If you will do intraday trading without MACD, you’re likely chasing price with no clue where momentum is heading. You might miss entries, get late exits, and enter in sideways moves. The MACD (Moving Average Convergence Divergence) allows traders to read shifting trends before the price jumps or falls.

But default settings often don’t fit quick timeframes. If you trade 5-minute or 15-minute charts, you need faster inputs to match the speed of charging prices. Let’s start the blog by first explaining MACD indicators. We will also learn about the MACD settings for intraday trading to get maximum profits.

What is the MACD indicator?

The MACD (Moving Average Convergence Divergence) gives traders a way to spot shifting momentum before the price trend becomes obvious. The real value comes when you adjust the MACD settings for intraday trading. Fast charts move differently than daily ones, so you need faster settings that keep up.

How does the MACD work?

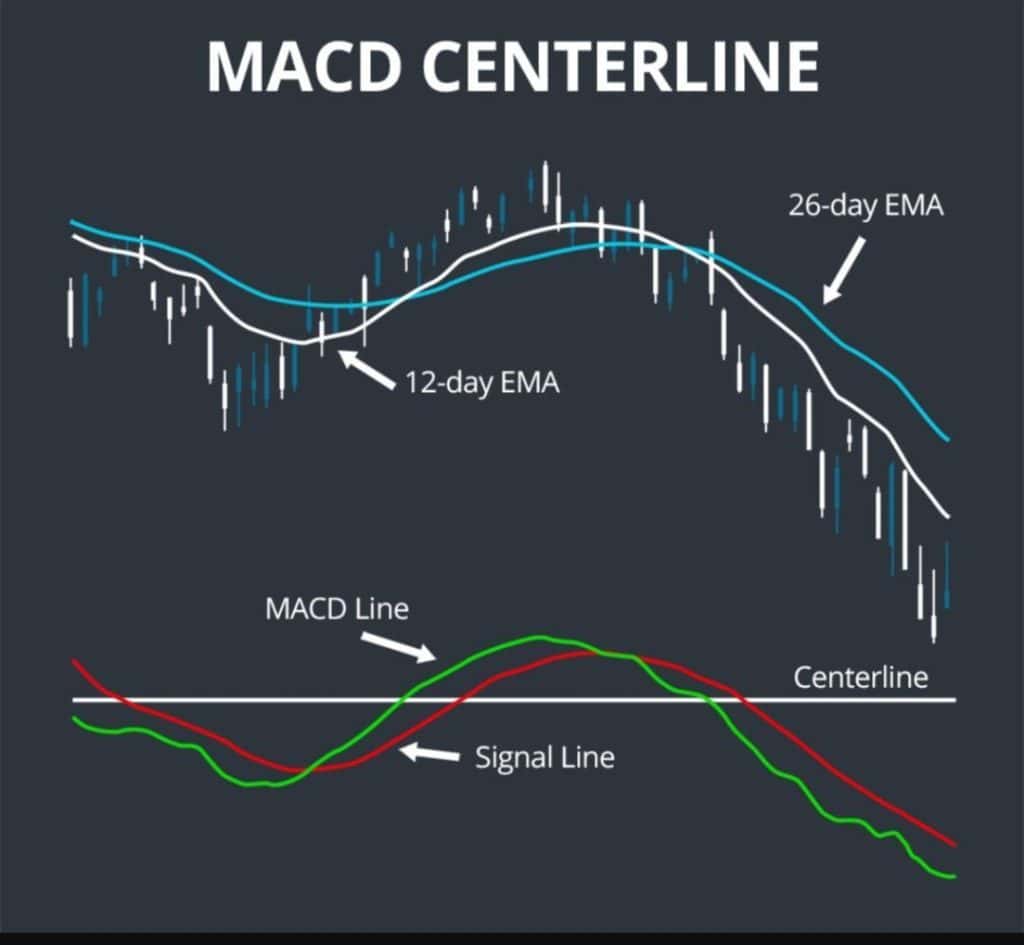

MACD settings for intraday trading works by measuring the space between the 26-period and 12-period exponential moving averages. The result is the MACD line. Add a 9-period EMA on top of that, and you’ve got the signal line.

