Ever wondered how top traders seem to catch market moves before everyone else? Their secret isn’t magic, it is smart tools like Volume Oscillator Indicator and Order Flow Indicators!

These indicators go beyond usual charts to illustrate who is truly buying, selling, and changing prices. Order flow and volume momentum are two things that might aid you a lot, even if you’re novice to trading. Are you ready to break the code? Let’s jump in!

What is an Order Flow Indicator?

Order flow indicators show visually real-time buy and sell orders reveals market sentiment, price changes, and who controls the market.

These tools go beyond simple price charts by showing executed trades, order book depth, and imbalances. This lets traders see the real reason behind changes instead of merely responding to candles.

How Does an Order Flow Indicator Work?

Order flow reads the tape: it analyses executed volume at each price, net buying vs selling (delta), and order book shifts to expose absorption, exhaustion, and aggressive participation. Platforms present this via volumetric/footprint bars, cumulative delta, VWAP bands, and volume profiles to pinpoint areas of control and likely continuation or rejection.

Order Flow vs. Volume Indicators

Volume indicators focus on how much is being traded over a period. Tools like the Volume Oscillator track changes in volume to hint at momentum. They’re useful for spotting activity spikes, but they don’t tell you who is driving the action.

Order flow indicators dig deeper. They show the actual buy and sell orders hitting the market in real time. You can tell if buyers are pushing prices up or sellers are pushing them down.

This is how it works:

- The volume informs you how loud the audience is.

- Order flow tells you who’s shouting and what they are saying.

Key Components of Order Flow Analysis

Order flow analysis typically combines several building blocks of technical analysis to construct a full picture of market intent and pressure.

Bid-Ask Spread

Bid ask spread is changes in the spread might show how urgent and liquid a market is right now. For example, trades that raise the ask price show active buying, while trades that hit the bid price show aggressive selling.

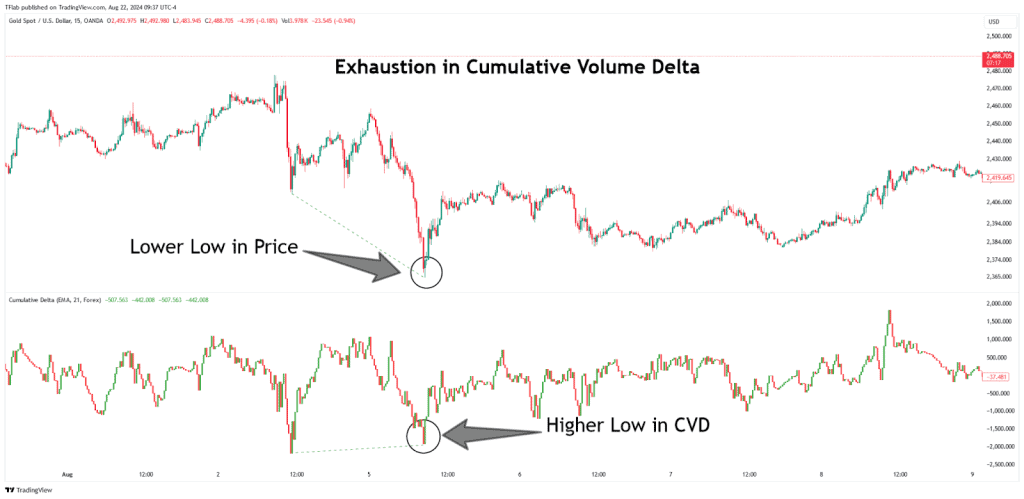

Volume Delta

Delta is the net difference between buying and selling at each price, often shown as cumulative delta to track who’s dominating over a session and to confirm or contradict price trends.

