The retail market in India is fast expanding and contributes more than 10% to the GDP as of February 2025. Along with FMCG, this industry acts as an economic powerhouse that fuels the needs of consumers all over India. While the FMCG industry deals with the manufacturing and distribution of fast-moving consumer goods, the retail industry focuses on selling goods and services directly to consumers.

Companies like Spencer, Trent, Aditya Birla Retail, Shoppers Stop, etc. are some key players in the retail industry. This blog compares the quarterly performance of the two leading retail industry players. A comparison of DMart vs. Reliance Retail might aid in optimum stock analysis before investment.

However, before getting into Reliance Retail vs. DMart, it is important to understand the state of the retail industry in India. Industry overview can serve as a benchmark for judging company performance and complement analysed decision-making.

Understanding the retail industry

Currently, the retail space in India is the fifth-largest globally. It is expected to reach USD 2 trillion by 2032. The massive growth of the Indian retail space can be traced to the increasing consumer demand over the past few years.

However, there was a slump in consumer demand. To combat this trend, the government brought significant relief in the Union Budget 2025. It exempts income up to ₹12,00,000 and ₹12,75,000 for salaried individuals. This move works towards pushing demand by increasing the disposable income. It also proves government support for the consumer goods industry, which is integral to the retail space.

The continued government support is because India is one of the most promising destinations for the retail space. The primary factors which contribute to this are listed below.

- India has the largest population in the world.

- A massive middle class with expanding disposable income.

- Rising rural-urban connection.

- By 2030, there will be around 500 million Indians shopping online.

Keeping in mind the growing prospects of the Indian retail industry, the following sections compare Reliance Retail vs. DMart in detail.

Also read: A guide to investing in the Indian retail sector: Trends and opportunities

Company overview

Along with a keen look at the retail industry, it is also necessary to understand the background of each company. Analysing DMart vs Reliance Retail is not possible without acknowledging the respective scale, history and growth prospects.

- Reliance Retail

Established in 2006, the company has become the biggest retailer in India. It is a part of the Reliance Industries Ltd. The company strives to deliver value to its customers with a range of brands operating under the Reliance Retail umbrella. Some of the top brands include the following.

- Grocery outlets and supermarkets like Smart Point, Smart Bazaar, FreshPik, etc.

- Tech commodity providers like Reliance Digital and Jio Digital Life.

- Offline fashion outlets like Trends and Fashion Factory.

- Online fashion outlets like Zivame, Tira, etc.

- Toys and related product brands like Hamleys.

The table below shows the quarterly report of the company for March 2025.

| Particular | Value |

| Revenue from operations (₹ Crore) | 261,388 |

| Operating Profit Margin (%) | 17 |

| Net Profit (₹ Crore) | 22,611 |

| EPS (₹) | 14.34 |

| ROCE (%) | 9 |

Headquartered in Mumbai, Maharashtra, the brand is owned and managed by Avenue Supermarts Ltd. ASL was established by Mr. Radhakishan Damani. DMart is a one-stop store that provides a range of items, from food and utilities to garments and beauty products, at competitive rates.

The brand opened its first store in 2002 in Powai. As of April 2025, it operates across 415 locations. DMart stores can be located in major cities like Maharashtra, Gujarat, Andhra Pradesh, etc.

Also read: India’s food retail revolution: Growth, trends, and insights

DMart vs. Reliance Retail: Comparing quarterly reports

Quarterly reports are essential for the fundamental analysis of a stock. The table below compares the December 2024 quarterly reports of DMart vs. Reliance Retail.

| Particulars | DMart | Reliance Retail |

| Revenue from operations (₹ Crore) | 15,973 | 79,595 |

| Net Profit (₹ Crore) | 724 | 3,458 |

| EBITDA (₹ Crore) | 1,217.3 | 6,828 |

| EBITDA Margin (%) | 7.6 | 8.6 |

Reliance Retail has fared better compared to DMart at multiple parameters. Some key takeaways from the report are listed below.

- Scale: The difference in the performance stems from a number of reasons. One such cause is the distinction in their scale. Reliance Retail and continued support from its industry-leading parent company, Reliance Industries Ltd. The scale of RIL is much bigger compared to Avenue Supermarts Ltd.

- Revenue from operation: Reliance has recorded a higher revenue from operations than DMart. The chairman and managing directors of Reliance Industries, Mr. Mukesh Ambani credited the rise in demand during festive season for its strong revenue from operations. There is 7% year-on-year growth. However, DMart has also recorded a healthy quarterly performance. DMart has also grown 21.5% in nine months of FY25 due to its rapidly growing e-commerce. The company has also incorporated home deliveries to grow its business.

- Operations: The operational efficiency of Reliance Retail seems better than DMart. A primary cause is the expansive network of Reliance Retail. It inaugurated 779 new stores. Their current store count stands at 19,102, whereas DMart has 387 operating stores. Moreover, Reliance has 77.4 million sq. ft area under operation whereas DMart has 16.1 million sq ft retail business area.

Reliance Retail vs. DMart: Share market performance

DMart operates under the listed Avenue Supermarts Ltd. However, Reliance Retail is not yet listed. It operates under its listed parent entity, Reliance Industries Ltd. The sections below compare the respective stocks of DMart vs Reliance Retail.

