Have you ever wondered how traders manage swift trade execution in ever-evolving financial markets where a fraction of a second can make all the difference? Stepping into the trading world, where global headlines can swiftly turn into market fluctuations, one should be aware of various tools and strategies.

There is a valuable tool empowering traders with greater efficiency, even amidst market turbulence, called the IOC order. Imagine a trade order that needs to be executed immediately and otherwise cancelled automatically. It is the core of the intriguing concept of IOC in the stock market.

Let’s explore a complete overview of an IOC order, including its mechanics and distinctions from market and limit orders.

IOC Meaning in Share Market

The full form of IOC is Immediate or Cancel order. The SEBI (Securities Exchange Board of India) defines an IOC order as an order to trade financial assets that attempts to execute all or a portion of the order immediately and then cancels if it remains unfulfilled.

Clarifying the concept, IOC order means a type of trading order that represents swift execution with accuracy. An IOC order allows traders to give instructions to execute the order immediately at the optimal price. Else, cancel it if immediate execution is not possible.

This distinct characteristic separates IOC orders from other order types in the stock market.

You may also like: What is LTP in share market & how it is calculated?

Understanding the functionality of IOC orders

Now, with a basic grasp of IOC meaning in the share market, let us delve into its mechanics that drive rapid and precise execution.

There are two operating conditions of IOC orders to define how they work – immediate execution and cancellation.

When a trader places an IOC order, the trading system is instructed to fulfil the trade order at the best available price. If the prerequisites for immediate trade execution are met, the trading platform executes the trade, and the order is regarded as complete.

On the other hand, if the order cannot be fulfilled immediately, the entire or partial order is cancelled to stay aligned with the trader’s strategy. In this manner, IOC orders balance the trader’s prompt responsiveness and the market dynamics, effectively mitigating the potential for losses.

Let us consider a scenario.

A trader decides to place an IOC order to buy 500 equities of a company at Rs. 80 per share. When he placed the order, only 350 equities were available at the desired price of Rs. 80. Consequently, the order was executed for 350 shares only. The IOC order for the remaining 150 shares gets cancelled automatically.

Advantages and Disadvantages of IOC

When you’re trading, knowing the different types of orders can really help you succeed. One important order type is the Immediate or Cancel (IOC) order. This can be a useful tool for traders who want to act fast. Let’s take a closer look at the pros and cons of using IOC orders to see if they’re a good fit for you:

Advantages of IOC Orders

Here is how these orders can work in your favor:

- Quick Execution: IOC orders are designed for rapid execution, allowing traders to take advantage of market conditions without delay.

- Flexibility: Traders can specify the quantity they want to fill immediately, providing greater control over their trades.

- Reduced Risk of Partial Fills: Since unfilled portions of an IOC order are canceled, traders can avoid the complications of dealing with partial fills that may occur with other order types.

- Effective for Volatile Markets: In fast-moving markets, IOC orders can help traders capitalize on short-lived price opportunities.

Disadvantages of IOC Orders

Now, let’s take a closer look at the disadvantages of using IOC orders to help you make informed trading decisions:

- Potential for Missed Opportunities: If the market moves quickly, your IOC order might not get filled at all, which could mean losing out on profitable trades.

- Higher Costs: Frequent use of IOC orders can lead to increased transaction costs, particularly in volatile markets where orders may frequently go unfilled.

- Not Suitable for Long-Term Traders: IOC orders are primarily designed for short-term strategies, making them less effective for those with long-term investment goals.

- Limited Order Size: The immediate nature of IOC orders may restrict the size of the order that can be executed at once, which could impact your overall trading strategy.

How IOC orders differ from other order types?

Utilising IOC orders, traders instruct to execute their orders at the optimal price at the right entry or exit point; otherwise, opting for trade cancellation if immediate fulfilment is not feasible. It differentiates an IOC order from conventional order types – limit, market, and day trades.

Also Read: How does arbitrage trading work?

Let’s find the characteristics that make IOC different from other types of trade orders:

- A limit order allows traders to trade securities at a particular price only as per the trader’s instruction. Limit orders remain on the order book until the trader cancels it. On the other hand, IOC orders are executed swiftly or removed immediately without the intervention of the trader.

- A market order is executed at the current market price of the security to ensure immediate execution but potentially at a price different from the trader’s expectation. In the case of IOC orders, there is no such risk as it gets cancelled if it does not meet the trader’s instructions.

- Differentiating from an intraday order, an IOC order is cancelled instantly after detecting the unavailability of the security. On the other hand, an intraday order expires at the end of the session if it remains unfulfilled.

Notably, traders can place a market IOC order or a limit IOC order.

Quick comparison of different order types:

| Order Type | IOC Order | Market Order | Limit Order | Day Order |

| Execution Speed | Rapid | Quick | Dependency on price | Dependency on time |

| Timeframe | Immediate or Cancelled | Immediate | Variable | Same trading session |

| Price Control | Moderate | Limited | High | Moderate |

| Suitability | For swift execution and minimise risk | For quick execution | For precision and price-sensitive | For capitalising on day’s price range |

Benefits of IOC orders for traders

As market scenarios can turn as rapidly as headlines emerge, IOC orders are considered a strategic step, enabling traders to respond promptly and precisely to changing scenarios. The benefits of IOC orders extend beyond speed and accuracy:

- Minimising slippage risk: Slippage is the difference between the execution and expected price that can risk potential profits. Thanks to IOC orders in the share market, traders can benefit from the price near their expectations. This element appeals to traders who prioritise precise execution.