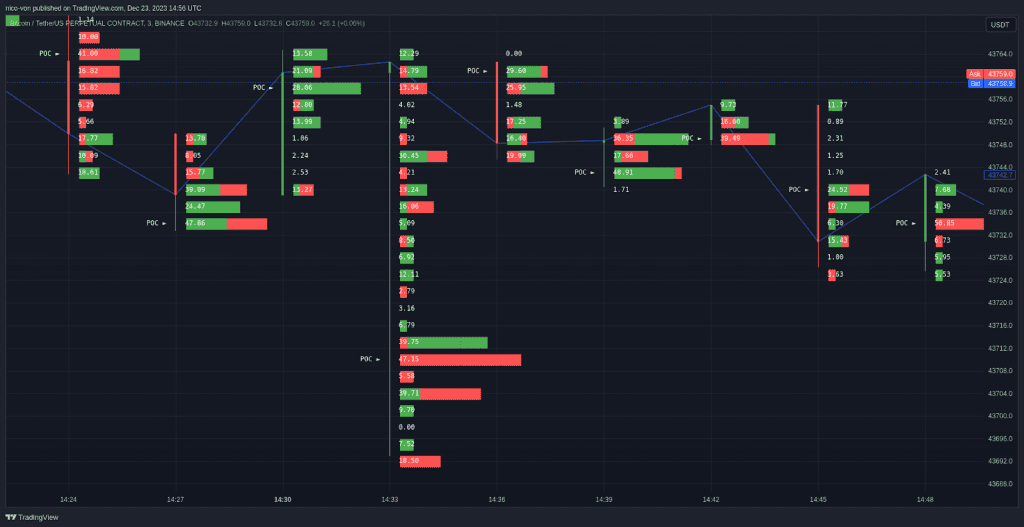

Footprint Charts

Footprint (volumetric) bars display traded volume at each price inside a candle, highlighting imbalances, absorption, and clusters where one side overwhelmed the other, useful for reading microstructure shifts.

Best Order Flow Indicators and Tools

To comprehend what’s going on with buying and selling in the markets right now, you need to look at order flow indicators. These tools enable traders, especially those who are interested in futures or intraday trading, to figure out who is in charge of the price and where big changes might happen.

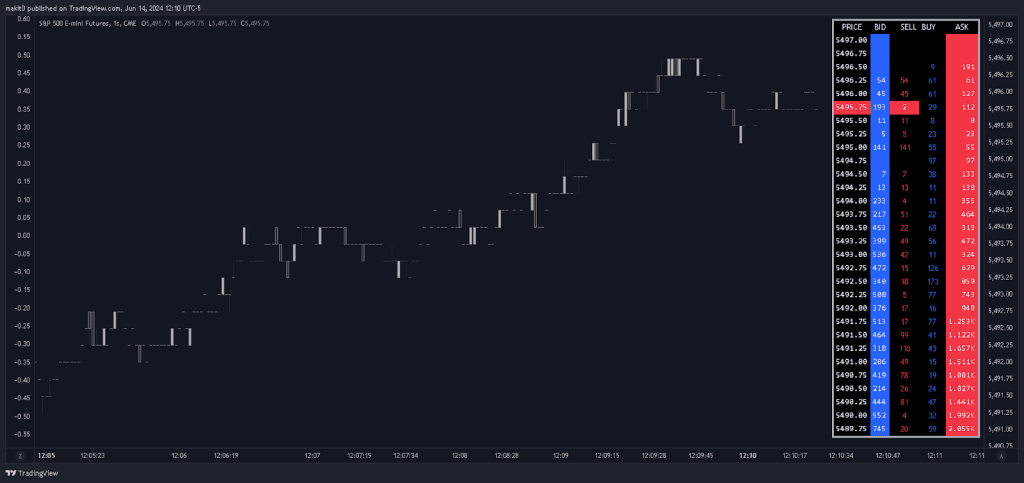

- Depth of Market (DOM):

DOM shows the order book with buy and sell orders waiting at different price levels. It’s like a live snapshot of market liquidity and trader aggression. Watching DOM helps you see how quickly orders fill or vanish, indicating momentum shifts.

- Footprint Charts:

These charts break down volume within each candle by price level. You can observe exactly where buyers or sellers were stronger, which shows where there was an imbalance or absorption. At a micro level, this helps find possible reversals or follow-through moves.

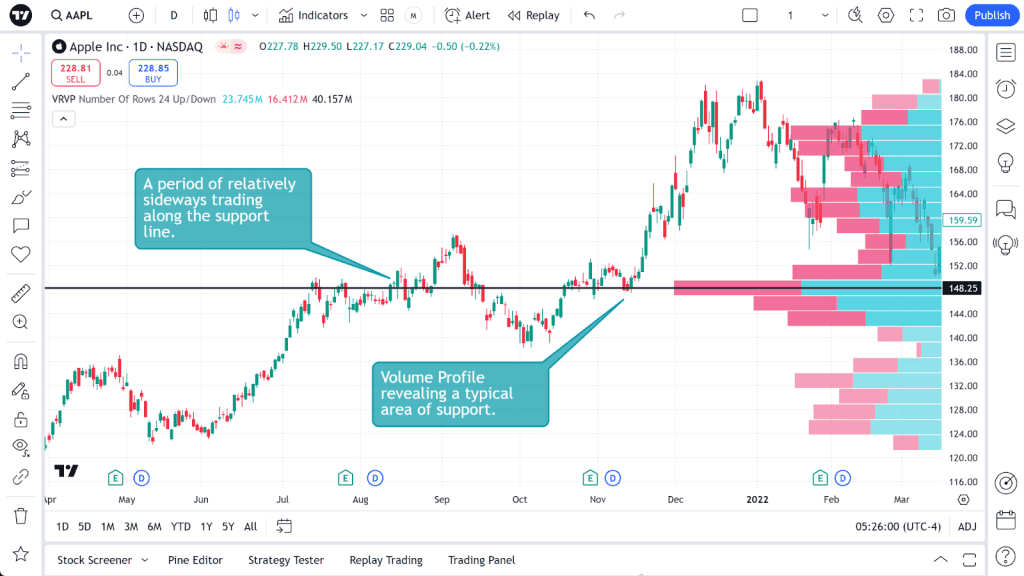

- Volume Profile:

Volume profile indicates traded volume spread out over price instead of time, which is different from regular volume bars. It shows important areas, including the Point of Control (POC), where most trades happened, which helps find strong support and resistance levels.

