Reliance Industries Limited (RIL), a symbol of India’s industrial strength, has just announced its Q4 FY24 results on April 22, 2024. As the nation’s largest private sector company, RIL’s quarterly figures are highly anticipated by investors, analysts, and industry followers.

This in-depth blog post aims to break down Reliance’s expected Q4 performance in simple terms. We’ll explore analysts’ expectations, dive into financials, and examine Reliance Industries’ position against competitors. Let’s begin!

About Reliance Industries

Being the biggest private sector company in India, Reliance Industries Limited (RIL) is a symbol of the nation’s industrial might. Headquartered in Mumbai, Reliance Industries Limited is a global corporation, founded by Dhirubhai Ambani.

Among the many businesses that make up Reliance Industries Ltd. are those dealing with petrochemicals, retail, telecommunications, hydrocarbons, and refinery and marketing. Other operations include the energy, natural gas, entertainment and media, and textile industries.

Additionally, RIL’s Jio True5G network is leading the way in India’s digital transformation. Its efforts in alternative energy demonstrate the organisation’s dedication to sustainability and innovation.

Reliance Industries share news

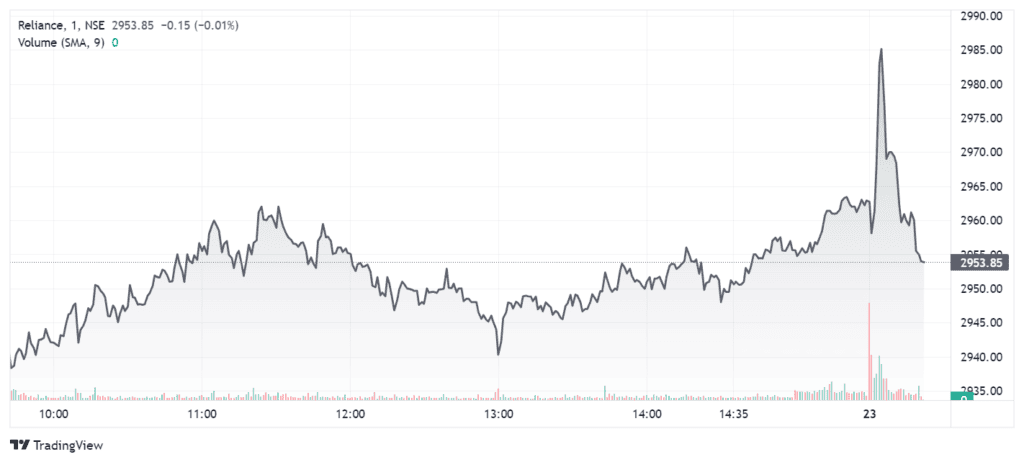

Ahead of the release of the Q4 results, RIL shares closed 0.67% higher on the NSE on April 22, 2024.

In March 2024, Reliance Industries share rose 3.42% and over the last three months, it rose 6.80%. As of April 23, 2024, Reliance Industries’ share price was ₹2,953.85 on the NSE.

Reliance Industries Q4 results: Previous quarterly performance comparison

With double-digit growth in both O2C (oil to chemicals) and consumer sectors, RIL’s net sales increased to ₹236,533 crore in Q4FY24. Revenues for the oil and gas business increased significantly by 42.0%.

Reliance Industries witnessed a robust 14.3% year-over-year growth in EBITDA, reaching ₹47,150 crore, thanks to significant contributions across all business sectors.

- A consistent rise in subscriber numbers that led to higher revenues helped JPL (Jio Platforms Limited) increase its EBITDA by 12.5%.

- Operating efficiencies and a margin increase of 60 basis points to 8.6% drove a remarkable 18.5% increase in RRVL’s (Reliance Retail Ventures Limited) EBITDA.

- The O2C segment (oil to chemicals) maintained a resilient EBITDA performance despite a challenging margin environment.

- Additionally, a significant 66.4% increase in gas and condensate production helped the Oil and Gas segment’s EBITDA soar by 47.5%.

In Q3 FY24, Reliance Industries Limited reported a strong financial performance, with its EBITDA soaring to ₹44,678 crore, marking a 16.7% increase year-over-year (YoY).

The company’s Q3 FY24 earnings growth was primarily driven by the robust performance of its Retail and Oil & Gas sectors, alongside steady contributions from digital services and the O2C (Oil to Chemicals) business.

That said, let’s examine the change from quarter to quarter for fiscal year 2024.

| CONSOLIDATED RESULTS | JUN ’23 – Q1 | Sept ‘23- Q2 | Dec ‘23- Q3 | Mar ‘23- Q4 |

| Net sales (₹ cr.) | 207,559 | 231,886 | 225,086 | 236,533 |

| Net Profit (₹ Cr.) | 18,182 | 19,820 | 19,488 | 21,143 |

| EPS | 23.66 | 25.71 | 25.52 | 28.01 |

Reliance Q4 results: 2024 expectations vs reality

If we look at RIL’s Q4 FY24 results expectations, analysts predicted that the organisation’s EBITDA would increase by 9.4% to ₹42,127 crore. Analysts polled by Moneycontrol estimated 11.4% growth in RIL’s consolidated sales of ₹239,000 crore.

