Since its establishment in 1987, the Indian Renewable Energy Development Agency Ltd., often known as IREDA, has been a significant contributor to the funding of energy-related and renewable-source projects.

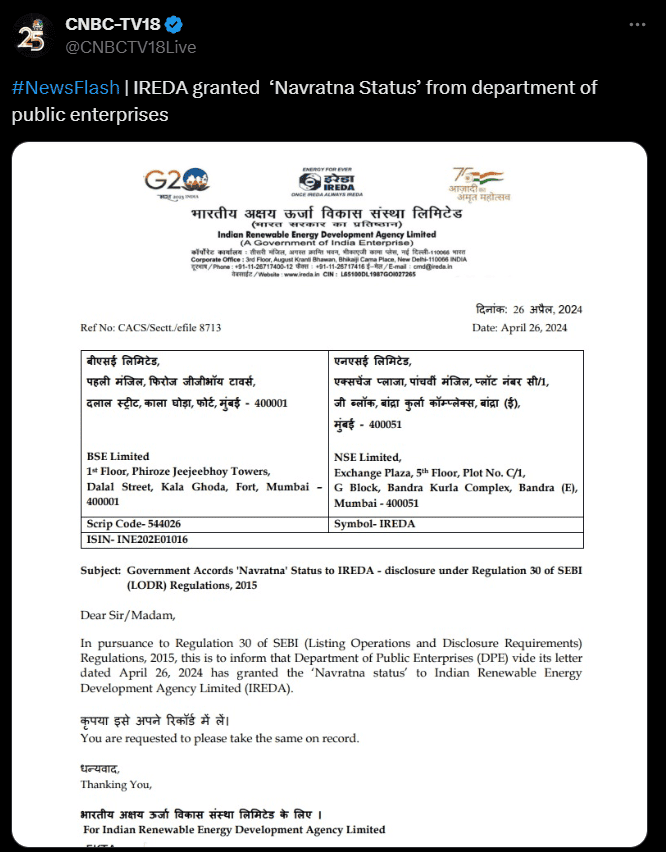

With the recent achievement of the renowned ‘Navratna’ title, the corporation gains more financial autonomy and decision-making capabilities, marking a significant turning point.

Let’s look at this achievement and how it affects the company’s finances, market position, and investment prospects.

About Indian Renewable Energy Development Agency Ltd. (IREDA)

The Indian Renewable Energy Development Agency (IREDA) is a government-owned company that engages in the promotion, development, and provision of financial support for initiatives related to energy efficiency and conservation (EEC) and renewable energy (RE).

In November 2023, IREDA went public for the first time. This organisation was a Mini Ratna (Category I) government company, run by the Ministry of New and Renewable Energy (MNRE).

Recently, IREDA has attained Navaratna status, which means the PSU no longer needs the central government’s clearance to invest up to ₹1,000 crore in a single financial year.

IREDA attains Navaratna status: IREDA share price soars over 10%

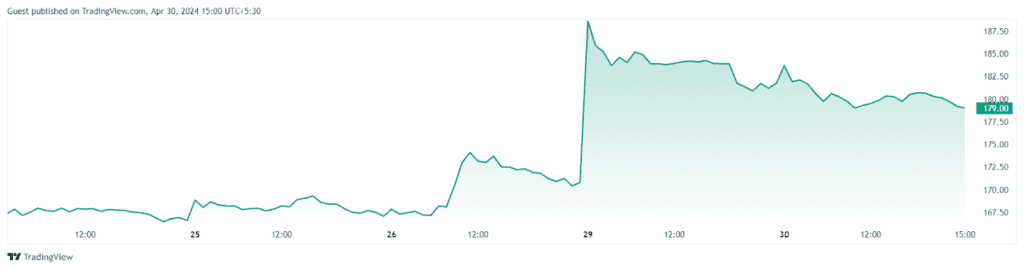

Shares of IREDA, the non-bank finance company that the central government owns entirely, increased by more than 10% when the markets opened on April 29.

This surge followed the “Navratna status” award to the public sector undertaking corporation by the Department of Public Enterprises. The opening trading price of IREDA on the BSE was ₹186.20, and the stock went as high as ₹191.50 and as low as ₹182.05, according to IREDA’s share price history.

Source: TradingView

When looking at the IREDA through the lens of stock market experts, this is a step forward, as the ‘Navratna’ title will allow the government-owned corporation to proceed more swiftly towards its objectives.

Several joint ventures in India and overseas will no longer need authorisation from the government under IREDA. After the strong Q4 results of 2024, they claim that this GoI agreement is a boon for the company and its shareholders.

