Paid-up capital plays an important role in a company’s financial structure, representing the portion of authorised capital that shareholders have actually contributed. This capital injection fuels business operations, expansion, and overall financial health.

In this article, we delve into the significance of paid-up capital, its calculation, and how it impacts a company’s ability to thrive and attract investors.

What is paid up capital?

The meaning of paid up capital is the contributed capital, representing the portion of a company’s authorised capital that shareholders have fully paid for with cash or other assets. It serves as a crucial component of a company’s balance sheet, reflecting the equity ownership of shareholders who have financially supported the business.

Paid-up capital provides a source of funds for the company to operate, invest, and expand its operations. It also influences financial ratios, such as the debt-to-equity ratio, and can impact a company’s ability to attract investors and secure loans, as a higher paid-up capital often signifies a stronger financial foundation and lower financial risk.

Also read: What is equity share capital?

Paid up capital formula

Calculation of paid up Capital = Total Common Stock Value + Extra Amount Contributed as Additional Paid-in Capital (APIC)

Paid up Capital is determined by summing up the value of Common Stock and the extra capital contributed by shareholders, known as Additional Paid-in Capital (APIC). Common Stock shows the amount invested initially by shareholders when purchasing shares.

APIC, on the other hand, reflects the additional amount shareholders contribute beyond the par value of the shares. This formula encapsulates the total capital infused into the company by its shareholders, which forms the financial base for the company’s operations and growth.

Paid up capital example

Let us understand paid up capital with a hypothetical example

Consider a scenario with XYZ Ltd. In this instance, the company issues shares with a face value of ₹20 per share, but the actual issuance price is ₹30 per share, resulting in a premium of ₹10 per share. As a result, the company receives a total of ₹600 million from the share issuance. This amount can be categorised as follows:

Common stock: ₹ 400 million (₹ 20 million * ₹ 20 per share)

Additional paid-in capital calculation: ₹ 200 million (₹ 20 million * ₹ 10 per share)

The additional share capital can be reported in various ways, such as contributed surplus or under the shareholders’ equity section on the company’s financial statements.

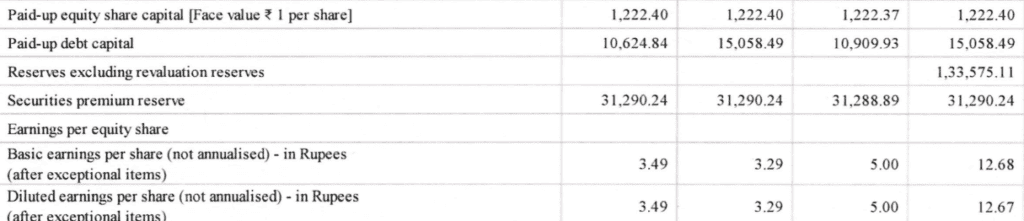

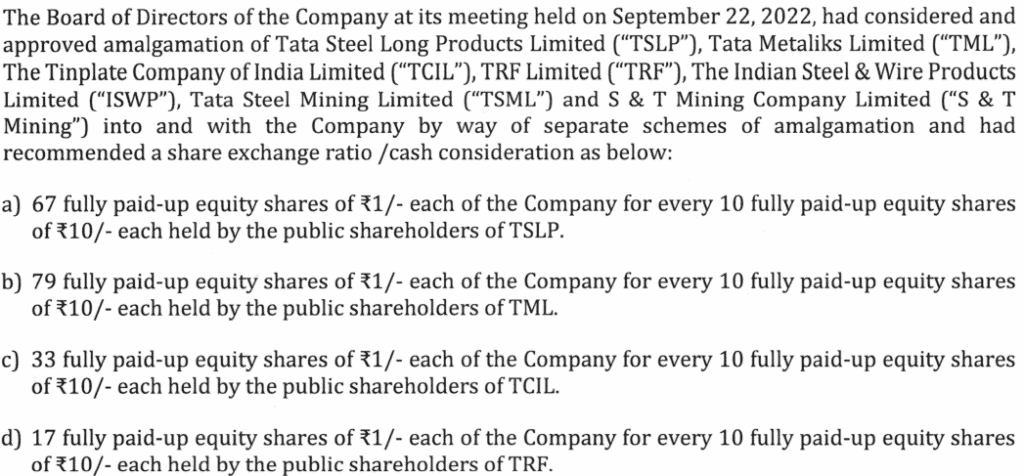

Below shown is the real-world example of the amount of paid-up capital for Tata Steel Pvt. Ltd.-

Source: Tata Steel

Source: Tata Steel

You may also like: What is face value? The investment secret you need to know!

Factors influencing paid up capital

Risk management: Paid-up capital can serve as a buffer against financial risks. Companies operating in volatile industries or facing uncertain market conditions may maintain higher paid-up capital to mitigate risks.

Dividend policy: The company’s dividend distribution policy can influence paid-up capital. Reinvesting profits rather than paying dividends can lead to higher capital accumulation.

Access to capital markets: Companies with plans to access capital markets, such as an initial public offering (IPO) or secondary public offerings, may adjust their paid-up capital to meet regulatory and investor expectations.

Debt-equity balance: Companies seeking a balanced debt-equity ratio may adjust their paid-up capital to manage financial leverage effectively, which can affect their borrowing capacity and creditworthiness.

Market conditions: Economic conditions and market sentiment can influence the willingness of shareholders to invest additional capital in the company, impacting the growth of paid-up capital.

Profitability and retained earnings: A company’s ability to generate profits and accumulated retained earnings can reduce the need to raise additional paid-up capital to fund operations or expansion.

Initial capitalisation: The capital initially invested by founders and early investors sets the foundation for paid-up capital. It often determines the company’s financial stability during its early stages.

Business growth and expansion: Scale and growth ambitions of a business significantly impact its paid-up capital. Companies aiming for rapid expansion often require higher paid-up capital to finance their growth initiatives.

Investor confidence: A company’s ability to attract investors can influence its paid-up capital. Higher capital levels often instil confidence in potential investors, making it easier to raise funds through equity offerings.

Also Read: What exactly do angel investors do?

Paid up capital vs authorised capital

| Factors | Paid-up capital | Authorised capital |

| Meaning | It represents the capital infusion made by shareholders when they acquire company shares. It constitutes the segment of authorised capital that has been fully paid for. | It signifies the highest capital limit that a company is legally permitted to generate by issuing shares. It is the upper limit, and the company cannot issue shares beyond this limit without altering its memorandum of association(MoA) |

| Flexibility | Once shares are issued and the corresponding funds are received, the paid-up capital cannot exceed the authorised capital without going through a formal process of increasing the authorised capital. | The company is allowed to issue additional shares only by altering its corporate documents such as the MoA. |

| Legal requirement | It is not a legal requirement but represents the capital available for the company to use in its operations. | It is legally required for the company to specify its authorised capital when incorporating, as mentioned in the company’s memorandum of association. |

| Share issuance | It signifies the complete worth of shares that have been issued and fully paid for by shareholders. | It creates an upper limit for the shares issued. The corporation issues shares up to the authorised capital but not beyond. |

| Capital utilisation | This capital is readily available for the company to use for various purposes, such as operations, investments, or debt repayment. | This capital is not available for immediate use by the company. |

Bottomline

In conclusion, paid-up capital is a tangible expression of shareholder commitment, fueling a company’s daily operations and growth initiatives. While authorised capital sets the upper limit of potential funds, paid-up capital represents the tangible financial foundation upon which businesses build their future.