Markets often appear chaotic in the short term, but beneath the noise, they display patterns and longer-term directional moves. Trend following is one of the oldest and most enduring trading approaches, built on the simple idea that “the trend is your friend”. As opposed to forecasting price direction, trend followers act in response to a trend in recognition with a degree of permanency. This blog examines principles, rules, and applications of trend following strategy in terms of various asset classes.

What Is the Trend Following?

Trend following is the investment or trade strategy where participants aim to gain the trend, moving in a certain direction and trying to chase the gains. The main assumption is that when a trend has begun, it is more likely to persist rather than reverse in the first instance. Using technical indicators, price patterns, or systematically rule-based formulas, the traders wait until an indicator signals that a move has concluded and then take up a position. Unlike forecasting strategies that aim to predict tops and bottoms, trend technical analysis does not do that. It uses responding to the price action as the main factor, focusing on discipline and consistency.

Trend Following Strategies

Trend following strategies come in all shapes and sizes, but the common denominator is that they all depend on price and not on what other people are saying. Well-known ways for trend following strategy guide are:

- Moving Averages: Moving average or MA refers to calculating an average to detect market direction.

- Breakouts: Taking a position when the price exceeds a past high or low, indicating a possible trend to continue.

- Momentum Indicators: Indicators such as the relative strength Index (RSI) or even the MACD that measure the magnitude of price movement.

- Systematic Rules: Algorithms or models that have been pre-planned and that exclude human biases when making an exchange.

The major objective is uniformity. The strategies are aimed at capturing the broad moves over time with many trades being small losses or break even.

Entry & Exit Rules: Crossover, Breakouts, Trailing Stops

Crossover:

A common way to introduce entry is the moving average cross strategy A short-term average that broke above the long-term average, an indication of an uptrend, would give a long position. The reverse indicates a downtrend

Breakouts:

The other rule entails breakout levels. When the price penetrates resistance, traders purchase; when it penetrates support, they sell. The reason behind this is that as a market passes a critical point, a kind of momentum will drive it further in that direction.

Trailing Stops:

Coming out of a trend is just as important as getting into one. Frequently, trend followers utilise trailing stops in which the stop-loss follows the price movement. This secures profits, yet it allows the trend to continue to expand. The exits are never positioned to target the top or bottom but to preserve gains and to avoid big reversals.

Risk Management & Position Sizing

Risk management is central to trend following strategy. Not all trends persist, and traders need to have capital protection against the inevitable chain of losing streaks. The major methods of the work are:

- Position Sizing: The amount of capital allowed to be allocated to each trade (normally 1-2 per cent). This makes it such that the account cannot be liquidated by a single trade.

- Stop-Loss Orders: Pre-set stopping points to reduce downside risk. An example is to exit when the market moves against you by a specified percentage.

- Diversification: A portfolio created through diversification into different asset classes (equities, currencies, and commodities) would minimise the dependency on one market.

- Volatility Adjustment: The volatility of various assets may also dictate the volume to be put in each of the statement-position-sizes or vice versa.

A proper risk management system is most of the time the difference that enables a trader to enjoy huge positive trades.

Types of Trend Following: Long vs Short, Systematic vs Discretionary

Long vs Short:

Trend following works both ways. A trader can go long when the market is rising or short when it is declining. Trend following also contrasts with buy-and-hold investing because it changes its behaviour and does not need bull markets to successfully produce profits.

Systematic vs Discretionary:

- Systematic trend following is based on algorithms, quantitative techniques or rules. These eliminate emotional bias and provide consistent decisions.

- Discretionary trend following involves the utilisation of judgement by the trader using fundamentals, market news, or individual appraisal of the signs. Although less rigid, it is also open to being guided by passions.

Both approaches can be combined, with rules about how to enter trades, but with discretion on when to take risks or when to trade.

Pros & Cons: Benefits vs Limitations

Pros: Benefits of Trend Following

- Captures large, long-lasting market moves: Trend following is aimed at riding major waves in the market. Once in a powerful upswing or downswing, the strategy enables traders to keep the trade open for weeks or months in an attempt to profit increasingly as highs or lows are reached.

- Works across multiple asset classes and timeframes: Regardless of whether a trader wants to work with a stock, a commodity, forex or even crypto, interest follows trend. It can be implemented on both short-term intraday charts as well as longer-term weekly and monthly setups, reaching many different trader profiles.

