In intraday trading, timing and precision often make the difference between a profitable exit and a missed opportunity. Among the many technical indicators used to guide such decisions, the Relative Strength Index (RSI) stands out for its clarity and practical application. Originally developed by J. Welles Wilder Jr. in 1978, the RSI Index is used to measure how strong or weak a stock’s price movement is, which can help spot possible entry and exit points.

But when trading within short timeframes, the default RSI setting may not always give the best results. That’s why finding the right RSI settings for intraday trading is important. In this blog, we’ll explain how RSI works, the best RSI settings for intraday trades, and more. So, let’s begin!

What is RSI and How Does It Work?

The Relative Strength Index (RSI) is a momentum indicator that ranges from 0 to 100 and helps spot overbought or oversold conditions in a stock’s price, especially useful in intraday trading.

- An RSI above 70 signals that the stock may be overbought and could face a pullback.

- An RSI below 30 suggests the stock might be oversold and due for a rebound.

RSI is calculated using the formula:

RSI = 100 – [100 / (1 + RS)]

Where RSI = Average Gains / Average Losses over a 14-period timeframe (default).

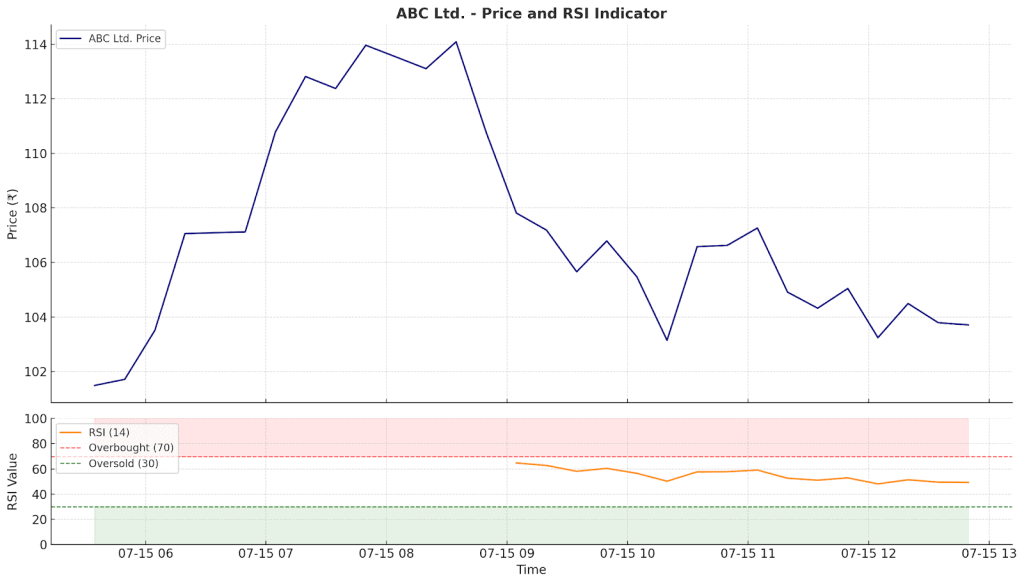

Let’s understand with an example example:

Suppose you’re looking at a stock called ABC Ltd. on a 15-minute chart. To calculate RSI, we look at how the stock has moved over the last 14 candles (periods).

- In that time, the stock went up in several candles, with an average gain of ₹2.07.

- In the candles where it fell, the average loss was ₹0.714.

Using the formula:

RSI = Average Gain / Average Loss = 2.07 / 0.714 = 2.8991

Now plug RS into the RSI formula:

RSI = 100 – [100 / (1 + RS)]

RSI = 100 – [100 / (1 + 2.8991)]

RSI = 100 – [100 / 3.8991] = 74.35

What this means:

An RSI of 74.35 tells us that ABC Ltd. is overbought, it has gone up too quickly in a short time. This doesn’t mean the stock will fall immediately, but it does suggest that the upward move might be slowing down. Traders often use this as a signal to:

- Avoid buying at this point, since the stock may be due for a pullback

- Consider booking profits if already in a trade

- Wait for a better entry, possibly after the RSI comes down below 70 again

This is how RSI helps intraday traders spot moments when a stock may be stretched and likely to reverse.

Best RSI Setting for Intraday

The most well-adapted RSI settings for intraday trading often depend on how quickly the indicator is expected to respond to short-term price movements.

- Shorter RSI periods, generally between 5 and 9, tend to respond more quickly, which may make them more suitable for fast-paced intraday environments.