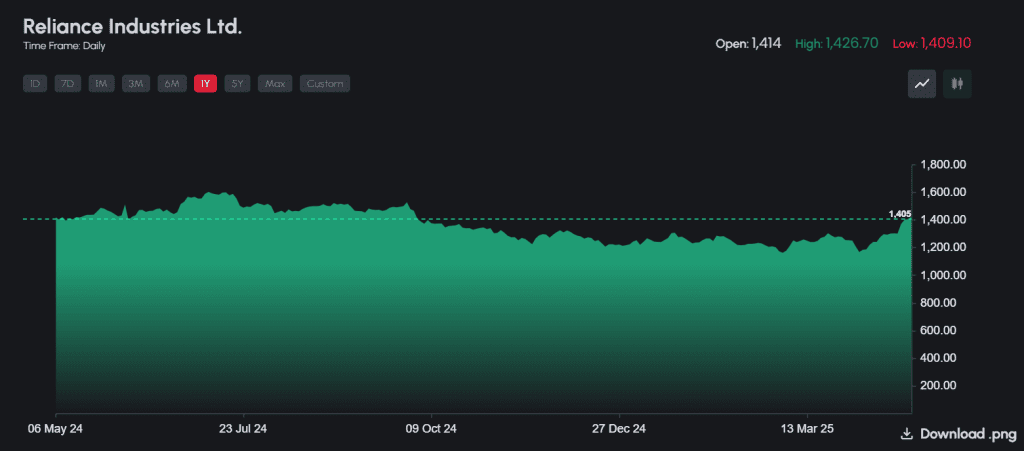

Reliance is one of the most prominent players in the Indian market, as demonstrated by its 175.35 lakh trading volume that represents a value of ₹2,489.41 crore. Therefore it is listed under Nifty 50.

RIL includes various business verticals like retail, oil and gas, etc. At 14.01 on 29 April 2025, the stock traded at ₹1,408.00. Currently, the company has a market capitalisation of ₹19,01,163 Crores. The company delivered an EPS of ₹8.29.

The PE ratio of the stock is 22.93. A PE ratio of 12 to 20 is often considered optimum. A high PE ratio indicates strong investor enthusiasm regarding the stocks. Moreover, the stock shows a daily volatility of 1.42. Usually a volatility around 1 is considered moderate in the Indian market. However, it may change with the changing market dynamics.

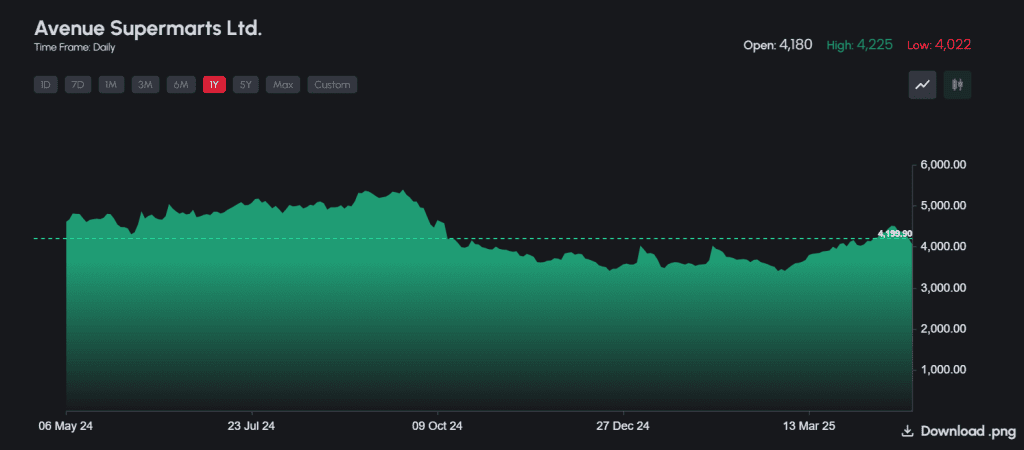

Avenue Supermarts Ltd., also known as ASL, is the parent company of DMart. The company is listed under Nift next 50 and records a trading volume of 7.52 lakhs which is valued at ₹308.02 Crores. Nifty next 50 refers to the next rung of market index curated by NSE that lists the securities that come after Nifty 50.

At 13.54 on 29 April 2025, the stock traded at ₹4299.43. The market capitalisation stands at ₹2,79,802.20 Crores. In its latest quarter, the company delivered an EPS of ₹12.06.

The PE ratio of the stock is 100.49. A PE ratio of 12 to 20 is often considered optimum. A high PE ratio indicates strong investor enthusiasm regarding the stocks. However, an exorbitant rise of PE ratio may indicate overvaluation of a stock. Moreover, the stock has a daily volatility of 1.90. Although it is marginally higher than reliance industries, usually a volatility around 1 is considered moderate in the Indian market. However, it may change with the changing market dynamics.

Bottomline

Reliance Industries Ltd. is a much bigger entity compared to Avenue Supermarts Ltd. RIL encompasses different verticals like oil and natural gas, Jio, etc. Therefore, the metrics of the stock might be exponentially greater than ASL. However, both DMart and Reliance Retail are leading companies in this industry.

Optimum analysis of stocks after duly considering the quarterly reports of DMart vs Reliance Retail can aid investment decisions. The retail industry in India is on an exponential growth, led by the growing middle class and e-commerce. Top players in the industry might get a first-mover advantage in this growing trend due to their scale and established reputation.

Also read: How to Invest in the Share Market: Comprehensive Guide