In the grand theatre of India’s hospitality industry, two narratives are being dramatically played out. Enter the stage, Indian Hotels Co. Ltd., the maestro behind the legendary Taj, and EIH Ltd., the virtuoso of the esteemed Oberoi and Trident.

With intense competition between these two giants in the hospitality industry, the sector is projected to surge from $247.31 billion in 2024 to an impressive $475.37 billion by 2029, expanding at a compound annual growth rate (CAGR) of 13.96%. This positions us as privileged spectators to a remarkable contest of corporate expertise.

This article provides an in-depth look into the operations of these industry leaders, delving into their strategies and achievements.

Company profiles

Indian Hotels Co

The Indian Hotels Company Limited (IHCL), renowned for its prestigious Taj brand, is a symbol of Indian hospitality with a long and illustrious history since its establishment in 1902 by the visionary industrialist Jamsetji Tata.

With its headquarters located in the vibrant city of Mumbai, IHCL has created a collection of high-end hotels that offer a range of experiences. From the renowned Taj hotels to the modern Vivanta brand, the innovative Ginger hotels, and the distinctive SeleQtions hotels, each property caters to a specific type of traveller looking for sophistication, style, and exceptional \]976 hospitality.

In the context of paying dividends, Indian Hotel’s dividends have a strong track record of consistently declaring them for the past 5 years.

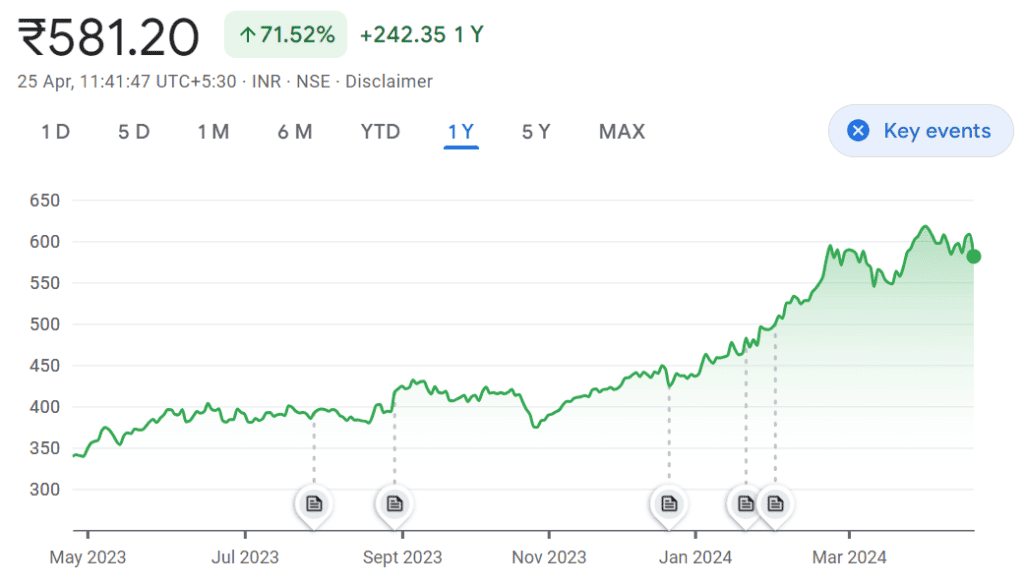

As of April 25, 2024, the Indian Hotels share price is ₹581.20.

Source: Google Finance

This chart represents the Indian Hotel share rate over the past year.

EIH Ltd

EIH Hotels, known as the flagship company of the prestigious Oberoi Group, is a beacon of luxury in the hospitality industry.

Operating under three distinguished brands – Oberoi, Trident, and Maidens – EIH has built a legacy that seamlessly combines elegance with impeccable service. These hotels offer more than just a place to stay; they provide an immersive experience that captures the epitome of luxury and individualised attention.

The company’s dedication to excellence is clear in its extensive portfolio, boasting over 30 properties in more than 14 locations, encompassing 4,269 rooms, and expanding its presence to 6 countries.

EIH Ltd news: As of April 25, 2024, the EIH Ltd share price is ₹449.95.

Source: Google Finance

This chart represents the EIH Ltd share rate over the past year.

