The Indian telecom sector plays a pivotal role in digital connectivity, inclusion, and service delivery in urban as well as rural areas. The tele-density in India has risen from 75.23% in March 2014 to 86.65% in September 2025.

The government has approved a Production-Linked Incentive (PLI) scheme of 12,195 crore to improve networking and telecom products in the nation.

In this fast-expanding industry, there are two players, Bharti Airtel and Reliance Jio, who dominate the market. In this study, we’ll take a deep dive and compare both companies to understand which is better and more prepared for the future.

Telecom Industry Overview

The Indian telecom industry had a subscriber base of 1,234.53 million as of November 30, 2025, making it the second-largest telecom market in the world. The sector has been growing rapidly in both rural and urban regions. The subscriber base is divided in the following manner:

- Urban Subscribers : 692.16 million(56.07%)

- Rural Subscribers: 542.37 million (43.93%)

Although the first growth is driven by 4G, the segment is set to experience a rapid evolution to become mainly 5G-based soon. As of 2024, the number of 5G subscribers stood at 290 million, which is estimated to reach 980 million by the end of the decade.

Investments in the sector are also increasing. The Department of Telecommunications and IT was allocated ₹81,005.24 crore in the Union Budget FY26. The department has also developed an innovation group for the sixth-generation (6G) technology.

Bharti Airtel Ltd overview

Bharti Airtel, one of the leading private sector telecom players in India, operates in 17 countries: India, 14 countries across Africa, and South Asian nations through associate entities in Sri Lanka and Bangladesh. The company offers integrated telecom and digital services across consumer, enterprise, and government segments under a single brand, “Airtel”.

Bharti Airtel’s diversified service portfolio includes:

- Digital & Mobility Services (wireless voice and data)

- Financial Services via Airtel Payments Bank

- Enterprise & Cloud Communications through Airtel Business – Airtel IQ, Communications Platform as a Service (CPaaS), Internet of Things (IoT)

- Data Centre Services via Nxtra Data

- Home Broadband & Entertainment (Airtel Xstream)

As of September 2025, it has 380,653 network towers, 1,154,810 mobile broadband base stations, and more than 507,000 route km of optical fiber. Airtel has 8 submarine cable systems, in addition to 12 large data centers, 120+ edge data centers, which enable it to provide national coverage, 5G networks, and enterprise-class digital services.

Let us have a look at the recent Q2FY26 results of this company:

| Metrics (In ₹ Crore) | Bharti Airtel Ltd |

| Revenue | 52,145 |

| Expenses | 22,226 |

| EBITDA | 29,919 |

| Net Profit | 6,792 |

| EPS (In ₹) | 11.91 |

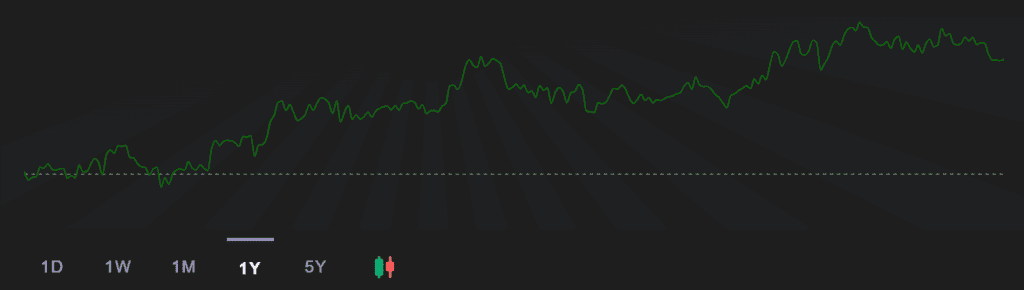

Bharti Airtel is quoting at ₹2,011 (As on 14th January 2026). This stock has made a 52-week high and low of ₹2,158 and ₹1,534, respectively.

This stock has given a return of around 26.33% in the last year. In the chart given below, we can observe this trend:

Source: Bharti Airtel StockGro

Reliance Jio Infocomm Ltd Overview

Reliance Jio Infocomm Ltd operates under Jio Platforms Ltd and has quickly become a major player in India’s digital space. Over the years, the company has expanded rapidly and, as of March 2025, serves more than 488 million mobile and fixed broadband customers, including 191 million users on 5G networks.

