As India’s economy bounces back from the COVID-19 impact, there’s a new problem looming on the horizon—one that arises from the depths of the Pacific Ocean: El Nino. This sneaky phenomenon has the potential to disrupt the country’s growth, especially in the agriculture sector.

Let’s dive into what El Nino is all about and how it can make or break the Indian economy.

What’s El Nino?

Normally, the Pacific Ocean has a chilly zone near South America (Peru and Ecuador), while the other side near Australia stays warmer. This sets the stage for a harmonious atmospheric balance, with easterly trade winds carrying warm surface water to the western coast of the Pacific, cooling the Peruvian coast.

The warm air rises near Australia, causing precipitation, and then mostly loops back to the eastern Pacific side in the upper atmosphere. This fancy process is technically called the ‘Walker Circulation.’ In this happy state, the Indian monsoon remains unaffected.

But when El Nino arrives, the trade winds mysteriously weaken. They struggle to push the warm surface water from the Peruvian coast to the western Pacific, resulting in warmer surface water on the eastern side of the Pacific Ocean.

This disrupts the Walker Circulation, which, in turn, messes up the southwest monsoon winds in India. El Nino brings the opposite effect of La Nina, leaving the monsoon in a less-than-ideal state.

Governments worldwide are gearing up to tackle the upcoming El Niño by allocating funds and forming disaster management bodies.

You may also like: The mega merger of HDFC and HDFC Bank

Impact of El Nino: Droughts, floods, and storms

El Nino brings significant disruptions to weather patterns worldwide. It can cause excessive rainfall, floods, and storms in some regions, while others experience severe droughts.

India has had its fair share of battles with El Niño. Let’s take a peek into the past and see the havoc it wreaked:

The Drought of 1877:

- Miserable monsoons and failed rains engulfed the country.

- Starvation and droughts led to the deaths of over 5 million Indians.

The 2015 Tragedy:

- Heatwaves and agricultural losses struck the nation.

- Approximately 2,500 people lost their lives due to heat strokes.

El Nino’s impact on the Indian economy

The Indian economy relies heavily on the monsoon for agriculture, making it susceptible to El Nino’s effects.

Deficit rainfall hits agriculture hard, causing a decrease in rice and pulse yields. Reduced yields lead to increased prices, contributing directly to inflation. Rice inflation is already at a daunting 11.33%, surpassing the RBI’s 6% tolerance band.

A significant portion of India’s workforce depends on agriculture, meaning any impact on crop yields affects these workers.

The uncertainty looms

The RBI Governor, Shaktikanta Das, expressed concern about the uncertain prediction of El Niño this year. While the CPI inflation has fallen to 4.25%, the timing and distribution of the monsoon will play a crucial role.

Also Read: SGBs: A smarter way to invest in gold

India’s resilience and challenges

Despite the risks posed by El Nino, India has a few advantages this time:

- The Indian ocean dipole factor: This year, the Indian Ocean Dipole (IOD) or “Indian Nino”, could come to the rescue. The IOD refers to the temperature difference between the western and eastern basins of the Indian Ocean.

In a positive IOD, the western basin is warmer, while the eastern basin, closer to Australia, is relatively cooler. This temperature contrast may partly offset El Niño’s warm effect and potentially bring in more rain, according to the Indian Meteorological Department. - Record production and inventory: India has experienced two years of record agricultural production, resulting in higher inventory levels. These reserves can help mitigate the impact of reduced rainfall in 2023. However, if El Nino worsens in 2024 and the IOD doesn’t play out, the situation could worsen.

El Nino’s global economic impact

El Nino doesn’t just affect India; it can have global economic implications. A recent study estimated that intense El Nino events have cost the global economy more than $4 trillion in subsequent years. The 2023 El Nino event is predicted to set back the global economy by $3 trillion over the next five years.

- By 2030, it is estimated that India could witness around 3.4 crore job losses due to heat stress out of the projected global total of eight crore.

