There is no denying that investors get a plethora of options when participating in an upcoming IPO or Initial Public Offering. IPO is an event when for the very first time a private company goes public to expand further by raising capital. Subsequently, the company lists on the stock market after releasing its shares via an initial public offering.

Investors are usually on the lookout for initial public offerings because they provide an excellent opportunity to invest in a reliable business that is looking to raise capital. Various kinds of investors are granted different slots for the IPO subscription. There is a fixed cap, expressed as a percentage of the total number of shares the company wishes to list for each category. You will be allotted a certain number of shares based on the category you requested.

QIB, NII, Anchor, and RII investors are some examples of these non-institutional investors. We’ll be looking at each of these investor types today with a focus on NII and QIB.

You may also like: DII: The power players of India’s economy

Who are non-institutional investors?

NII’s full form in IPO is non-institutional investors. Institutions seeking to invest above 2 lakh fall into the category of NII. Similarly, people who invest more than this threshold in one investment are categorised as high net-worth individuals or HNIs. Compared to institutional investors, NIIs participate actively in the markets, making huge deals with greater flexibility and fewer regulatory restrictions, which enables individuals to seize market opportunities quickly.

Understanding NII in IPO

An application for more than INR 2 lakhs of IPO shares is eligible for the NII category. Unlike RIIs, they are exempt from SEBI registration requirements.

In IPOs, non-institutional bidders are allotted 15% of the total shares. In addition to not being able to bid at the cut-off price, NIIs are not required to register with SEBI. Bidders who are not affiliated with an institution may also withdraw their bids up to the day of allocation. No matter how successful the IPO is, investors still get their shares.

An applicant for 10,000 shares will be given 1,000 shares (10,000/10) if the offer is oversubscribed ten times. This implies that they always get shares, whether or not there is a demand for more shares. Employees are often awarded 1-2% of the company’s shares as a reward for taking a chance by joining a new business.

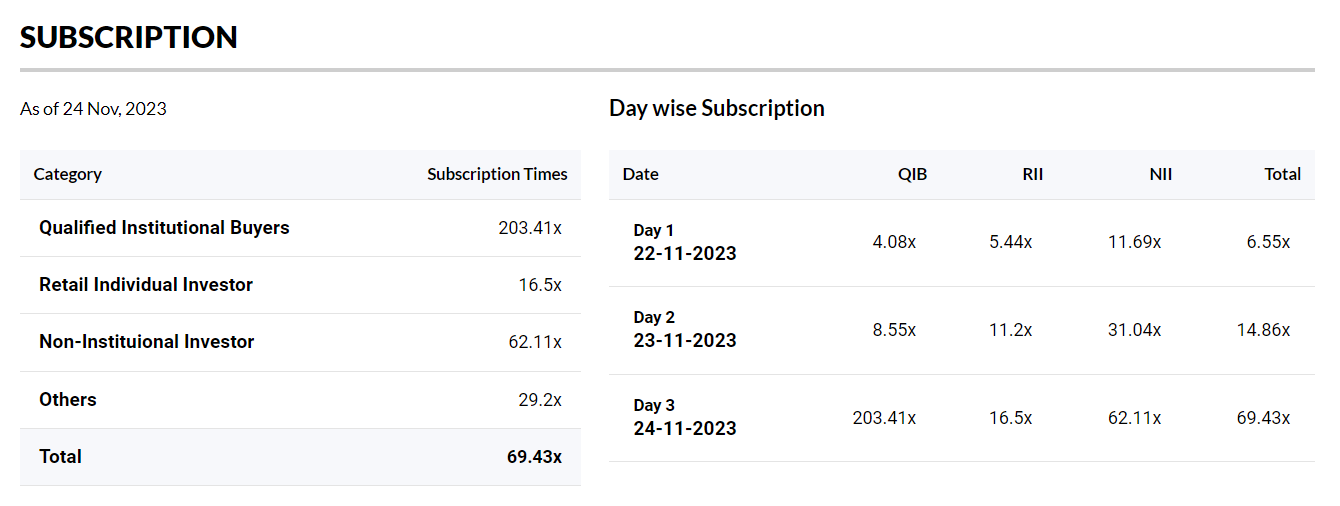

The below image shows the different subscription categories and day-wise subscriptions of the Tata Technologies IPO as of 24 November 2023.

