Coal is a naturally occurring material that is used as fuel in thermal power plants and is also used as raw material in certain industries. India mined 1.04 billion tonnes of coal in FY25. In addition to the coal mined, India imported 243.6 million tonnes of coal.

As of FY25, 73.16% of electricity generated in India was from thermal power plants. Thermal power plants require a significant amount of coal. As per Ministry of Coal data, of all the coal produced in April 2025, 81% was consumed by the power sector.

Overall, the mining sector saw 289 million metric tonnes of mining in FY25. Aluminium production stood at 42 lakh tonnes, and copper production stood at 5.73 lakh tonnes. High metal production can be attributed to increasing industrial activity.

In India, in terms of market capitalisation as of 29th May 2025, the largest government owned company involved in the coal mining business is Coal India Limited and the largest private sector company in the natural resources mining business is Vedanta Limited. In this blog, we will compare two major mining companies in India – Coal India Vs Vedanta Limited.

An interesting read: Mahindra vs Ashok Leyland: Who’s leading the commercial vehicle market?

Company Overview

Let us take a look at overview of Coal India and Vedanta:

Coal India Limited

Coal India Limited is a government-owned mining company that focuses on coal mining. It began operations in 1975 and is the largest coal-producing company in the world. Coal India has ‘Maharatna’ status from the government.

The company operates in 84 mining areas with 313 active mines. Coal India mined 781.05 million tonnes of coal in FY25, and the coal offtake was at 763 million tonnes.

Coal India has eight main subsidiary companies –

- Bharat Coking Coal Limited

- Central Coalfields Limited

- Central Mine, Planning & Design Institute Limited

- Mahanadi Coalfields Limited

- Northern Coalfields Limited

- South Eastern Coalfields Limited

- Eastern Coalfields Limited

- Western Coalfields Limited

In FY25, the company plans to invest ₹25,000 crores to develop solar power plants to generate up to 2.5 to 3 GW of electricity.

Vedanta Limited

Vedanta is a mining company involved in the business of mining various metals. The company mines and produces zinc, aluminium, copper, coal and oil & gas. The company is the largest producer of zinc, lead, and copper in India.

The company is also included in the business of power generation, steel manufacturing, port operations, and glass substrate manufacturing.

The company produced the following in FY25:

- Aluminium – 2,422 kilotonnes

- Zinc – 1,095 kilotonnes

- Silver – 687 tonnes

- Iron Ore – 6.2 million tonnes

Hindustan Zinc, a listed company with a market capitalisation of ₹1,94,365 crores as of May 29, 2025, is a subsidiary of Vedanta Limited.

A must read: What Makes a Stock the Best for Long-Term Investments?

Coal India and Vedanta comparison

Here is the financial comparison of Coal India Vs Vedanta Limited as of FY25:

| Particulars (₹ crores) | Coal India Limited | Vedanta Limited |

| Market Capitalisation (as on 29th May 2025) | 2,45,924 | 1,74,306 |

| Sales | 1,43,369 | 1,52,968 |

| Operating Profit | 47,063 | 42,343 |

| Operating Profit Margin | 32.82% | 27.68% |

| Net Profit | 35,302 | 20,535 |

| Net Profit Margin % | 24.62% | 13.42% |

| Earnings per share | 57.37 | 38.33 |

| Long-term Borrowing | 7,386 | 52,712 |

| Particulars (on 29th May 2025) | Coal India Limited | Vedanta Limited |

| ROE% | 38.8% | 38.8% |

| ROCE% | 48% | 27% |

| Price to Earnings Ratio | 6.96 | 12.6 |

| Price to Book Value | 2.49 | 4.23 |

| Debt to Equity | 0.09 | 1.82 |

| Interest Coverage Ratio | 54.15 | 3.52 |

| Inventory Turnover Ratio | 0.76 | 5.21 |

- Sales: Vedanta Limited has higher sales as compared to Coal India Limited. This might be due to the diversified product mix of Vedanta Limited. Coal India, on the other hand, focuses primarily on coal mining.

- Profitability: Despite having lower sales than Vedanta Limited, Coal India has a higher operating profit and net profit. As a result, Coal India Limited also has a higher operating profit margin and net profit margin than Vedanta Limited. This shows that Coal India has better sales-to-net profit conversion efficiency.

