Here is a little scenario for you before we begin!

Assume that a company is recording all its expenses for a specific period. The company then compares it with the previous period’s expenses. While the current recording has nine months, the previous period has twelve months. Do you think this comparison will help in accurate analysis?

No. In an ideal scenario, you must compare two periods of equal lengths.

Fiscal year is a concept that helps in bringing about this standardisation. Read further to know what fiscal year means and its applicability in the financial world.

What is a fiscal year?

The fiscal year is synonymous with the financial year. Fiscal year and financial year are terms denoting the period of 12 months used by businesses and the government for accounting and reporting purposes.

The financial statements, government plans, tax filings and many other monetary assessments happen for a period of 12 months called the fiscal period.

Also read: Mastering the tax tango: Financial year and assessment year

Understanding the fiscal year in India

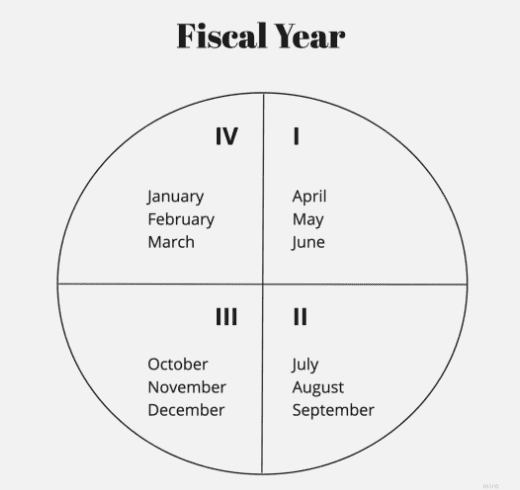

The fiscal year start and end varies from one country to another, though the length of the year is fixed at 12 months. Some countries follow the calendar year of January 01 to December 31 as their fiscal year, while other countries have a different period altogether..

In India, the fiscal year starts on April 01 and ends on March 31 of the next year.

India has been following this period as its financial year for a long time. People have different theories on why April 01 is the beginning of the Indian financial year. Here are some interesting reasons that may have led to the decision:

- India was under British governance for more than a decade. The British followed a similar fiscal period, which India might have taken over.

- The Hindu calendar coincides with India’s fiscal year. The new year, based on the lunar Hindu calendar, starts on April 01, which may have influenced the country’s fiscal year.

- Some others believe that the fiscal year is based on the crop cycle in India. Since agriculture is one of the primary sectors in the country, following the crop cycle may help the government to formulate policies that are favourable to farmers.

- India is a country with a strong and diverse culture. The final leg of the calendar year is usually filled with festivals and celebrations. Some people feel that the fiscal year is not the same as the calendar year in India, as it may become difficult for businesses to focus on year-end accounting amidst festivals.

Relevance of fiscal year

India uses the concept of fiscal year in various capacities:

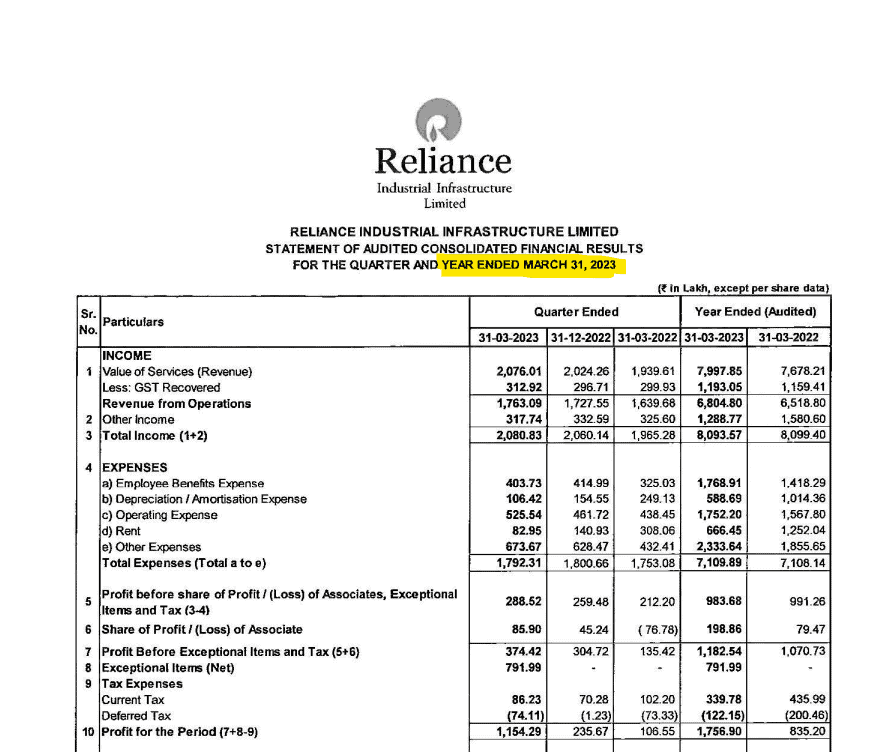

- Businesses – Most businesses, especially all companies, use the fiscal year to record and maintain their accounts. The financial statements – Profit/loss account and balance sheet are drawn for the fiscal period of April 01 to March 31.

- Government – The government uses the fiscal period for all its financial plans, including implementing the yearly budget. The new budget announced at the end of February every year is effective from April 01.

- Tax – The income for the fiscal period is the basis for tax computation and filing tax returns. The assessment period for tax is also based on the fiscal period.

Also read: What is ITR? How to file ITR Declaration?

The fiscal year is a crucial component in the country’s economy and has an impact across all aspects of the economy.

Benefits of using the fiscal year

- Using the fiscal year in India helps companies comply with the government and regulatory authorities like the Securities and Exchange Board of India (SEBI).

- If India followed the calendar year as its fiscal year, it would be difficult to make changes as per the yearly budget. But the current fiscal year is apt as it starts a month after the budget is announced, giving businesses reasonable time to plan their year.

- Following the fiscal year helps to maintain a consistent and standard approach across the country. It facilitates easy comparison of businesses and also helps the government in putting together economic policies for the country.

Also read: What is a budget – A beginner’s guide

Calendar year v.s. fiscal year

The calendar year relies on the Gregorian calendar. It follows the system of dates according to the solar cycle and is widely accepted across many countries in the world.

The calendar year that is in use in most countries starts on January 01 and ends on December 31.

Some countries like Bulgaria, use their calendar year as the fiscal year. Other countries like the United States of America, the United Kingdom, India, etc., follow different periods for their fiscal year.

The calendar year and fiscal year are similar in length, i.e., both of them consist of 12 months. However, for countries that follow a standard fiscal year which is different from the calendar year, the fiscal year becomes very significant and crucial for the economy. The calendar year may not be very relevant in such cases.

Bottomline

The fiscal year in India starts on April 01 and ends on March 31 of the following year. The concept of fiscal year is significant in India as various economic policies, financial statements, tax assessments, and other vital monetary aspects depend on it. Hence, it is essential for the public to be aware of the fiscal year, its relevance and how it is different from other periods like the calendar or assessment year.