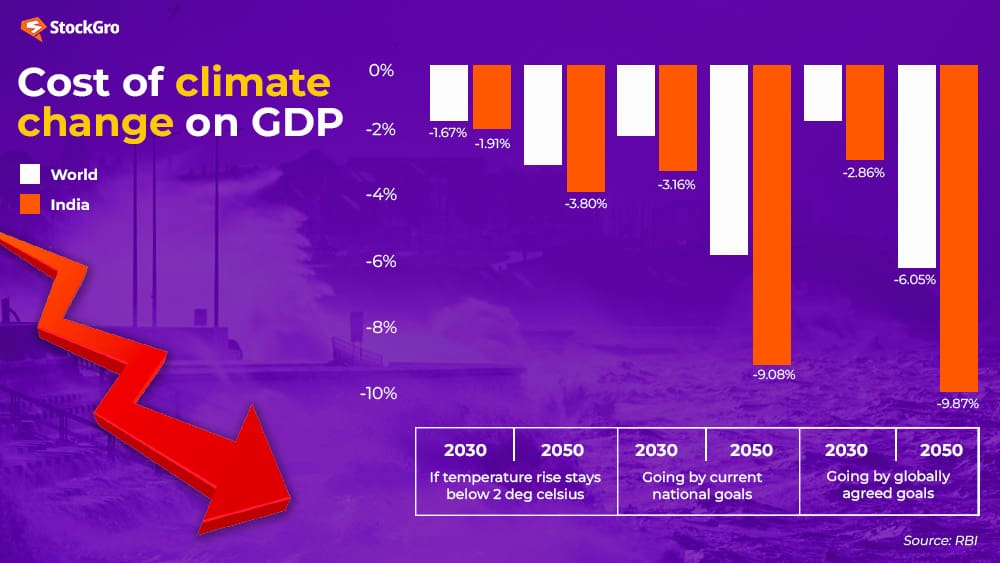

- The Reserve Bank of India warns that extreme heat and humidity could lead to a loss of up to 4.5% of India’s GDP by 2030, resulting from lost labour hours.

India’s stock market is also at risk due to El Nino, primarily impacting sectors such as agriculture, consumer goods, and banking. However, historical data suggests that local equities have mostly risen in the three-to-six months following the onset of El Nino.

Let’s dive into the numbers and see how India’s stock market fared during previous El Niño occurrences:

| EL Nino and Nifty Returns | |||

| El Nino Year | Returns from August (%) | ||

| 3 Month | 6 Month | 1 Year | |

| 2002 | -0.78 | 8.65 | 23.67 |

| 2004 | 9.47 | 26.06 | 41.66 |

| 2006 | 19.12 | 29.89 | 44.08 |

| 2009 | 1.62 | 5.30 | 15.77 |

| 2014 | 7.78 | 14.09 | 10.51 |

| 2015 | -5.47 | -11.36 | 1.24 |

| Average | 5.29 | 12.10 | 22.82 |

| Median | 4.70 | 11.37 | 19.72 |

- El Niño visited India in 2002, 2004, 2006, 2009, 2014, and 2015.

- Out of these six occasions, the Nifty fell only twice over three months and once over six months.

- On average, the three-month and six-month Nifty returns after August during these years were 5.29% and 12.1%, respectively.

El Niño impact: Sectors and Stocks

While the stock market seems resilient, certain sectors might feel the heat from El Niño: Analysts predict that companies in consumer-centric and agriculture-oriented industries, such as agro-industries, FMCG, and consumer goods and services, could face pressure.

Agriculture: Bearing the brunt

When suffering the most from El Niño’s wrath, the agriculture sector takes the crown. Recent years have seen agricultural production plummet by 20-40% due to the dreaded droughts caused by El Niño.

Food Inflation: Higher food prices as reduced productivity pushes up inflation. Ouch! It’s not good news for our wallets, especially since inflation is already on the rise despite the Central Bank’s efforts.

Rural Economy: As the backbone of the rural economy, agriculture plays a vital role in supporting livelihoods. A decline in agricultural production will deal a severe blow to rural communities, impacting their overall economic well-being.

Top 5 agricultural stocks with the highest market cap:

| Name | Current Market Price (As of 26/06/23) | 1-Year Share Performance |

| UPL | Rs. 679.20 | -9.8% |

| Rallis India | Rs. 196.10 | -27.8% |

| PI Industries | Rs. 3850.80 | 3% |

| Dhanuka Agritech | Rs. 791.10 | -17.1% |

| Coromandel International | Rs. 936.40 | 10.3% |

Consumption: Inflation hits hard

Next in line is the consumer goods sector to feel the burn of El Niño. Rising inflation, a common aftermath of El Niño, brings a double whammy for consumer goods:

Increased Costs: As raw material costs soar, consumer prices rise accordingly. Say goodbye to affordable prices!

Dwindling Demand: With inflation squeezing income levels, consumer demand takes a hit. It’s a tough time for the market as people tighten their purse strings.

El Nino impacts the FMCG sector – below are the 5 consumer goods stocks with the highest market cap.

| Name | Current Market Price (As of 26/06/23) | 1-Year Share Performance |

| ITC | Rs. 445.70 | 46.2% |

| HUL | Rs. 2651.15 | 17.5% |

| Varun Beverages | Rs. 799.20 | 114.4% |

| Britannia | Rs. 5009.20 | 27.8% |

| Dabur | Rs. 569.55 | -6.7% |

While El Niño poses risks and challenges, India’s stock market seems to have a knack for weathering the storm. Keep an eye on the sectors impacted—with every storm comes the potential for growth and profit.