Indian Hotels & EIH Ltd Financials

Now, let’s compare EIH Ltd results provided in EIH Ltd annual report with that of Indian Hotel results:

| Indian Hotels Co(Q3FY24) | EIH Ltd(Q3FY24) | |

| Revenue (₹ crores) | 1,964 | 741 |

| Operating profit (₹ crores) | 732 | 324 |

| Profit before tax (₹ crores) | 605 | 304 |

| Net profit (₹ crores) | 477 | 230 |

| EPS (₹) | 3.18 | 3.51 |

Source: Screener

Reasons for growth

Indian Hotels Co

- Purpose-driven vision: IHCL strives to become the most renowned and lucrative hospitality company in South Asia, fueled by the mission of generating value through exceptional hospitality brands.

- Tajness culture: The distinct culture of ‘Tajness’ embodies the company’s dedication and enthusiasm for delivering exceptional guest experiences, which is at the core of its strategy.

- Diversified revenue: The company has been dedicated to expanding its revenue sources, revitalising its brands, and improving operational efficiency to achieve financial success.

- Sustainable growth: IHCL’s approach prioritises sustainability, with a focus on environmental stewardship, social responsibility, and responsible corporate governance.

EIH Ltd

- Diversification: The company’s growth can be attributed to its strategic diversification across different business segments, such as real estate, hospitality, and infrastructure projects.

- Market expansion: The company’s growth trajectory has been bolstered by its expansion into various geographical regions.

- Strategic acquisitions: The company’s growth is driven by strategic acquisitions, which allow it to expand into new markets and reach a wider customer base.

- Strong financial performance: The company’s impressive financial performance, with notable revenue growth and profitability, has played a crucial role in fueling its overall expansion.

- Innovation and adaptability: Embracing innovation and adapting to market changes have been crucial in maintaining the company’s competitiveness and driving its growth.

Indian Hotels Co & EIH Ltd strategies

Indian Hotels Co

- Portfolio growth: The company has achieved significant growth in its hotel portfolio, having secured agreements for 28 properties and inaugurated 16 new hotels so far this year. The goal is to have a total of 85 hotels in development, with the objective of launching an average of two new hotels each month.

- New brands and businesses: Launching new brands and reimagining businesses, anticipating a strong 30% year-on-year growth, with a keen emphasis on pursuing asset-light expansion and broadening the sources of top-line revenue.

- Effective asset management: Strategic investments in assets to fuel growth and maximise value, prioritising the maintenance of high-quality products and utilising the company’s extensive presence in various locations.

- Customer loyalty and centricity: Utilising the Tata Neu loyalty platform to enhance customer engagement, with a focus on expanding the loyalty base and implementing strategic marketing campaigns to drive revenue growth.

EIH Ltd

- Expansion plans: The company’s primary objective is to achieve significant growth by adding 15 new hotels to its portfolio by 2030. These properties will be a mix of leisure and city hotels, enabling the company to broaden its reach and cater to a diverse clientele.

- Location strategy: The company focuses on selecting prime locations for city hotels and exceptional destinations for leisure hotels.

- Service quality: The company upholds exceptional standards of service and attention to boost revenues from room rates and occupancy.

- Hotel upgrades: Devote time and attention to enhancing hotels to stand out from competitors and cater to lucrative business opportunities.

Future outlook of hospitality industry

The future expectations of the Indian hotel industry look bright and are expected to be influenced by various significant trends.

The hospitality industry is on the brink of a technological revolution. With the rise of contactless check-ins and smart room controls, technology is playing a crucial role in improving guest experience and making operations more efficient.

Sustainability has become a fundamental principle that is shaping the future of the hospitality industry. Hotels are embracing a new approach that aligns with global environmental goals, incorporating eco-friendly construction materials and energy-efficient operations.

The culinary landscape within the hospitality industry is positioned to experience a fundamental transformation. The era of guests being content with just basic nourishment is over; they now crave engaging and immersive food experiences.

Nevertheless, the industry encounters obstacles such as fierce competition, shifts in regulations, and the imperative to constantly innovate to satisfy evolving customer demands.

Bottomline

The future of Indian hospitality is shaped by technological advancements, sustainability, and evolving culinary experiences, despite challenges like intense competition and regulatory changes.

Powerhouses like Indian Hotels Co. Ltd. (IHCL) and EIH Ltd. are leading the way, exhibiting strategic growth through portfolio expansion, brand diversification, and a focus on sustainability and innovation.

These developments encapsulate the dynamic nature of the hospitality industry in India, providing a snapshot of its current state and prospects.

Leave a Comment