We all love a good bargain, don’t we?

But what happens when we are forced out of our comfort zone of affordability? This is where understanding the cost of living comes into play. And what better way to understand it than by comparing the purchasing power of our beloved rupee in different cities across the globe? Here’s a run-through the rupee’s worth:

Cost of living is the amount of money required to maintain a certain standard of living in a specific location. Understanding the cost of living in different cities is crucial for planning your finances and lifestyle.

So, let’s dive into the factors that affect the cost of living in different cities.

Factors that Affect Cost of Living

Housing

It is one of the most significant expenses for most people. Housing costs can make or break your budget.

In New York, a one-bedroom apartment in the city centre can cost you around 1 lakh rupees per month, whereas in Mumbai, you can rent a similar apartment for about 50,000 rupees. Factors like location, size, and amenities affect housing costs.

| Rent Per Month | Mumbai | New York, NY | Difference |

| Apartment (1 bedroom) in City Centre | 44,927.27 ₹(547.58 $) | 318,670.56 ₹(3,884.00 $) | +609.3 % |

| Apartment (1 bedroom) Outside of Centre | 25,608.70 ₹(312.12 $) | 198,103.40 ₹(2,414.51 $) | +673.6 % |

| Apartment (3 bedrooms) in City Centre | 117,325.58 ₹(1,429.98 $) | 599,437.90 ₹(7,306.03 $) | +410.9 % |

| Apartment (3 bedrooms) Outside of Centre | 63,250.00 ₹(770.90 $) | 332,525.92 ₹(4,052.87 $) | +425.7 % |

Source – Numbeo

Food

A man’s gotta eat, but at what cost? According to a recent comparison, basic food items such as bread, milk, and potatoes are significantly cheaper in India compared to other nations.

In fact, a 500g loaf of bread costs around 320 ₹ in New York, which is over five times the price in India.

While 1$ can get you a decent meal or snack in some parts of the world; unfortunately, the same cannot be said for 1₹.

Interestingly, despite the higher food prices in countries like the US and UK, the overall cost of food is still lower than in India. This is due to the higher GDP per capita in these countries, which is 31 times that of India in 2020.

In addition, the average income of a British citizen is 17 times higher than that of an average Indian, further contributing to the cost difference. Factors like availability, quality, and demand affect food costs.

Transportation

Transportation is a wallet-buster; it can quickly add up in some cities. In London, a monthly travel card for public transport can cost you around 8,500 ₹, while in Bangalore, a monthly pass will only set you back around 1,200 ₹.

Factors like distance, mode of transportation, and fuel prices affect transportation costs.

| Transportation | India | United Kingdom | Difference |

| One-way Ticket (Local Transport) | 25.00 ₹ (0.25 £) | 254.43 ₹ (2.50 £) | +917.7 % |

| Monthly Pass (Regular Price) | 800.00 ₹ (7.86 £) | 6,637.33 ₹ (65.22 £) | +729.7 % |

| Taxi Start (Normal Tariff) | 50.0 ₹ (0.49£) | 305.32 ₹ (3.00 £) | +510.6 % |

| Taxi 1km (Normal Tariff) | 20.00 ₹ (0.20 £) | 126.20 ₹ (1.24 £) | +531.0 % |

| Taxi 1 hour Waiting (Normal Tariff) | 100.00₹ (0.98 £) | 1,770.84 ₹ (17.40£) | +1,670.8% |

Source – Numbeo

Entertainment

Whether you’re a cinephile, a music lover, or just like to hit the town for a night out, entertainment is a big part of the cost of living. Entertainment is another factor that can vary greatly depending on the city you’re in.

In Dubai, a movie ticket can cost you around 1000 ₹ rupees, while in Delhi, you can get a ticket for less than 300 ₹. Popularity, availability of entertainment options, and quality affect the costs of entertainment.

Read Also: How to Invest in US Stocks from India?

Impact of Currency Exchange Rates on Cost of Living

Now that we’ve covered the factors contributing to the cost of living let’s talk about the impact of currency exchange rates. When travelling or living abroad, currency exchange rates can significantly impact purchasing power.

For example, if the exchange rate between the Indian rupee and the US dollar is 1: 0.012, then 1 US dollar would be equivalent to around 83 ₹. This means that if you’re living in New York and your rent is $1,000 per month, you’d need to shell out around 83,000 ₹.

But what happens when the exchange rate changes? Let’s say the exchange rate increases to 1 : 0.014, then 1 US dollar would only be worth around 71 ₹. This means your rent would now cost you around 71,000 Rs, saving you 12,000 ₹ monthly!

For instance, when the rupee is weak against the dollar, it becomes more expensive to live or travel in the United States.

