Bharti Hexacom Limited IPO coming soon – get ready to dial into the future with it!

This telecom titan, a powerful alliance between Bharti Airtel and Telecommunications Consultants India Limited (TCIL), has been revolutionising connections across India’s northeastern states and Rajasthan. Now, it’s time for Bharti Hexacom to connect with the world of public finance.

Yes, you heard it right! Bharti Hexacom is going public with an exciting Initial Public Offering (IPO). This IPO isn’t just a financial event; it’s a landmark moment in Bharti Hexacom’s journey, paving the way for unprecedented growth.

So, buckle up as we decode the buzz around this much-awaited IPO.

Bharti Hexacom IPO

There will be a book-built issue of ₹4,275 crores for the Bharti Hexacom IPO. 7.5 crore shares are being offered for sale in this offering. It quantifies a 15% stake in the company. Currently, the Bharti Hexacom IPO promoter holding is 70% for Bharti Airtel and 30% for Telecommunications Consultants India.

It should be noted that the IPO is solely an OFS (offer-for-sale), hence Bharti Hexacom will not be receiving any funds from the IPO. Rather, the selling shareholders will receive the funds. With this setup, the promoters can get some money out of their shares in the business.

Important Dates

| Particulars | Date |

| Open for subscription | 3 April 2024 |

| Close for subscription | 5 April 2024 |

| Listing date | 14 April 2024 |

The IPO price band of ₹542-570 per equity share is a reflection of the company’s strong financial position and encouraging future prospects. All of the company’s financial data, current market circumstances, and growth forecasts go into establishing this pricing range.

Bharti Hexacom IPO lot size is 26 equity shares, and investors have the option to apply for additional shares in multiples of 26. From individual retail investors to huge institutional funds, this strategic move welcomes participation from all.

Bharti Hexacom IPO reservation

| Investor category | Shares offered |

| QIB shares offered | At least 75% of the issue |

| Retail shares offered | At least 10% of the issue |

| NII (HNI) shares offered | At least 15% of the issue |

The primary objective of the issue is that the company aims to achieve the benefits of listing on the stock exchanges. The listing will enhance the company’s visibility in the market and could potentially lead to a broader investor base. It also provides a public market for equity shares in India, thereby improving the liquidity of the shareholders.

About Bharti Hexacom Ltd

Bharti Hexacom Limited has been around since 1995 and mainly serves the North East and Rajasthan with fixed-line telephone and broadband services.

The company plans to invest ₹206 billion in digital infrastructure by December 2023. It has 89,454 retail touchpoints and a distribution network of 616 distributors that allow it to service 27.1 million clients in 486 census towns.

Through its innovative network, Bharti Hexacom strives to provide customers with an exceptional experience. Its market leadership position, largest client base, and highest revenue are all results of its persistent investment in technology and network.

The director of Bharti Hexacom Ltd., Soumen Ray, told the media that expanding their network’s coverage in existing locations is their present priority when asked about their plans to explore new regions.

Financial position of Bharti Hexacom Ltd

Key financial metrics of the company highlighted in the Bharti Hexacom Limited annual report are as follows:

