Investing might at first seem like a jigsaw puzzle if you’re just getting started. But there is a way to make the most of your investment journey without putting in much effort. We are talking about mutual funds.

Mutual funds are becoming extremely popular, with 54% of Indians preferring this investment vehicle over others like fixed deposits in 2023. The best-performing mutual fund category over the long and short terms this year was index funds/ETFs.

In today’s article, we will analyse the factors that drive new investors to mutual funds and the current market scenario. We will understand the importance of SIP in mutual funds. So, if you are looking for a comprehensive guide on mutual funds and how to invest in them, this blog is for you.

You may also like: Mutual funds or stocks: Which is a better investment?

Understanding mutual funds

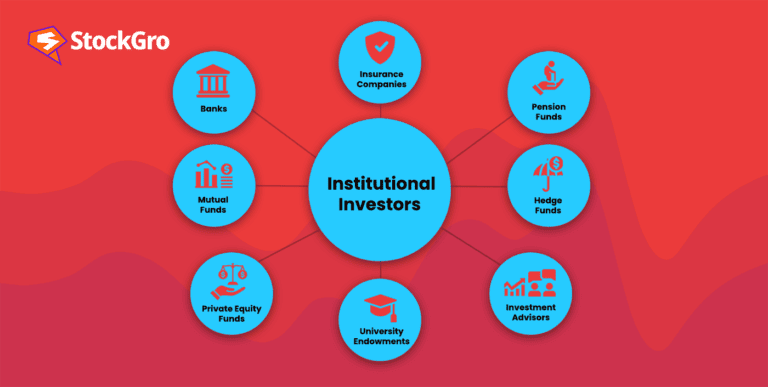

Mutual funds are investment vehicles that combine the funds of investors and use them to buy financial instruments that are related to the stock market, including bonds and equities, to generate revenue. A fund’s portfolio is a collection of all of its holdings.

India has a powerful and distinctive mutual fund framework. The Securities and Exchange Board of India’s (SEBI) rules and regulations govern how each of the part entities operates. SEBI is responsible for regulating and supervising the administration of mutual funds.

Mutual funds can be separated into two segments: closed-ended funds and open-ended funds. Open-ended mutual funds allow investors to make investments and withdrawals at any time, while closed-ended funds don’t offer this feature. An investor can take their money out only at maturity.

What is SIP in a mutual fund?

Mutual funds provide investors with the opportunity to make disciplined investments via a programme called Systematic Investment Plans (SIP), or simply SIP. With the SIP feature, an investor may choose a mutual fund plan and invest a certain amount of funds at specified times.

By taking away the possibility of guesswork in market performance, SIPs may help you avoid market volatility. Systematic investment guarantees that the average purchase cost is eventually amortised.

Thanks to the effect of compound interest, investing a small amount of money regularly over an extended period may provide exponential returns.

How to cancel a mutual fund SIP?

If you invest in mutual funds via trading apps or similar online methods, you need to be aware of how to stop your SIP online. There are various online methods for cancelling your SIP mutual fund.

- Go to the AMC (Asset Management Company) website

If you choose to cancel the SIP, make sure to have your bank account information and folio number accessible. After logging in, choose the SIP that you want to stop or terminate.

Select the ‘Cancel SIP’ menu item. To complete your request and discontinue the SIP payments, the AMC may need up to 21 days. The automated payments will stop when the request is processed. Your previous SIP investments, however, will continue to be held in the fund.

- Connect with an agent

If you want to stop paying SIP payments, you must get in contact with the online agency you invested in. By contacting the AMC overseeing the fund, the agent will initiate the cancellation request on behalf of you.

- Online distributor network

It is also possible to cancel an SIP if you acquired it in a mutual fund and set up automatic payments using an online distributor platform. To cancel the SIP payments for a mutual fund that you have enabled on an online distributor platform, just log in and choose the “Cancel SIP” option for that particular fund.

Also read: Mutual fund overlap – Meaning and effects

Differences between SIP and mutual funds

First-time investors often wonder, “What’s the key distinction between mutual funds and SIPs?”

A mutual fund is an investment scheme that is overseen by a team of experts. An asset management company oversees the scheme and pools the funds from investors to make investments in equities, gold, or other assets.

SIP, on the other hand, is only an investment approach to investing in mutual funds. SIP allows you to set up automatic investments of a certain amount of money at pre-specified periods.

The reason why most long-term investors prefer to invest in mutual funds via SIPs rather than put their lump sum money into them is their ability to even out market volatility in the long term. The investment value and trade value are also lower through SIPs, as are the redemption charges.

Why are investors preferring mutual funds more?

According to initial estimates quoted in several reports, the most popular mutual fund investment techniques in 2023 included lump sums, SIPs, and systematic transfer plans (STPs). SIP-based mutual fund investments hit a record high in November 2023, totaling ₹17,073 crore.

SIP inflows into mutual funds were ₹1,66,131 crore in the first 11 months of 2023, which ended on November 30. This is a 22.23% growth over the same period in the previous year.

Here are some reasons why investors prefer mutual funds over other investments:

The recent bull run

A major contributing factor was the current bull run in the financial market. The Nifty 50 and Sensex market indexes also reached all-time highs. Retail investors are encouraged to increase their mutual fund investments, ideally via systematic investment plans (SIPs), when they see a rise in their portfolio.

Due to market gains in 2020, 2021, and 2022, more investors are looking to make investments in stocks. As a result, market penetration is rising. Investors will boost their SIP contribution in a buoyant market.

A change in perspective

Many factors, including a change in investor mindsets and behaviours, more significant disposable income, and strong financial markets, have contributed to the increasing popularity of SIPs. Particularly after the pandemic, people’s attitudes and behaviours have changed considerably.

Analysts think that new investors are joining MF as a result of this change in mindset, as well as growing disposable income, booming markets, and more access to the internet.

The ease of investing

The ease of investing in mutual funds at regular intervals—that is, once a week or once a month—as opposed to lumping together large sums of funds at once is another important benefit of using SIPs.

All kinds of investors with ultra-short, short, and long-term horizons may benefit from mutual funds. SIPs are an excellent tool for staggered investing since they let investors make small, regular payments on a schedule that suits them.

Also read: Your comprehensive guide to successful share market investing

Conclusion

At present, traditional asset classes such as gold, real estate, and bank deposits have little appeal to semi-urban investors; mutual funds have become a popular choice instead. According to the AMFI monthly report, mutual funds have grown into the go-to option for dedicated retail investors.

However, to be on the safe side, they should thoroughly research the fund, weigh the risk-return trade-off, and assess their time horizon before investing.