In FY23, India produced 125.32 MT of crude steel and 121.29 MT of finished steel, making it the world’s second-largest producer of crude steel. Forecasts indicate a growth of 4-7%, reaching 123-127 MT.

In this competitive industry of steel and aluminium, two names stand out: JSW Steel and Hindalco. By deftly navigating the market’s ups and downs, these industry giants have carved out a special place for themselves.

But how do they stack up against each other? This article will delve into the intricacies of these two companies, comparing their histories, product offerings, financial performances, and more.

JSW Steel: An overview

A small steel company in Tarapur, Maharashtra, called Piramal Steel Limited was acquired in 1982 by the Jindal Group, marking the beginning of JSW Steel’s existence. Near Mumbai, in the city of Vasind, they set up their first steel plant in 1982. To become what is now known as JSW Steel Limited, JISCO and JVSL combined in 2005.

Among the several businesses that comprise the JSW Group, JSW Steel stands out as a leading Indian multinational steel maker with headquarters in Mumbai.

Products from JSW Steel’s extensive inventory include galvanised, colour-coated, hot-rolled, and cold-rolled steel. In addition, it offers special alloy steel, wire rods, and TMT bars. A wide variety of sectors make heavy use of these products, such as building and infrastructure, transportation, electrical applications, and home appliances.

JSW Steel has been honoured with multiple accolades. Among them, it has been honoured with several prestigious titles, such as Steel Sustainability Champion (2019–2022) by the World Steel Association, Leadership Rating (A–) in CDP (2020–2021), and the Deming Prize for TQM for its Vijayanagar and Salem plants (2018) and 2019, respectively (2019).

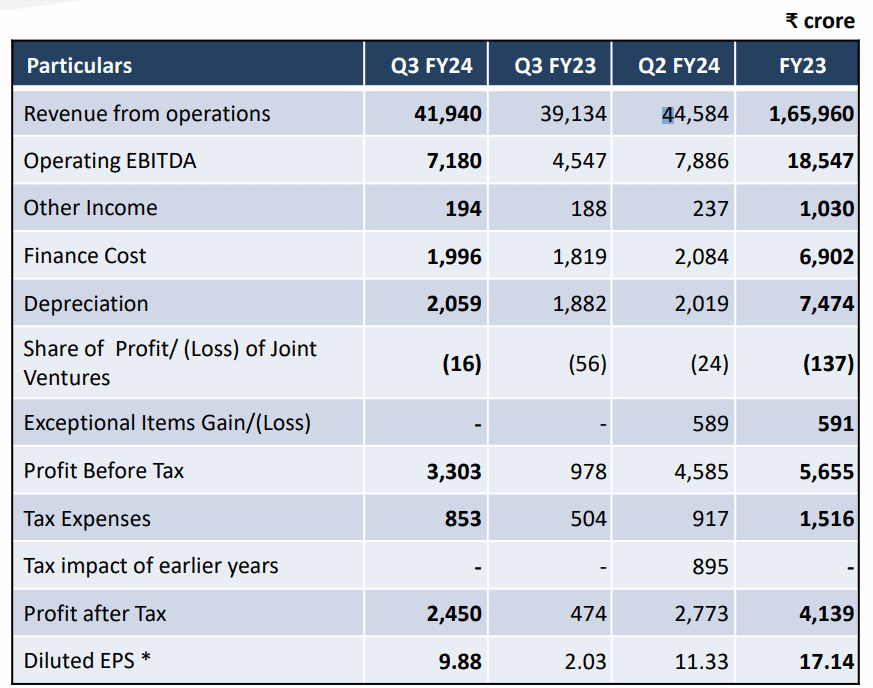

After the basics about the company, now let’s look at JSW Steel quarterly results

These figures represent the JSW steel results for the most recent financial quarter compared with the equivalent quarter last financial year. The good financial performance would have an impact on the JSW steel share price, which is currently at 871.00 (as of April 1, 2024), showing the company’s healthy market position.

