Table of contents

The mutual fund market is widely popular today, especially among risk-averse investors. Investing through mutual funds not only allows diversification but also gives investors the benefit of professional management. These funds offer a good mix of returns and stability, which makes them appealing to investors.

The mutual fund market is huge and offers multiple options to investors to meet their varied requirements. One such unique option is the conservative mutual fund. In today’s article, we will learn the meaning and features of conservative mutual funds.

What are conservative funds?

Before understanding what conservative funds mean, let’s learn about hybrid funds.

A hybrid fund is a mutual fund category that invests in stocks and debts to offer high returns backed by stability to investors. It works on the idea of diversification, which is the fundamental risk-mitigating strategy in financial markets. The percentage of allocation in debt and equity varies from one fund to another to meet the different objectives of investors.

A Conservative fund is a type of hybrid fund that also invests in debt and equity. The uniqueness of this fund is its conservative approach. These funds focus more on stability over growth. Hence, they invest a large portion of funds into debt instruments and a small portion into equity investments.

How do conservative hybrid funds work?

Conservative funds, as the name suggests, follow a conservative strategy in investing. The objective of such funds is to preserve capital over providing high returns or capital appreciation to investors. However, they do not neglect the latter completely. A small portion invested in equities benefits investors with high returns and capital appreciation, while the portion invested in debts conserves their money and gives them stable returns.

Features:

- Fund managers often reserve 75% or more towards debt funds and the rest towards equities.

- Fund managers look for debt securities with high credit ratings to ensure low chances of default at the time of repayment.

- The equity investment usually involves large-cap stocks which have a proven history of dividend payments and capital appreciation.

- These funds offer moderate returns and are exposed to less risk.

- Conservative funds are ideal for investors with low-risk appetites.

Real-world example of conservative funds in India

Consider the example of the SBI Conservative Hybrid Fund.

The fund was launched on March 24, 2001, and has an average return of 8.42%. It is an open-ended scheme with below-average risk, indicating that the fund has been working well for risk-averse investors.

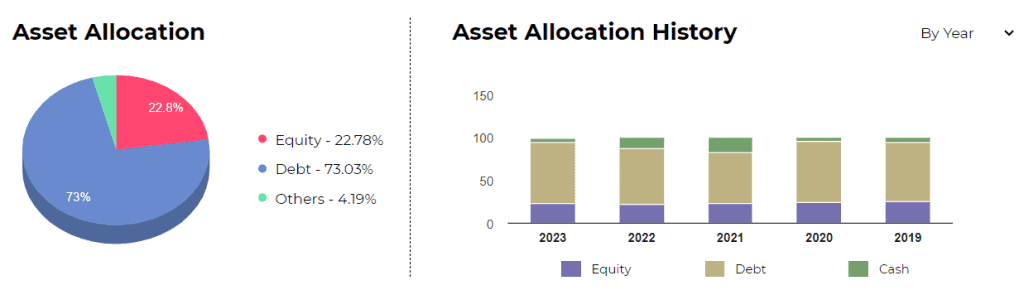

With a fund size of ₹9,642.13 crores, the fund allocates about 73% in debt, 23% in equity and the rest in other instruments. With close to 3/4th of the fund going to debt instruments, the conservative approach is seen.

Besides, the risk ratios are another proof of the fund’s conservative strategy. The fund’s standard deviation is 3.15 against the market average of 4.19, and the fund’s beta is 0.44 against the industry average of 0.57, indicating low volatility.

Benefits of conservative funds

- Conservative funds are hybrid funds that include investments in debts and equities. These funds expose investors to both markets and allow them to maintain a diversified investment portfolio.

- Since conservative funds invest majorly in high-quality debt funds, the risk of default is low.

- Conservative funds provide investors with a stable source of income since a large portion of the investment goes into fixed-income instruments.

- Despite earning lesser returns than equity funds, investors reap the benefit of high returns and capital appreciation to a certain degree if their stocks perform well.

Taxation of conservative hybrid funds

Returns from conservative funds are liable for tax under two categories based on the tenure of the investment: Long-term capital gains and short-term capital gains.

- For investments of less than three years, returns are liable for tax as per the investor’s income tax slab rate.

- For investments of more than three years, returns are liable for tax at a rate of 20%, including indexation.

If these investments are made after 31 March 2023, both short-term and long-term gains are taxed according to the investor’s income tax slab.

Bottomline

Conservative funds offer a combination of investments in stocks and fixed-income securities. The objective of such funds is to maintain capital and stability, with high returns taking a back seat.

These funds mostly invest in high-rated securities in both categories to minimise risks to the maximum extent possible. Hence, conservative mutual funds are ideal for risk-averse investors, who want to hold a diverse investment portfolio.

FAQs

Yes, conservative funds are low-risk since they invest a very small portion in equities. The debt investment is also focused on high-quality instruments to mitigate the risk of defaults.

However, these funds are not risk-free. There is a certain degree of risk associated since equities may or may not perform well. The chance of debt instruments defaulting is also rare but not impossible.

Mutual funds that invest entirely in equities are the highest risk. Especially, equity funds focused on small and mid-cap stocks carry a great level of risk. However, the return on such investments is also high compared to other mutual funds.

A conservative fund is a good choice if you are a beginner who wants to explore the equities and debt markets, but without being exposed to high risks. This continues to remain a good choice for all passive investors who are willing to compromise on their earnings in return for low-risk exposure.

Whether you want to invest conservatively or aggressively depends on your personal financial objective.

A conservative approach is suitable for investors with low expectations of returns, but want a low risk exposure.

An aggressive approach is suitable if you are an investor looking at growth and capital appreciation, with the willingness to take high risks.

Some of the top-performing conservative funds in India are:

SBI Conservative Hybrid Fund

Canara Robeco Conservative Hybrid Fund

Baroda BNP Paribas Conservative Hybrid Fund

Bank of India Conservative Hybrid Fund

UTI Conservative Hybrid Fund

LIC MF Conservative Hybrid Fund

HSBC Conservative Hybrid Fund