Why use MACD for intraday trading?

Here’s why you should use this indicator:

- Crossover signals between the MACD line and signal line often show right movement in the market.

- Spotting divergence between price and MACD can warn you of short-term reversals before they hit the chart.

- The MACD histogram shows momentum strength visually and is made for confirming trade setups in fast markets.

Best MACD settings for intraday trading

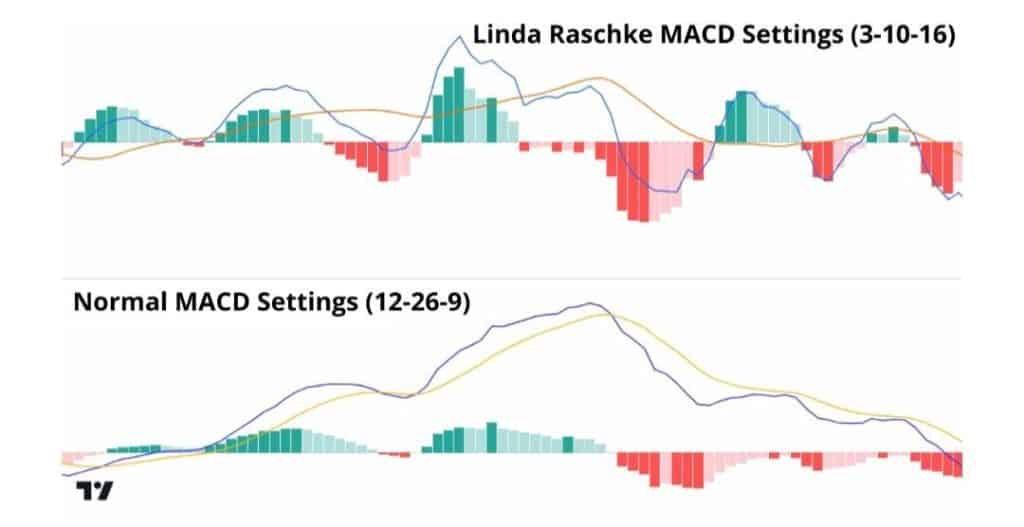

Most traders default to 12-26-9, but that’s built for bigger timeframes. When you’re trading minutes, you need faster signals. So, here’s how you can use the MACD indicator:

- 3-10-16

It’s for those who want scalp with accuracy. This setting reacts quickly to price shifts and gives early signals.

- 5-34-1

Built for traders who value clean signals. It keeps the candle sticks to not show volatility during erratic moves.

- 12-26-9

This is made for traders who are holding their trades for hours or into the next session.

How to choose the right MACD settings

- For quick scalps: Go with 3-10-16. It picks up speed shifts almost instantly.

- For short swings within a day: Use 5-15-9.

- For volatile stocks: Choose 5-34-1 to avoid getting caught in every spike.

- Always test before trading: What works for Nifty may not work for crude oil or bank stocks.

Popular MACD settings (examples)

You might be chasing price or exit too early. But with following MACD settings, you won’t have to worry about it:

- 5-13-8 or 5-13-9: A popular choice among intraday traders. It delivers better entries while still keeping some restraint.

- 8-17-9 or 13-30-10: These are slower settings and are used when markets are calm.

How to adjust MACD for different timeframes

MACD is one of the best indicators for intraday trading and can be adjusted as per the different chart timeframes.

- If you’re using 1-minute to 5-minute charts, go for 3-10-16 or 5-13-8 to catch faster signals.

- For 15-minute to 1-hour charts, 5-15-9 or 5-34-1 can give more steady signals.

How to trade with the MACD: Step-by-step

Here’s a plan experienced traders follow every day:

- Apply the MACD setting to your chart. Intraday traders might use 5-15-9 or 3-10-16. Add it at the bottom pane.

- If the MACD is above zero, bulls are likely in control. Below zero, the bears are pressuring.

- MACD line if crosses above the signal line, it’s a bullish signal and vice versa.

- Close your trade when the MACD line comes below the signal line.