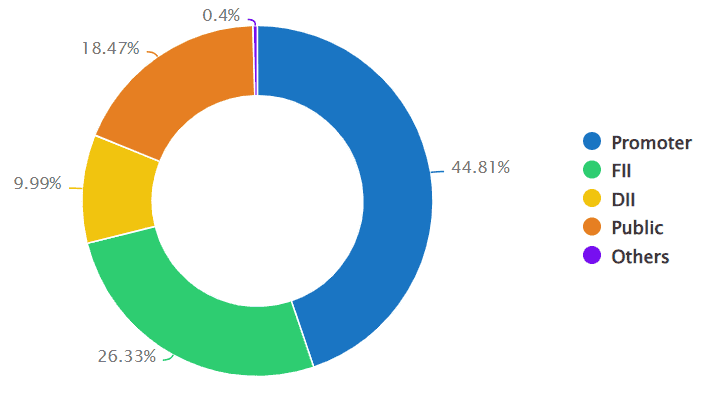

Shareholding pattern:

Hindalco: An overview

In 1958, the Aditya Birla Group founded Hindalco Industries as a subsidiary. Establishing the first integrated aluminium facility in India at Renukoot, the business set out on its journey with the objective of an industrial India.

Hindalco is now one of the biggest primary producers of aluminium in Asia, and it has grown into a huge vertically integrated aluminium enterprise in India. Among the leading aluminium manufacturers in India, Hindalco also ranks high among the world’s leading producers of flat-rolled goods and recyclers of metal.

Aerospace and defence, construction, electricals, electronics, transportation, beverage packaging, consumer durables, food packaging, pharmaceuticals, electric vehicles, renewable energy, refractories, and ceramics are some of the significant industries it supports.

Hindalco has a long history of receiving accolades for its dedication to worker and community safety, environmental protection, and high-quality exports. When it came to health and wellness, Hindalco was one of the top ten “Great Places to Work” in 2024. In addition, according to S&P’s DJSI ranking, it has been named the world’s Most Sustainable Aluminium Company for four years running.

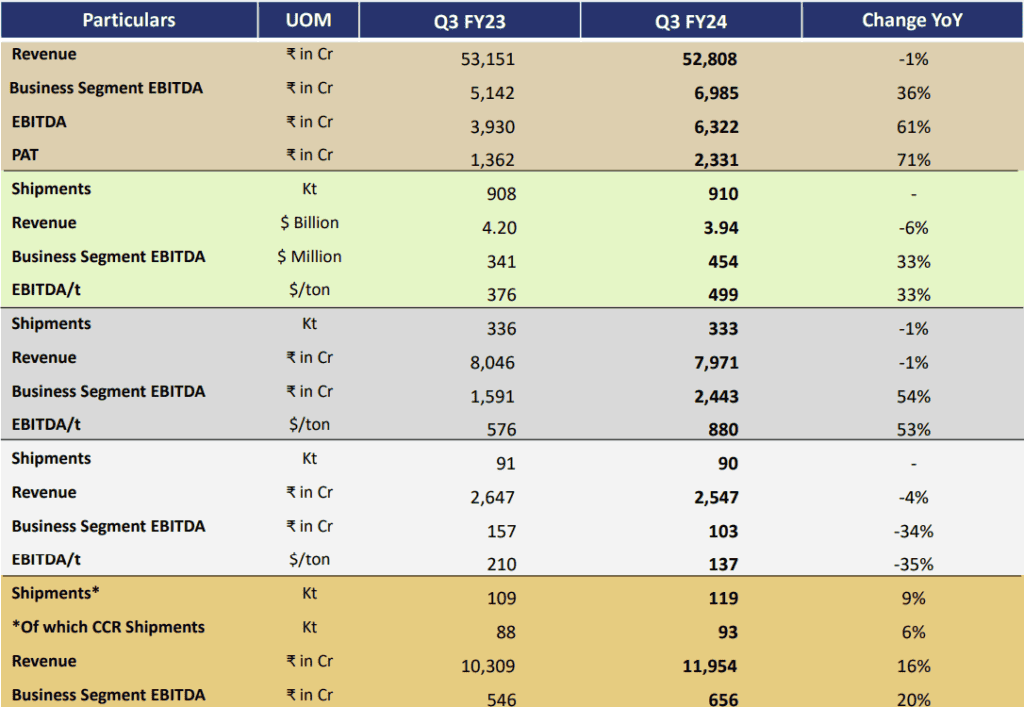

After the basics about the company, now let’s look at Hindalco quarterly results

The figures represent Hindalco results, a detailed financial summary for Q3 FY23 and Q3 FY24. The stock price of the firm right now is 568.25 (as of April 1, 2024).

These figures indicate a robust financial performance by Hindalco in these quarters. The Hindalco share price would be influenced by these strong financial results, reflecting the company’s healthy market position.