The state-owned company announced a 33% increase in net profit to ₹337.38 crore for the quarter ended in March 2024, driven by higher revenues. In Q4 of FY24, the overall revenue climbed from ₹1,036.31 crore to ₹1,391.63 crore. From January to March 2024, the profit before tax (PBT) increased by 66.33%, reaching 479.67 crores, compared to ₹288.38 crores in Q4 FY23.

About Navratna status and criteria

In India, Navratna companies can make significant investments up to ₹1,000 crore without requiring Central Government clearance. They can autonomously decide on strategies owing to their financial independence.

If Navratna enterprises have a net worth of less than ₹1,000 crores, they can invest up to thirty per cent of their net worth in a year. They may also create subsidiaries overseas, develop partnerships, and participate in joint ventures.

Criteria for the Navratna status are as follows:

- As stated in Schedule A of Central Public Sector Enterprises (CPSEs), the organisation is expected to have the Miniratna Category I classification.

- For a minimum of three of the previous five years, it must have continuously earned an exceptional grade under the Memorandum of Understanding System.

- The business must fulfil certain requirements in areas like net profit to net worth, PBDIT to capital employed, etc. In each of these categories, the organisation has to have a composite score of 60 or above.

Quarterly performance of IREDA in FY24

| JUN ’23 -Q1 | Sept ‘23- Q2 | Dec ‘23- Q3 | Mar ‘24- Q4 | |

| Revenue (₹ cr.) | 1,143 | 1,177 | 1,253 | 1,391 |

| Net Profit (₹ Cr.) | 295 | 285 | 336 | 337 |

| EPS | 1.29 | 1.25 | 1.25 | 1.26 |

Current financials

| Metric | Value (as of 30 April 2024) |

| Market cap (₹ Cr.) | 48379.77 |

| Book value (₹) | 31.8 |

| ROE | 17.3% |

| Stock PE | 39.3 |

Shareholding pattern of IREDA

The shareholding pattern (as of March 2024) of IREDA is as follows:

| Promoters | 75% |

| Foreign Institutional Investors (FIIs) | 1.36% |

| Domestic Institutional Investors (DIIs) | 0.94% |

| Public | 22.70% |

Competitors of IREDA

| TTM PE | Market cap(₹ crores) | ROE (%) | Net profit last quarter | |

| IRFC | 33.99 | 206874.47 | 14.66 | 1604.23 |

| REC Ltd. | 10.19 | 134136.35 | 22.19 | 4079.09 |

| Power Finance Corporation | 7.71 | 145204.48 | 20.40 | 6294.44 |

Investing in IREDA

Pros

- Solid financial position and profitability:

IREDA’s Profit After Tax (PAT) for Q4 FY24 was ₹337.38 crore, an increase of 33% against Q4 FY23. The strong financial performance of this company has been mirrored in its share price, which has significantly surged over 10%. Investors are pleased with the company’s achievement since the share price has soared.

Given its Navratna status, IREDA is anticipated to significantly improve its operational efficiency and financial autonomy.

- Excellent track record in loan disbursements and sanctions:

In FY24, IREDA sanctioned a record-breaking ₹37,354 crore in loans and disbursed ₹25,089 crore. The substantial market need for renewable energy funding and IREDA’s capacity to fulfil it efficiently is shown by high loan sanctioning and disbursements.

- Government assistance and position in the market:

IREDA, a significant participant in the renewable energy financing category, has a 31% market share. Efforts by the government to promote renewable energy have benefited the corporation and potentially resulted in long-term prosperity.

Cons

- Technological advancements and competition in the industry:

As new technologies emerge, competition in the renewable energy market intensifies.

If the company wants to succeed in the long run, IREDA has to keep up with technological developments and maintain its competitive advantage.

- Policy dependence:

Government regulations and support for renewable energy have an impact on IREDA’s operations and profitability. The company’s financial results might be impacted by any major changes in government policy or reductions in subsidies.

- Sector comparison:

In comparison to the sector average of 17.65, IREDA’s PE ratio is 38.4 as of April 30, 2024. Some may find IREDA’s higher PE ratio concerning when contrasted with the average for the sector. This might be something that investors think about while evaluating the stock.

Conclusion

This government-owned company has been working hard to finance renewable energy projects across India for decades, and now they’ve earned the right to make bigger investment decisions on their own.

With their impressive financial performance and the government’s backing, IREDA seems poised for success. Of course, there are always challenges, like keeping up with new technologies and dealing with competition. But overall, this Navratna status could give IREDA a real boost in achieving its goals in the future.