Stock Overview

| Ticker | RELIANCE |

| Industry/Sector | Energy, Retail, Telecommunications |

| Market Cap | ₹17.5 Lakh Crores (Large Cap) |

| CMP (Current Market Price) | ₹1253.05 |

| 52-Week High/Low | ₹1,608 / ₹1,201 |

| P/E Ratio | 22.4 (vs. Industry Avg. 25.6) |

| Dividend Yield | 0.31% |

| Free Float | 49% |

| Beta (vs. NIFTY 50) | 1.15 |

About Reliance Industries

Reliance Industries is a behemoth in the Indian market with interests spanning oil & gas, petrochemicals, telecom, retail, and digital services. It has undergone significant transformation in recent years, positioning itself as a leader in the green energy revolution while leveraging its established dominance in telecom (Jio) and retail.

Key drivers of growth:

- Green energy transition:

- Capex commitment: $10 billion over the next 3 years for green energy projects, including solar modules, hydrogen production, and battery storage.

- Growth potential: RIL aims to dominate the renewable energy space, riding the global push towards decarbonisation.

- Recent development: Commissioned a 5 GW solar module manufacturing facility in Gujarat.

- Jio platforms – Digital dominance:

- Market share: 37% of India’s telecom subscribers (largest in the country).

- 5G expansion: Aggressive rollout with 80% of urban India covered in FY24.

- Subscriber growth: 10 million net additions in Q2 FY25.

- Upcoming IPO: A potential trigger for unlocking shareholder value.

- Retail revolution:

- Revenue surge: ₹3.2 lakh crore in FY24 (+18% YoY).

- Omni-Channel approach: Strategic tie-ups with global brands and technology-driven platforms.

- E-commerce push: Strengthening its online grocery and fashion presence through JioMart and Ajio.

- Store expansion: Added 500 new stores in FY25, totaling 18,000 stores nationwide.

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY25 | Q3 FY24 | YoY Growth |

| Revenue | ₹2.5 lakh cr | ₹2.3 lakh cr | +8.7% |

| Net Profit | ₹18,540 cr | ₹17,260 cr | +7.4% |

| Jio Platforms Profit | ₹6,477 cr | ₹5,205 cr | +24.4% |

| Retail Segment Revenue | ₹79,595 cr | ₹74,400 cr | +7% |

| O2C Revenue | ₹1.5 lakh cr | ₹1.41 lakh cr | +6% |

- The telecom arm, Reliance Jio Infocomm, reported a 24.4% rise in quarterly profit, benefiting from tariff hikes and an increase in 5G subscribers.

- The retail segment experienced nearly a 7% rise in revenue, boosted by festive season demand.

- The oils-to-chemicals (O2C) business reported a 6% increase in revenue due to higher production levels.

Valuation insights

When we look at Reliance Industries Ltd. (RIL) from a valuation standpoint, we’re basically asking, How much are investors willing to pay for each rupee of profit, and how does it stand against its history and competitors?

- Relative Valuation:

- RIL trades at a P/E of 22.4, which is slightly below its 5-year average of 25, suggesting the stock could be a bit cheaper and attractive now relative to its past pricing.

- On an EV/EBITDA basis, RIL is at 14.8x, which is lower than some rivals like Adani Green (21.5x). A lower multiple often indicates better value, but you also have to factor in growth prospects and company risk.

- A DCF analysis suggests a fair value of ₹1,475 implying an 18% upside from current levels.

Key assumptions taken:

- Revenue CAGR of 12% (FY24–FY30): This means analysts expect RIL’s revenues to grow, on average, by 12% each year until 2030.

- Terminal Growth of 3%: How fast RIL might keep growing indefinitely after FY30.

- WACC of 10.5%: The blended cost RIL pays for using both debt (6%) and equity (13.9%) to fund its operations.

Competitor analysis

Now, let’s compare Reliance Industries’ performance with its top competitors across revenue segments —from green energy to telecom—and comparing their strengths and weaknesses. This will give a clear picture of how Reliance stacks up against industry leaders like Adani Green Energy and Bharti Airtel.

