Table of contents

Managing one’s finances, particularly when it comes to long-term investments, can feel like navigating a maze blindfolded. That’s where fund managers come in, who use their deep market knowledge to guide your hard-earned money through the complex landscape of investments.

Whether it’s a mutual fund, a pension fund, or a high-stake hedge fund, these investment experts have one mission: to ensure your capital is working smarter, not harder, and generating the highest possible returns.

But what exactly do these financial masterminds do, and how can you become one? Let’s dive in and understand the world of fund management.

What is fund management?

At its core, fund management (also known as asset management) is about preserving and growing an entity’s assets – be they physical assets like real estate or machinery or intangible ones like patents. It’s a systematic approach to operating, deploying, preserving, distributing, and improving these assets to maximise profitability.

In the financial realm, however, the term “fund management” is most closely associated with investment and financial managers who oversee the management of their clients’ investment capital. A fund manager’s job is to gather information about their clients, develop an investment strategy, and bring that strategy to life.

Who is a fund manager?

A fund manager is someone who oversees an investment portfolio on behalf of an investor while skillfully guiding the investment strategy. The responsibilities of a fund manager basically revolve around selecting equities, bonds, or other investments that a particular fund will invest in.

These financial experts oversee a diverse range of financial assets, including mutual funds, pension funds, trust funds, and even hedge funds.

More often than not, you’ll find fund managers for mutual funds or pension funds, where they’re aptly called mutual fund managers or NPS pension fund managers. But these financial masterminds don’t work alone; they oversee a team of investment analysts who assist them in their decision-making process.

To be a successful fund manager, it takes a unique blend of business savvy, mathematical expertise, and exceptional interpersonal skills. And when it comes to hedge fund managers, the stakes are even higher – only accredited clients with substantial minimum investments can play in this high-stakes game.

Before entrusting your hard-earned money to a fund manager, it’s crucial to do your due diligence and thoroughly research their investment approach. After all, the primary benefit of investing in a fund is having a professional make those tough decisions on your behalf.

Responsibilities of a fund manager

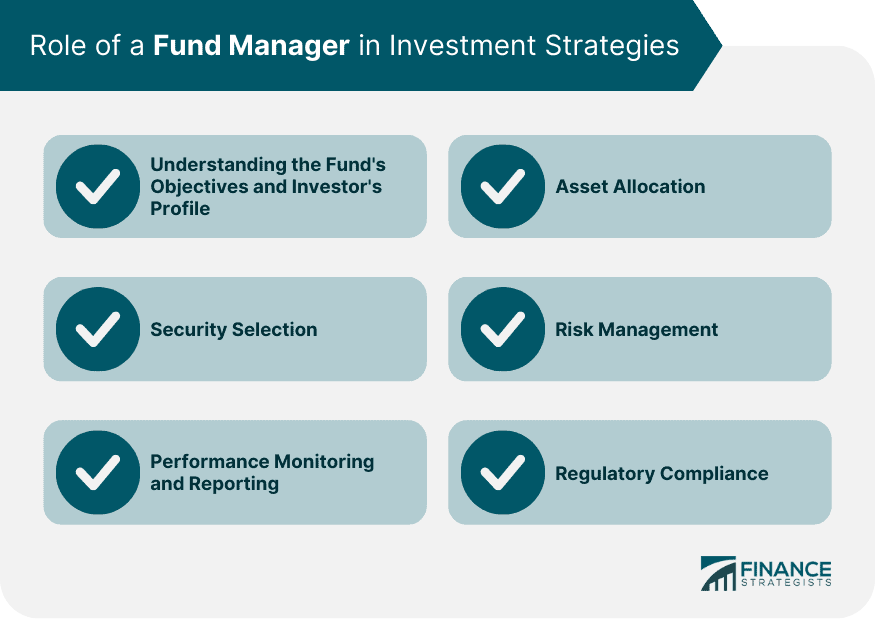

A fund manager’s primary responsibility is to oversee the assets being invested in a fund and work towards achieving its objectives. This includes:

Choosing investments:

Fund managers conduct comprehensive research to select the most appropriate assets for the fund’s portfolio. They also decide when to sell or replace certain assets with more lucrative ones.

Risk management is a critical part of a fund manager’s job. They ensure the portfolio’s risk profile aligns with the fund’s goals and requirements.

Monitoring results:

If a fund isn’t performing as expected, fund managers may decide to sell off underperforming assets.

Checking for compliance:

The Securities and Exchange Board of India (SEBI) sets the rules and regulations for mutual funds, and it’s the fund manager’s responsibility to ensure the fund adheres to every applicable guideline.

How to become a fund manager in India?

Becoming a top-notch fund manager in India requires following a specific path:

- Earn a bachelor’s degree in finance, economics, or a closely related field. This will give you a solid foundation in financial markets and investment management.

- Gain practical experience in the banking and finance industry. Take on roles like financial analyst, investment banker, or portfolio analyst to hone your skills.

- Consider obtaining a relevant certification, such as the Chartered Financial Analyst (CFA) designation. This credential attests to your in-depth knowledge of investment management funds and the financial industry, potentially boosting your career prospects.

Conclusion

Fund managers have a significant influence on how people’s financial goals turn out. Their knowledge, insight, and ability to skillfully navigate complex markets make them invaluable assets to the financial industry. A skilled fund manager can give you the peace of mind you need when managing your hard-earned money and securing your financial future.

To understand who fund managers are and how they shape investment success? To explore the key roles, responsibilities, and strategies of fund managers in investing, download the StockGro app your trusted platform for simplified financial education and market insights.

FAQs

A fund manager’s role extends beyond mere execution; they are the architects of a fund’s investment strategy. Their responsibilities include researching markets, selecting securities, and balancing risk and return. They must align their decisions with the fund’s objectives, considering factors like economic trends, industry performance, and investor preferences. Effective communication and adaptability are essential, as fund managers navigate dynamic markets and evolving investor needs.

Becoming a fund manager can be rewarding, but it demands a blend of skills. While it offers the potential for financial success, it also entails pressure. Fund managers must outperform benchmarks, adhere to regulations, and communicate effectively with clients. The job’s appeal lies in its ability to shape investors’ financial futures, but it requires resilience, analytical prowess, and a passion for financial markets.

A successful mutual fund manager possesses a deep understanding of markets, analytical acumen, and the ability to navigate risks. They must outperform benchmarks consistently, demonstrating a track record of superior returns. Effective communication skills are crucial for explaining investment decisions to clients. Integrity, ethical conduct, and a commitment to continuous learning contribute to a good fund manager’s success.

Fund managers base investment decisions on a blend of technical and fundamental analysis. They consider market conditions, economic indicators, and sector trends. Factors like fiscal policies, interest rates, and global events influence their choices. The fund’s investment mandate guides them, ensuring alignment with its goals. Regularly assessing risk-reward trade-offs is essential for prudent investment decisions.

Mutual fund managers invest by researching stocks, bonds, and other assets. They analyse company financials, industry prospects, and macroeconomic trends. Their goal is to build a diversified portfolio that aligns with the fund’s strategy. They consider metrics like price-to-earnings ratios, dividend yields, and growth potential. Regular monitoring and adjusting the portfolio as needed are critical for sustained success.