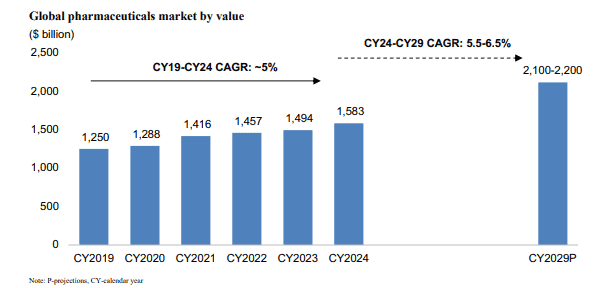

From $1,250 billion in 2019 to $1,583 billion in 2024, the global pharma market has grown at a steady 5% CAGR, and it’s not slowing down. It is now expected to reach $ 2,200 billion by 2029 and redefine the future of healthcare. Amidst this growth, stands a bioengineering pharma company that is launching its ₹230.35 Crores IPO soon.

Fabtech Technologies is a solutions provider for many pharma companies. And, with its IPO, it’s ready to cater to the investors’ market too. This blog helps you with the Fabtech Technologies IPO details in India, including its share price, lot size, grey market premium, and much more. So, read till the end for insightful updates.

Fabtech Technologies IPO Details

This table highlights the main details related to the Fabtech Technologies IPO.

| IPO Open Date | 29 September 2025 |

| Ends on | 1 October 2025 |

| Face Value | ₹10 per share |

| Price Range | ₹181-191 per share |

| Issue size | ₹230.35 Cr |

| IPO Lot size | 75 Shares |

| Sale Type | Fresh capital |

| Offer for Sale | – |

| Fresh Issue | ₹230.35 Cr |

| Issue Type | Book-building IPO |

| Listing At | BSE, NSE |

| Total Issue Size (₹ Cr) | ₹230.35 Cr |

| Reserved for Market Maker | – |

| Net Offered to Public | 1,20,60,000 shares |

| Minimum Investment | ₹14,325 |

| Employee Discount | ₹9 per share |

Fabtech Technologies IPO Timeline

Mark your calendars with the Fabtech Technologies IPO timeline below:

| IPO Open Date | 29 September 2025 |

|---|---|

| Ending Date | 1 October 2025 |

| Tentative Allotment | 3 October 2025 |

| Initiation of Refunds | 6 October 2025 |

| Shares reach demat | 6 October 2025 |

| Tentative Listing Date | 7 October 2025 |

| Cut-off Time for UPI Mandate Confirmation | 1 October 2025 (5 pm) |

Fabtech Technologies IPO Grey Market Premium (GMP)

Checking the GMP will give you a fair idea about the market sentiment. Here is the Fabtech Technologies IPO GMP today:

| Date | GMP (₹) | Estimated Listing Price |

| 25 Sept 2025 | ₹10 | ₹201 |

Fabtech Technologies IPO Reservation

Check the investor categorisation and reservation quota for the Fabtech Technologies IPO below:

| Investor Group | Allocation of Shares |

| QIB shares offered | Maximum 50% |

| Non-Institutional Investors (NII/HNI) | Minimum 15% |

| Retail Individual Investors | Minimum 35% |

Fabtech Technologies IPO Key Performance Indicator

Key performance indicators (KPIs) measure the company’s true financial picture. This table highlights the major KPIs for Fabtech Technologies IPO:

| 2025 | 2024 | 2023 | |

| ROE | 30.46% | 24.65% | 27.80% |

| ROCE | 24.46% | 28.76% | 29.35% |

| Debt to Equity Ratio | 0.32 | 0.07 | 0.39 |

| RoNW | 30.46% | 24.65% | 27.80% |

| Net profit ratio/margin | 13.83% | 11.80% | 10.87% |

| EBITDA Margin | 14.07% | 17.24% | 16.20% |

| EPS | ₹14.34 | ₹8.43 | ₹6.74 |

Fabtech Technologies IPO Financials

Now, let’s check out the financials of the Fabtech Technologies IPO:

| 2025 | 2024 | 2023 | |

| Revenue | 32,666.85 | 22,613.63 | 19,379.75 |

| Total Asset | 42,655.80 | 26,923.58 | 21,386.41 |

| Profit | 4,645.30 | 2,721.74 | 2,173.37 |

(Amount in ₹ lakhs)

Fabtech Technologies IPO Lot Size

Check out the minimum and maximum investment amounts for each category of investors for the Fabtech Technologies IPO:

| Application | Lot Size | Shares | Amount(in ₹) |

| Individual investors (Retail) (Min) | 2 | 75 | 14,325 |

| Individual investors (Retail) (Max) | 13 | 975 | 1,86,225 |

| S-HNI (Min) | 14 | 1050 | 2,00,550 |

| S-HNI (Max) | 69 | 5175 | 9,88,425 |

| B-HNI (Min) | 70 | 5250 | 10,02,750 |

Fabtech Technologies IPO Promoter Holding

Understand the promoter’s pre-issue vs post-issue holdings for the Fabtech Technologies IPO below:

| ShareHolding Pre-Issue | 94.61% |

| ShareHolding Post Issue | – |

Fabtech Technologies is promoted by Mr. Aasif Ahsan Khan, Mr. Hemant Mohan Anavkar, Mr. Aarif Ahsan Khan, and Mrs. Manisha Hemant Anavkar.