- Flexibility: The provision of partial fulfilment of the order makes these order flexible. Another aspect of flexibility is placing a market or limit order. Traders can place an IOC order as a market or limit order.

- Increased success rate with minimal delay: Market volatility brings opportunities and challenges. IOC orders can help traders to navigate challenges and seize opportunities.

Seeking to capitalise on rapid price movements, they can enter or exit a position in the market with minimal delay. It increases the odds of capturing favourable prices that might otherwise slip away in an instant.

- Precision to elevate trading strategies: The effectiveness of short-term trading strategies often lies in precision. Whether it is about engaging in scalping, momentum trading, or others, traders can consider IOC orders for the high level of accuracy required for such trading approaches’ success.

When is an IOC order effective?

Traders who want to capitalise on momentary market opportunities can rely on IOC orders. There are a few factors determining its effectiveness:

- Large orders, especially for low-volume stocks, can influence the prices if they remain open for long. Therefore, these orders are considered most effective when traders want to execute significantly large orders without impacting the markets.

Also Read: A beginner’s guide to understanding share price calculations

- IOC orders are also considerable when one takes multiple positions in the market but finds it challenging to monitor each trade. To avoid any risk of loss due to an open trade till the trading session ends, traders can consider this orders.

How to Place an IOC Order

Placing an IOC order can streamline your trading process and increase your ability to seize market opportunities. If you’re ready for IOC orders, let’s walk through the simple steps to get you started on making your trades effectively:

Step 1. Select Your Trading Platform

Selecting your trading platform is the first step to placing an IOC order. Choose a reputable online brokerage or trading app that suits your needs. Make sure it offers the ability to place IOC orders, as not all platforms do. Log in to your account or create one if you haven’t already.

Step 2. Choose the Asset

Choosing the right asset is crucial when placing an IOC order. An asset can be anything you want to trade, such as stocks, commodities, or currencies. Start by researching which asset aligns with your trading strategy and goals.

Look for factors like market trends, volatility, and recent news that might affect the asset’s price. Once you’ve identified the asset you want to trade, you can proceed to place your IOC order effectively.

Step 3. Specify Order Type

Now you need to specify the type of order you want to place. Look for the order type selection on your trading platform, which typically includes options like market orders, limit orders, and others.

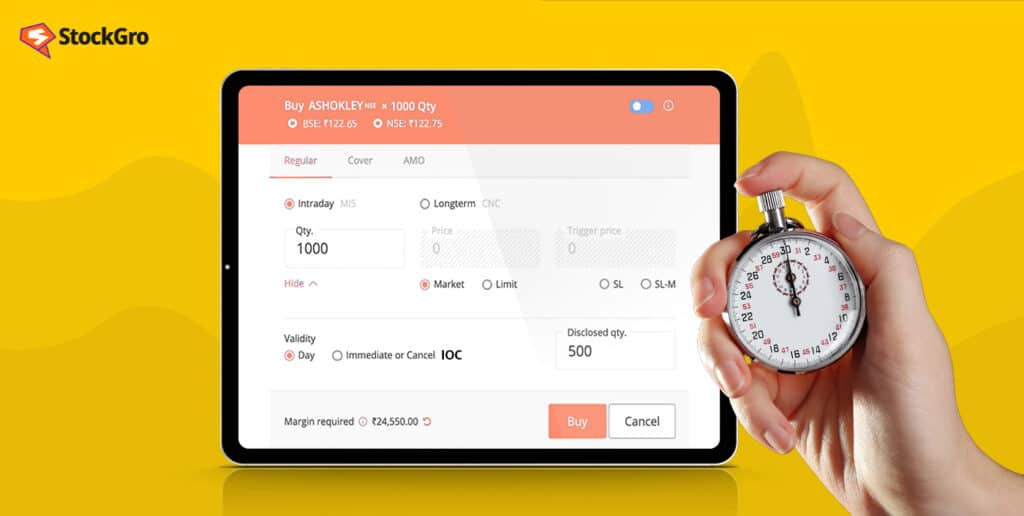

Choose “IOC” or “Immediate or Cancel” from this list. This tells the system that you want your order to be executed right away, and any unfilled part of the order will be canceled automatically.

Step 4. Enter Order Details

Once you specify the order type, just enter specific details for your IOC order. First, decide how many units of the asset you want to buy or sell. Then, set the price at which you want the order to execute. This could be the current market price or a specific price you choose.

Make sure the quantity and price are correct before moving on to the next step to avoid mistakes. Now, double-check your order details and submit the order. That’s it.

The closing

IOC orders enable traders to seize opportunities, manage risks, and optimise their trading strategies like never before.

Whether you are a seasoned trader who wants to refine your approach or a newbie keen to understand varied trading strategies, unlocking the potential of IOC orders can help you in today’s dynamic financial markets.