The company offers services across:

- Mobility

- Home broadband (JioFiber and JioAirFiber)

- Enterprise solutions

- Cloud services and 5G networks

- Digital platforms such as JioTV, JioCinema, JioSaavn, MyJio, and JioMart

Reliance Jio Infocomm Ltd. is still unlisted. Therefore, their stock market performance can’t be determined. However, it is expected that the initial public offering will be launched during the first half of 2026.

Company Financials

Let us take metrics and perform the financial Airtel and Jio comparison. Below are the results for the Q2FY26:

| Metric (₹ crore) | Bharti Airtel | Jio |

| Revenue | 52,145 | 36,332 |

| Expenses | 22,226 | 17,575 |

| Expense Margin | 42.6% | 48.4% |

| EBITDA | 29,919 | 18,757 |

| EBITDA Margin | 57.4% | 51.6% |

| Net Profit (PAT) | 6,792 | 7,375 |

| Net Profit Margin | 13% | 20.3% |

| EPS (in ₹) | 11.91 | 5.51 |

| Subscribers (crore) | 45 | 50.6 |

| ARPU (in ₹) | 256 | 211.4 |

1. Revenue: Revenue gives a clear picture of how big a company’s business is. In FY25, Bharti Airtel reported revenue of ₹52,145 crore, supported by growth in digital services and Airtel Business.

Reliance Jio generated ₹36,332 crore in the same year. Looking at the revenue size, Airtel remained ahead.

2. Expenses: Running a telecom network is expensive, and both companies reflect that reality. Bharti Airtel spent ₹22,226 crore on operations, while Reliance Jio’s expenses came in at ₹17,575 crore.

Looking beyond absolute numbers, Jio’s expense margin stood at 48.4%, above Airtel’s 42.6%. This suggests that cost structures for both players are closely matched, with no wide efficiency gap.

3. EBITDA: Operating strength becomes clearer when EBITDA is looked at. Bharti Airtel generated an EBITDA of ₹29,919, while Jio reported ₹18,757 crore.

Margins tell a similar story. Airtel converted 57.4% of its revenue into operating profit, compared with 51.6% for Jio. On this front, Airtel edges ahead with stronger operating efficiency.

4. Net Profit: Net profit is the amount left after all expenses are paid. In FY25, Bharti Airtel earned ₹6,792 crore, giving it a profit margin of 13%.

Reliance Jio made ₹7,375 crore in profit, with a margin of 20.3%. Jio is earning higher profit margins from its business.

5. EPS: EPS is a tool used to determine how much a company gains per share. Bharti Airtel posted an EPS of 11.91, showing better results for its stockholders. Reliance Jio’s EPS is ₹5.51, which is much lower. In this area, Airtel is definitely leading.

6. Subscriber Count: The number of subscribers measures size, not profits. As of March 31, 2025, Reliance Jio had 50.6 crore subscribers and Bharti Airtel had 45 crore Indian subscribers.

Jio has a larger base in terms of reaching the market.

7. Average Revenue Per User (ARPU): It calculates how much a company is making from each customer. The ARPUs of Bharti Airtel were at Rs. 256, which was higher than Reliance Jio at Rs. 211.

This implies that Airtel makes more money per customer and with fewer customers compared to Reliance Jio.

| Metric | Bharti Airtel Ltd | Reliance Jio Infocomm Ltd |

| Revenue | 👍 | 👎 |

| Expenses | 👍 | 👎 |

| EBITDA | 👍 | 👎 |

| Net Profit | 👍 | 👎 |

| EPS | 👍 | 👎 |

| Subscribers | 👎 | 👍 |

| ARPU | 👍 | 👎 |

Bottomline

Bharti Airtel has more revenue, higher EBITDA, higher EPS, and the industry’s highest ARPU. On the other hand, Reliance Jio has more customers and slightly better profit margins. From an operational point of view, Bharti Airtel is performing much better than Reliance Jio.

However, both companies are still major players in the telecom market and play an integral part in catering to the needs of consumers. One needs to analyze such parameters before making an investment.