Table of contents

Picture a scenario where you have the opportunity to capitalise on market fluctuations weekly, rather than just once a month. Welcome to the exciting realm of weekly future options!

In 2023, a remarkable 85 billion options contracts were traded by Indian investors, surpassing all other countries globally. Since 2019, when India first outpaced the US in annual trade volume, it has consistently topped the global rankings. This is not just a statistic; it is a clear indication of the increasing popularity and dynamic nature of options trading in India.

Learn how weekly options can improve your trading approach and how to understand them in this article.

What are weekly options?

Weekly options have a duration of one week before they expire. Aside from the shorter expiration period, all other features of weekly options are the same as standard (monthly) options contracts. You can apply any trading strategy that works for monthly options with weekly options as well.

Because of the shorter expiry period, weekly options usually have lower premiums compared to longer-term monthly contracts. This is one of the main reasons why weekly options have become increasingly popular, especially among traders who like to buy options and those who participate in options trading on the day of expiration.

Types of weekly options

Nifty 50 options

The Nifty50 index offers weekly options based on the performance of 50 renowned Indian companies listed on the NSE. Each contract typically involves 50 units per lot and expires on Thursdays. If the last Thursday falls on a holiday, the contracts expire on the preceding trading day.

Bank Nifty options

Options on the Bank Nifty are associated with the Bank Nifty Index, which tracks the performance of the 12 most liquid large-cap banking companies listed on the National Stock Exchange (NSE). Each contract involves 25 units per lot and expires every Wednesday. Contracts expire the trading day before the last Wednesday if that day is a holiday.

FINNIFTY options

The FINNIFTY index, which began tracking banks, NBFCs, home finance, and insurance companies in India in January 2021, is considered a standard in the industry. Each FINNIFTY options contract comprises 40 units and expires every Tuesday. Contracts expire the trading day before the last Tuesday if that day is a holiday.

Nifty midcap options

The 25 equities that make up the Nifty Midcap Select Index, which in turn follows the Nifty Midcap 150 index, constitute the basis for Nifty Midcap options. This Nifty weekly options strategy has a lot size of 75 units and expires every Monday. Contracts expire on the trading day before the last Monday if that day is a holiday.

Advantages and disadvantages of weekly options

Advantages of weekly options:

- Flexibility: Weekly options allow traders to navigate short-term events, such as earnings announcements.

- Lower premiums: Weekly options are typically priced lower than monthly options because of their shorter lifespan.

- Higher time decay: Weekly options offer a greater advantage to option sellers due to their higher theta, or time decay.

Disadvantages of weekly options:

- Higher gamma risk: Weekly options exhibit a greater level of gamma, resulting in more pronounced price movements compared to monthly options.

- Limited lifespan: If your timing is not perfect, the short lifespan of weekly options can result in them expiring worthless.

- Less liquidity: Some weekly options may not be as liquid as their monthly equivalents, leading to greater bid-ask spreads.

Weekly options trading strategies

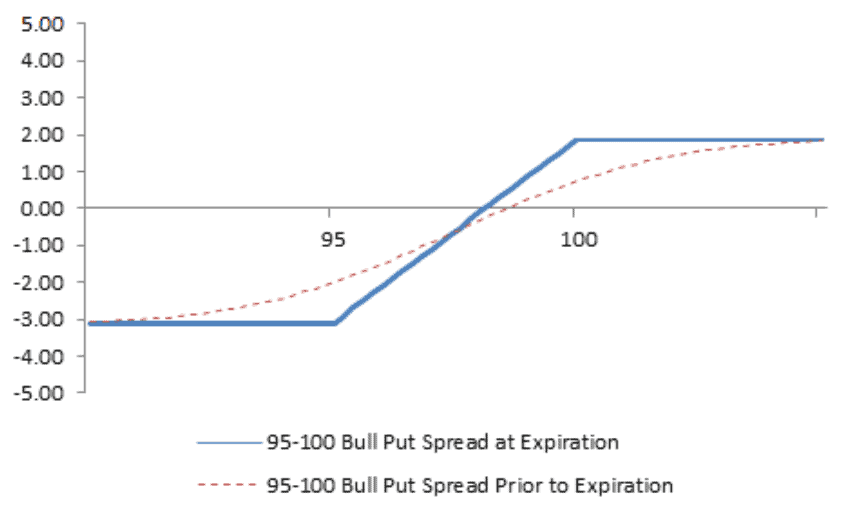

Traders employ various strategies when handling weekly options. A popular tactic is the bull put spread. This approach entails selling weekly options for put, that is out of the money and subsequently purchasing another put option that is even further out of the money. If the stock price closes higher than the short strike on expiration, the strategy will have been successful.

Calendar spreads with weekly options

Executing a calendar spread strategy entails the simultaneous purchase or sale of options with different expiration dates. This approach allows traders to effectively manage the impact of time decay by strategically structuring their trades to minimise the erosion of value over time.

For a calendar spread to be profitable, it is most advantageous when the underlying asset maintains a relatively stable value, with minimal price fluctuations in either direction, until the near-term option reaches its expiration date.

With the longer-dated option still holding its value, the trader can profit from the time decay of the near-term option they sold. The calendar spread technique has a better chance of succeeding when stability and temporal decay work together.

Double calendar spread weekly options

This options trading strategy involves selling near-term calls and puts while simultaneously buying longer-term calls and puts with the same strike price and underlying asset. This approach is commonly employed in a market with low volatility and offers a broad range of breakeven points.

Bottomline

Weekly options have revolutionised trading, providing investors with fresh opportunities to profit from short-term market fluctuations. Traders can take advantage of the flexible expiration cycle and diverse trading strategies offered by weekly options to effectively manage risks and generate profits.

Understanding the ever-changing market landscape, and incorporating weekly options into a trader’s toolkit can prove to be a valuable asset.

FAQs

Whether to buy weekly or monthly options depends on your trading strategy. Weekly options can be beneficial for capitalising on short-term market events due to their lower premiums and higher time decay. However, they carry higher gamma risk. Monthly options, on the other hand, offer more time for the trade to work in your favour, but come with higher premiums. Always consider your risk tolerance and market outlook.

When you sell (or “write”) an uncovered call option, you can face unlimited loss. This is because if the price of the underlying asset rises above the strike price, you’re obligated to sell the asset at the lower strike price, but must buy it at the higher market price to fulfil the contract. The higher the asset price rises, the greater your potential loss.

Options trading is often compared to gambling due to the risk involved. However, it’s not the same. While both involve risk and uncertainty, options trading is based on the analysis of market trends, economic data, and company fundamentals. It’s a strategic activity that requires knowledge, skill, and risk management. Conversely, gambling is based on pure chance and probabilities. So, while risky, options trading isn’t gambling when done responsibly.

Option trading is more of a skill than luck. It requires a deep understanding of financial markets, proficiency in technical and fundamental analysis, and a well-defined trading strategy. While there’s an element of uncertainty, as in any investment, success in options trading is largely about making informed decisions based on market indicators and trends, not luck. However, even with skill, risk is inherent and losses are possible.

Certain practices in options trading are considered illegal. For instance, naked short-selling is prohibited in many jurisdictions, including the U.S. In India, the Reserve Bank of India (RBI) has deemed binary trading and certain forex trading platforms as unauthorised. It’s crucial to understand the regulations in your jurisdiction and trade responsibly. Always ensure that your trading activities comply with the law.