- Cumulative Delta:

This keeps track of how much more aggressive buying and selling is over time. If delta goes up with price, it suggests strength; if it goes down, it means reversals are possible. It’s a terrific way to validate patterns or spotting exhaustion early.

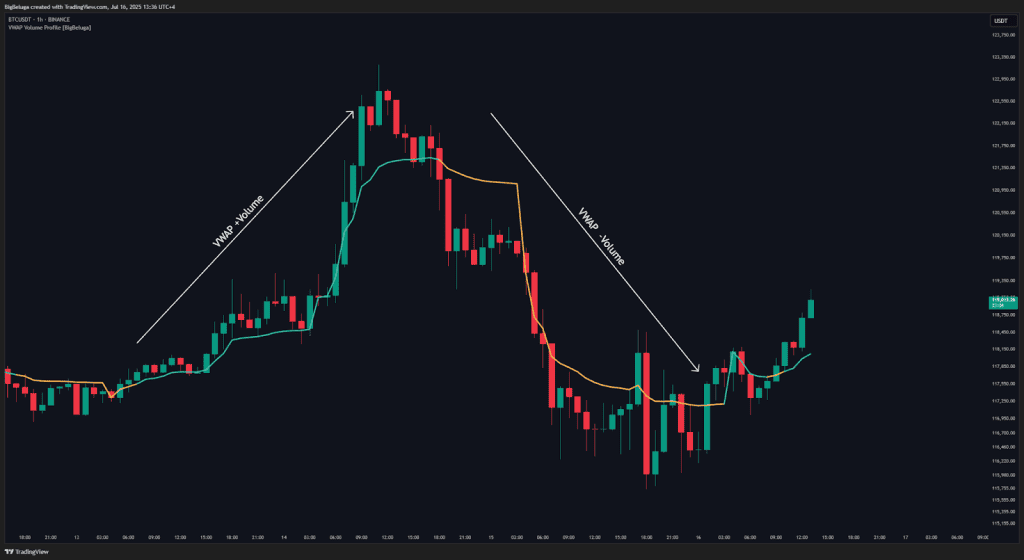

- VWAP and Order Flow VWAP:

The VWAP (Volume Weighted Average Price) shows the day’s average price based on volume. Order Flow VWAP adds bands showing momentum zones, helping traders align with big players and identify breakout areas.

Order Flow Bubble Indicator

This visual tool shows individual trades (or clusters) as “bubbles” on the chart: size = volume, colour/side = aggressive buy vs sell (for example, trades hitting the ask vs trades hitting the bid).

Why use it? Unlike classic volume bars, bubbles let you see when big players step in — you’ll spot large buys near support, or heavy sells near resistance.

How to use it:

- Add the bubble indicator on your intraday/high-liquidity chart.

- Watch for unusually large bubbles at key levels (e.g., prior day high/low, value zones).

- Large aggressive buys at support = possible bounce.

- Large aggressive sells at resistance = possible reversal or failure.

- Combine with your structural levels and trend context: bubble flows are most meaningful when aligned with other signals.

Watch out for: - Lots of noise — filter for significant size/volume.

- Requires a good data feed — many Indian platforms may not show ultra-granular order flow.

- It’s reactive (you still see after the trade happens) so risk control remains essential.

VWMA (Volume Weighted Moving Average)

The VWMA gives more weight to price points where volume was higher — so instead of treating each bar equally (as in a simple moving average), VWMA tilts towards where the action actually is.

Why it matters: When combined with trend analysis, VWMA helps you measure not just where price is but where the smart money has been trading. If price stays above a rising VWMA, you’re likely in a strong uptrend. If price dips below with rising volume, trend may be weakening.

How to use it:

- Overlay (say) a 20-period VWMA on your chart.

- Watch the interaction:

- Price above VWMA + VWMA rising ⇒ bullish bias.

- Price breaks below VWMA + VWMA flattens/turns ⇒ caution.

- Combine with other tools: e.g., VWMA vs simple MA crossover, or VWMA at key support/resistance zones.