- Removes the need for constant prediction; focuses on reaction: The strategy does not face the necessity of always trying to pre-determine the tops and bottoms. This transition in prediction to adherence mitigates decision fatigue and discretionary bias.

- Can generate strong returns even in volatile or bearish markets: Trend following is not just about bull runs. By shorting the declining markets, traders can make money even in times of recession, collapsing commodity prices, or devalued forex- essentially when other long-only investors suffer.

- Well-suited for systematic, rules-based strategies: Since the rules can be expressed clearly, including moving average crossover or breakout levels, trend following is well-suited to automation and algorithmic trading, lowering the effect of emotions.

Cons: Limitations of Trend Following

- Requires patience; trends may take time to develop: Markets frequently move sideways over a long period of time before tending to develop a trend. It might take traders weeks or months to identify any clear signs, and that may be a challenge to discipline.

- Frequent false signals in sideways or choppy markets: In sideways or choppy markets, a breakout signal generates a series of small losses. Trend followers are often frustrated by these whipsaws.

- Long losing streaks are possible before hitting a big trend: By the nature of the strategy, losing streaks can consist of small losses before a big trend is hit. Such an unequal tendency in the returns can be disheartening at times to the players who anticipate a steady win.

- Can be capital-intensive, especially in futures or leveraged products: Stop-losses and margin requirements are capital-intensive, particularly in futures or leveraged products. Entering leveraged markets requires disciplined money management, as it involves the risk of a margin call.

- Psychological difficulty of sticking to rules during drawdowns: Even when the strategy has passed the statistical test, it is psychologically tough to follow the strategy during prolonged downtimes. Many traders exit the system prematurely and fail to appreciate the later payoff.

Examples: Moving Average, Donchian Four-Week Rule

Moving Average

This daily chart of Bombay Dyeing shows how traders can comprehend price momentum in futures trading with the use of moving averages, especially the Moving Average Convergence Divergence (MACD) indicator. Changes in the strength of trends are shown by the interplay of the blue MACD line and the red signal line, which are both derived from price moving averages.

As an example, futures traders often look for signs of bullish momentum, such as the MACD crossing above the signal line, which can be seen on the right side of the chart recently. The MACD’s persistence below the signal line, as it did throughout July and into early August, indicates a decrease in momentum or negative pressure. By reducing the impact of short-term fluctuations, moving averages let traders see the bigger picture of the stock’s trajectory and adjust their trading strategies accordingly.

Donchian Four-week rule

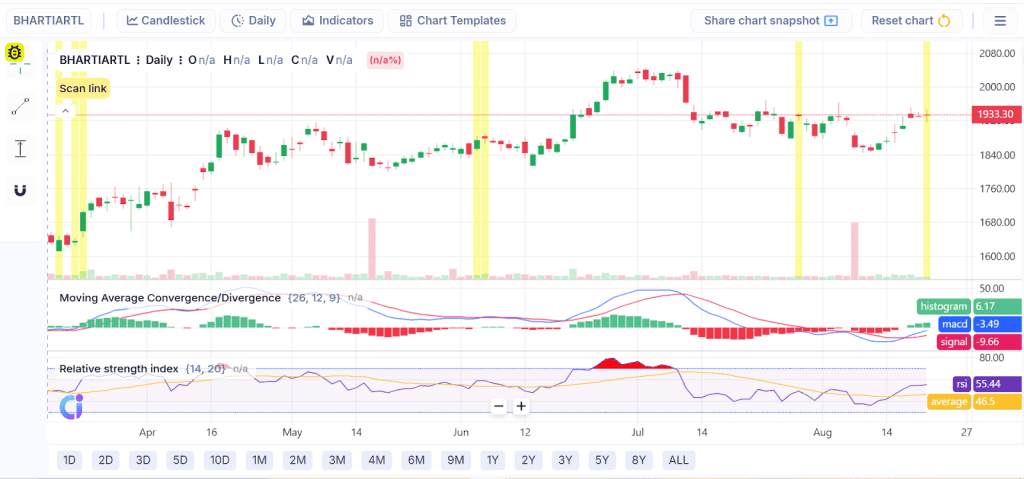

Buy when price breaks above the highest high of the last four weeks and sell (or short) when price declines below the lowest low of the past four weeks; this is the basic Donchian Four-Week Rule, a trend-following strategy. The yellow-highlighted consolidation stages on this Bharti Airtel daily chart indicate periods of sideways price movement that may have served as breakout or breakdown levels in the past.