Also read: Tata technologies IPO after 20 years in the TATA conglomerate.

Categories of NII

NIIs fall into two primary categories: sNII and bNII.

sNII: sNII or the small NII category is for those non-institutional investors who bid for stock between 2-10 lakhs. The sNII sub-category takes up only ⅓ of the NII category and is also known as the sHNI.

sNII allotment structure

- All applicants in the sNII category will get full allocation if the IPO is not oversubscribed in the sNII sub-category.

- The allocation to each investor in the event that the IPO in the sNII sub-category is oversubscribed will not be less than the minimal application size i.e. 2 Lakhs, provided that equity shares in the sNII portion are still available.

- While the sNII investor receives shares equivalent to the smallest application size, which is a little over Rs 2 lakhs, rather than a single lot, the allocation is comparable to that of the RII category.

bNII: bNII or the big NII sub-category are those investors who bid more than 10 lakhs and have reserved ⅔ of the NII category. bNII is also classified as bHNI or Big HNI.

bNII allotment structure

- Complete allocation to each and every applicant in the bNII category provided the IPO is not oversubscribed in the bNII sub-category.

- If the bNII sub-category of the IPO is oversubscribed, each investor will get an allocation that does not fall below the minimum sNII application size of approximately Rs 2 lakh, provided that equity shares in the bNII portion are still available.

- The bNII investor receives shares worth the minimal application size, which is just around Rs 2 lakhs, in place of one lot, which is comparable to allocation in the RII category.

Features of NII

In an IPO, a non-institutional bidder has the following characteristics:

- Every IPO reserves 15% of the offer for non-institutional investors.

- Bids may be withdrawn by NIIs up to the allocation date.

- Cut-off pricing is not available for NII bids.

- The Securities and Exchange Board of India’s registration process is not required for NIIs.

- NIIs fall into two categories: sNII and bNII. In the event that there are no over-subscriptions in either of the two sub-categories, all of the shares in that category are offered as the whole allotment in that specific sub-category.

What is QIB in IPO?

Qualified institutional buyers, or QIBs in the share market, are a category of investors who are specifically registered with SEBI. Underwriters sell a large number of stocks at a gain to qualified investors when an IPO nears closer to acquiring required funds.

If a company wants to allocate more than fifty per cent of its shares to QIBs, the SEBI calls for a 90-day lock-in period. A lock-in implies that the shares are restricted or frozen. An investor is not permitted to sell their shares during this time.

Scheduled commercial banks, mutual funds, foreign institutional investors, and public financial institutions are some examples of entities that can be classified as QIBs.

Other types of IPO investors

In the course of the initial public offering, investors may bid for shares in four different ways as per the guidelines set by SEBI. While two of these investor categories according to their bidding structure are already discussed in the article, the other two are:

Anchor investors

An anchor investor is any QIB who applies for more than ₹10 crore. Usually, these investors attract further investments as well. Anchor investors may purchase shares up to 60% reserved for QIBs.

Retail investors

Retail investors are individuals who purchase and sell debt, stocks and other investments via a broker, mutual funds, or banks. 35% of the retail quota must be allocated as a minimum. According to a directive from SEBI, all retail investors would get at least one lot of shares if the offer is oversubscribed, provided that they are still available. A lottery method is used to distribute IPO shares to the general public in cases when the one-lot-per-investor approach isn’t possible.

Also read: Understanding the difference between equity and debt IPO for the right investment

Conclusion

Diversification among investors is essential because it creates a fair distribution of equities in the case of an IPO and maintains equal playing fields. You can determine which investor category you belong to after reading this article and may use this knowledge to make informed investing decisions.