations than BPCL as of FY25.

- Net profit and net profit margin: BPCL had a net profit of ₹13,337 crores, higher than ₹6,736 crores earned by HPCL. BPCL also had a higher net profit margin than HPCL, showing its better efficiency at converting revenues into net profits.

- Market capitalisation and valuation: BPCL has a higher market capitalisation than HPCL (as of 27th May 2025). But despite the higher market capitalisation, BPCL has a lower price-to-book value and a lower price-to-earnings ratio than HPCL. This could indicate that investors perceive HPCL as having stronger growth potential in the future, despite BPCL’s larger size.

- Gross refining margin: GRM or gross refining margin is the profitability margin of a refinery. A higher GRM is better as it shows higher profitability. BPCL has a higher GRM of $6.82 per barrel as compared to $5.74 per barrel GRM of HPCL.

- Debt and debt ratios: BPCL has a lower debt-to-equity ratio of 0.75 as compared to 1.38 of HPCL. BPCL also has a higher interest coverage ratio than HPCL. This shows that BPCL can more easily fulfil its debt and interest liabilities.

- Return ratios: BPCL has higher return ratios as compared to HPCL. In terms of RoE (Return on Equity), BPCL is at 17.3%, and HPCL is at 13.7%.

Both BPCL and HPCL face competition from other industry giants like Reliance Industries and Indian Oil Corporation Limited or IOCL.

An interesting read: Adani Green vs Tata Power: Who leads the charge in India’s evolving power sector?

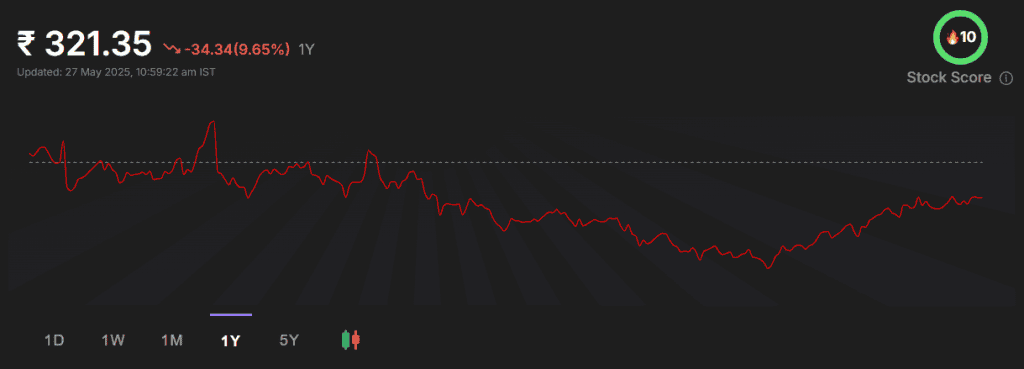

Bharat Petroleum and Hindustan Petroleum stock price

BPCL shares are trading at ₹321.35 as of May 27, 2025. The share price has fluctuated between a 52-week low of 230.32 and a 52-week high of ₹412.70.

The stock has returned -9.65% in the past year, but in the last five years, the stock has returned 75.18%.

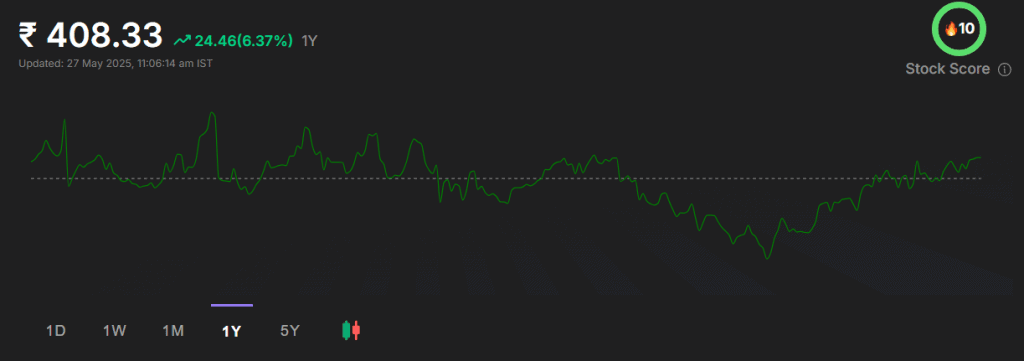

HPCL shares are trading at ₹408.33 as of May 27, 2025. The share price fluctuated between a 52-week low of 285.85 and a 52-week high of ₹473.99.

The stock has gained 6.37% in the past year, and in the last five years, the stock has returned 114.78%.

Conclusion

BPCL has relatively better financials, lower debt, and higher operational efficiency than HPCL. However, HPCL has a higher number of filling stations and higher green energy generation capability than BPCL, which might benefit HPCL in the future. While choosing an investment between Bharat Petroleum or Hindustan Petroleum, traders must conduct their own thorough analysis.