| Particulars | March 31, 2023 (₹ million) | March 31, 2022 (₹ million) |

| Non-current assets | 153,553 | 126,520 |

| Current assets | 28,976 | 40,223 |

| Non-current liabilities | 79,013 | 68,348 |

| Revenue from operations | 65,790 | 54,052 |

| PBT | 7,338 | 18,411 |

| Profit for the year | 5,492 | 16,746 |

Also read: Understanding asset valuation: A comprehensive guide

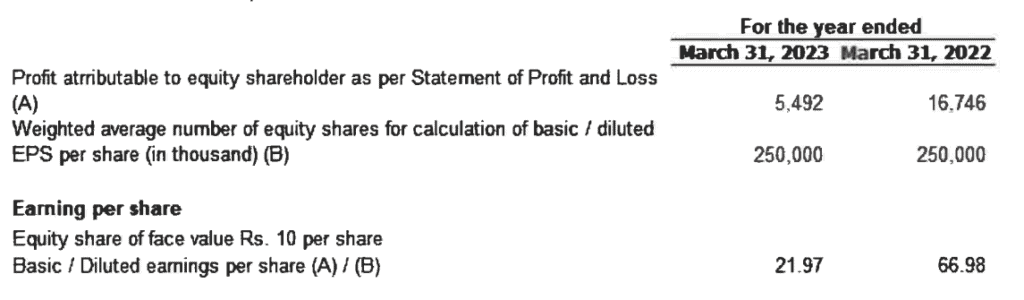

Investors rely on earnings per share (EPS) as a crucial financial metric to gauge a company’s profitability. It is the rupee amount that stands for the percentage of a company’s net income that goes toward paying the shareholders of common stock.

In the case of Bharti Hexacom Ltd, the EPS has seen a significant decrease from 66.98 in 2022 to 21.97 in 2023. This drop could be due to many factors, including increased costs, decreased revenues, or an increase in the number of outstanding shares.

Investors should take this shift in EPS into account when assessing the current and future financial health of the company.

As of September 30, 2023, Bharti Hexacom’s insurance coverage was ₹92,950 million, representing 178.07% of the net book value of total assets. It indicates a significant increase in coverage compared to previous years, reflecting the company’s proactive approach to managing risks and protecting its assets.

Also read: Earnings Per Share (EPS): What it means and how to calculate it

Potential risks and rewards

Investing in an IPO, such as the Bharti Hexacom IPO, comes with its own set of potential risks and rewards. Here’s a detailed analysis:

Potential rewards:

Established leadership and large customer base: Bharti Hexacom, a leader in telecom, provides services to 29.1 million customers across Rajasthan and North East India as of September 2023. With a strong presence in 486 towns, it boasts 18.27 million 4G and 5G customers, each consuming about 22.8 GB of data monthly.

Presence in markets with high growth potential: Bharti Hexacom operates in high-growth potential markets of Rajasthan and North East India, with a growing customer base and increasing teledensity. With robust revenue growth and rising internet penetration, it’s poised for significant expansion in the coming years.

Strong parentage and established brand: Bharti Hexacom, backed by Airtel (which owns 70% of its equity share capital), benefits from Airtel’s strong global presence and robust financial profile. As of January 15, 2024, Airtel, a blue-chip company with a market capitalization of ₹6.4 trillion, had a customer market share of 32.8% and a CRISIL rating of AA+.

Potential risks:

Competition and market trends: Bharti Hexacom faces intense competition and needs to keep up with technological advancements and changing consumer preferences to remain competitive.

Financial risks: The company has incurred losses in the past and requires significant capital for its operations. Any adverse change in credit ratings or interest rates could affect its ability to raise funds.

Personnel and relationships: Bharti Hexacom’s success is dependent on its key personnel and its relationship with its promoter, Airtel. Any changes in these could adversely affect its operations.

Also read: Key risks in investing in the stock market

Impact of market conditions on the IPO

Market circumstances have a substantial impact on the success of an initial public offering. An initial public offering (IPO) has a better chance of succeeding in a bull market because more investors are willing to put money into them.

The success of the IPO could be affected if investors become more cautious in a negative market. So, before putting money into the Bharti Hexacom IPO, prospective investors should think about the market.

Bottomline

Significant opportunities for development, capital appreciation, and dividends may arise as a result of the Bharti Hexacom IPO. Market volatility, company performance, and liquidity concerns are some of the dangers that come with it.

The IPO’s success is highly dependent on market conditions. Investors should heed these warnings and seek the advice of qualified financial professionals. Value realisation and enhanced visibility can be achieved through the IPO. Due diligence and thoughtful deliberation are necessary, as with any investment.