2024 is on track to be a blockbuster year for Indian IPO markets, as numerous companies across industries are gearing up to tap the public markets for funds.

So far, SEBI has given the green light to 27 companies to collect a total of ₹28,500 crore, while another 36 companies are in line to get ₹40,500 crore. Three of these 63 companies are new-age technology companies, such as OYO, Digit Insurance and First Cry, which aim to raise about ₹16,000 crore.

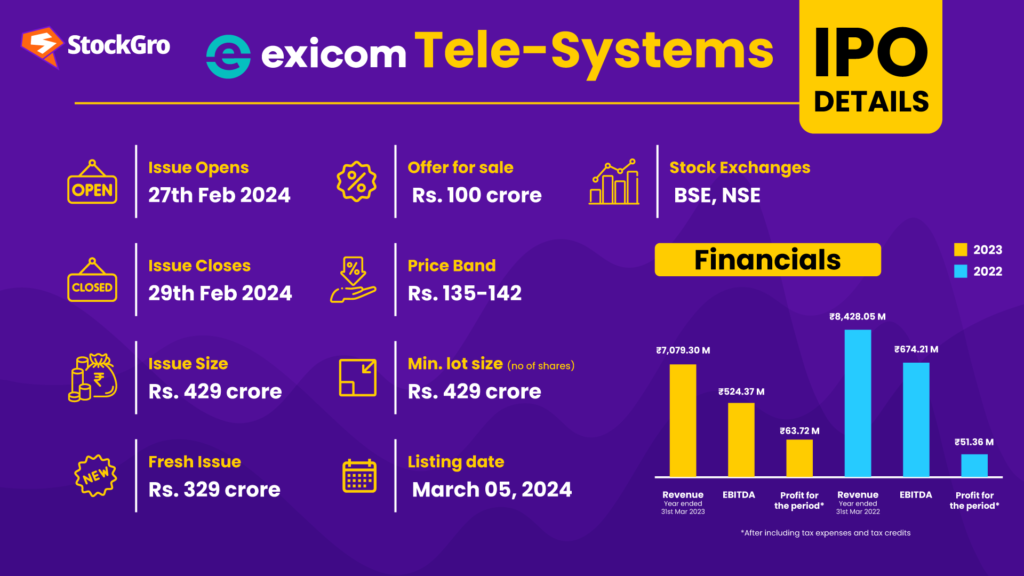

Exicom Tele-Systems Limited, a prominent player in the EV charging and energy storage market, is also about to get listed.

In this article, let’s take a look at Exicom’s business, financial performance, and the risks and opportunities associated with its IPO.

About Exicom Tele-Systems Limited

Exicom Tele-Systems Limited, established in 1994, is a power management solutions company with two core business segments.

One segment focuses on electric vehicle (EV) chargers, providing intelligent charging infrastructure for residential, commercial, and public use across India. This includes both slow charging alternatives like AC chargers for homes and faster DC options for commercial and public stations in cities and along highways.

As one of the early entrants in India’s growing EV charging market, Exicom has been at the forefront of establishing infrastructure to support increased EV adoption. The other segment centres around critical power solutions.

Through in-house research and manufacturing, Exicom develops and maintains vital digital infrastructure and energy management technologies. These solutions serve telecommunications sites and large enterprises domestically and globally.

The clientele comprises well-known charge point operators (CPOs), automotive OEMs (for passenger cars and EV buses), and fleet aggregators.

Also read: Nvidia’s historic surge propels record market capitalisation gain

Exicom Tele-Systems Ltd History

In 1994, Exicom Tele-Systems Ltd was founded under the name Himachal Exicom Communications Limited as a joint venture between Himachal Futuristic Communication Limited and Exicom Australia to manufacture telecommunications power equipment.

The company’s initial product line included items like DC converters, controllers, battery modules, and rectifiers that were crucial components for supporting telecom infrastructure.

After Exicom Australia had liquidated its assets and officially left the market, the company underwent a rebranding process where it adopted its current identifying name.

Today, Exicom Tele-Systems Ltd is involved in manufacturing key electric power components like rectifiers and AC to DC converters. They also supply energy storage solutions. In a recent move, the company has expanded into the electric vehicle charging market.

Exicom Tele-Systems Ltd vision & mission

Vision

The company’s goal is to operate as an influential company that makes a meaningful contribution to the sustainable shift toward renewable energy sources. They seek to facilitate the electrification of transportation systems and ensure the reliable provision of energy required to power digital communication networks.

Mission

The company’s mission is to provide cutting-edge technology products and solutions worldwide while focusing on sustainability. They aim to generate value for their vendors, customers, employees, and shareholders.

Must read: The startup saga: Tracing the growth of India’s entrepreneurial landscape

How is Exicom Tele-Systems Ltd shaping the future of EV and power solutions?

The company’s critical power business aims to provide comprehensive energy administration for telecommunications sites and enterprise environments. They have successfully implemented their DC power systems throughout 15 Southeast Asia and African nations.

As of September 30, 2023, the company has deployed approximately 470,810 Li-ion Batteries for utilisation in the telecommunications industry, equal to a storage capability of over 2.10 GWH.

In addition, they have installed more than 61,000 EV charging stations in 400 places across India. This will help encourage more widespread adoption of electric vehicles and progress toward environmental sustainability goals.

Over the years, they have steadily grown their international reach and operations by founding five overseas subsidiaries. They strategically established a presence in key global markets to better serve their clients abroad and amplify their impact worldwide.

Investment considerations

Strengths

- Leading position in the Indian EV charger market: The Indian EV charger market, which is growing fast and hard to enter, gives the company an edge as an early adopter and learner. They have a dominant market share of about 60% in the residential segment and 25% in the public segment as of March 31, 2023.

- Expertise and diversity in product offerings: With a range of products that meet the needs of various customers and sectors, the company has a diversified product portfolio. They have demonstrated their skill in delivering successful outcomes in critical cases. Since their inception, they have accumulated nearly three decades of domain experience and know-how in energy management, power conversion, etc.

Weaknesses

- Reliance on global suppliers for essential materials and inputs: Exicom depends on global suppliers for raw materials and key inputs and may face challenges in reducing its import reliance. If there is a shortage or unavailability of critical components, it may face delays in the production and delivery of its products.

- Outsourcing of specific business operations to third parties: Some of Exicom’s business activities, like setting up, testing and servicing its products and other procedures, are outsourced to external parties. If these parties fail to deliver their services, it could harm its business and operational outcomes.

Bottomline

Exicom Tele-Systems is a pioneer and leader in the EV charging and power solutions market in India and abroad. The IPO will help the company expand its production capacity, reduce debt, and invest in its R&D.

The IPO is expected to generate a lot of interest from investors looking for exposure to the fast-growing EV and power sectors.

If you are one of them, you may want to mark your calendar for February 27 and get ready to apply for Exicom Tele-Systems IPO!