Coforge stands tall in the vast ocean of the digital world, demonstrating unwavering resilience as it rides the waves. This global IT solutions & services company has been a shining example of innovation, guiding businesses across various sectors. Having a presence in 21 countries, Coforge has earned the trust of over 250 clients globally.

But even the mightiest of ships can be rocked by the stormy seas of the financial markets. Recently, Coforge found itself in choppy waters. The announcement of its Q4 earnings sent shockwaves through the market, resulting in a 9% drop in its share price. That’s a significant dip, considering the company’s market capitalization of over ₹27,712 crores.

This sudden turn of events has ignited a wave of conversations among investors and market analysts.

This article seeks to unravel the factors contributing to this significant market reaction and evaluate the potential implications for current and prospective investors.

About Coforge

Coforge, previously recognized as NIIT Technologies, is a prominent global IT corporation with its main offices situated in Noida, India, and New Jersey, United States. The company’s shares are listed and actively traded on the Bombay Stock Exchange and the National Stock Exchange of India, under the ticker symbol COFORGE.

Coforge stands as a worldwide provider of digital services and solutions, utilizing cutting-edge technologies and profound domain expertise to yield tangible business outcomes for its clientele. The company’s focus on select industries, comprehensive understanding of the inherent processes of those industries, and collaborations with premier platforms endow it with a unique perspective.

Coforge pioneers with its product engineering approach and capitalizes on Cloud, Data, Integration, and Automation technologies to metamorphose client businesses into smart, rapidly expanding enterprises.

The company’s proprietary platforms drive crucial business processes across its principal verticals. The firm boasts a global presence in 21 countries, with 26 delivery centres dispersed across nine countries.

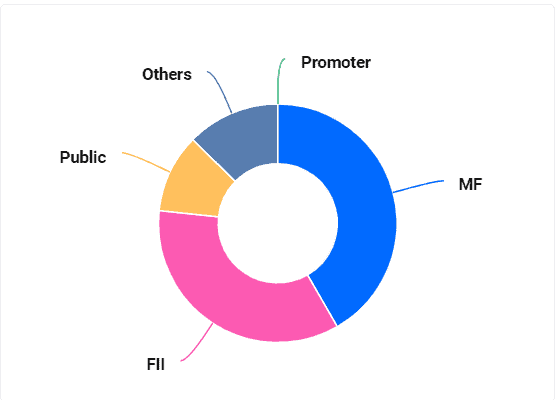

Coforge’s shareholding pattern:

Source: Trendlyne

Also read: A comparative study of FIIs and DIIs in financial markets

Coforge Q4 results

Coforge, a leading global IT solutions and services company, recently announced its Q4 earnings for the fiscal year 2023-24.

The company disclosed a 5.6% decrease in net profit for the quarter ending in March 2024. The net profit dwindled to ₹229.2 crore in Q4, down from ₹242.8 crore in the quarter of December 2023.

Conversely, the revenue experienced a 1.5% surge, escalating to ₹2358.5 crore in Q4 from ₹2323.3 crore in the previous fiscal quarter. The company’s board declared an interim dividend of ₹19 per share, with the record date set for May 15, 2024.

The per-share earnings of the IT corporation, Coforge, experienced a downturn to ₹36.21 in Q4, compared to ₹38.63 in Q3 of FY24. The Earnings Before Interest and Tax (EBIT) saw a 4.1% decrease, falling to ₹301.1 crore in the final quarter from ₹314 crore in the December 2023 quarter. Consequently, EBIT margins also declined from 13.5% to 12.8% on a quarter-to-quarter basis.

When viewed on a yearly basis, the operational revenue saw an increase of 14.52%, escalating to ₹91790 crore in FY24 from ₹80,146 crore in FY23. Similarly, the net profit witnessed a growth of 12.14%, rising to ₹835.6 crore in the recent fiscal year, up from ₹745.1 crore in FY23.

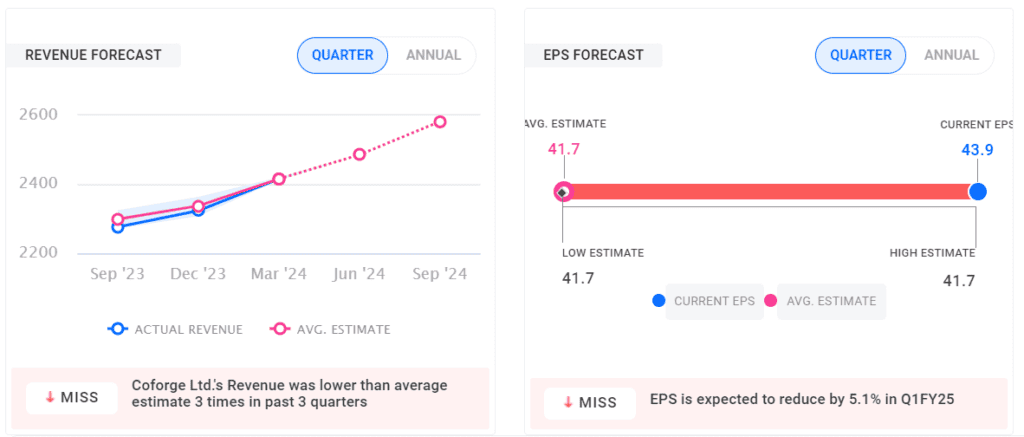

These are the estimated quarterly forecasts of the revenue and EPS of the company:

Source: Trendlyne

Also read: Earnings Per Share (EPS): What it means and how to calculate it

Cigniti-Strategic Acquisition

Coforge’s strategic procurement of Cigniti Technologies Limited signifies a crucial step in its ambition to become a $2 billion entity by FY’27. This initiative is not merely about expansion; it’s about generating value through synergies anticipated to boost Coforge’s operating margins by 150 to 250 basis points within the same period.

