Prepare for an exciting journey as Indegene, a leading player in healthcare solutions, takes centre stage with its highly anticipated initial public offering (IPO).

This article provides a deep analysis of this significant event, giving you an exclusive perspective on the Indegene latest news – Indegene IPO specifics, the company’s history, and its implications for the market. Stay tuned as we explore this thrilling development in the realm of healthcare technology!

Also read: NFO or IPO – What do you think is the better option?

Indegene IPO details

The Initial Public Offering (IPO) of Indegene is structured as a book-built issue, amassing a total of ₹1,841.76 crores. This sum is the aggregate of a fresh issue of 1.68 crore shares, which amounts to ₹760 crores, and an offer for sale of 2.39 crore shares.

The subscription window for the Indegene IPO is set to commence on May 6, 2024, and will conclude on May 8, 2024. The allotment status for the IPO is anticipated to be determined by Thursday, May 9, 2024. Then, on Monday, May 13, 2024, the preliminary listing is set to take place, and the IPO is anticipated to launch on the BSE and NSE.

| Book-built issue | ₹1,841.76 crores |

| Fresh issue (₹) | ₹760 crores |

| Offer for sale | 2.39 crore shares |

| IPO opening date | May 6, 2024 |

| IPO closing date | May 8, 2024 |

| Listing date | May 13, 2024 |

Source: Indegene Limited – Red Herring Prospectus

The Indegene Limited IPO has a lot size of 33 shares. Here are the details:

- For those investing as retail individual investors, the smallest investment possible is 1 lot, which is equivalent to 33 shares and costs ₹14,916. On the other hand, the largest investment allowed is 13 lots, translating to 429 shares and a cost of ₹193,908.

- When it comes to small individual investors, the smallest permissible investment is 14 lots, equating to 462 shares and a total cost of ₹2,08,824.

- Lastly, for big individual investors, the minimum investment threshold is set at 68 lots, which corresponds to 2,244 shares and amounts to ₹10,14,288.

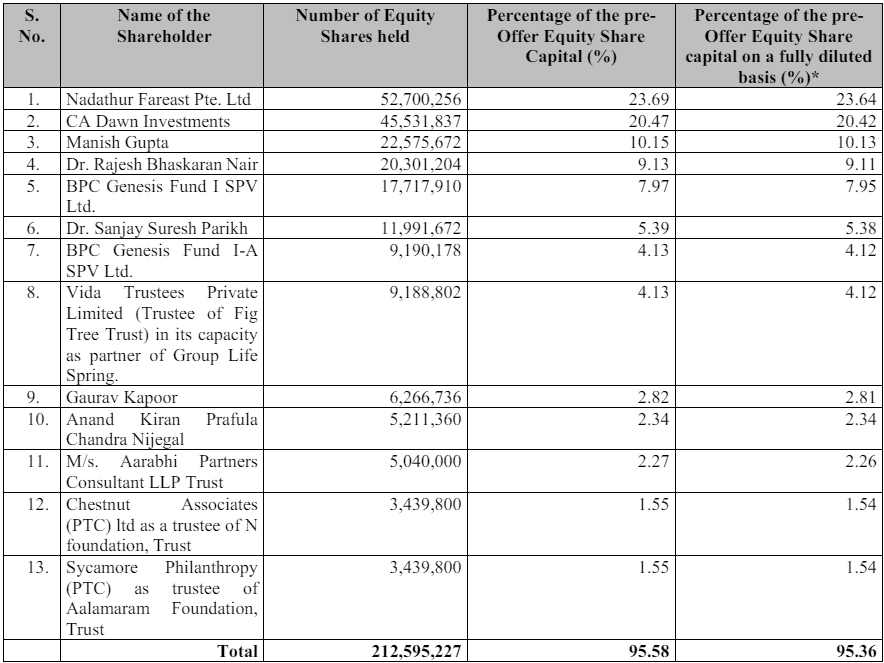

This table represents the details of the equity shareholding of the major shareholders in the company:

Source: Indegene Limited – Red Herring Prospectus

Objectives of IPO

- To repay or prepay the debt of a significant subsidiary, ILSL Holdings, Inc.

- To finance the capital expenditure needs of the company and another key subsidiary, Indegene, Inc.

- For general corporate activities and to facilitate growth through acquisitions.

Indegene private limited

Indegene company is dedicated to assisting biopharmaceutical, emerging biotech, and medical device companies in developing their products. They focus on bringing these products to market and expanding their impact throughout the product life cycle.

Their approach is characterised by efficiency, effectiveness, and modernity, ensuring that their clients can navigate the complex healthcare landscape with ease.