Limitations: - Still a lagging tool – volume weighting improves responsiveness but it doesn’t predict, only confirms.

- Works best in high-volume stocks or futures; less reliable in thin liquidity segments.

3. OHLC Indicator

OHLC stands for Open, High, Low, Close – these are the four fundamental price points for each bar/period. The OHLC indicator may refer to plotting yesterday’s (or prior period’s) open, high, low, close levels on your current chart to give reference zones.

Why it’s useful: These levels are often watched by traders and institutions. When price approaches yesterday’s high/low/close, you get natural psychological & structural zones. For intraday in India, the session open price is also very relevant.

How to use it:

- On your chart, mark yesterday’s (or prior session) OHLC levels.

- Watch how price behaves when it comes near these zones:

- Bounce from yesterday’s low? Watch flow for confirmation.

- Break above yesterday’s high with volume + VWMA alignment? Potential breakout.

- Use it as a structure layer before looking at flow/volume tools.

Keep in mind: - OHLC levels give context but don’t tell you who is pushing price. Use them alongside flow and trend.

- In volatile sessions or illiquid stocks, these levels can be breached quickly — risk control is key.

Order Flow Trading Strategies

Order flow strategies often combine structure (levels), context (trend), and real-time flow (delta/footprint) to time entries with low risk and clear invalidation.

Scalping with Order Flow

For effective scalping, identify a nearby liquidity pocket (yesterday’s POC or value area edge) and watch footprint for an imbalance flip with rising buy/sell aggression into that level.

Use cumulative delta confirmation: if price bounces and delta turns positive with strong lifting of offers, a quick scalp towards the nearest micro-structure makes sense; bail if delta stalls or reverses.

Trend Continuation with Order Flow

In an uptrend, lean on pullbacks into VWAP or volume profile high-volume nodes where buyers previously absorbed; look for renewed buy imbalances and positive delta recovery to join the trend.

Avoid continuation entries if the Volume Oscillator shows persistently negative values (short-term volume below long-term), signalling fading participation that weakens breakout odds.

Reversals with Order Flow Clusters

Watch for exhaustion: price makes a new high but footprint shows poor follow-through, strong sell imbalances, and cumulative delta divergence.

A negative Volume Oscillator print during a “high” suggests volume momentum is waning, adding confidence to fade attempts around prior resistance or single prints.

Pros and Cons of Order Flow Indicators

| Pros | Cons |

| Real-time clarity on who’s pushing the price. | Needs reliable data and often paid platforms. |

| Better signals during explosive moves or breakouts. | Can overwhelm because of too much detail, too fast. |

| Helps craft smarter entries and exits. | Not a magic bullet; price behavior and structure still matter. |

Common Mistakes to Avoid

- Chasing every imbalance without context (trend, level, session profile).

- Ignoring confirmation from cumulative delta or volume momentum; a breakout on shrinking volume has lower odds per VO logic.

- Trading during dead liquidity where order flow signals are noisy and unreliable.

- Overfitting to footprints without a plan for invalidation and risk control.

Conclusion

Order flow indicator turns charts into x-rays, revealing who’s actually pushing price and whether that push has fuel to continue. It’s a good idea to use it with the Volume Oscillator indications. When VO rises over zero, it means that short-term volume momentum is stronger than the long-term baseline. This gives breakouts and trend trades more confidence. On the other hand, when VO falls below zero, it means that participation is weak and there is a chance of fakeouts.

For new traders, start with just a few tools, such as cumulative delta and footprint around critical levels. Before you make a trade, utilise the Volume Oscillator to evaluate the volume momentum in a clean, percentage-based way.

FAQs

Order flow works best in markets with high liquidity and fast activity, like futures, forex, and popular stocks. These markets have enough trading volume to make the data meaningful and the patterns easier to spot.

Yes, beginners can use them, but start with just one or two tools like Volume Delta or Footprint Charts. Focus on learning how to read buyer-seller pressure before trying advanced setups or multiple screens at once.

Footprint charts break down each price bar to show exactly how many contracts or shares were bought or sold at every price level. This helps traders see the real battle between buyers and sellers inside each candle.

They show real-time buying and selling pressure inside the market — revealing who is driving price moves, not just the direction. Examples: Order Flow Bubble, Footprint, and Volume Profile.

No single “best” one, but traders often use a mix of tools like the Order Flow Bubble Indicator, VWMA, and Volume Profile to track volume strength and trader intent.

Use platforms such as TradingView, GoCharting, or NinjaTrader that display real-time bid-ask data or bubble charts. Focus on large trades near key price levels to gauge momentum.

It measures the gap between aggressive buyers and sellers.

More buy orders hitting the ask = bullish imbalance

More sells hitting the bid = bearish imbalance

This helps spot early strength or weakness before price reacts.