This acquisition is a significant milestone for Coforge due to three key factors. Firstly, Coforge has expanded its portfolio by introducing three new industry verticals: Retail, Hi-Tech, and Healthcare. After the merger, the Retail vertical is expected to generate close to $100 million in annual revenue, giving Coforge a strong competitive edge in these industries.

Secondly, the acquisition allows Coforge to considerably broaden its footprint across the southwest, Mid-west, and West US, regions where it previously had minimal presence.

This geographical expansion is projected to augment Coforge’s North American revenue by approximately 33%, adding twenty-eight Fortune 500 companies to its clientele and paving the way for further growth through cross-selling.

Lastly, the rapid integration of AI in software development brings forth new challenges and opportunities for specialized Assurance services. Cigniti’s proficiency in non-functional testing, security, performance, and automation, along with its AI-driven quality engineering platform BlueSwan, equips Coforge to effectively address these needs.

The amalgamated expertise of Coforge’s AI CoE and Cigniti’s BlueSwan platform will facilitate the creation of a robust “AI Assurance” service, catering to the escalating demand for AI system validation and performance testing.

Also read: How is generative AI affecting the financial industry?

Market Reaction

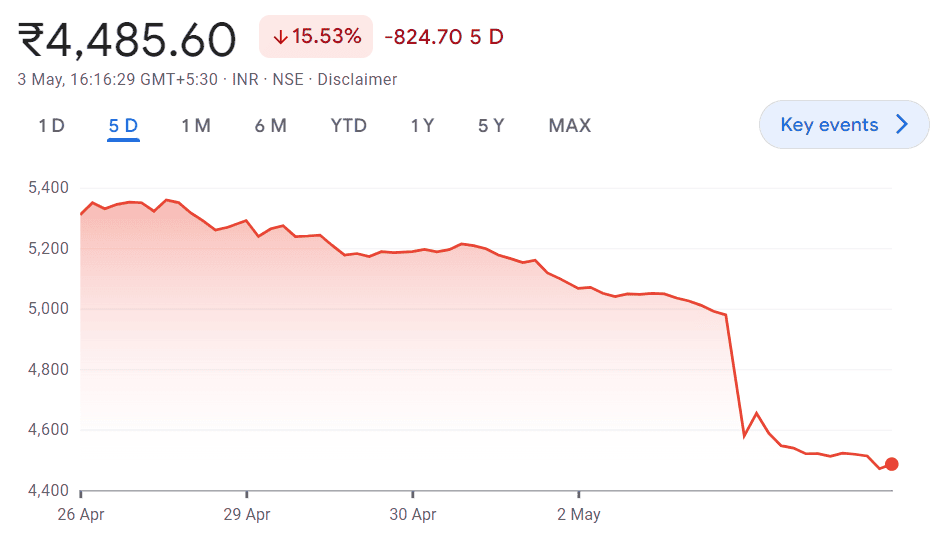

The Coforge Ltd share price experienced a downward adjustment of over 9% during the morning trading session on May 3, 2024. The company had announced its Q4 earnings performance after the market closed on May 2, 2024.

Previously a high performer, the IT stock has wiped out 20% of investors’ capital in 2024 (year-to-date), in contrast to the benchmark Sensex which has seen a 3% increase during the same period. Over a one-year timeframe, Coforge shares have yielded a return of 22%, mirroring the gains observed in the Sensex.

This chart shows the 5-day trading pattern of the Coforge share price and clearly indicates a sudden decline.

Source: Google Finance (as of April 4, 2024)

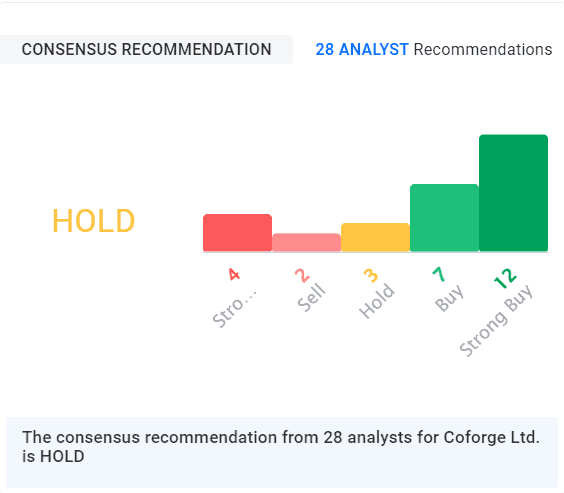

Share price targets

Source: Trendlyne

Let’s delve deeper into the recommendations given by various brokerages for the Coforge share price target:

The international brokerage firm, Jefferies, has revised its rating for the Coforge stock to ‘underperform’ and reduced the target price to ₹4,290. This suggests a potential decrease of 14% from the closing price as of May 2.

InCred has also revised its rating for the stock to ‘reduce’ and lowered the target price to ₹4,431. The firm believes that the acquisition of Cigniti is responsible for a 6% reduction in the compound annual growth rate (CAGR) of earnings per share (EPS) for FY24-26.

Concurrently, Citi has assigned a ‘sell’ rating to the stock and has reduced the target price to ₹4,550, primarily due to the revenue and margin falling short of its estimates.

Bottomline

Coforge, a major player in the global IT solutions and services sector, has recently faced challenges in the financial markets after revealing its Q4 earnings.

Global brokerages such as Jefferies, InCred, and Citi have downgraded their ratings on the Coforge stock and cut their target prices, indicating potential challenges ahead for the company.

Investors are advised to closely monitor Coforge’s performance in the coming quarters, especially in light of the recent acquisition and its potential impact on the company’s earnings.