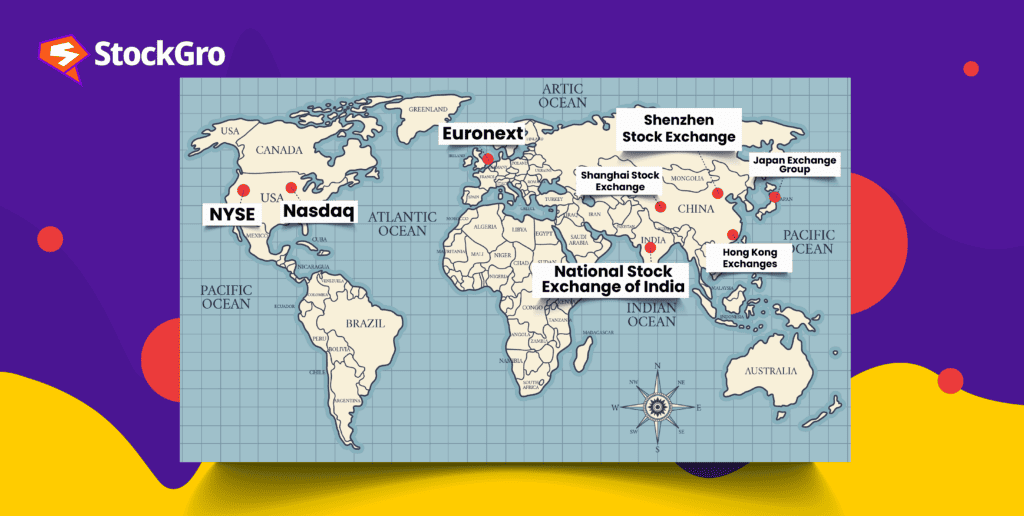

Did you know that there are currently about 80 significant stock exchanges in the world with a combined market capitalisation of $110.2 trillion as of August 2023?

The NYSE and NASDAQ, the two largest exchanges around the globe, hold 42.4% of the world’s market cap. Even though emerging economies are growing at a rapid pace, the United States still dominates the capital markets by a wide margin. India, for example, is expected to overtake the United Kingdom in 2023.

India has been engaged in stock trading since the 18th century, when the East India Company began purchasing and selling loan securities. India also boasts the first stock exchange in Asia, the Bombay Stock Exchange.

In this article, we will talk about the major largest stock exchange worldwide by market capitalisation. Let’s get started.

You may also like: How to Invest in US Stocks from India?

What is a stock exchange?

Stock exchanges are where the process of buying and selling shares or other securities takes place.

Organisations may acquire capital on exchanges by issuing shares, bonds, or other securities to public investors, and investors can use real-time market data to make well-informed decisions.

Apart from that, stock exchanges also offer liquidity, guaranteeing that there is always a sufficient amount of capital available for trading stocks. In India, SEBI regulates the stock exchanges, where BSE and NSE are the leading ones. Read the day BSE shares dropped sharper than ever.

In a stock market, there are various entities involved, apart from the exchanges. While companies and investors might be an easy guess, other key players are stockbrokers, regulators, financial intermediaries, depository, depository participants, and clearing corporations. Learn about different types of stock market portfolios to generate maximum profits.

Below is an illustration of the largest stock exchanges around the world by market capitalisation of the companies listed as of October 2022 (in trillions of U.S. dollars).

List of Top stock exchanges in the world

Even though the size of the U.S. stock market is unparalleled in a global context, investors may choose to diversify their portfolios by investing in different exchanges worldwide. Uncover the key role of stock exchanges. This is why we have listed the top 10 exchanges in the world for you to make a better decision about your investments.

New York Stock Exchange (NYSE)

The New York Stock Exchange (NYSE) has its headquarters in New York City, the United States. With around 2,400 publicly traded businesses, the NYSE has a market capitalisation of $25.24 trillion as of September 2023.

The listed businesses are diverse across all industries and comprise a large number of blue-chip companies. The S&P 500 Index, which is frequently used as a threshold for the overall economic status of the U.S. stock market, is primarily composed of companies that are listed on the largest stock exchange in the world.