As an example, following a period of consolidation in early April, the stock surged over its four-week highs, signaling a buy according to the Donchian rule. Subsequently, it made a robust ascent towards ₹2000. As time went on in July and early August, the stock continued to fall after failing to hold above its four-week high, which would have indicated an exit or possibly a short position according to the strategy. To assist futures traders hear the big picture and ignore the little noise, this graphic shows how the Donchian Four-Week Rule works.

Asset Class Applications: Stocks, Forex, Commodities, Crypto

Stocks:

Trend following trades on individual stocks and Indices. By investing in bull markets or short downfalls during recessions, the investors have the chance of taking advantage of any profits.

Forex:

Forex is a great place to use tendency-based tactics because currency pairs tend to execute long-term directional trends, caused by macroeconomic forces.

Commodities:

Energy, metals, and agricultural commodities are often trending due to an imbalance in the supply and demand. A great deal of commodity trading advisors (CTAs) base their strategies on a systematic trend following strategy.

Crypto:

With such volatility, however, cryptocurrencies are frequently characterised by momentum trends. Breakout or moving average traders who use these techniques should also profit, as risk management is even more essential because of the changes in direction.

Best Practices & Psychological Discipline

Technical aspects of trend following strategy are not the whole picture; the psychological aspects also play a critical role. Important best practices are:

- Stick to the Rules: Deviating from tested strategies often leads to poor outcomes. Discipline is more important than intuition.

- Accept Losses Gracefully: Many trades will be small losses. The aim is to preserve capital until a strong trend emerges.

- Stay Diversified: Trade multiple markets simultaneously to smooth out equity curves.

- Backtest and Review: Historical testing provides confidence in the system and reduces emotional interference.

- Patience: Trends can take time. Constant over-trading destroys returns.

- Resilience: Drawdowns are inevitable. Traders must have the psychological strength to stay consistent during difficult phases.

Trend following requires more than just skill; it requires temperament. The capacity to stay disciplined even when feelings are directed otherwise is what marks the difference between long-term success and failure.

Conclusion

Trend following is one of the strongest and long-proven market strategies. By following the direction of prices, they can gain large moves in equities, currencies, commodities and even crypto by following the prevailing directions as opposed to trying to outsmart them. Nevertheless, this strategy is not devoid of risks, i.e., false signals, long burrs, and emotional problems are the factors demanding high discipline and quality risk management. In the end, trend following strategy should not be viewed as a prediction, but rather reaction, persistence, and consistency.

FAQs

A trend following strategy is a strategy where traders aim to take advantage of prolonged price movements on markets. Rather than forecast reversals, they go long or short in a known direction build-up, whether rising or falling. Capturing the essence, the fundamental philosophy is that markets are foreseen to move in a particular direction, likely to remain so at least in the short term. The first option available to traders is rules-based systems as a means of entry and exit, like moving averages or breakout signals. The strategy is popular in the case of stocks, forex, commodities, and crypto.

Technical indicators and predetermined signals are usually used as the basis of entry and exit in trend following. The typical entry signals are moving averages crossovers, break of resistance, or highs/lows. The exits can be established as either a trailing stop, reverse crossover, or volatility-based stop-loss level to take profits. The point is to ride the trend until it changes its direction. Rules are systematic, and these make traders stay disciplined and not make emotional decisions that can result in the management of risk and maximisation of returns.

Trend following and buy-and-hold are different strategies, as trend following strategy is an active momentum trading strategy that is centred on exploiting price changes, whereas buy-and-hold is passive, relying on long-term appreciation. Trend followers place and close trades according to signals, and buy-and-hold investors do not even consider short-term volatility. Trend following works in rising markets and declining markets; it is flexible, whereas buy-and-hold is dependent on future improvement.

The dangers of trend following are the excess of incorrect signals, and primarily inside, non-directional markets, where price lacks direction. Traders can be confronted by prolonged drawdowns or periods of losses before they can capture a powerful trend. It may also be capital-intensive, especially when doing trading with leveraged instruments, such as futures or forex. Emotional discipline is equally difficult, as it is not easy to adhere to the systematic rules in downturns.

Trend following is based on technical indicators that point to the direction and power of the movements in the market. The freely used ones include the moving average (simple or exponential), a cross-over of a moving average, and momentum, e.g., MACD. There are also breakout systems like Donchian channels that are used in new trend entries. Traders can utilise the Average Directional Index (ADX) to gauge the strength of a trend and trailing stops to help them manage exits.