- Rather than the standard 70/30 levels, some traders use 80 and 20 to reflect more extreme momentum conditions.

- An RSI value above 80 can suggest overbought conditions or potential for a pullback. A reading below 20 may indicate oversold conditions or a possible bounce. These signals are often used in combination with price action or other technical indicators for confirmation.

Why Adjust RSI Settings for Intraday Trading?

While the RSI is a helpful tool, its default setting is better suited for longer timeframes like daily charts, ideal for swing or position trading. But in intraday trading, where decisions are made in minutes or even seconds, adjusting the RSI makes it better as an intraday indicator. Here’s why:

- Faster response to price moves

Intraday price action can change rapidly. The default RSI may react too slowly, making it harder to capture timely signals. A shorter period allows RSI to respond more quickly to short-term momentum shifts.

- Fewer false signals

Highly sensitive RSI settings may react to minor fluctuations, creating noise. Adjusting the settings can help reduce unnecessary signals while still capturing relevant movements.

- Better for entry and exit points

Quick market movements can make overbought or oversold levels less clear. Modified RSI levels can offer better visibility in such conditions, helping identify potential turning points more effectively.

- Matches trading style and timeframe

Intraday traders vary in approach, some prefer quick trades (like scalping), others hold positions longer. Adjusting RSI settings allows better alignment with different timeframes, risk preferences, and market behavior.

Recommended RSI Settings for Different Intraday Timeframes

After understanding the importance of adjusting RSI settings, the next step is choosing the right configuration based on your intraday trading style and chart timeframe.

- For Scalping (1–5 Minute Charts)

In scalping, trades are often executed within minutes, sometimes even seconds. On such short timeframes, price changes happen quickly, so the RSI needs to react faster. Using a shorter RSI period, such as 5 to 7, allows the indicator to respond more sharply to quick movements, helping scalpers spot entry and exit points with better timing.

- For General Intraday Trading

Traders who take slightly longer intraday positions often prefer a more balanced RSI. A setting between 9 and 14 periods is commonly used, as it smooths out minor price fluctuations while still reacting quickly enough to intraday swings.

The 14-period RSI fits well for general use, especially when paired with adjusted overbought and oversold levels, typically set at 80 and 20 instead of the default 70 and 30. These modified levels are better suited to faster markets and help highlight clearer reversal zones.

To improve accuracy, this RSI setting is often combined with other intraday indicators like moving averages for additional confirmation.

How to Apply RSI in Intraday Trading

Follow these simple steps to use RSI in intraday trading:

Step 1: Start by adjusting the RSI period to suit your intraday approach, shorter settings can respond faster to price moves.

Step 2: Pay close attention to extreme RSI levels as they reflect strong momentum shifts hinting at possible entry or exit points.

Step 3: Watch for divergence between price and RSI; when they move in opposite directions, it may indicate a possible trend shift.

Step 4: Use RSI along with other tools like moving averages or MACD to study price behavior more accurately.

Step 5: Plan exits in advance, using RSI behavior as a cue to lock in profits or avoid reversals. Always place a stop-loss to manage risk if the trade doesn’t go as expected.

Tips for Optimizing RSI Settings

In order to optimize your RSI settings for intraday, keep these tips in mind:

- Shorten the default RSI period from 14 to 5 or 7 for quicker signals in intraday trades.

- Review historical price data with varied RSI settings to help identify the most effective timeframe.

- Use RSI levels to spot clear overbought and oversold signals for better entry and exit points.

- Match your RSI settings with your specific intraday profit targets and risk appetite.

- Rely on data-driven insights from RSI signals to make timely and confident trade decisions.

Common Mistakes to Avoid

When using RSI for intrading trading, steer clear of these common pitfalls:

- Don’t rely only on RSI. Always confirm with price action or other indicators to avoid false signals.

- Avoid treating overbought or oversold levels as automatic buy/sell cues in trending markets, RSI works better in sideways zones.

- Wait for proper reversal signs before entering trades. Jumping in just because RSI hits a level can lead to early and risky entries.

- Adapt RSI settings based on your asset, timeframe, and intraday strategy, fixed defaults may not suit every setup.

Best RSI Settings for Chart

Best RSI settings for 1-minute chart

For ultra-short-term moves, use a fast setting like RSI 7 or RSI 5. These respond quickly to momentum shifts and help spot overbought/oversold zones early. Expect more volatility, so confirm with volume or VWAP.