In another instance, if you’re planning to study in Europe and the euro is stronger than the rupee, you’ll need to factor in the higher cost of living. On the other hand, if the rupee is stronger than the euro, you can stretch your money further.

How powerful is the Indian rupee?

The value of your money, or in other words, purchasing power parity, is a fancy term that refers to how much your money can actually buy you in different parts of the world.

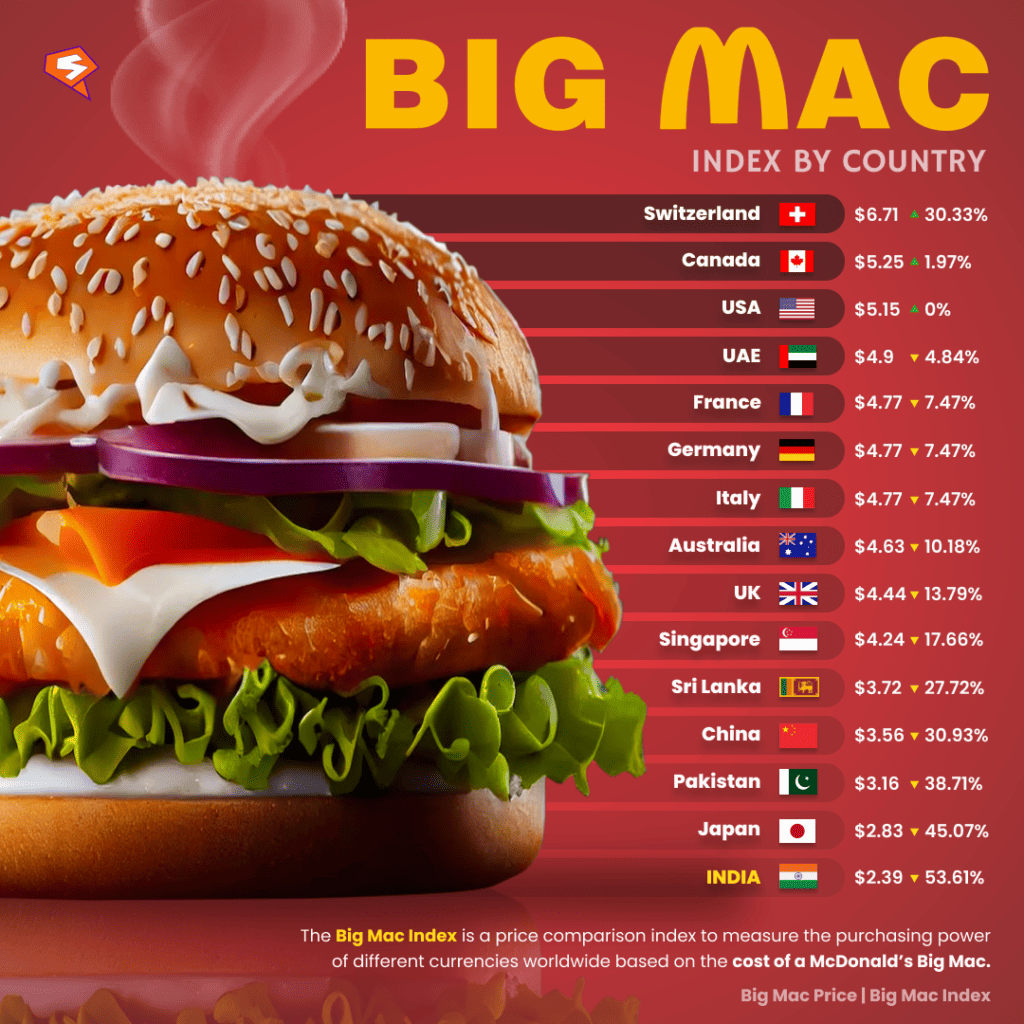

Have you ever wondered why the price of the same product varies between countries? That’s where the Big Mac Index comes in. Yes, I’m talking about that famous burger that we all love. The Big Mac Index is a fun way of comparing the prices of the same product, the Big Mac burger, in different countries.

Let’s take the example of a Big Mac. In the US, a Big Mac costs around $5, which is equivalent to 400 ₹. However, in India, the same burger costs only 200 ₹. That’s quite a difference! The reason for this difference is the PPP.

So, why is the Big Mac cheaper in India than in the US? It’s because of lower input costs (like lower rent, salaries, and other expenses).

This means that even though the exchange rate is INR 80 for $1, the PPP between the US and India is 1$ = INR 22. The Indian rupee might seem weak compared to the US dollar, but its purchasing power is much stronger in India.