Let’s look at the comparison of expectations vs. reality in the Reliance Q4 results.

| Q4 FY24 | Analysts’ predictions | Actual figures |

| Net sales (₹ crores) | 239,000 | 236,533 |

| Net profit (₹ crores) | 18,248 | 21,143 |

| EBITDA (₹ crores) | 42,127 | 47,150 |

Current financials

| Metric | Value (as of 22 April 2024) |

| Market cap (₹ Cr.) | 2,002,502 |

| Book value per share (₹) | 1,213.66 |

| Dividend Yield | 0.30 |

| ROCE | 9.38% |

| ROE | 8.77% |

| TTM PE | 28.62 |

Financial summary: FY24 growth over FY23

| Particulars | FY24 | FY23 |

| Gross revenue (₹ crore) | 1,000,122 | 974,864 |

| EBITDA (₹ crore) | 178,677 | 153,920 |

| EBITDA % | 17.9 | 15.8 |

| Profit before tax (₹ crore) | 1,04,727 | 94,046 |

| Profit after tax (₹ crore) | 79,020 | 73,670 |

| Net debt (₹ crore) | 116,281 | 125,766 |

Also read: Disney reliance merger

Competitor information of Reliance Industries

| TTM PE | Market cap(₹ crores) | ROE (%) | Net profit in Q3 2024(₹ crores) | |

| ONGC | 8.44 | 347,089.90 | 12.62 | 10748.46 |

| Oil India | 10.87 | 64,543.80 | 22.68 | 2607.66 |

| Petronet LNG | 12.67 | 44,437.50 | 21.78 | 1190.67 |

Shareholding pattern of Reliance Industries

The shareholding pattern (as of March 2024) of Reliance Industries is as follows:

| Promoters | 50.31% |

| Foreign Institutional Investors (FIIs) | 22.06% |

| Domestic Institutional Investors (DIIs) | 17.2% |

| Public | 10.43% |

Investing in Reliance Industries

Pros

Capturing the O2C market in India:

- The O2C division of RIL now encompasses the company’s refining and petrochemical operations. Being the biggest integrated polyester producer worldwide, it is also one of the leading petrochemical producers on a global scale.

- In Q4 FY24, despite a difficult margin environment, O2C EBITDA improved slightly thanks to improved feedstock procurement and robust domestic demand. Revenue in this segment grew to ₹142,634 crore from ₹141,096 crore in the last quarter.

- Among the top five worldwide manufacturers of polypropylene and purified terephthalic acid (PTA), RIL ranks third in paraxylene production.

- At full capacity, RIL’s petrochemical factories can take advantage of economies of scale thanks to the company’s dominant market position.

Solid foothold in the retail sector:

- A gain of 17.8% over the previous year, the company’s gross revenue for FY24 was ₹3,06,786 crore.

- When it comes to sales, scale, and profitability, no Indian retailer can compare to Reliance Retail Ventures Limited (RRVL). With record-breaking foot traffic of over one billion, there was a 17.8% year-over-year increase in revenue in FY24.

- In addition to tier-1 and tier-2 cities, RRVL has an extensive network of 18,650 retailers, as of November 2023. With robust growth throughout all consumption baskets, RRVL added 15.6 million square feet to its gross area in FY24.

Long-term success in the telecom industry:

- According to its Q4 FY24 quarterly report, Jio Platforms Limited (JPL) has demonstrated outstanding financial performance and growth in the telecom sector. The company’s revenue soared to ₹33,835 crore, marking a 13.3% increase year-over-year.

- The widespread adoption of 5G technology and the scaling up of home connectivity solutions have propelled data traffic to approximately 148 exabytes for the fiscal year, a 31% increase year-over-year. JPL is at the forefront of India’s transition to 5G, now boasting over 108 million subscribers and accounting for roughly 28% of Jio’s wireless data traffic.

- This makes JPL the operator with the largest 5G subscriber base outside China. Additionally, the JioAirFiber service is experiencing robust demand across approximately 5,900 towns, leading to the highest-ever quarterly home connections.

Cons

Telecom regulation and technology risks:

- When policies and regulations change, it affects the telecom industry in India.

- Constant investment is required due to vulnerability to technological advances.

- The expansion of 5G services by RJIL might lead to an increase in capital expenditure.

Intense retail competition:

- In addition to competing with other organised merchants, RRVL also has difficulties in the unorganised sector.

- Within India, organised retail penetration is less than 15%.

Also read: LIC q3 results 2023

Conclusion

As we conclude our analysis of Reliance Industries Limited’s anticipated Q4 FY24 results, it’s clear that this industrial powerhouse is well-positioned for continued growth.

With a diverse business portfolio spanning petrochemicals, retail, telecommunications, and energy, it is safe to say that RIL’s financial performance is expected to remain strong after the results.