Best RSI settings for 15-minute chart

A balanced intraday setup works well with RSI 14 or a slightly faster RSI 10. These settings reduce noise but still give timely signals during trend reversals or breakout pullbacks.

Best RSI settings for 5-minute chart

Ideal for frequent intraday trades. Use RSI 9 or RSI 14.

- RSI 9 = faster signals

- RSI 14 = smoother, fewer false triggers

Great for identifying short-term dips in an ongoing trend.

Best RSI settings for 1-day chart

For positional or swing trades, stick to the classic RSI 14. It filters out noise and highlights genuine overbought/oversold setups on the daily timeframe. Many traders also track RSI 21 for even smoother long-term signals.

Best RSI Settings for Scalping

Scalping needs fast reaction. Use RSI 5 or RSI 7 to catch micro pullbacks and momentum bursts. These settings offer quick entries but must be paired with tight stop-losses and a confirmation tool like VWAP or price-action levels.

Alternatives for RSI Indicator (MACD)

If you want a momentum tool that gives both trend direction and strength, MACD is the best alternative.

- MACD crossovers help spot trend reversals

- Histogram shows momentum shifts

- Works well with RSI to avoid false signals

Traders often combine RSI for overbought/oversold with MACD for trend confirmation to build high-probability intraday setups.

Conclusion

The default RSI settings may not offer the speed or clarity needed in intraday markets. By adjusting the RSI settings for intraday trading, traders can better respond to quick momentum shifts and avoid misleading signals. When used wisely, combined with confirmation tools, it becomes more than a signal generator. It becomes part of a disciplined, well-rounded trading approach.

FAQs

Best RSI settings for day trading typically uses a 14-period setting, but for intraday trading, some traders reduce it to a range of 5 to 9 periods. A shorter period makes the RSI more sensitive to rapid price changes, which can be helpful in volatile, short-term markets. However, the optimal setting varies depending on the trading strategy, the asset in question, and personal preferences related to sensitivity and signal frequency.

The 70/30 rule in the Relative Strength Index (RSI) uses two key levels to indicate potential market conditions. An RSI value above 70 generally suggests the asset may be overbought and could face downward pressure. An RSI below 30 indicates the asset might be oversold and subject to upward corrections. These thresholds help traders identify potential turning points, but prices can remain in these zones for extended periods during strong trending markets without immediate reversal.

The relative strength index (RSI) is commonly set to 14 periods, following the original methodology introduced by its creator, J. Welles Wilder Jr. This setting attempts to strike a balance between sensitivity and reliability, smoothing short-term price fluctuations while still identifying momentum shifts. Many traders and charting platforms adopt this period as a default, as it offers a widely recognized and consistent reference for market analysis across various timeframes.

An RSI reading below 30 is generally interpreted as an asset being in oversold territory, which could indicate potential for a future price increase. However, this level is not considered a guaranteed buy signal, as prices may remain oversold for a prolonged period during strong downward trends. Investors and analysts often use a combination of technical indicators rather than relying solely on a single RSI threshold when evaluating market opportunities.

A Relative Strength Index (RSI) reading above 50 typically suggests that positive price momentum is prevailing, which is often described as a bullish signal. When RSI moves significantly above 50, it reflects a period in which average gains are outpacing average losses for the measured timeframe. Nonetheless, some traders also consider readings above 70 as indicating particularly strong momentum, although this may also point to overbought market conditions.

For intraday trading, the most effective RSI lengths are 7, 9, and 14.

RSI 7 / 9 → faster signals for scalping and quick entries

RSI 14 → smoother, more reliable intraday trend signals

Setting RSI is simple:

Open your charting platform (TradingView / StockGro / broker terminal).

Search for RSI in the indicators tab.

Choose a length (7, 9, 14 depending on your style).

Keep default overbought/oversold levels — 70/30 (or 80/20 for strong trends).

Use RSI to identify momentum and reversal zones:

Buy when RSI drops near 30 and starts curling upward in an uptrend.

Sell when RSI touches 70 and begins turning down in a downtrend.

Combine RSI with VWAP, support/resistance, or trendlines for confirmation.

Avoid using RSI alone in choppy markets — it gives false signals.

For intraday trading, the best RSI timeframes are:

5-minute → frequent but reliable signals

15-minute → cleaner, trend-focused signals

1-hour → for higher conviction intraday entries

Scalpers may also use 1-minute or 3-minute charts with fast RSI settings (5 or 7).