MACD entry and exit signals

Here’s what to look for while entering or exiting the trade:

1. Entry signal 1

Traders can buy if the MACD line crosses the signal line from below. Also, sell when it crosses below from above.

2. Entry signal 2

Traders can also enter if the MACD crosses the zero line from below. This shows the growing bullish strength.

3. Exit signal

The MACD line when moved below the signal line shows its the time to exit.

Combining MACD with other indicators

Traders often want to understand how to use technical indicators for swing trading or intraday trading. So, MACD with the right tools can help you get better profits during your intraday trading. One can start with indicators that complement its signals.

Combining MACD with moving averages

Traders can go for a 20 or 50-period moving average on the chart. When MACD crosses up and price is also above the MA, you’ve got stronger confirmation to go long.

MACD with volume indicators

On low volume, the signal may lack conviction. Try pairing with OBV (On-Balance Volume) or volume bars.

Synergy with fibonacci retracement levels

If a MACD crossover happens near a key Fib level like 38.2% or 61.8%, watch closely. It could hint at a high-probability reversal zone.

Alternatives to MACD

Try RSI for momentum shifts, or Stochastic for overbought/oversold setups. These work well with tight intraday timeframes.

Common mistakes when using MACD for intraday

Following mistakes can lead to bad entries:

- Using standard MACD settings blindly

- Skipping volume confirmation

- Ignoring market structure

Advantages and limitations of MACD for day trading

Advantages

- Highlights trend momentum clearly

- Easy to read for intraday use

- Entry/exit signals via line crossovers

Limitations

- Can give false signals

- Misses news-based price shifts

- Needs confirmation with other tools

Best MACD Settings for Various Chart

1. Best MACD settings for 1-minute chart

Use fast settings like 3-10-16 or 5-13-8. They react quickly to price moves, ideal for rapid trades. Expect more noise, so confirm with volume and tight stops.

2. Best MACD settings for 3-minute chart

Go for 5-13-9 or 6-13-4. These give quick signals but with less noise than 1-minute charts — great for active intraday scanning.

3. Best MACD settings for 5-minute chart

A balanced timeframe. Use 8-17-9 for faster entries or 5-35-5 for cleaner trend signals in choppy markets.

4. MACD settings for 15-minute chart

Use 5-15-9 or 8-17-9 for smoother intraday trends. Traders wanting very few but strong signals often use 5-34-1.

5. Best MACD settings for 30-minute chart

For slower, reliable moves use 12-26-9 (standard). For slightly quicker reaction, go with 8-17-9.

Best MACD settings for scalping

Scalping needs ultra-fast settings like 3-10-16, 5-35-5, or 2-8-5. These catch quick momentum bursts but create more false signals, so pair with VWAP, volume spikes and strict stop losses.

Conclusion

MACD settings for intraday trading need more than default values. Quick scalpers may prefer 3-10-16, while calmer setups must have 5-34-1. So, match the setting to your trade speed. Pair MACD with volume and structure to catch the best entry points.

FAQs

Traders can get 3-10-16 to catch early signals. If you want fewer whipsaws, try 5-34-1. Many intraday traders also use 5-13-9. But test setting each on your chart before you start intraday trading.

MACD is a lagging indicator because it’s built on moving averages. It reacts to price, not predicts it. That’s why traders pair it with leading tools like RSI or volume to stay ahead of sharp turns.

MACD can be used only with fast settings like 3-10-16 or 5-13-8. Scalpers need instant reactions, so stick to quick EMA periods. Combine MACD with price action and volume for confirmation. Avoid using default settings as they react too late.

MACD works well with RSI, volume tools like OBV, and Moving Averages. This combination helps filter false signals. MACD shows the trend, but the other tools tell you when it’s real.

Use MACD on 1-minute to 5-minute charts for scalping. For short swings, try 15-minute to 1-hour charts. Also, faster timeframes need tighter EMA values. So, test before going live because price action behaves differently across time blocks.

The most effective MACD setting for swing trading is 12-26-9, as it gives smooth, reliable signals on daily and 4-hour charts. For slightly quicker entries, traders use 8-17-9, while 19-39-9 works well if you prefer fewer but stronger, trend-focused signals.