- Debt: Vedanta Limited has significantly higher long-term debt as compared to Coal India Limited. Coal India has a better debt-to-equity and interest coverage ratio as compared to Vedanta Limited. This shows that Coal India can easily pay off its interest and debt liability, as compared to Vedanta Limited.

- Returns: Both companies have the same return on equity of 38.8%. In terms of return on capital employed, Coal India is better than Vedanta Limited. This highlights Coal India’s stronger operational efficiency and asset utilisation.

- Market capitalisation: Coal India has a higher market capitalisation as compared to Vedanta Limited. Coal India has lower P/E and P/B values as compared to Vedanta Limited. This might be due to higher investor conviction in the future prospects of Vedanta Limited.

- Inventory turnover ratio: Coal India’s inventory turnover ratio is at 0.76, which shows slow inventory movement. This also indicates possible stockpiling issues. Vedanta Limited has an inventory turnover ratio of 5.21, showing faster inventory movement.

Also read: Container Corporation of India stock analysis & expert insights in detail

Coal India Vs Vedanta stock price

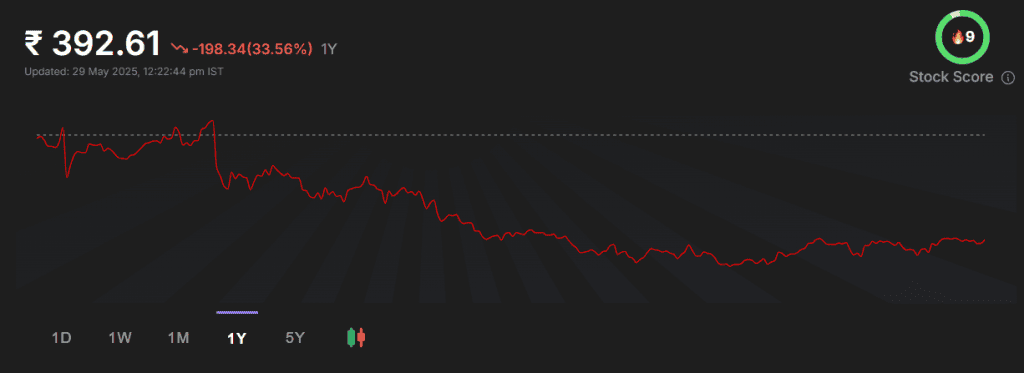

Coal India Limited stock is trading at ₹392.61 as of 29th May 2025. The stock touched a 52-week high of ₹642.14 and a 52-week low of ₹342.27.

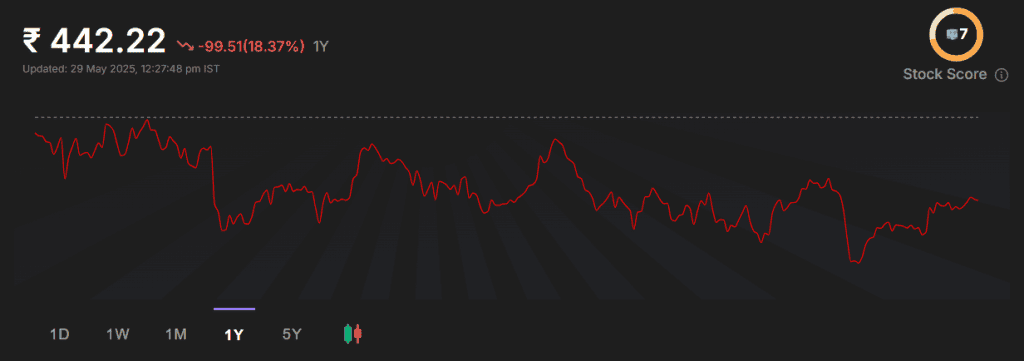

Vedanta Limited stock is trading at ₹442.22 as of 29th May 2025. The stock has made a 52-week high of ₹542.99 and a 52-week low of ₹357.09.

Coal India Limited stock has dropped by 33.56% on the other hand, Vedanta Limited stock dropped by just 18.37%.

In the last five years, Coal India has performed better than Vedanta Limited. The Vedanta Limited stock returned 27.72%, and Coal India returned 146%.

Conclusion

From the comparison between Coal India and Vedanta, it is evident that while Vedanta reports a higher revenue, it operates with lower profit margins, and has a higher debt burden as compared to Coal India Limited. However both companies operate in slightly different domains with different business models and different market risks, so investors must conduct thorough research before selecting a better investment among the two mining giants.