Fabtech Technologies IPO Anchor Investors Details

This table presents the Fabtech Technologies anchor investor details:

| Bid Date | September 26, 2025 |

| Shares Offered | Up to 60% of the QIB Portion |

| Anchor Portion Size (In Cr.) | NA |

| Lock-in period end date for half of the shares (30 Days) | NA |

| Lock-in period end date for remaining shares (90 Days) | NA |

Fabtech Technologies IPO Prospectus

To get a comprehensive perspective on the Fabtech Technologies IPO, you can read the official documents below:

About Fabtech Technologies

Established in 2018, Fabtech Technologies provides specialised engineering solutions for major pharmaceutical and healthcare companies. Their footprint spans more than 62 countries. Their business involves providing technical expertise and infrastructure assistance to establish aseptic manufacturing units.

While a majority of their orders are self-executed, certain key functions are also contracted to third-party contractors. The company follows an asset-light approach by engaging a global network of contractors to execute projects efficiently.

The revenue from operations is divided into turnkey services and standalone services. The former contributes 75.51% and the latter 24.49% as of FY25.

Fabtech has the following peers: Airtech Systems (India) Private Limited, Avant Garde Cleanroom & Engg. Solutions Private Limited, Azbil Telstar/ Azbil Corporation, Exyte GmbH, Fablab Engineering India Private Limited, Hvax Technologies Limited, and others.

Objectives of the Fabtech Technologies IPO:

Fabtech Technologies has the following utilisation plan for the incoming proceeds of the IPO:

| Utilisation of Funds | Amount (₹ in lakhs) |

| Working capital needs | 127.00 |

| Certain acquisitions for growth purposes | 30.00 |

| General corporate purposes | NA |

Strengths Of Fabtech Technologies IPO:

- Overall solutions provider: Fabtech Technologies’ services span from designing and installation to engineering and operation support. Integration of these services becomes a key strength for the company.

- Asset-light and integrated business model: The company operates through an asset-light approach, which eliminates the need for manufacturing setups. This leads to better and timely deliveries, cost-effectiveness, and maintenance.

- In-house software designing: The company has a strong, well-experienced, and suitable management team. Additionally, their proprietary project management software, FabAssure, provides a great push to efficiency.

- Robust order book: The company is experiencing tremendous growth in its order book. With a growth of nearly 80% in three years, reaching ₹76,174 lakhs in FY25, it is able to execute a wide range of pharmaceutical projects.

Risks of Fabtech Technologies IPO:

- Low order conversion: In the past, only 11% of the proposals have actually been converted into sales for Fabtech Technologies. This exposes the company to prolonged weak conversions, which could damage the business’s scope.

- Limited track record: Despite its incorporation in 2018, the company commenced its operations in 2021 after a demerger. This means the company only holds a track record of four years. This limited history reduces the scope of evaluation for the company.

- Major related party reliance: Through its asset-light model, the company relies heavily on related parties. This increases their dependency risk.

- Limited projects: The company relies on a limited number of projects in its otherwise wide order book. This exposes the company to a major risk in case of a disruption in any project.

The takeaway

Fabtech Technologies IPO is on its way. The company has shown growth in its financials and also boasts of a robust order book, an in-house team, and diverse offerings. However, low order conversions and a limited track record are associated risks that cannot be ignored.

Other Recent IPO List

Not just Fabtech IPO, many more have hit the markets. Check them out here.

| Epack Prefab Technologies IPO | Ganesh Consumer IPO |

| Jain Resource Recycling IPO | Atlanta Electricals IPO |

| Jinkushal Industries IPO | Euro Pratik Sales IPO |

| Solarworld Solutions IPO | Saatvik Energy IPO |

FAQs

The Fabtech Technologies IPO is set to open on September 29, 2025. The IPO will close on October 1, 2025. Its IPO size is ₹230.35 Crores, which is a completely fresh issue.

To apply for the Fabtech Technologies IPO through the Zerodha app, follow these steps: First, log in to the Zerodha website or app, go to ‘bids’, search for ‘Fabtech Technologies IPO’, and click on ‘apply’. Next, choose the number of lots you want to apply for, submit the form, and make a payment.

The Fabtech Technologies’ IPO subscription opens on September 29, 2025, and closes on October 1, 2025. Its tentative allotment date is October 3, 2025. The listing date is October 7, 2025.

The Fabtech Technologies IPO lot size is 75 shares. The Fabtech Technologies IPO share price is between ₹181 to ₹191 per share. A retail investor can bid for a minimum of 1 lot, and a maximum of 13 lots. This means the minimum investment for a retail investor shall be ₹14,325.

To apply for the Fabtech Technologies IPO, an investor must have a demat account. Choose to invest in any one of the many online broking platforms. Once the IPO is open for subscription, select the ‘Fabtech Technologies IPO’ and enter the quantity. Then, make the payment to confirm your bid.

The tentative allotment date for the Fabtech Technologies IPO is October 3, 2025.

The tentative listing date for the Fabtech Technologies IPO is Tuesday, October 7, 2025.