India’s retail industry is a dynamic segment of the economy, forecasted to grow significantly in the coming years. Within this vibrant market, two major players stand out: Trent Ltd. and Avenue Supermarts Ltd.

Trent Ltd., a part of the prestigious Tata Group, is known for its popular retail chains like Westside and Zudio, catering to a wide range of fashion and lifestyle needs. Avenue Supermarts, operating under the brand name DMart, is renowned for offering a variety of products, from groceries to home essentials, at economical prices.

In this blog, we will delve into a comprehensive comparison of these two leading companies in the Indian retail sector.

Retail industry in India

India’s retail industry is on a growth trajectory, projected to reach more than $2 trillion by 2032. The sector, vital to the economy, accounts for over 10% of the country’s GDP and employs around 8% of the workforce. This industry is a major employment driver, expected to create 25 million new jobs by 2030.

The market for brick-and-mortar retailers remains strong. As the fourth largest retail market globally, India offers vast opportunities driven by a burgeoning middle class, rising urbanisation, and increasing consumer spending.

Organised retail space is also expanding, now encompassing around 120 million square feet across major cities. This growth accommodates increasing consumer demand in segments like food & grocery, apparel, and consumer electronics, which dominate the retail landscape.

Company profile

Trent Ltd.

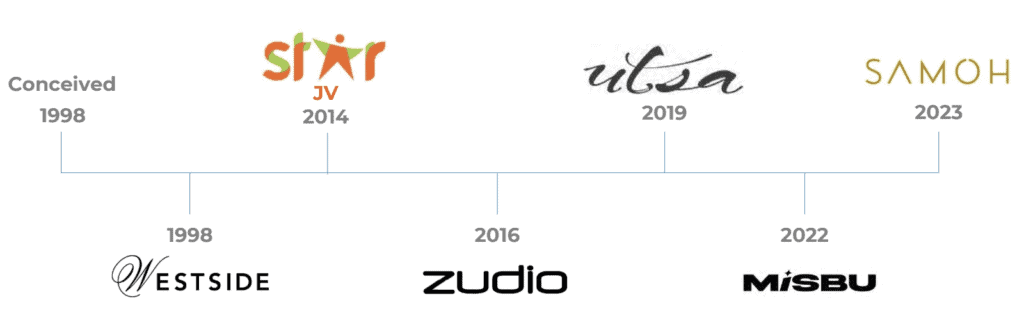

Trent Ltd., part of the Tata Group, transitioned from cosmetics to apparel retail in 1998 under its original name, Lakme. The company operates several retail formats, including Westside and Zudio. Westside covers a wide range of fashion, accessories, and home furnishings across 227 stores as of March 2024. Zudio offers competitively priced fashion items and operates 460 stores.

In addition to fashion retail, Trent collaborates with Tesco PLC in a joint venture. This venture, Trent Hypermarket Private Limited, manages 67 Star stores offering groceries and everyday essentials in 10 cities. This strategic diversification allows Trent to meet varied consumer needs effectively.

Source: Trent Ltd. Investor Presentation Q3 FY23

Avenue Supermarts Ltd.

Avenue Supermarts Ltd., known for its retail chain DMart, was founded by Radhakishan S. Damani in 2002 and is headquartered in Thane, India. Their three product categories are Foods, Non-Foods (FMCG) and General Merchandise & Apparel product categories.

The company specialises in operating large-format stores under various brands, including D Mart and D Homes, offering a wide array of products from groceries to home appliances at competitive prices.

DMart aims to provide a comprehensive shopping experience by stocking a diverse range of daily essentials and household items under one roof. Its core objective is to deliver good quality products at great value, catering to the everyday needs of Indian families.

Today, DMart operates over 336 stores across multiple Indian states, including Maharashtra, Gujarat, and Tamil Nadu. The company’s strategy focuses on cost-efficiency and centralised large-scale procurement to maintain low prices, aiming to be the lowest-priced retailer in the regions it serves.

Financial performance

Let’s now compare Trent Ltd. and Avenue Supermarts Ltd. financials for Q3 of FY23

| Trent Ltd. | Avenue Supermarts Ltd. | |

| Revenue (₹ crores) | 3467 | 13572 |

| Operating profit (₹ crores) | 629 | 1120 |

| Profit before tax (₹ crores) | 475 | 949 |

| Net profit (₹ crores) | 371 | 690 |

| EPS (₹) | 10.53 | 10.61 |

Share price performance

Trent Ltd. share price performance

On April 26, 2024, the share price of Trent Ltd was ₹4,342. Based on historical data, Trent Ltd. shares have yielded a return of 216.85% over the past year.

Avenue Supermarts share price history

On April 26, 2024, Avenue Supermarts Ltd.’s share price was recorded at ₹4,667. Based on the historical data, it appears that the company’s share has yielded a return of 34.85% over the past year.

Strength & weakness

Trent Ltd

Strength

- Strong management: As part of the Tata Group, Trent benefits from strong managerial support and financial backing.

- Diversified brand portfolio: Trent operates under well-known retail brands such as Westside, Zudio, and Star, catering to both lifestyle and value segments.

- Robust financial performance: Trent saw its operating income jump significantly, with contributions from Westside and Zudio showing substantial revenue growth. The total operating EBIT grew by 142% from Q3 FY22 to Q3 FY23, demonstrating robust business expansion.

Weakness

- High competition and market sensitivity: Trent faces stiff competition from both offline retailers like Shoppers Stop and online platforms like Amazon. The retail market’s low barriers to entry also intensify competition from unorganised sectors.

- Economic sensitivity: The discretionary nature of the retail sector makes it vulnerable to economic downturns, which can adversely affect sales and overall performance.

Avenue Supermarts Ltd.

Strength

- Strong financial profile: Avenue Supermarts maintains a healthy capital structure with a gearing ratio of 0.93 times. The company’s financial risk profile is supported by favourable net cash accrual to total debt and interest coverage ratios, indicating robust financial health.

- Established market position: As a leading retailer under the brand DMart, Avenue Supermarts has established a strong presence in the retail market, attracting a large customer base with its focus on value pricing.

Weakness

- Competitive market pressures: The company faces intense competition, which can limit operational scalability and affect its ability to adjust pricing with suppliers and customers. This intense market competition could impact profitability.

- High customer concentration: A significant portion of revenue comes from Avenue Supermarts Ltd itself, indicating a high concentration of business risk if diversification does not improve.

- Substantial working capital needs: The company’s operations require substantial working capital, with gross current assets averaging over 150 days due to significant inventory levels and receivables. This could strain cash flows, especially in tight market conditions.

Bottomline

In this comparative analysis between Trent Ltd. and Avenue Supermarts Ltd., we have explored key aspects of their operations, financial health, and market strategies. Both companies have demonstrated strengths that solidify their positions in India’s retail market, but they also face challenges that could impact their future growth and market share.