- Market Cap: ₹7.7 Lakh Crores

- Strengths: Leading renewable energy player with 25 GW capacity.

- Weaknesses: High debt (~₹1.4 Lakh Crores).

- Comparison: RIL’s $10 billion green energy capex is aggressive, but Adani leads in scale.

- Market Cap: ₹4.5 Lakh Crores

- Strengths: 45% telecom market share.

- Weaknesses: High debt (~₹1.3 Lakh Crores).

- Comparison: Jio (RIL) outpaces Airtel with 37% market share and faster growth.

Key risks to watch

- Volatility in crude prices: A decline in oil prices could impact refining margins.

- Regulatory challenges: Telecom pricing pressures or new government policies could weigh on profitability.

- Execution risk: Large-scale capex in renewables and 5G needs flawless execution.

- Debt levels: Net debt of ₹2.5 lakh crore may constrain future investments.

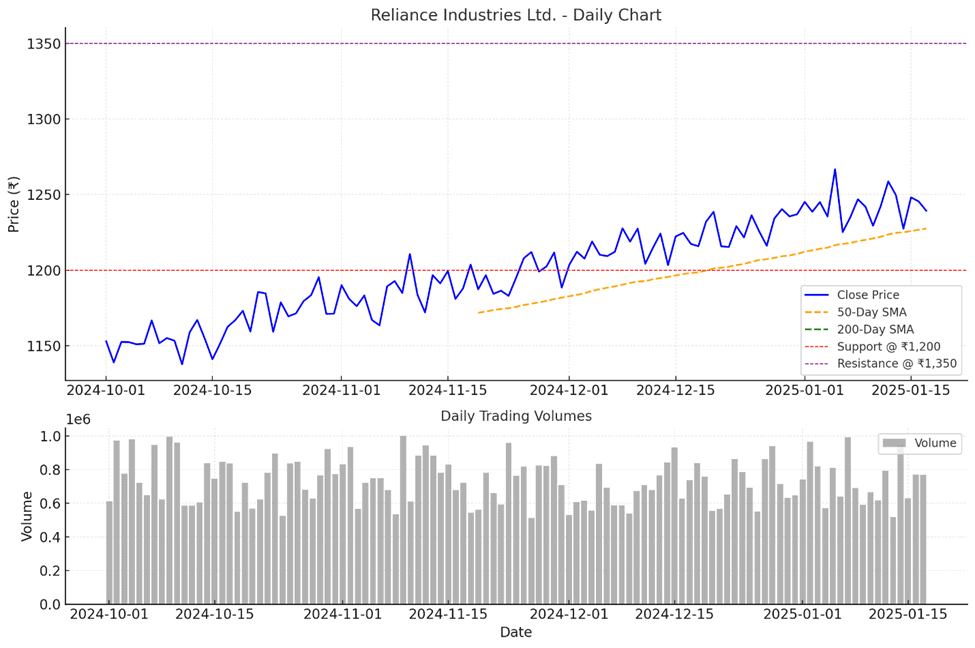

Technical outlook on Reliance Industries

- Short-Term: Stock is trading near its 200-day moving average (₹1,240), indicating strong support.

- RSI: 58 (Neutral to Slightly Bullish).

- Resistance: ₹1,350

- Support: ₹1,200

- Volume Trend: 20-day average volumes are up 15% compared to the prior month, signaling rising investor interest.

Here’s a technical chart of RIL :

Above chart showcases the following :

- Close Price: Represented by the blue line.

- 50-Day SMA (Orange) and 200-Day SMA (Green): Key indicators showing short- and long-term trends.

- Support and Resistance Lines: Marked at ₹1,200 and ₹1,350, respectively.

- Volumes: A bar chart indicating daily trading activity, showcasing increased investor interest.

Reliance stock recommendation

Current Stance: Buy with a target price of ₹1,475 (12-month horizon).

Why Buy Now:

- Attractive valuation amidst robust growth in consumer business.

- Upcoming catalysts: Jio IPO and progress in green energy.

Portfolio Fit: Ideal for long-term investors seeking exposure to a diversified Indian conglomerate with growth across traditional and new-age sectors.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0d