A stop-loss order is a directive given to a broker to buy or sell a specific stock once the stock hits a certain price. This order aims to limit a person’s loss on a security’s position.

What is a stop-loss order?

A stop-loss order is an automated directive set by a person with their broker to sell a security if the price dips below a certain level. This mechanism helps investors manage their losses by triggering the sale of stocks and bonds if the price falls to a set level.

You may also like: What Is a Limit Order in Trading, and How Does It Work?

How do stop-loss orders work?

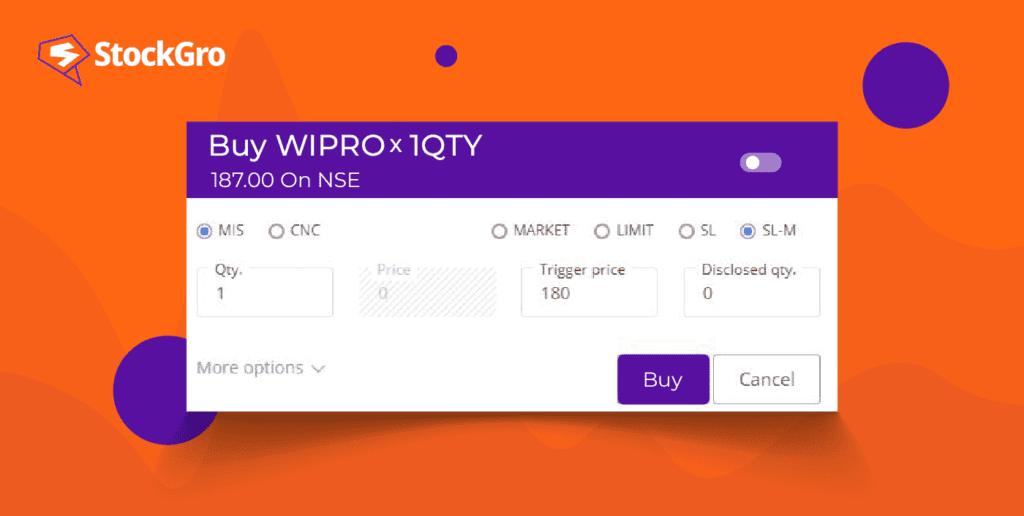

A stop loss order is a tool that automatically initiates the sale of a certain share when its price reaches a designated level, known as the stop price. An investor picks a particular price (stop price) at which the order will activate.

If the stock’s price hits the stop price, the stop loss order changes to a market order, meaning the stock sells at the best available price, which might vary from the chosen stop price. This tool’s primary function is to curb potential losses during a changed & rapid price trend of a specific stock.

Example

Consider Suresh has 400 shares of Tata Motors bought at Rs. 150 per share, investing Rs. 60,000. If the share price starts to drop, Suresh can set a stop-loss order at Rs. 130 to limit loss. If the price hits Rs. 130, the shares are sold, limiting the loss to Rs. 20 per share.

Types of stop-loss orders

Here’s a simple explanation of the types of stop-loss orders:

- Fixed stop loss

A fixed stop loss is set to sell the shares if the price falls to a certain level. For instance, a fixed stop loss is set at Rs. 130 right when the trade is made..

- Trailing stop-loss order

A trailing stop-loss order helps protect gains while offering a guard against price drops. It’s set as a percentage of the asset price, adjusting if the price increases.

In a scenario, a 10% trailing order is set for shares bought at Rs. 150. If prices drop to Rs. 135, a sell order is triggered. But if prices rise to Rs. 200, the new trigger price is Rs. 180 (10% less). So, if prices fall after reaching Rs. 200, the order sells the shares at Rs. 180, securing a gain of Rs. 30 per share.

Also Read: Know how a cover order favours traders in the stock market

Stop-loss order vs market order

A stop-loss order sells stocks when prices drop to a certain level, to prevent big losses. A market order, on the other hand, tells a broker to trade stocks at whatever the current price is, to quickly buy or sell. This helps in removing the gap between buying and selling price, making the market more active.

Stop-loss order and limit order

A limit order is set to trade stocks when they reach a specific price, making a profit. For buying, it waits for prices to drop to a set level, and for selling, it waits for prices to rise to a set level. Unlike a stop-loss order that only acts to avoid losses when prices fall, a limit order looks to make profits by taking advantage of price changes.

Advantages and disadvantages of using a Stop-loss Order

Advantages of stop loss trading:

Minimizing losses:

Stop loss helps cut losses, acting as a safety net in a falling market. For instance, if a stock’s price drops sharply, a stop loss order can prevent severe losses by selling it before the price drops too far.

Automation:

With stop loss, exiting position becomes automated, removing the need to constantly check the portfolio. If a stock touches a set price, the stop loss triggers, squaring the position without manual intervention.

Balancing ‘Risk and Reward’:

In stock trading, managing risk against potential reward is crucial. A trader might decide to risk only 10% of the investment aiming for 20-30% profit. Stop loss helps enforce this risk limit, aiding in disciplined trading.

Promotes Discipline:

Stop loss encourages sticking to a financial plan amidst market ups and downs, fostering disciplined trading.

Also Read: What is a GTT order? How is this tool beneficial for investors?

Disadvantages:

Short term fluctuations:

Stop loss can activate due to short-term market changes, possibly selling stocks during a minor dip before they recover.

Selling stocks too soon:

There’s a chance of exiting a trade early that could have yielded more profit if held longer, limiting the earnings.

Investors have to take the call on stop loss limit:

Deciding the stop loss price can be tough. Though financial advisors can help, they charge for their service.

Costly:

Some stock brokers charge extra for placing stop loss orders, adding to the trading cost.

Importance of stop-loss order

A stop-loss order helps manage losses without needing to watch the market constantly. This is good for those who don’t like risk but want to earn well from stocks while reducing the impact of market changes.

Limitations

A stop-loss order uses market analysis to lower risk by tracking investor losses. It doesn’t predict when market drops will happen. If share prices fall sharply due to rumours, executing a stop-loss order can bring big losses as you may not recover the initial amount and miss out on profits.

In times when many are selling, the rush can push prices lower since there aren’t enough buyers. Stop-loss orders can’t be executed at the chosen limit, causing even bigger uncapped losses.

Conclusion

Stop-loss orders with brokerage firms manage the ups and downs, but aren’t built to handle a sharp market crash. However, if you are averse to big risks, a stop-loss order can be signed to limit losses if prices go down.