Also read: The healthcare industry in India: An overview

The company offers a wide range of services, including enterprise commercial solutions, omnichannel activation, enterprise medical solutions, enterprise clinical solutions, and consultant services, among others.

At the core of the company’s services is integrating healthcare domain expertise with fit-for-purpose technology. Because of this synergy, they are able to provide a comprehensive menu of options designed to meet each client’s specific requirements.

By leveraging their deep understanding of the healthcare industry and cutting-edge technological tools, they can deliver high-quality outcomes that are both scalable and personalised.

The company operates with an agile model, which enables them to respond quickly to the changing demands of the healthcare sector. This adaptability is vital in a field where new ideas and quick changes are the keys to success. Their agile approach ensures they can provide timely and relevant solutions that keep their clients ahead of the curve.

One of the company’s primary goals is to create an omnichannel experience for patients and physicians that is both personalised and scalable. They strive to deliver solutions that enhance the interaction between healthcare providers and recipients, making it more convenient, efficient, and effective.

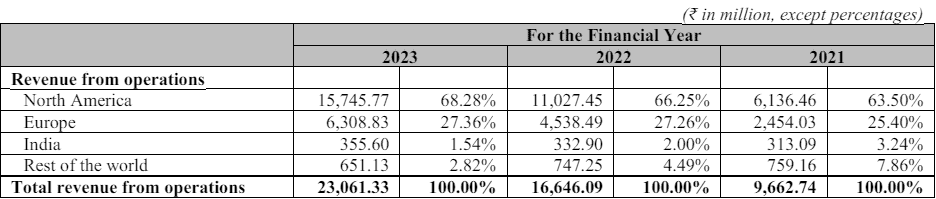

The table gives a comprehensive regional breakdown of a company’s operational revenue.

Source: Indegene Limited – Red Herring Prospectus

Financial profile

Indegene Limited, a global leader in providing clinical, commercial, and marketing solutions to healthcare organisations, has shown robust financial performance.

Some of the most important financial measures for the business are these:

| Particulars | As of Dec 31, 2023 (₹ million) |

| Total non-current assets | 7,470.56 |

| Total current assets | 17,710.91 |

| Total liabilities | 11,911.46 |

| Revenue from operations | 19,166.11 |

| Net profit | 2,419.02 |

| EPS | 10.91 |

| Cash generated from operating activities | 3,542.67 |

| Cash and cash equivalents at the end of the period | 1,199.44 |

Source: Indegene Limited – Red Herring Prospectus

Also read: Earnings Per Share (EPS): What it means and how to calculate it

Company’s strengths and weaknesses

Strengths

- Healthcare expertise: A significant portion of the delivery employees have healthcare-related educational backgrounds, indicating strong domain expertise in healthcare.

- Robust digital capabilities: The company has developed proprietary tools and platforms with advanced AI and analytics capabilities, showcasing its robust digital prowess.

- Long-standing client relationships: Indegene has forged lasting partnerships with leading biopharmaceutical firms, including all of the top 20 global biopharmaceutical companies in terms of revenue. This underscores its credibility and standing in the industry.

- Global delivery model: The company has a global presence, catering to clients through 6 strategic centres and 17 offices spread across North America, Europe, and Asia.

- Value creation through acquisitions: Indegene has a track record of creating value through strategic acquisitions, enhancing its capabilities and market position.

Weaknesses

- Industry-centric revenue: The company’s revenue is entirely generated from clients within the life sciences industry, particularly from the biopharmaceutical sector, and is influenced by the industry’s growth, outsourcing trends, healthcare reforms, and the pace of digitisation.

- Client concentration: Indegene garners over 69.00% of its total revenue from its top 20 clients, who are among the world’s largest biopharmaceutical companies. This heavy reliance on a limited client base could present a risk if any of these key clients decide to cut back on their spending or end their contracts.

- Industry-specific focus and investor familiarity: The company’s operations are exclusively concentrated in the life sciences sector. This may make it less familiar to potential investors compared to other service providers like IT/BPO firms or product/platform organisations that cater to a diverse range of industries.

- Client restructuring: Business and operational restructuring within the company’s clients has in the past, and could potentially, lead to a reduction in the number of the company’s clients and potential clients. Such restructuring may include consolidations, de-consolidations, and internal reorganisations.

Bottomline

Indegene’s forthcoming initial public offering (IPO) represents a pivotal moment in the healthcare solutions sector, presenting a distinctive chance for investors to participate in the company’s expansion journey.

The company’s commitment to transforming the healthcare industry with its pioneering solutions and advanced technology is praiseworthy.

Through the flawless amalgamation of healthcare domain knowledge and contemporary technological resources, Indegene has established itself as an international frontrunner in delivering clinical, commercial, and marketing solutions to healthcare entities globally.