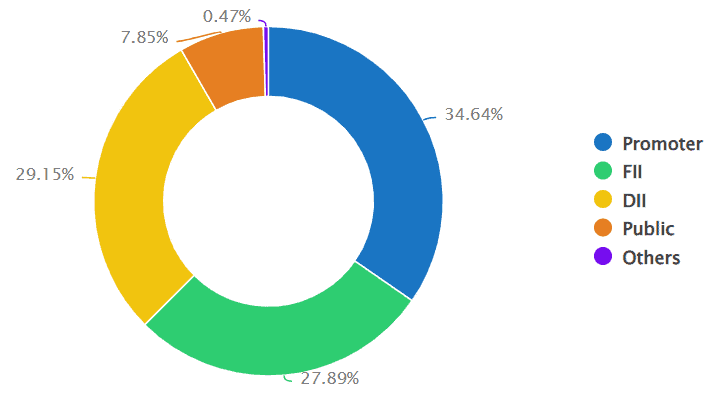

Shareholding pattern:

Also read: https://www.stockgro.club/blogs/stock-market-101/fii-vs-dii/

Comparative analysis

| Hindalco | JSW Steel | |

| Price | 568.25 | 871.00 |

| % change | 1.43 | 4.96 |

| Market capitalisation ( ₹Cr) | 127,698.08 | 213,084.63 |

| TTM PE | 13.60 | 19.06 |

| P/B | 1.35 | 3.25 |

| ROE (%) | 10.65 | 6.30 |

| 1 Yr performance (%) | 40.19 | 26.63 |

| Net profit (₹) | 10,088 | 4,276 |

| Net sales (₹) | 223,202 | 165,960 |

| Debt to equity | 0.62 | 1.20 |

Starting with the share price, Hindalco’s share price stands at ₹568.25, while JSW Steel’s is higher at ₹871.00. The percentage change in share price is 1.43% for Hindalco and 4.96% for JSW Steel, indicating a more significant recent increase for JSW Steel.

In terms of market capitalisation, JSW Steel (₹213,084.63 crore) is larger than Hindalco (₹127,698.08 crore). The trailing 12-month price-to-earnings (TTM PE) ratio is lower for Hindalco (13.60) compared to JSW Steel (19.06), suggesting that Hindalco’s shares are less expensive relative to its earnings.

The price-to-book (P/B) ratio is higher for JSW Steel (3.25) than Hindalco (1.35), indicating that the market values every rupee of JSW Steel’s net assets more highly. The return on equity (ROE) is higher for Hindalco (10.65%) than JSW Steel (6.30%), suggesting that Hindalco is more efficient at generating profits from its shareholders’ equity.

Over the past year, Hindalco’s performance (40.19%) has outpaced JSW Steel’s (26.63%). Hindalco also has a higher net profit (₹10,088 crores) and net sales (₹223,202 crores) compared to JSW Steel’s net profit (₹4,276 crores) and net sales (₹165,960 crores).

Hindalco has a lower debt-to-equity ratio (0.62) than JSW Steel (1.20), indicating that Hindalco has been more conservative in its use of debt.

While JSW Steel has a larger market capitalisation and has seen a more significant recent increase in share price, Hindalco outperforms JSW Steel in several key financial metrics, including ROE, one-year performance, net profit, net sales, and debt management.

It’s crucial to keep in mind that these numbers can fluctuate quickly, and investors should always perform comprehensive research and take into account various factors before making investment choices.

Challenges and opportunities in the steel industry

Challenges:

Overproduction: The steel industry, particularly in China, has been grappling with overproduction, leading to a supply-demand imbalance.

Environmental concerns: The manufacturing process of steel contributes significantly to the emission of greenhouse gases. Adhering to environmental initiatives, such as reducing emissions, is a pressing challenge.

Quality of raw materials: The depletion of high-quality raw materials and the use of low-quality substitutes could lead to environmental pollution.

Opportunities:

Demand growth: With countries moving towards infrastructural development, the global demand for steel has increased exponentially.

Technological advancements: The emergence of Industry 4.0 technologies offers potential for enhanced efficiency and performance.

Foreign direct investment (FDI): The industry can attract more FDI by adopting the latest production technology and efficient use of resources.

Also read: https://www.stockgro.club/blogs/trending/iron-and-steel-industry-in-india/

Bottomline

JSW Steel and Hindalco Industries are prominent players in the steel and aluminium sectors, respectively. While JSW Steel boasts a higher market capitalisation and recent share price surge, Hindalco outperforms key financial metrics like return on equity, net profit, and net sales.

Both companies face challenges such as overproduction and environmental concerns but also benefit from growing demand and technological advancements. When making investment selections, investors should keep these aspects in mind.

Further reading: https://www.stockgro.club/blogs/trending/adani-port-vs-jsw-infra-shares/