National Association of Securities Dealers Automated Quotations (NASDAQ)

Founded in 1971, NASDAQ is the first electronically operated stock exchange and the second-largest stock exchange worldwide. With over 3,000 publicly traded businesses, NASDAQ boasts a market capitalisation of 20.58 trillion U.S. dollars as of September 2023.

Large, renowned tech companies like Microsoft, Google, Facebook, Amazon, Tesla, Apple, and others are listed on the NASDAQ exchange. It does not, however, have any listed companies in the gas, oil, or utility industries. It leans more towards the consumer products and services, healthcare, and tech industries.

Shanghai Stock Exchange (SSE)

China not only has the second-biggest economy in the world, but it also has one of the major stock exchanges. In terms of market capitalisation, the SSE ranks third globally and first in Asia.

Because it relies on government oversight, the SSE stands apart from Western exchanges. Investors from outside China are subject to strict laws enforced by the government on the country’s stock markets.

The SSE Composite Index is the benchmark index of the SSE. With a total market valuation of 6.6 trillion USD as of September 2023, it includes over 2200 public limited companies.

European New Exchange Technology (Euronext)

Euronext is a multi-state stock exchange, which means it covers more than one state. Businesses listed on the Euronext stock exchange had a total market cap of about 6.26 trillion euros by the end of September 2023. Since it serves multiple states, it runs exchanges in various locations, such as Oslo, Milan, Dublin, Paris, Brussels, Lisbon, and Amsterdam.

Some of the most renowned businesses are listed on this platform, like L’Oréal, Royal Dutch Shell, and Procter & Gamble. French luxury goods titan LVMH Moët Hennessy Louis Vuitton is the most prominent brand trading on the Euronext market.

Japan Exchange Group (JPX)

The Tokyo Stock Exchange and the Osaka Securities Exchange are two of the many stock exchanges run by the Japan Stock Exchange (JPX), a Japanese securities trading company. The two companies merged on January 1, 2013, to form it.

The combined market value of all the companies listed on JPX exceeds US$ 5.75 trillion at the end of September 2023.

Shenzhen Stock Exchange (SZSE)

With a market valuation of $4.38 trillion at the end of September 2023, SZSE is home to 2,836 publicly traded businesses.

The SZSE, which has been around since 1990, is China’s second-largest stock exchange, right behind the Shanghai Stock Exchange.

Also read: A beginner’s guide to the stock market

Hong Kong Stock Exchange (HKEX)

Among Asia’s stock markets, the third largest Stock Exchange is Hong Kong, which has been around since 1891. The Hang Seng Index makes up about 58% of the total market capitalisation of HKEX; it is a free-floating, adjusted-MCap-weighted index that includes 50 stocks.

China Mobile, PetroChina, HSBC Holdings, AIA, Bank of China, and many more global powerhouses are trading on the exchange.

The top 20 companies make up the majority of the market capitalisation, which currently stands at $4.1 trillion as of September 2023.

National Stock Exchange (NSE)

While the BSE is the oldest stock exchange in Asia, the most prominent Indian government-owned stock exchange is the NSE. With a market valuation of US$3.59 trillion as of September 2023, the NSE is home to around 2137 listed companies.

London Stock Exchange (LSE)

Established in 1801, the LSE is one of the world’s oldest stock markets. As of September 2023, the overall market value of the about 3,000 companies listed on the LSE is USD 3.42 trillion. In Europe, it was the first to keep records on equity market liquidity, benchmark prices, and marketplaces.

Saudi Exchange

Located in Saudi Arabia, the Saudi Stock Exchange was established in 2007 as a joint stock company. It is the only organisation in Saudi Arabia with the authority to operate as a securities exchange.

At the end of September 2023, it ranked as the 10th largest exchange globally, with nearly 203 (as of December 2020) publicly traded businesses and a total market value of US$3.06 trillion.

Also read: Your comprehensive guide to successful share market investing

Conclusion

As we can see, the top positions are held by the United States with NYSE and NASDAQ. However, emerging nations like India and Saudi Arabia are also becoming strong competitors by securing 8th and 10th positions, respectively.

The tendency is also prominent in a recent report by Goldman Sachs, which states that the total market value in emerging economies will exceed that in the United States by 2050. This could certainly be a good move for investors looking to capitalise on these countries’ flourishing economies as well as a chance to diversify their portfolios.